- Switzerland

- /

- Capital Markets

- /

- SWX:UBSG

Top European Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

In recent weeks, European markets have shown resilience, with the STOXX Europe 600 Index climbing 3.93% as investor sentiment improved following the European Central Bank's rate cuts and a delay in U.S. tariff hikes. As market conditions stabilize, dividend stocks may offer an attractive option for investors seeking steady income streams amidst ongoing economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.03% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.47% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.72% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.95% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.99% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.25% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.19% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.41% | ★★★★★★ |

Click here to see the full list of 245 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

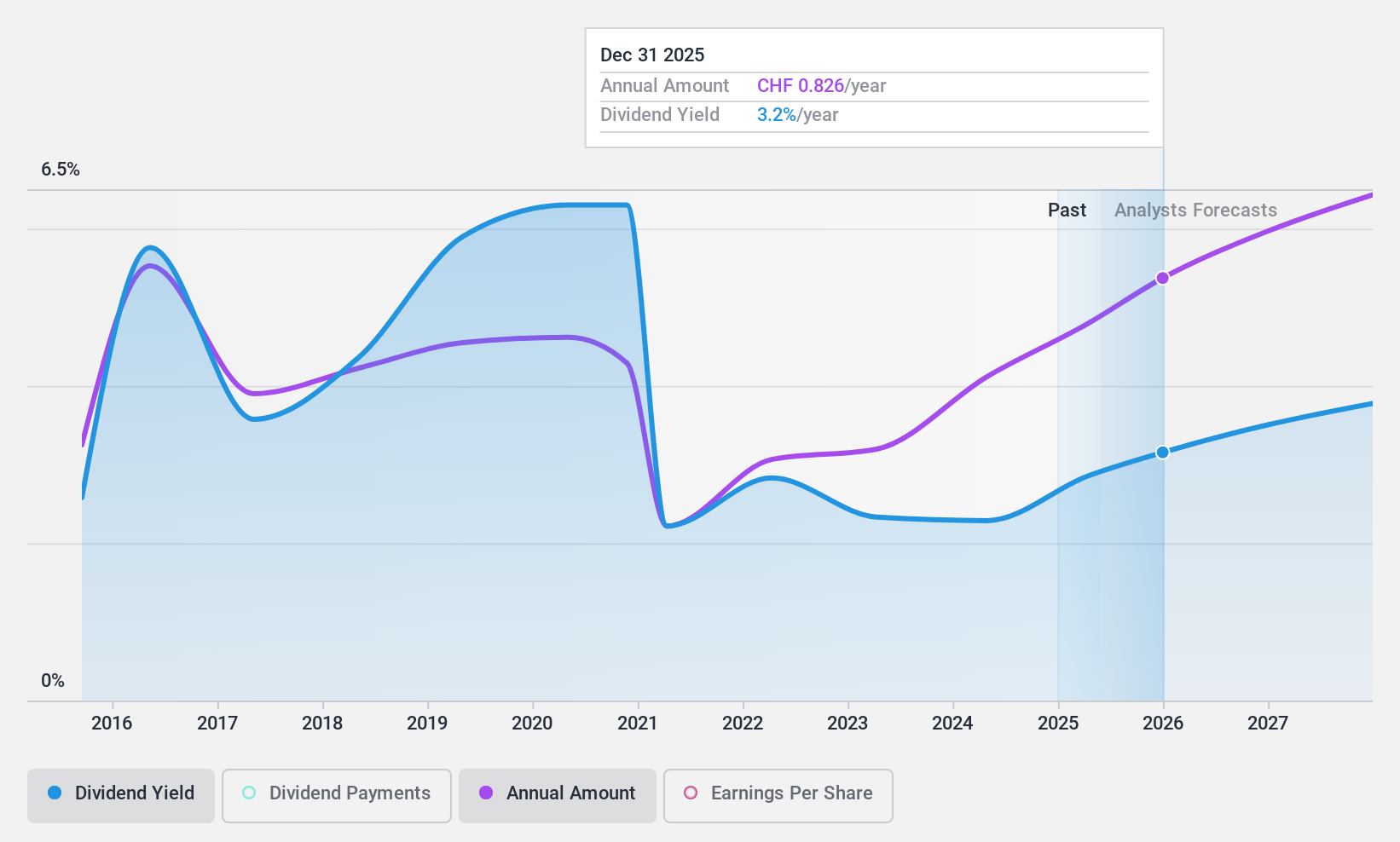

UBS Group (SWX:UBSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UBS Group AG is a global financial services company offering advice and solutions to private, institutional, and corporate clients, with a market capitalization of CHF73.95 billion.

Operations: UBS Group AG generates its revenue through several segments, including Global Wealth Management ($24.53 billion), Investment Bank ($10.85 billion), Personal & Corporate Banking ($8.93 billion), Asset Management ($3.18 billion), and Non Core and Legacy ($1.54 billion).

Dividend Yield: 3%

UBS Group's dividend payments have been volatile over the past decade, with an unstable track record. Despite this, dividends have increased over the same period and are currently covered by earnings with a payout ratio of 56.6%. Recent M&A activity in India suggests strategic growth efforts, which could impact future dividend stability. However, UBS's dividend yield of 3.04% is below top-tier Swiss market payers. The upcoming AGM will address a proposed USD 0.90 per share dividend for 2024.

- Get an in-depth perspective on UBS Group's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that UBS Group is priced lower than what may be justified by its financials.

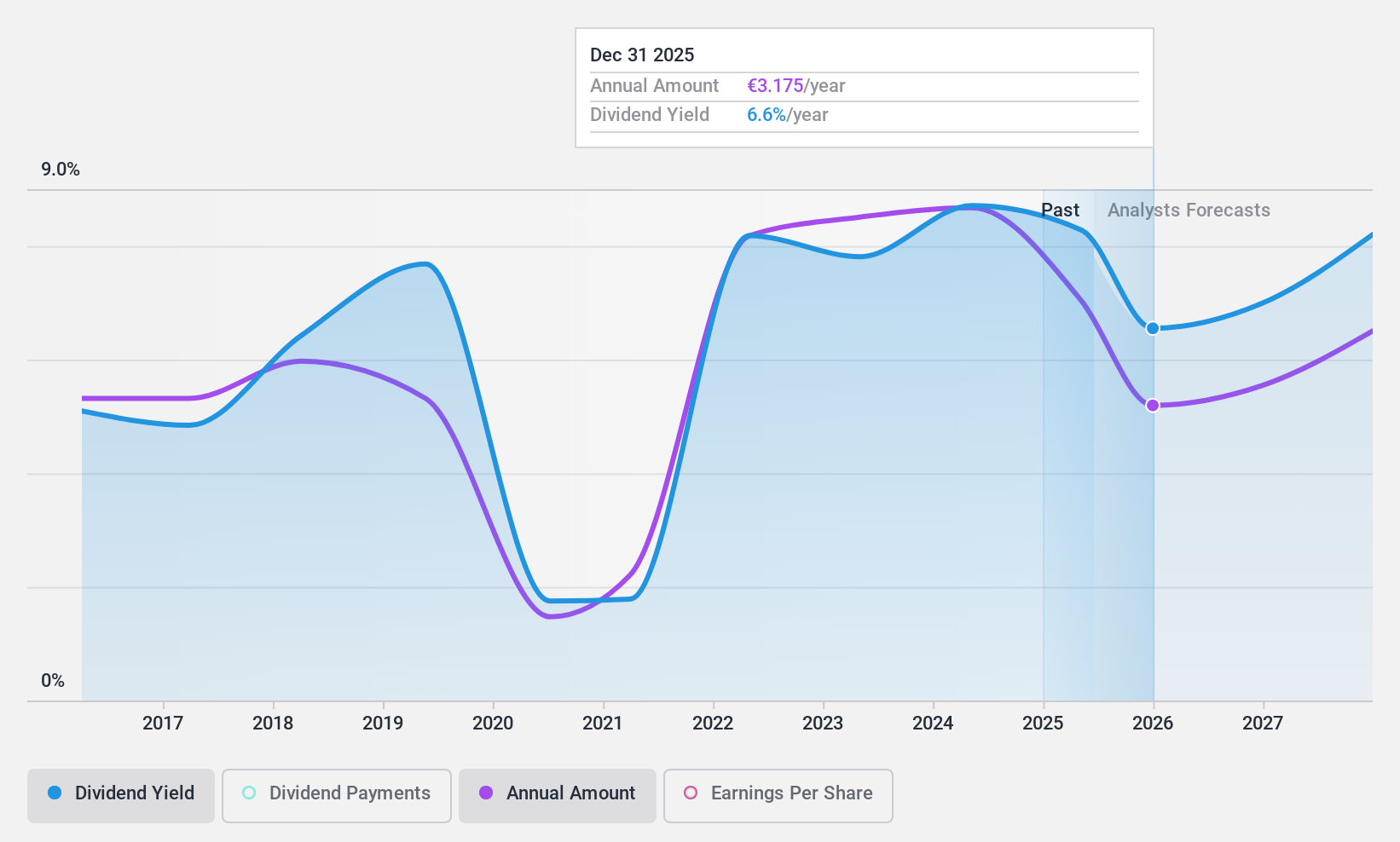

Mercedes-Benz Group (XTRA:MBG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercedes-Benz Group AG is an automotive company operating in Germany and internationally, with a market cap of €51.76 billion.

Operations: Mercedes-Benz Group AG generates revenue through its segments: Mercedes-Benz Cars (€107.76 billion), Mercedes-Benz Vans (€19.32 billion), and Mercedes-Benz Mobility (€25.08 billion).

Dividend Yield: 8%

Mercedes-Benz Group's dividend payments have been volatile, with a recent decrease to €4.30 per share from €5.30 in 2023. Despite this, the dividends are well covered by earnings and cash flows, with payout ratios of 42.2% and 45.6%, respectively. The stock trades at a significant discount to its estimated fair value and offers one of the highest yields in Germany at 7.99%. However, declining earnings and revenue guidance for 2025 may affect future payouts.

- Click here to discover the nuances of Mercedes-Benz Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Mercedes-Benz Group's current price could be quite moderate.

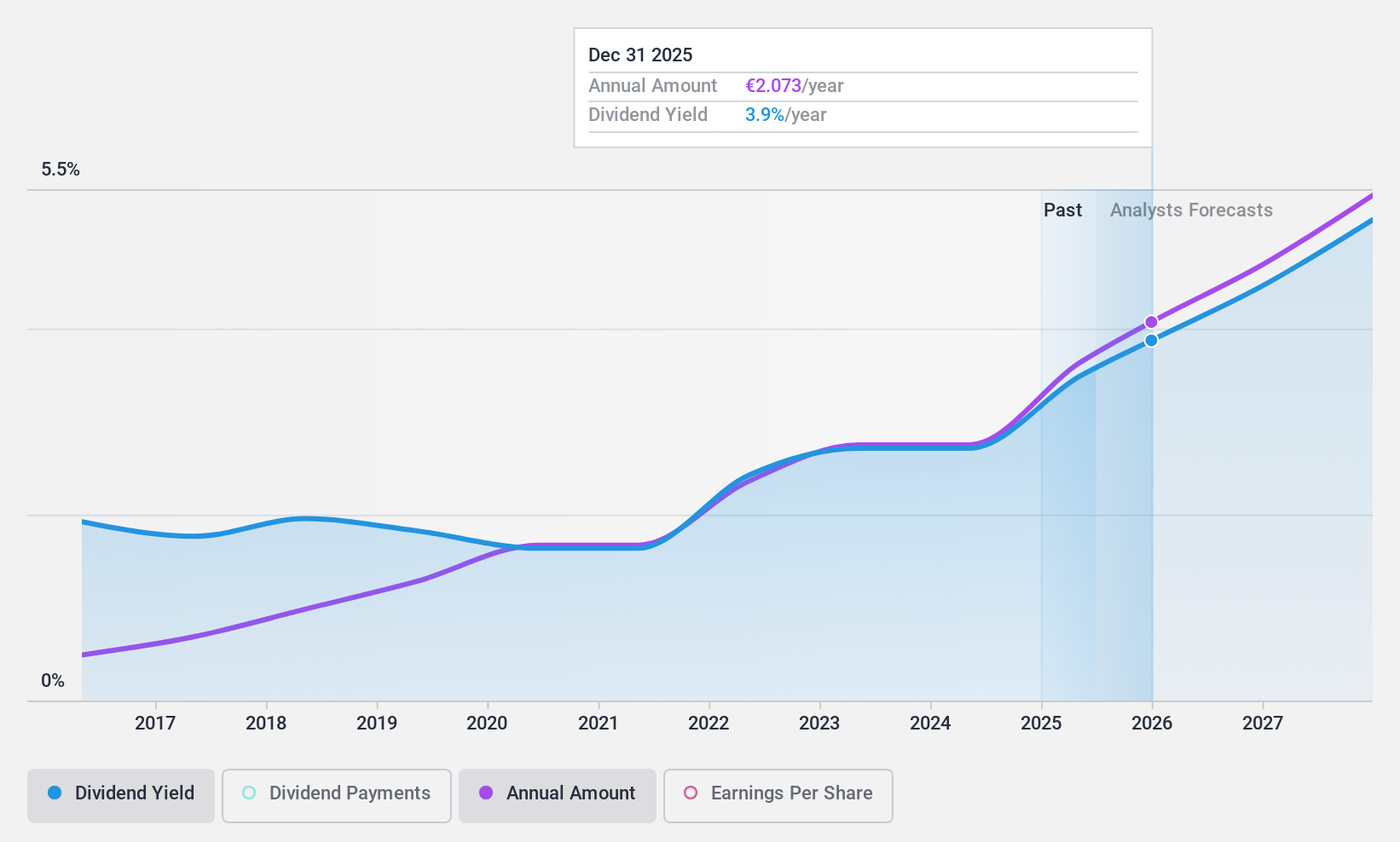

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE solutions, product data management, and building information modeling/management services in Germany and internationally, with a market cap of €915.94 million.

Operations: Mensch und Maschine Software SE generates revenue from its solutions in computer-aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management.

Dividend Yield: 3.4%

Mensch und Maschine Software's dividend of €1.10 per share reflects consistent growth over the past decade, although it is not well covered by earnings with a high payout ratio of 102.6%. However, dividends are supported by cash flows given a reasonable cash payout ratio of 60.1%. Recent earnings for Q1 2025 showed a decline in sales to €66.02 million from €100.87 million year-on-year, yet net income remained relatively stable at €10.39 million, indicating resilience amidst revenue fluctuations.

- Delve into the full analysis dividend report here for a deeper understanding of Mensch und Maschine Software.

- Our expertly prepared valuation report Mensch und Maschine Software implies its share price may be lower than expected.

Where To Now?

- Unlock our comprehensive list of 245 Top European Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBSG

UBS Group

Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives