As the global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, investors are closely monitoring economic indicators and policy shifts. With U.S. equities experiencing declines and small-cap stocks underperforming, the focus on identifying undervalued stocks becomes even more pertinent as these may offer potential opportunities amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Turkcell Iletisim Hizmetleri (IBSE:TCELL) | TRY95.20 | TRY190.03 | 49.9% |

| Livero (TSE:9245) | ¥1564.00 | ¥3113.47 | 49.8% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.34 | 50% |

| Bank BTPN Syariah (IDX:BTPS) | IDR860.00 | IDR1715.86 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | US$39.26 | US$78.06 | 49.7% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1115.85 | ₹2226.73 | 49.9% |

| MLG Oz (ASX:MLG) | A$0.57 | A$1.14 | 49.9% |

| Atlas Arteria (ASX:ALX) | A$4.89 | A$9.73 | 49.7% |

| Shinko Electric Industries (TSE:6967) | ¥5868.00 | ¥11708.78 | 49.9% |

| Coeur Mining (NYSE:CDE) | US$6.35 | US$12.63 | 49.7% |

Let's explore several standout options from the results in the screener.

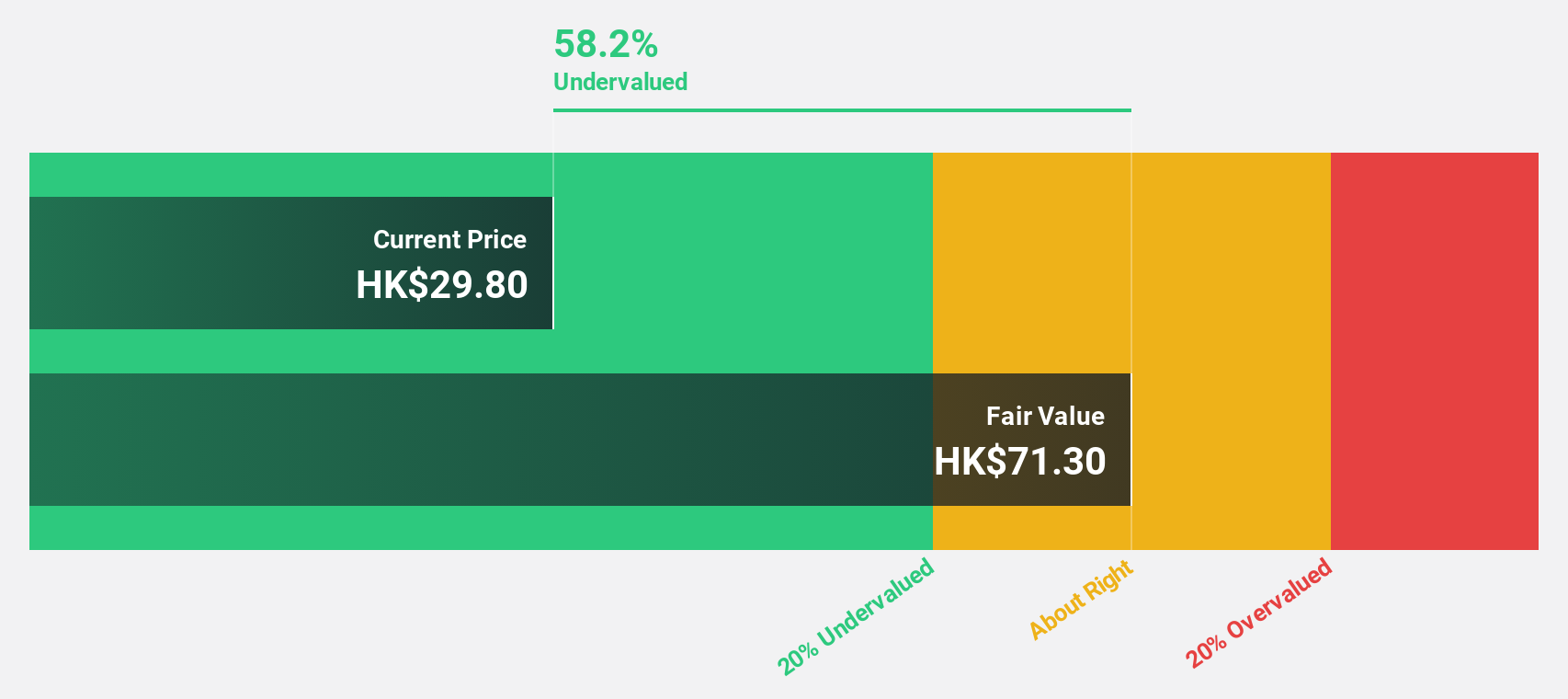

Cowell e Holdings (SEHK:1415)

Overview: Cowell e Holdings Inc. is an investment holding company that designs, develops, manufactures, and sells optical modules and systems integration products for smartphones and other mobile devices across various regions including China, India, and Korea; it has a market capitalization of approximately HK$23.55 billion.

Operations: The company's revenue segment primarily consists of photographic equipment and supplies, generating approximately $1.14 billion.

Estimated Discount To Fair Value: 38.4%

Cowell e Holdings is trading at HK$27.8, significantly undervalued compared to its fair value estimate of HK$45.12. Its earnings are forecast to grow 30.5% annually, outpacing the Hong Kong market's 11.2%. Revenue growth is also expected to exceed market averages at 27.3% per year, despite a decline in profit margins from 6.6% to 3.9%. The company shows potential for strong returns with high-quality earnings and robust cash flow projections.

- Our growth report here indicates Cowell e Holdings may be poised for an improving outlook.

- Click here to discover the nuances of Cowell e Holdings with our detailed financial health report.

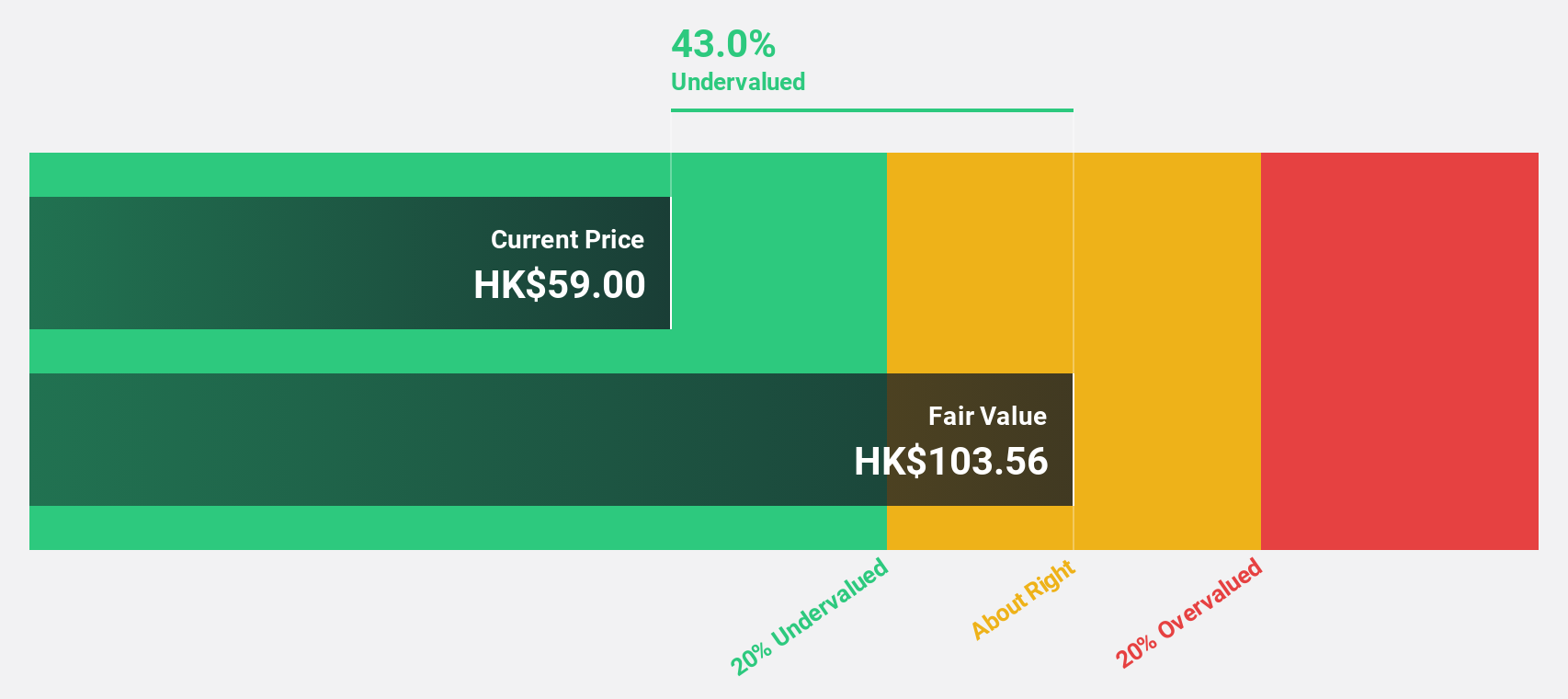

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company focused on the research, development, manufacture, and sale of bioactive material-based beauty and health products in China with a market cap of HK$52.18 billion.

Operations: The company generates revenue of CN¥4.46 billion from its biotechnology segment, which involves bioactive material-based beauty and health products in China.

Estimated Discount To Fair Value: 49.7%

Giant Biogene Holding, trading at HK$52.4, is significantly undervalued with a fair value estimate of HK$104.12. Despite past shareholder dilution, its earnings grew by 68.1% last year and are expected to grow significantly at 23.5% annually, surpassing the Hong Kong market's average growth rate of 11.2%. Revenue is projected to increase by 19.4% per year, also outpacing market averages, indicating robust cash flow potential despite moderate revenue growth forecasts.

- Upon reviewing our latest growth report, Giant Biogene Holding's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Giant Biogene Holding.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited develops data centers and technology campuses, with a market cap of CN¥93.99 billion.

Operations: The company's revenue from IDC Services amounts to CN¥8.08 billion.

Estimated Discount To Fair Value: 11.2%

Range Intelligent Computing Technology Group, trading at CN¥52.37, is undervalued with a fair value estimate of CN¥58.96. Recent earnings reports show substantial growth in revenue and net income over the past year, though profit margins have decreased from 44% to 26.7%. Earnings are expected to grow significantly at 30.6% annually, outpacing the Chinese market's average growth rate of 25%. However, debt coverage by operating cash flow remains inadequate.

- According our earnings growth report, there's an indication that Range Intelligent Computing Technology Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Range Intelligent Computing Technology Group.

Seize The Opportunity

- Dive into all 870 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300442

Range Intelligent Computing Technology Group

Provides provides internet data center (IDC) and automatic identification and data capture (AIDC) services to telecom operators, internet companies, and cloud vendors in China.

Undervalued with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026