- China

- /

- Electronic Equipment and Components

- /

- SZSE:002937

Prominent Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, investors are increasingly seeking stability in the form of dividend stocks. In such an environment, dividend-paying stocks can offer a measure of resilience and potential income, making them an attractive consideration for those looking to weather market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.40% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.50% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

China World Trade Center (SHSE:600007)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China World Trade Center Co., Ltd. operates commercial mixed-use developments in China and internationally, with a market cap of CN¥23.62 billion.

Operations: China World Trade Center Co., Ltd. generates revenue from its commercial mixed-use developments both within China and internationally.

Dividend Yield: 3.3%

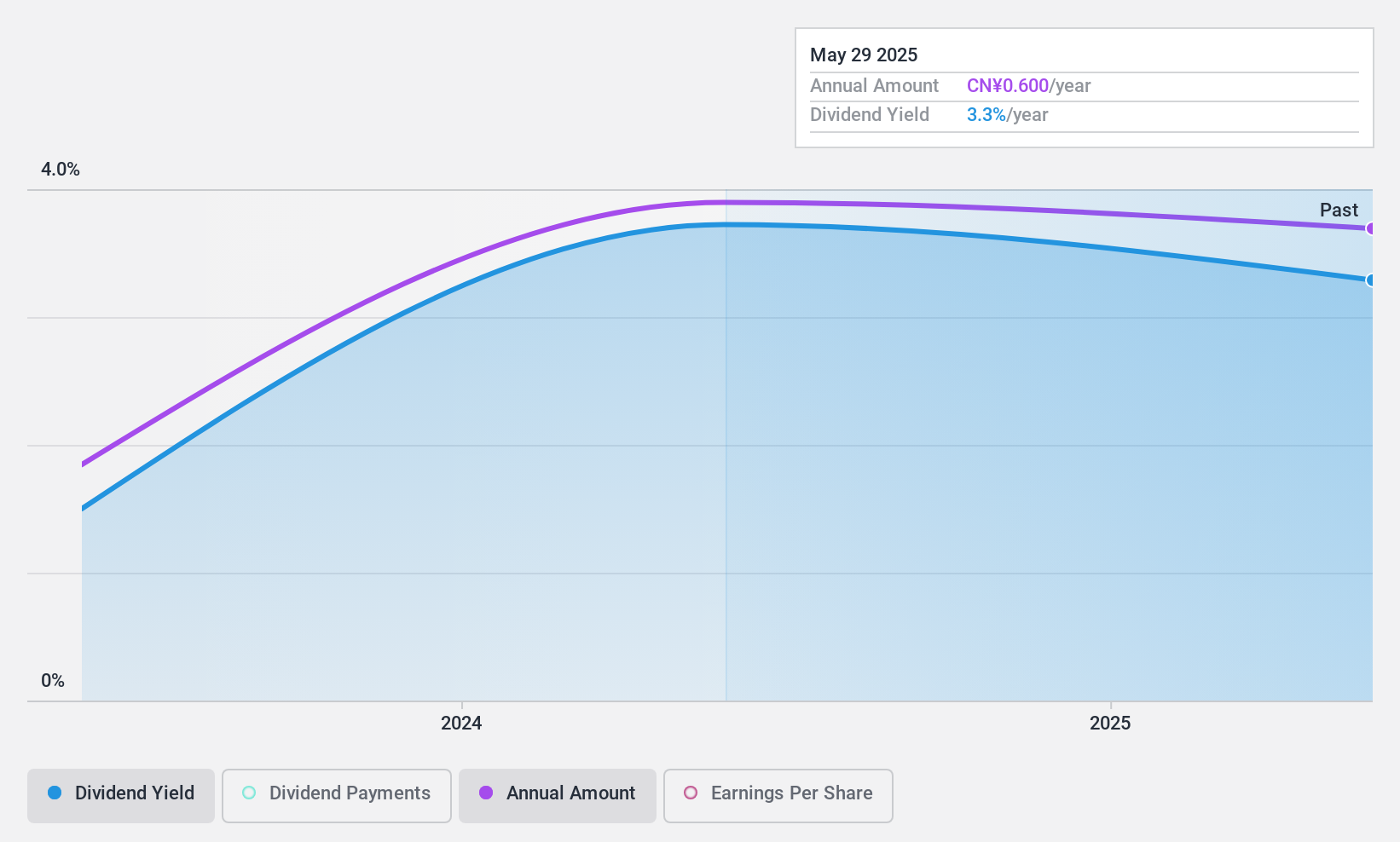

China World Trade Center offers a reliable dividend yield of 3.35%, placing it in the top 25% of CN market dividend payers. The company's dividends have been stable and growing over the past decade, supported by a reasonable payout ratio of 63.5% and a cash payout ratio of 46.4%. Despite recent earnings showing slight declines, dividends remain well-covered by both earnings and cash flows, indicating sustainability amidst current financial performance challenges.

- Dive into the specifics of China World Trade Center here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China World Trade Center shares in the market.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd manufactures and sells precision components and has a market capitalization of CN¥4.90 billion.

Operations: Ningbo Sunrise Elc Technology Co., Ltd generates its revenue from the manufacture and sale of precision components.

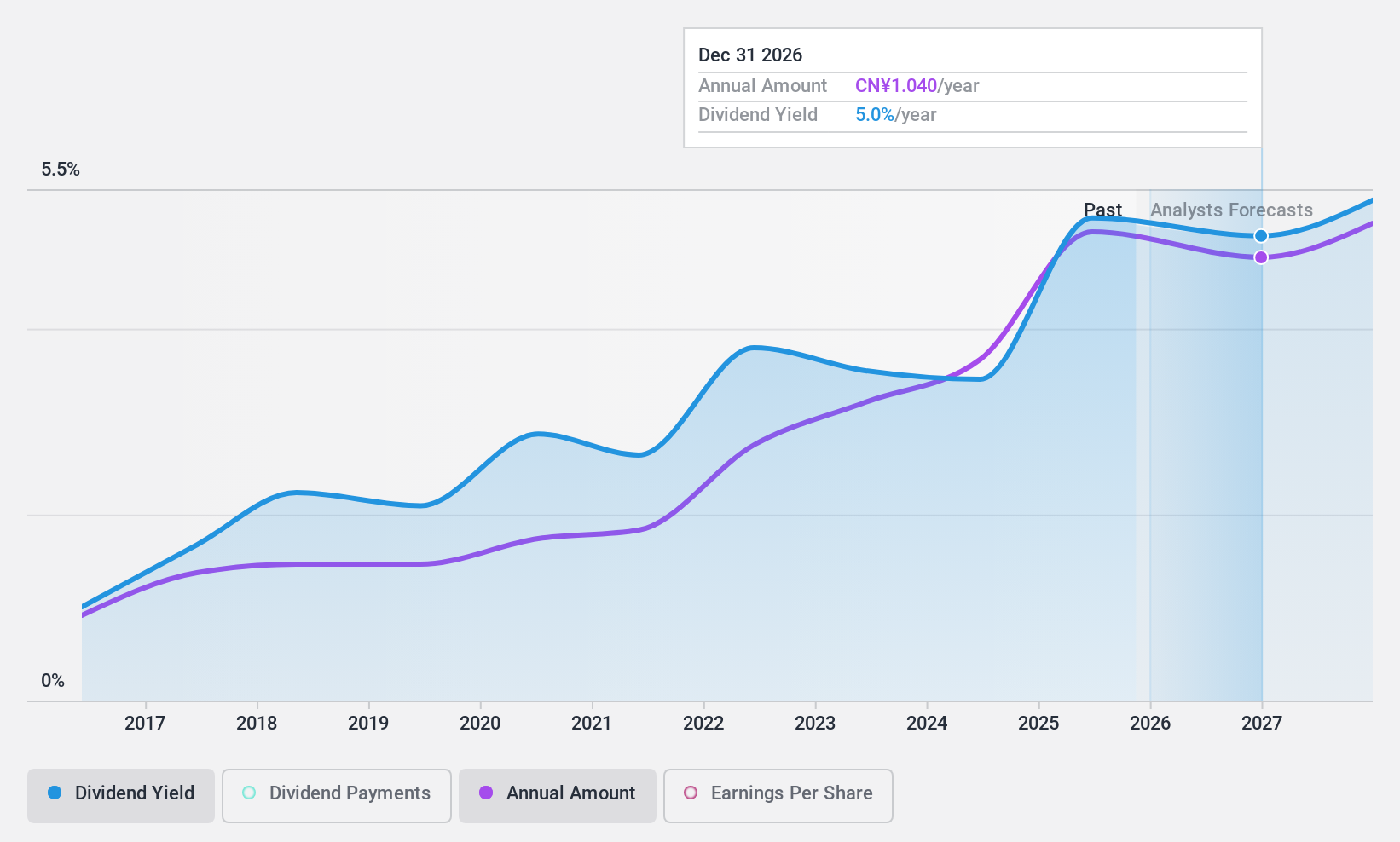

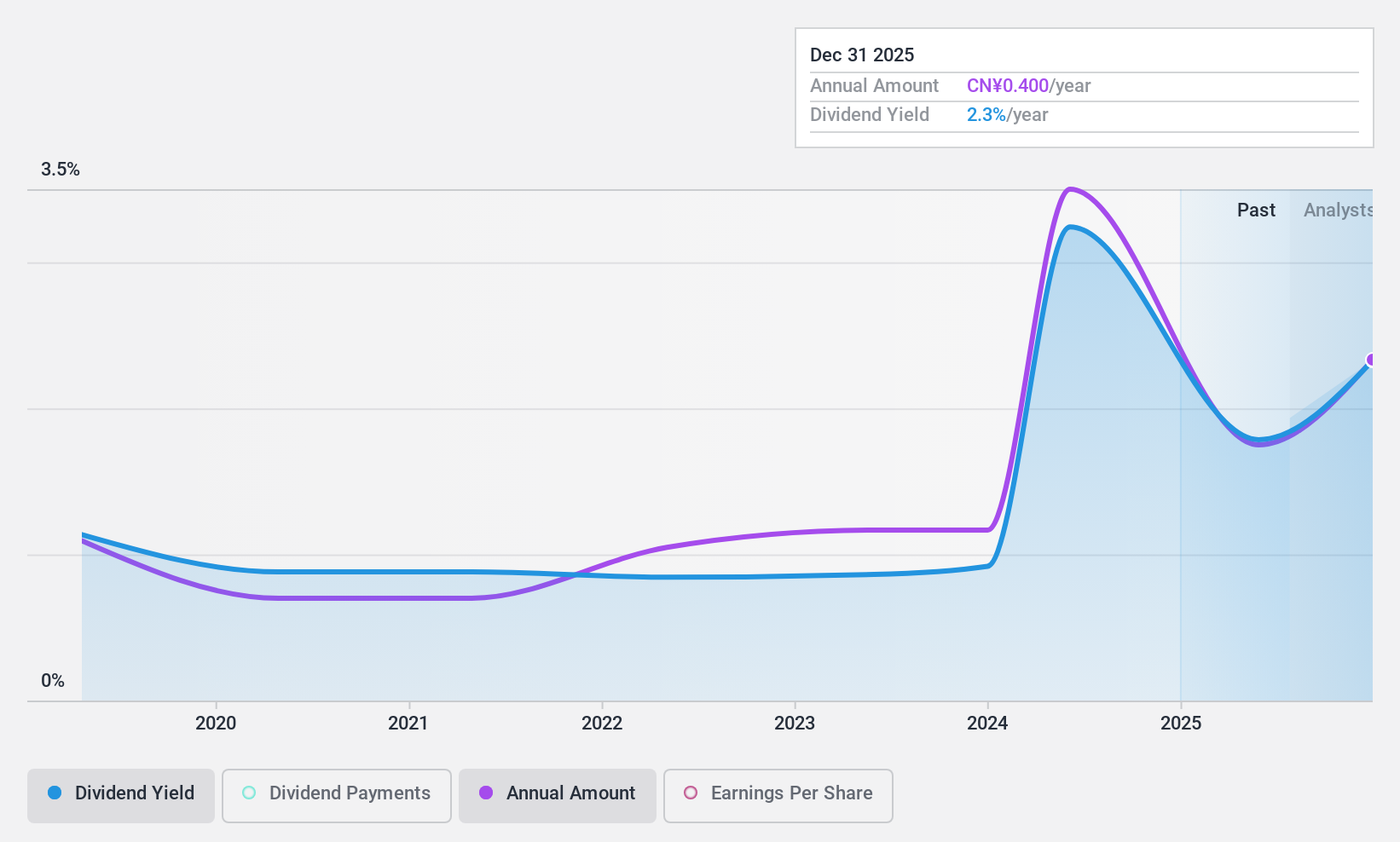

Dividend Yield: 3.6%

Ningbo Sunrise Elc Technology Ltd's dividend yield of 3.59% ranks in the top 25% of CN market payers, supported by a low payout ratio of 33.4%. While dividends are covered by earnings and cash flows, the cash payout ratio stands at a higher 81.1%. Despite earnings growth over five years, dividends have been volatile and unreliable due to a short six-year payment history and instability in annual payments exceeding a 20% drop.

- Click here and access our complete dividend analysis report to understand the dynamics of Ningbo Sunrise Elc TechnologyLtd.

- According our valuation report, there's an indication that Ningbo Sunrise Elc TechnologyLtd's share price might be on the cheaper side.

Beijing Jiaman DressLtd (SZSE:301276)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Jiaman Dress Co., Ltd. is involved in the research, design, production, and sale of children's clothing, apparel, and home textile products in China with a market cap of CN¥2.12 billion.

Operations: Beijing Jiaman Dress Co., Ltd.'s revenue is derived from its activities in the children's clothing, apparel, and home textile sectors within China.

Dividend Yield: 3.8%

Beijing Jiaman Dress Ltd.'s dividend yield of 3.8% places it among the top 25% in the CN market, with a payout ratio of 52.4% indicating dividends are well-covered by earnings. Despite stable and growing payouts, the company has only been distributing dividends for two years. Recent earnings showed a decline to CNY 103.88 million from CNY 127.33 million year-over-year, which may affect future dividend sustainability if trends continue.

- Click here to discover the nuances of Beijing Jiaman DressLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Beijing Jiaman DressLtd is trading beyond its estimated value.

Turning Ideas Into Actions

- Reveal the 1990 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Sunrise Elc TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002937

Ningbo Sunrise Elc TechnologyLtd

Engages in the manufactures and sale of precision components.

High growth potential with excellent balance sheet and pays a dividend.