- China

- /

- Life Sciences

- /

- SHSE:603108

Insiders Back These 3 Promising Growth Stocks

Reviewed by Simply Wall St

In a week marked by choppy market conditions and inflation concerns, U.S. equities faced declines, with the Nasdaq Composite experiencing its largest weekly drop since mid-November. Amid this backdrop of uncertainty, insider ownership can serve as a reassuring indicator for investors seeking companies with strong growth potential and aligned management interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

We're going to check out a few of the best picks from our screener tool.

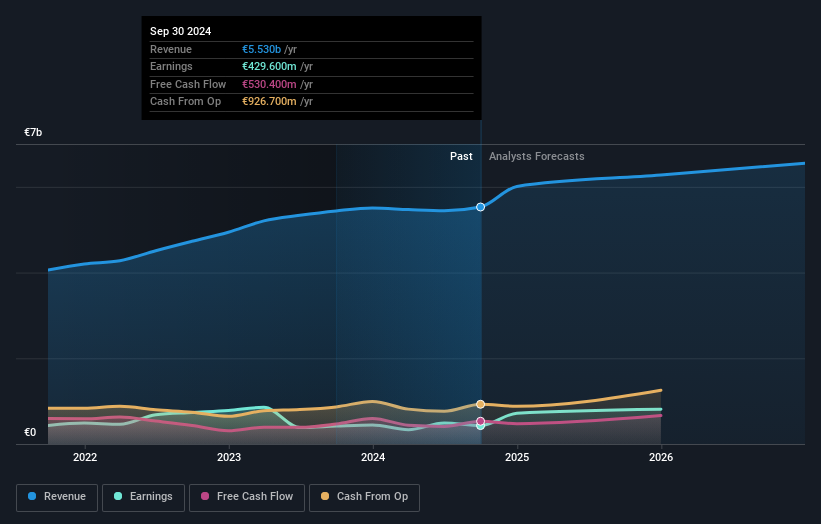

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK102.03 billion.

Operations: The company's revenue segments include Feed (€1.11 billion), Farming (€3.46 billion), Sales & Marketing - Markets (€3.90 billion), and Sales and Marketing - Consumer Products (€3.68 billion).

Insider Ownership: 15.4%

Earnings Growth Forecast: 38.1% p.a.

Mowi has demonstrated consistent earnings growth of 10.2% annually over the past five years, with future earnings expected to grow significantly at 38.1% per year, outpacing the Norwegian market. Despite trading well below its estimated fair value, Mowi faces challenges such as an unstable dividend track record and high debt levels. Recent board changes include Ørjan Svanevik's election as Chairperson, potentially influencing strategic directions amidst stable insider ownership.

- Navigate through the intricacies of Mowi with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Mowi's share price might be too pessimistic.

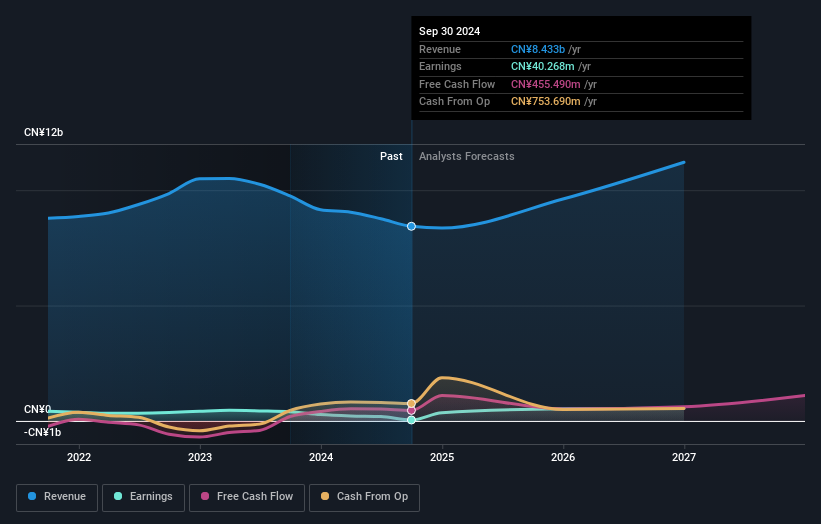

Shanghai Runda Medical Technology (SHSE:603108)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Runda Medical Technology Co., Ltd. operates in the medical technology sector, focusing on providing diagnostic products and services, with a market cap of CN¥9.02 billion.

Operations: Shanghai Runda Medical Technology Co., Ltd. generates its revenue through various segments in the medical technology sector, primarily focusing on diagnostic products and services.

Insider Ownership: 16.1%

Earnings Growth Forecast: 55.3% p.a.

Shanghai Runda Medical Technology is forecasted to achieve significant earnings growth of 55.3% annually, surpassing the Chinese market's average. However, its recent financial performance showed declining revenue and net income, with profit margins dropping from 4.1% to 0.5%. Despite trading at a good value relative to peers, its debt coverage by operating cash flow is weak and dividend sustainability is questionable due to low earnings coverage. No substantial insider trading activity was reported recently.

- Click here to discover the nuances of Shanghai Runda Medical Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Shanghai Runda Medical Technology implies its share price may be lower than expected.

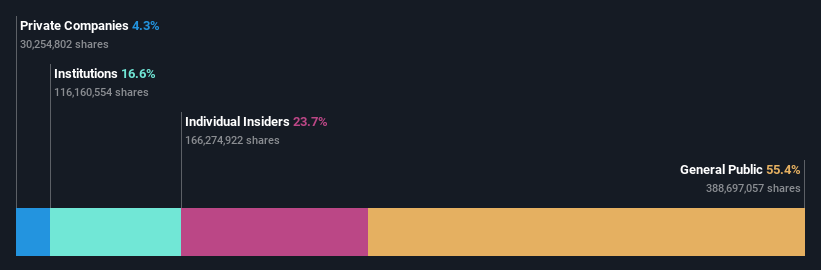

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD is involved in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥10.32 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD generates revenue from the research, production, and marketing of Chinese medicinal products within China and abroad.

Insider Ownership: 23.3%

Earnings Growth Forecast: 23.3% p.a.

Zhejiang Jolly Pharmaceutical is trading at 59% below its estimated fair value, presenting a good relative value compared to peers. Earnings grew by 45.4% over the past year, with revenue rising from CNY 1.46 billion to CNY 2.04 billion for the nine months ending September 2024. Despite earnings forecasted to grow slower than the market, revenue growth outpaces it at an expected annual rate of 22.5%. Recent shareholder meetings focused on stock incentive and ownership plans indicate strategic insider alignment with company growth objectives.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang Jolly PharmaceuticalLTD.

- The analysis detailed in our Zhejiang Jolly PharmaceuticalLTD valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1466 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603108

Shanghai Runda Medical Technology

Shanghai Runda Medical Technology Co., Ltd.

Reasonable growth potential and fair value.