- China

- /

- Communications

- /

- SZSE:301600

Global Growth Companies With High Insider Ownership For April 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and mixed performances across major indices, investors are paying close attention to the impact of geopolitical tensions on economic growth and inflation. Amid these challenges, identifying growth companies with high insider ownership can offer insights into potential investment opportunities, as insiders often have intimate knowledge of their company’s prospects and may signal confidence in its future performance.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.4% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

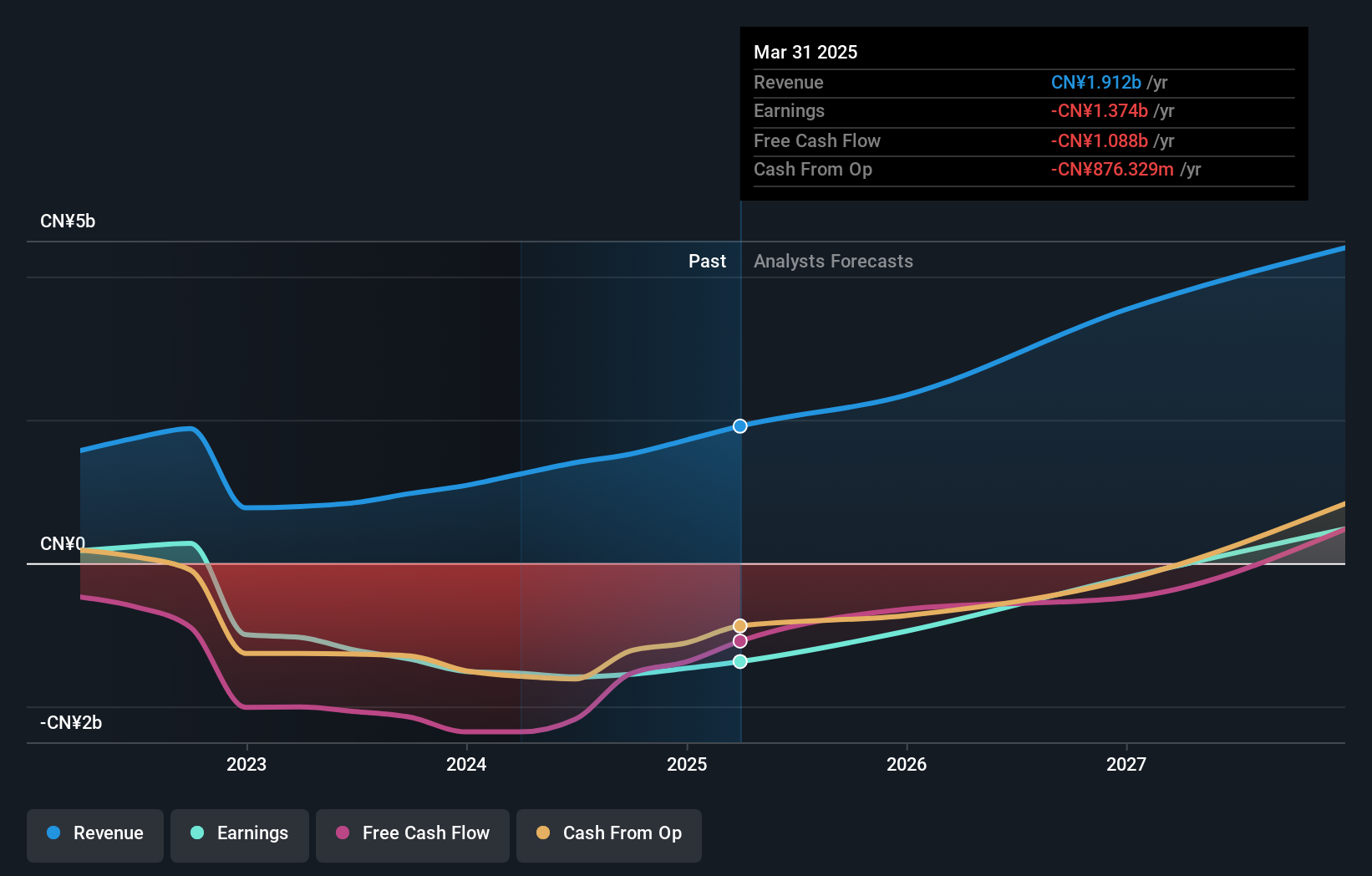

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of HK$23.17 billion.

Operations: The company's revenue is primarily generated from its biopharmaceutical research, service, production, and sales activities, totaling CN¥1.72 billion.

Insider Ownership: 11.6%

RemeGen is poised for significant growth, with revenue projected to increase 23.2% annually, outpacing the Hong Kong market. Despite a current net loss of CNY 1.47 billion, its earnings are expected to grow by 60.99% per year and become profitable in three years, outperforming average market expectations. Recent strategic leadership changes and promising clinical trial results for Disitamab Vedotin highlight RemeGen's focus on innovative cancer therapies, though its share price remains highly volatile.

- Delve into the full analysis future growth report here for a deeper understanding of RemeGen.

- According our valuation report, there's an indication that RemeGen's share price might be on the expensive side.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

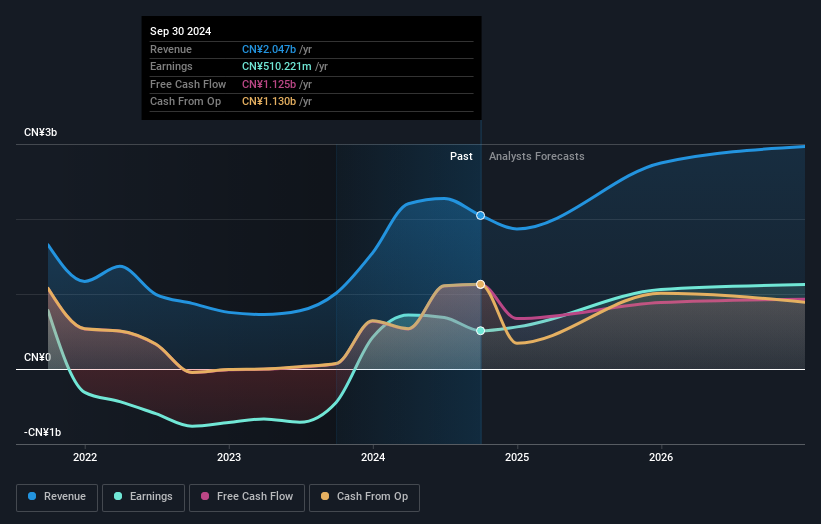

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China, with a market cap of CN¥57.84 billion.

Operations: The company's revenue segments include the investment, production, and distribution of film and television projects in China.

Insider Ownership: 12.1%

Beijing Enlight Media's earnings are forecast to grow at 39.4% annually, surpassing the 23.7% average growth of the Chinese market. While revenue is projected to increase by 19.6% per year, which is faster than the market's 12.6%, it remains below the desired threshold for high growth expectations. Despite becoming profitable recently, its share price has been highly volatile over three months and Return on Equity is expected to be low at 10.9%.

- Unlock comprehensive insights into our analysis of Beijing Enlight Media stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Beijing Enlight Media shares in the market.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★☆

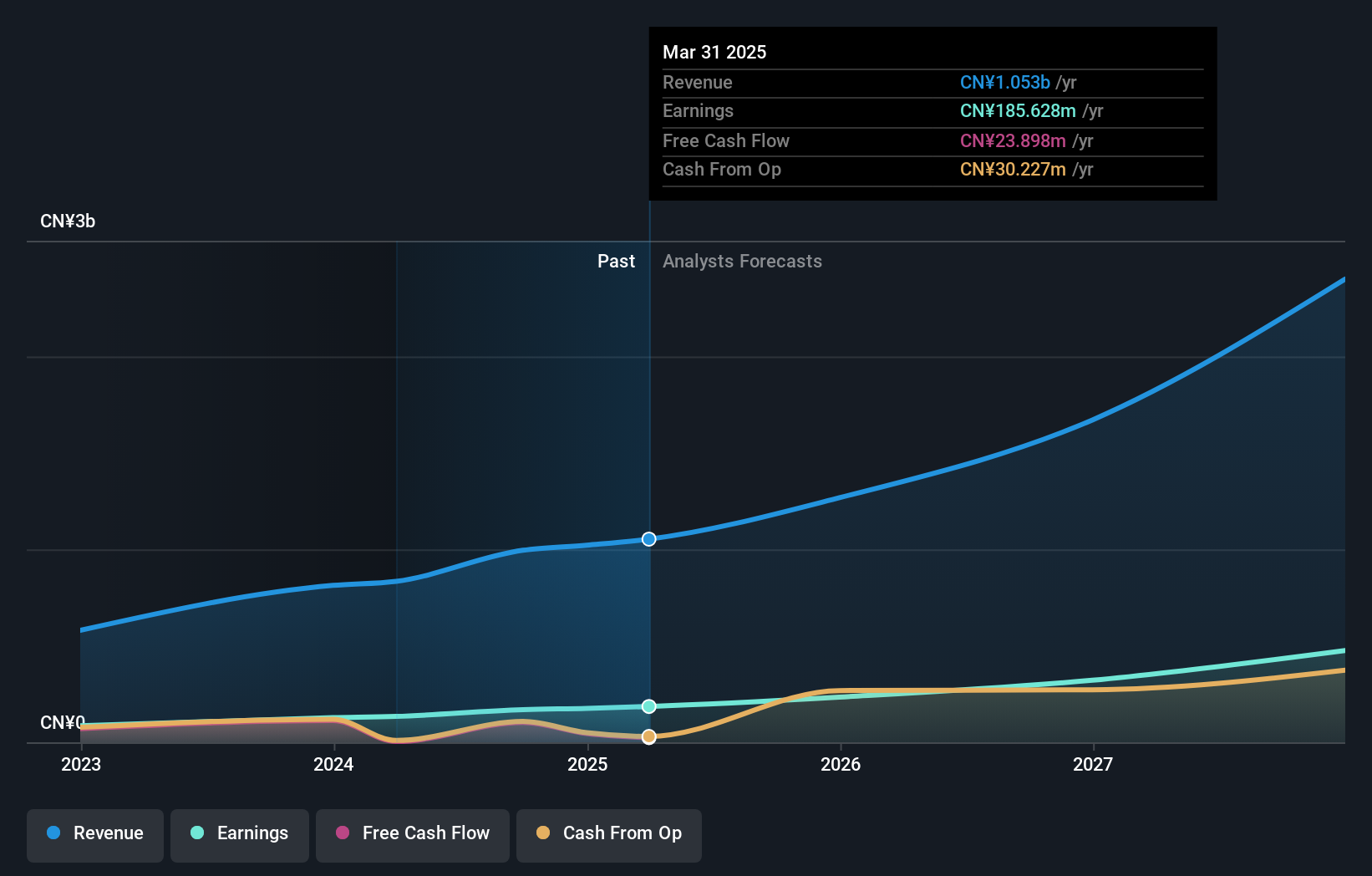

Overview: Flaircomm Microelectronics, Inc. specializes in developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥10.81 billion.

Operations: The company's revenue primarily comes from its wireless communications equipment segment, which generated CN¥995.17 million.

Insider Ownership: 35.5%

Flaircomm Microelectronics is expected to see significant annual earnings growth of 30.8%, outpacing the Chinese market's 23.7% average, with revenue projected to grow at 26.7% annually, exceeding the market's 12.6%. Despite a highly volatile share price recently and a forecasted low Return on Equity of 17.2%, its addition to the S&P Global BMI Index highlights its growing prominence in the sector.

- Navigate through the intricacies of Flaircomm Microelectronics with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Flaircomm Microelectronics' shares may be trading at a premium.

Next Steps

- Unlock more gems! Our Fast Growing Global Companies With High Insider Ownership screener has unearthed 868 more companies for you to explore.Click here to unveil our expertly curated list of 871 Fast Growing Global Companies With High Insider Ownership.

- Seeking Other Investments? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives