- China

- /

- Communications

- /

- SZSE:301600

Hainan Mining And 2 Other Hidden Small Caps with Promising Potential

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, Chinese equities have recently retreated, reflecting weak corporate earnings and mixed economic data. Despite these challenges, the search for promising small-cap stocks in China remains compelling for investors looking to uncover hidden gems. In this context, identifying a good stock involves looking beyond immediate market sentiment to focus on companies with strong fundamentals and growth potential. This article highlights three such small-cap stocks: Hainan Mining and two other lesser-known entities that show promising potential in the evolving Chinese market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changsha Tongcheng HoldingsLtd | 8.27% | -12.36% | -6.10% | ★★★★★★ |

| Changzhou Zhongying Science & Technology | 0.31% | 10.88% | 29.30% | ★★★★★★ |

| Hangzhou Biotest BiotechLtd | 0.07% | -46.81% | -19.87% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | 8.86% | 3.45% | 14.40% | ★★★★★★ |

| Center International GroupLtd | 28.83% | 3.14% | -40.37% | ★★★★★★ |

| Hollyland (China) Electronics Technology | 4.43% | 12.39% | 9.21% | ★★★★★★ |

| Aeolus Tyre | 35.66% | -1.22% | 10.27% | ★★★★★☆ |

| Tianjin Lisheng PharmaceuticalLtd | 1.27% | -6.38% | 19.81% | ★★★★★☆ |

| Sinomag Technology | 52.01% | 17.08% | 3.65% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 85.99% | 7.52% | 27.60% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hainan Mining (SHSE:601969)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hainan Mining Co., Ltd. mines, processes, and sells iron ore in China with a market cap of CN¥10.84 billion.

Operations: Hainan Mining generates revenue primarily from the mining, processing, and sale of iron ore. The company's market cap stands at CN¥10.84 billion.

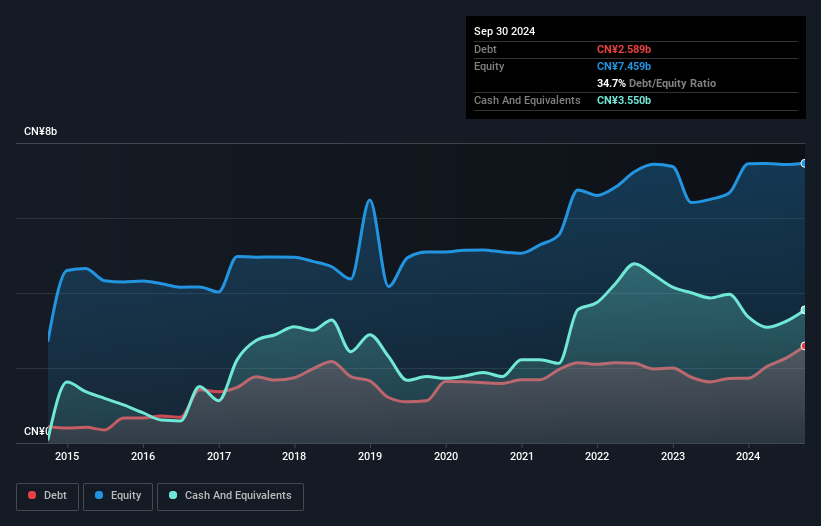

Hainan Mining has shown impressive earnings growth of 51% over the past year, outpacing the Metals and Mining industry’s 6.2%. Its debt to equity ratio increased from 22.2% to 31.2% in five years, yet it holds more cash than total debt, ensuring financial stability. Recently, Hainan reported half-year sales of ¥2.19 billion and net income of ¥402.82 million, up from ¥302.5 million last year, alongside a share repurchase plan worth up to ¥100 million for capital reduction and equity incentives.

- Click to explore a detailed breakdown of our findings in Hainan Mining's health report.

Evaluate Hainan Mining's historical performance by accessing our past performance report.

Huada Automotive TechnologyLtd (SHSE:603358)

Simply Wall St Value Rating: ★★★★★☆

Overview: Huada Automotive Technology Corp., Ltd. manufactures and markets car assembly parts with a market cap of CN¥12.99 billion.

Operations: Huada Automotive Technology Ltd generates revenue primarily from the sale of car assembly parts. The company has a market cap of CN¥12.99 billion.

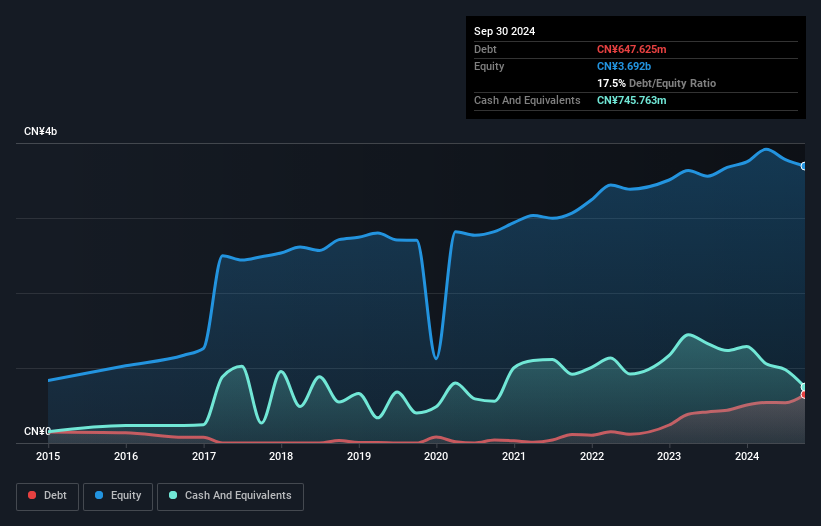

Huada Automotive Technology, a small player in China's auto components sector, reported half-year sales of ¥2.34 billion, slightly down from ¥2.36 billion last year. Net income rose to ¥164 million from ¥160 million, with basic earnings per share at ¥0.37 versus ¥0.36 previously. Over the past five years, earnings have grown 12.7% annually and are forecasted to rise by 35.95% yearly moving forward, despite not outpacing the industry's growth rate of 19.7%.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥2.79 billion.

Operations: Flaircomm Microelectronics generates revenue primarily from the sale of wireless communication modules, embedded software, and turnkey system solutions. The company's net profit margin is 12.5%.

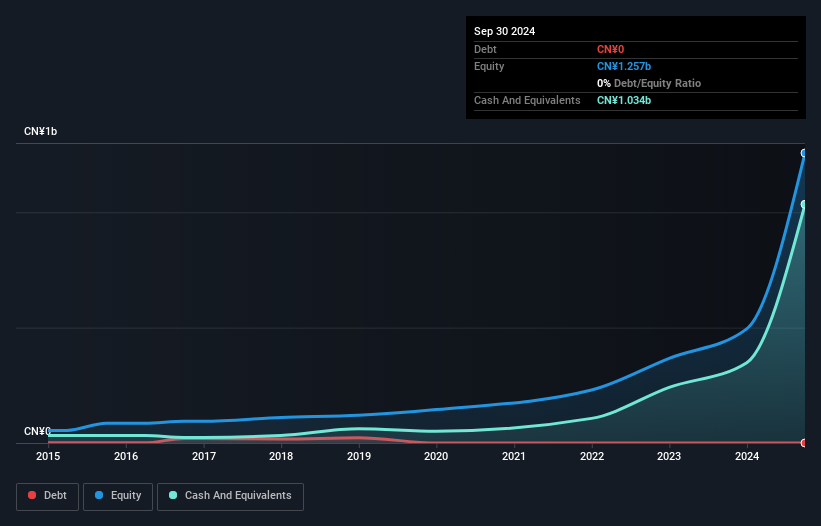

Flaircomm Microelectronics, recently included in both the Shenzhen Stock Exchange Composite and A Share Indexes, reported a net income of CNY 74.27 million for the first half of 2024, up from CNY 53.04 million last year. Its earnings per share rose to CNY 1.41 from CNY 1.01 over the same period. The company's IPO raised CNY 699.19 million at a price of CNY 39.84 per share, highlighting strong market interest and potential growth opportunities ahead.

Next Steps

- Get an in-depth perspective on all 946 Chinese Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Flawless balance sheet with high growth potential.