- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

Asian Market's May 2025 Stock Selections Possibly Trading Below Fair Value Estimates

Reviewed by Simply Wall St

Amid ongoing global trade discussions and fluctuating economic indicators, Asian markets are experiencing a mix of cautious optimism and strategic adjustments. As investors navigate these complex conditions, identifying stocks that may be trading below their fair value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.80 | CN¥52.53 | 49% |

| Boditech Med (KOSDAQ:A206640) | ₩16120.00 | ₩31078.75 | 48.1% |

| People & Technology (KOSDAQ:A137400) | ₩38250.00 | ₩73496.26 | 48% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩556000.00 | ₩1081643.83 | 48.6% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥18.01 | CN¥34.35 | 47.6% |

| GEM (SZSE:002340) | CN¥6.33 | CN¥12.10 | 47.7% |

| Shanghai OPM Biosciences (SHSE:688293) | CN¥40.51 | CN¥77.39 | 47.7% |

| Kolmar Korea (KOSE:A161890) | ₩84400.00 | ₩167658.11 | 49.7% |

| Taiyo Yuden (TSE:6976) | ¥2354.50 | ¥4607.14 | 48.9% |

| True Corporation (SET:TRUE) | THB12.50 | THB24.22 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Xiaomi (SEHK:1810)

Overview: Xiaomi Corporation is an investment holding company that develops and sells smartphones in Mainland China and internationally, with a market cap of HK$1.31 trillion.

Operations: Xiaomi Corporation generates revenue from several segments, including CN¥191.76 billion from smartphones, CN¥34.12 billion from internet services, CN¥104.10 billion from IoT and lifestyle products, and CN¥32.75 billion from smart EV and other new initiatives.

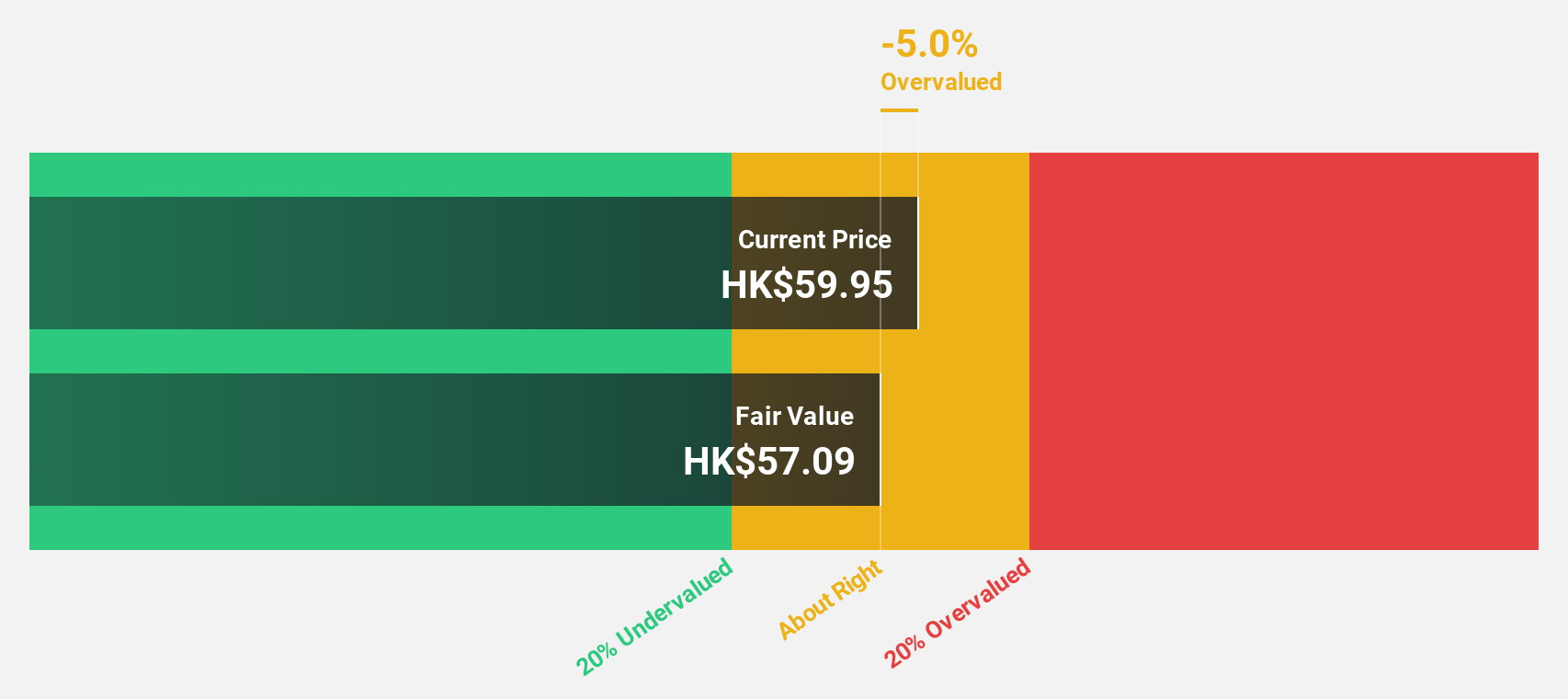

Estimated Discount To Fair Value: 21.9%

Xiaomi is trading at 21.9% below its estimated fair value of HK$64.55, highlighting potential undervaluation based on cash flows. The company's earnings grew by 35.4% last year and are expected to grow significantly, outpacing the Hong Kong market's growth rates. Recent financial results show increased sales and net income, with a strategic partnership in the EV sector potentially enhancing future revenue streams amid strong market demand for new energy vehicles in China.

- Upon reviewing our latest growth report, Xiaomi's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Xiaomi's balance sheet by reading our health report here.

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. operates in the fiber laser industry and has a market cap of approximately CN¥12.27 billion.

Operations: Wuhan Raycus Fiber Laser Technologies Co., Ltd. generates its revenue primarily from the fiber laser industry, with total revenue segments amounting to CN¥12.27 billion.

Estimated Discount To Fair Value: 35.8%

Wuhan Raycus Fiber Laser Technologies is trading 35.8% below its estimated fair value of CN¥33.85, suggesting it may be undervalued based on cash flows. Despite a decline in recent earnings, with Q1 2025 net income at CN¥16.94 million compared to CN¥63.58 million a year ago, earnings are forecast to grow significantly over the next three years, outpacing the broader Chinese market's growth rates and indicating potential for future profitability improvements.

- In light of our recent growth report, it seems possible that Wuhan Raycus Fiber Laser TechnologiesLtd's financial performance will exceed current levels.

- Dive into the specifics of Wuhan Raycus Fiber Laser TechnologiesLtd here with our thorough financial health report.

Round One (TSE:4680)

Overview: Round One Corporation operates indoor leisure complex facilities and has a market cap of ¥275.95 billion.

Operations: Revenue segments (in millions of ¥): Amusement: ¥60,000; Bowling: ¥40,000; Karaoke: ¥30,000; Spo-Cha (Sports Challenge): ¥20,000.

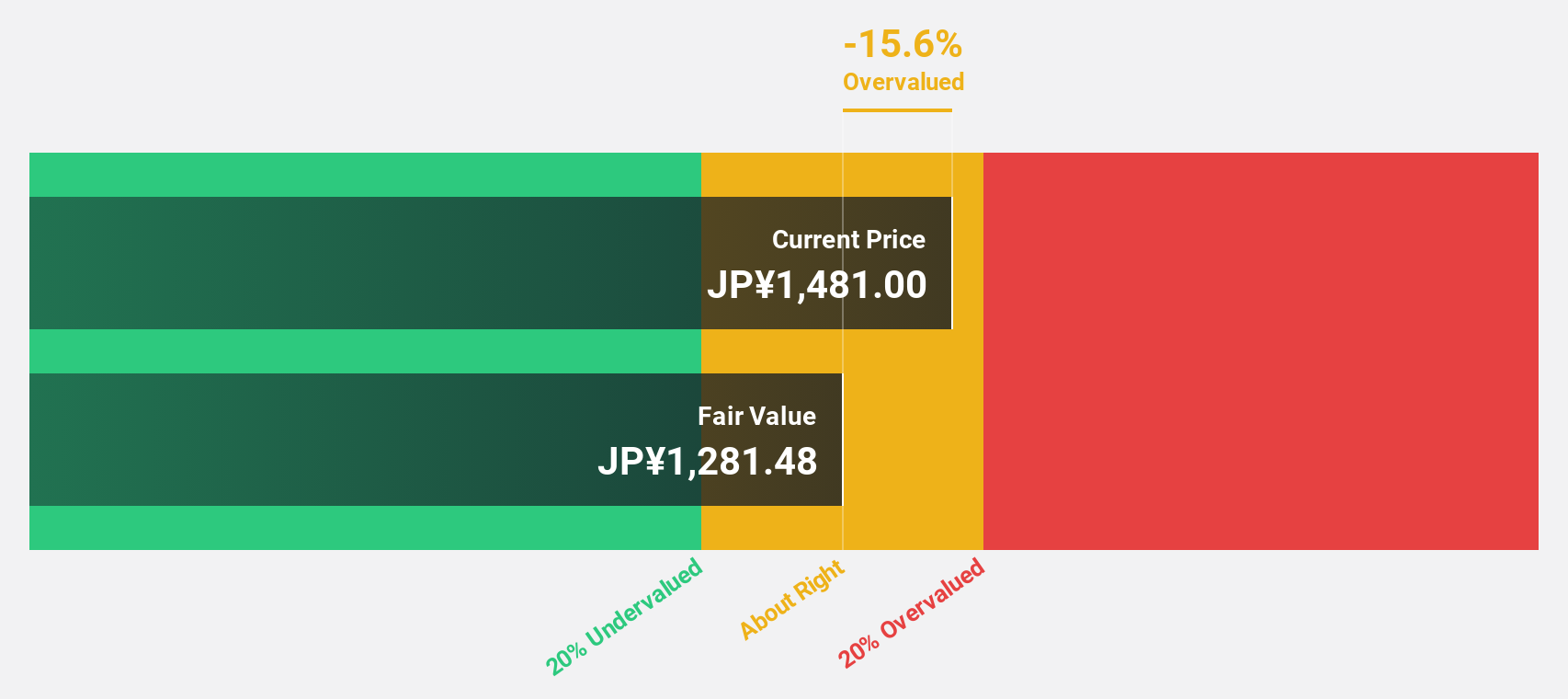

Estimated Discount To Fair Value: 22.3%

Round One Corporation, trading at ¥1,044, is undervalued with a fair value estimate of ¥1,343.79 based on discounted cash flows. Despite recent share price volatility, earnings are forecast to grow 12.62% annually, outpacing the Japanese market's growth rate of 7.5%. Recent dividends have increased to ¥4.50 per share quarterly for fiscal year ending March 2026. The company completed a buyback of 8.20 million shares for ¥9,999.9 million in March 2025.

- According our earnings growth report, there's an indication that Round One might be ready to expand.

- Navigate through the intricacies of Round One with our comprehensive financial health report here.

Taking Advantage

- Navigate through the entire inventory of 275 Undervalued Asian Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, engages in the development and sales of smartphones in Mainland China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives