- Switzerland

- /

- Machinery

- /

- SWX:GF

3 European Stocks Estimated To Be 20% To 48.9% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets navigate the turbulence caused by escalating trade tensions, with major indices like Germany's DAX and France's CAC 40 experiencing declines, investors are increasingly on the lookout for opportunities that may have been overlooked. In such an environment, identifying stocks trading below their intrinsic value can be particularly appealing as they may offer potential upside if market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Cenergy Holdings (ENXTBR:CENER) | €8.50 | €16.46 | 48.3% |

| LPP (WSE:LPP) | PLN15600.00 | PLN30639.11 | 49.1% |

| Lindab International (OM:LIAB) | SEK191.70 | SEK372.05 | 48.5% |

| Net Insight (OM:NETI B) | SEK4.66 | SEK9.04 | 48.5% |

| Schaeffler (XTRA:SHA0) | €3.608 | €7.06 | 48.9% |

| Etteplan Oyj (HLSE:ETTE) | €11.85 | €22.85 | 48.1% |

| Fodelia Oyj (HLSE:FODELIA) | €7.04 | €13.91 | 49.4% |

| Komplett (OB:KOMPL) | NOK11.55 | NOK22.74 | 49.2% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €7.70 | €14.73 | 47.7% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.76 | 48.2% |

Underneath we present a selection of stocks filtered out by our screen.

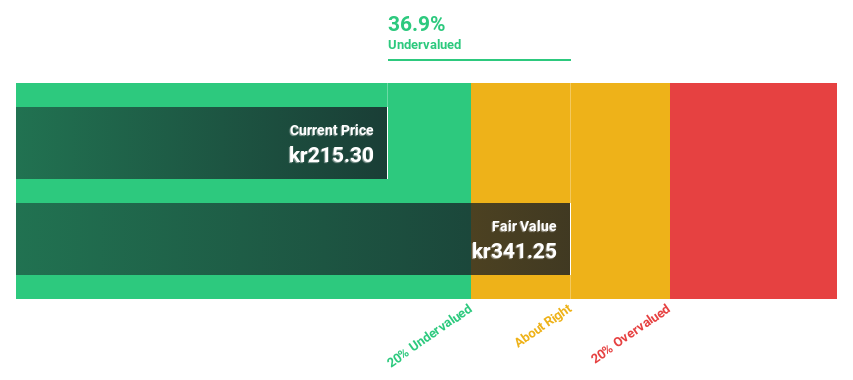

Mowi (OB:MOWI)

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK97.53 billion.

Operations: Mowi's revenue segments include Feed (€1.12 billion), Farming (€3.51 billion), Sales & Marketing - Markets (€4.00 billion), and Sales and Marketing - Consumer Products (€3.70 billion).

Estimated Discount To Fair Value: 46.6%

Mowi ASA is trading significantly below its estimated fair value of NOK 352.9, presenting a potential opportunity for investors focused on cash flow valuation. Recent earnings reports show strong financial performance, with net income rising to EUR 215.6 million in Q4 2024 and full-year sales reaching EUR 5.60 billion. Despite high debt levels, Mowi's earnings are projected to grow at an impressive rate of over 20% annually, outpacing the broader Norwegian market growth expectations.

- According our earnings growth report, there's an indication that Mowi might be ready to expand.

- Navigate through the intricacies of Mowi with our comprehensive financial health report here.

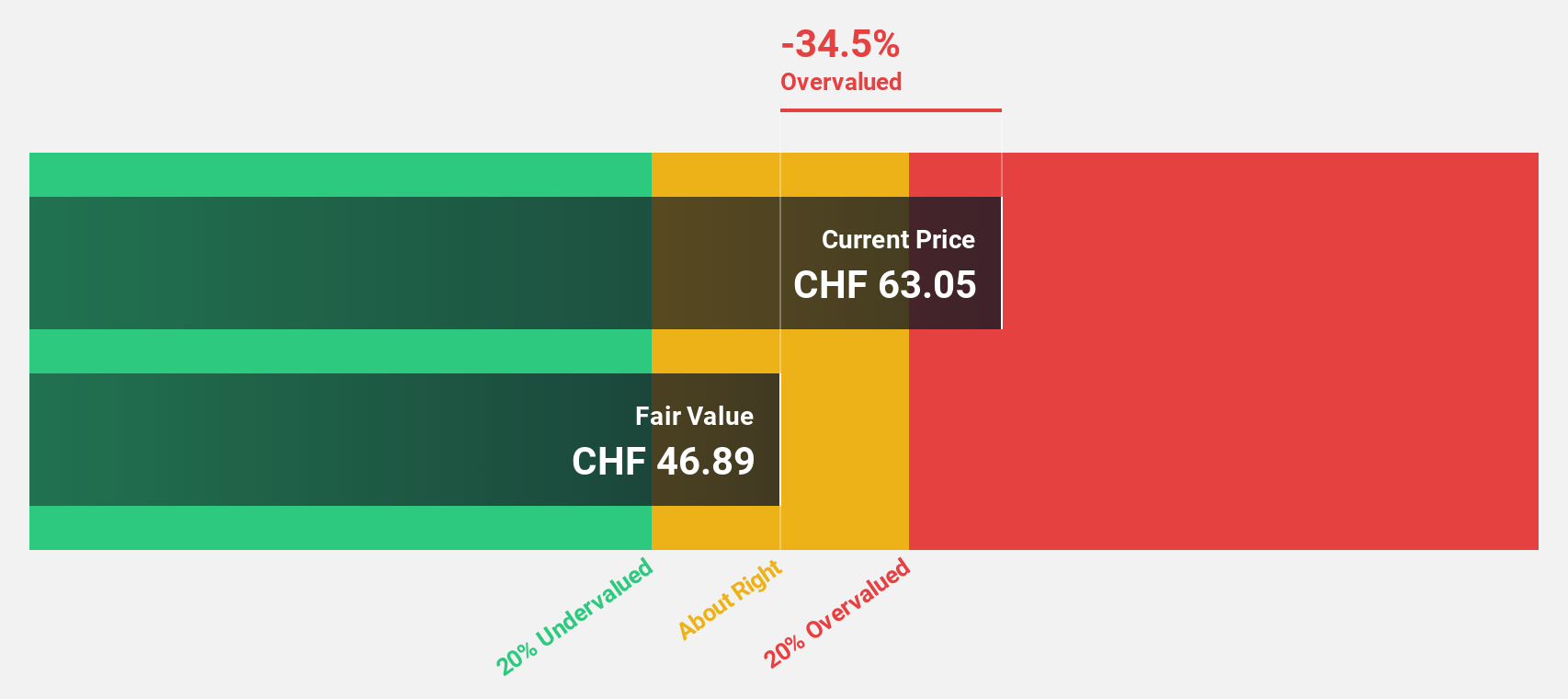

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG operates in the provision of piping systems and casting and machining solutions across Europe, the Americas, Asia, and internationally with a market cap of CHF4.89 billion.

Operations: The company's revenue segments include GF Piping Systems at CHF1.97 billion, GF Casting Solutions at CHF841 million, GF Machining Solutions at CHF885 million, and GF Building Flow Solutions at CHF1.08 billion.

Estimated Discount To Fair Value: 20%

Georg Fischer is currently trading at CHF 59.65, below its estimated fair value of CHF 74.53, indicating potential undervaluation based on cash flows. Despite a slight decline in net income to CHF 214 million for the full year ending December 31, 2024, earnings are forecast to grow significantly by over 20% annually. However, revenue growth lags behind the Swiss market average and debt coverage by operating cash flow remains a concern.

- The analysis detailed in our Georg Fischer growth report hints at robust future financial performance.

- Dive into the specifics of Georg Fischer here with our thorough financial health report.

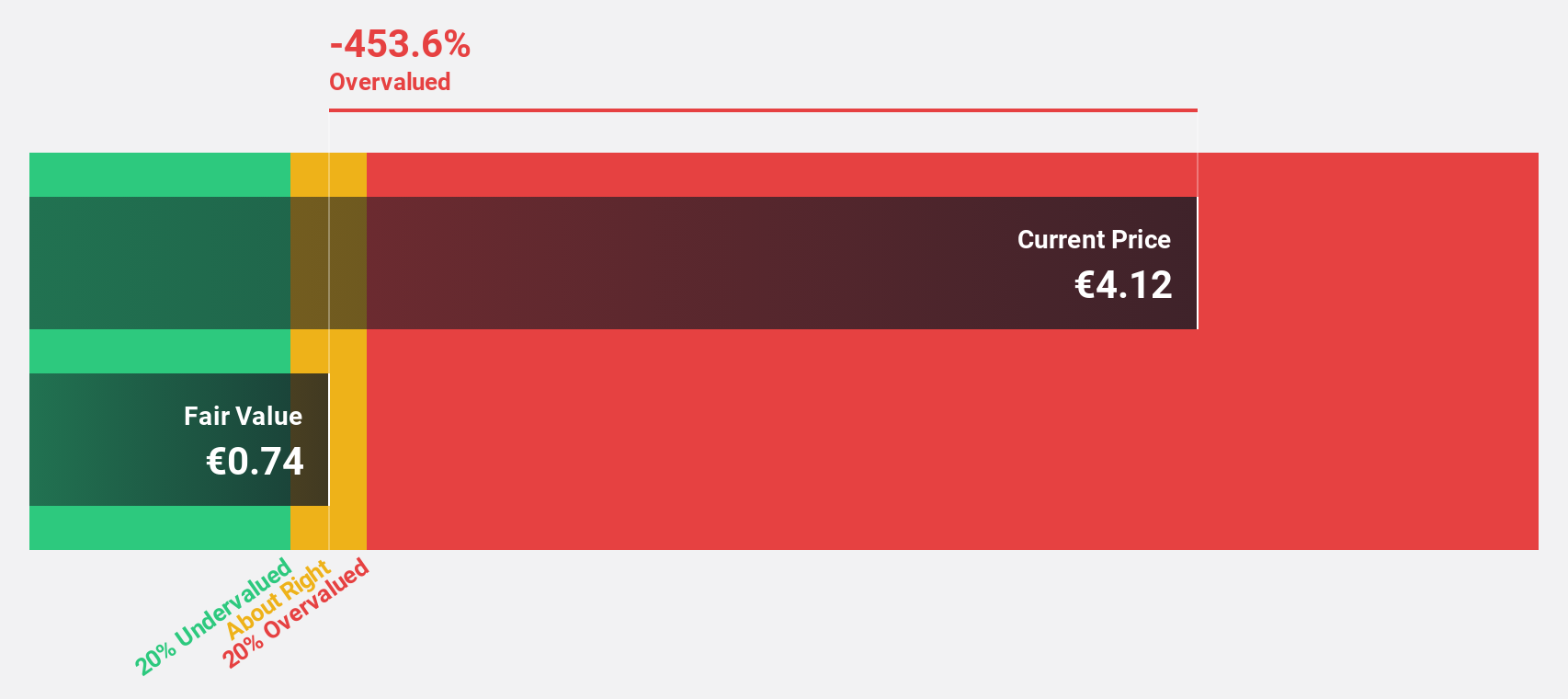

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific with a market cap of approximately €3.41 billion.

Operations: The company's revenue segments include Automotive Technologies at €6.96 billion, Vehicle Lifetime Solutions at €2.58 billion, and Bearings & Industrial Solutions at €6.57 billion.

Estimated Discount To Fair Value: 48.9%

Schaeffler is trading at €3.61, significantly below its estimated fair value of €7.06, suggesting undervaluation based on cash flows. Despite a net loss of €632 million for 2024, the company is forecasted to become profitable within three years with an impressive earnings growth rate of 83.18% annually. However, recent shareholder dilution and inadequate dividend coverage by earnings present challenges amidst these positive projections.

- Upon reviewing our latest growth report, Schaeffler's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Schaeffler's balance sheet health report.

Summing It All Up

- Click here to access our complete index of 178 Undervalued European Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Georg Fischer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GF

Georg Fischer

Engages in the provision of piping systems, and casting and machining solutions in Europe, the Americas, Asia, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives