- China

- /

- Tech Hardware

- /

- SZSE:000066

DBAPPSecurity And 2 Other High Growth Tech Stocks To Watch

Reviewed by Simply Wall St

The global markets have recently experienced a mix of volatility and growth, with U.S. stocks facing pressure from AI competition fears and the Federal Reserve holding interest rates steady amid solid economic activity. In this environment, identifying high-growth tech stocks such as DBAPPSecurity can be crucial for investors looking to navigate these challenges, as strong earnings potential and innovative capabilities often define promising opportunities in the tech sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1229 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

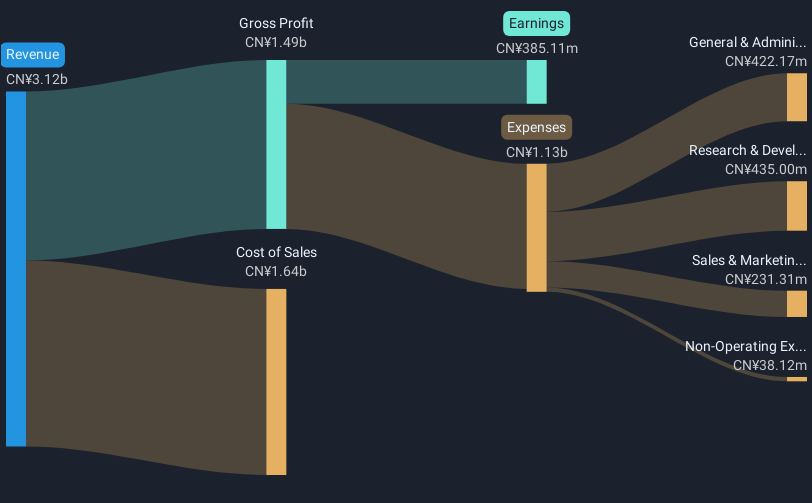

DBAPPSecurity (SHSE:688023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DBAPPSecurity Co., Ltd. focuses on the research, development, manufacture, and sale of cybersecurity products in China with a market capitalization of CN¥4.41 billion.

Operations: DBAPPSecurity Co., Ltd. specializes in cybersecurity solutions, generating revenue primarily through the sale of its developed products in China. The company's operations involve significant investment in research and development to enhance its product offerings and maintain competitiveness within the cybersecurity industry.

DBAPPSecurity, amidst a challenging tech landscape, shows promising signs with an expected annual revenue growth of 19%, outpacing the Chinese market's average of 13.3%. This growth is underpinned by its strategic focus on expanding its cybersecurity solutions, crucial as digital security concerns escalate globally. Despite recent setbacks like being dropped from the S&P Global BMI Index and ongoing unprofitability, the company is poised for a turnaround with forecasted profitability within three years and an impressive earnings growth projection of 53.76% annually. These developments suggest DBAPPSecurity’s potential resilience and adaptability in a rapidly evolving industry.

- Delve into the full analysis health report here for a deeper understanding of DBAPPSecurity.

Evaluate DBAPPSecurity's historical performance by accessing our past performance report.

Geovis TechnologyLtd (SHSE:688568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China, with a market cap of CN¥26.65 billion.

Operations: Geovis Technology Co., Ltd specializes in creating digital earth products, catering to government, enterprise, and public sectors within China. The company leverages its expertise in research and development to industrialize these products across diverse applications.

Geovis TechnologyLtd, amidst a flurry of recent acquisitions, including a significant CNY 640 million stake purchase by major investment firms, demonstrates robust growth potential in the tech sector. With an annual revenue increase of 30.6% and earnings growth at 39.4%, the company outstrips many peers in its market segment. These figures are particularly impressive given the broader Chinese market's average growth rates of 13.3% for revenue and 25.1% for earnings respectively. Despite challenges such as a highly volatile share price over the past three months, Geovis's aggressive expansion strategy and substantial R&D focus—evidenced by their latest financials showing substantial investment in innovation—position it well for future technological advancements and market share gains.

- Take a closer look at Geovis TechnologyLtd's potential here in our health report.

Assess Geovis TechnologyLtd's past performance with our detailed historical performance reports.

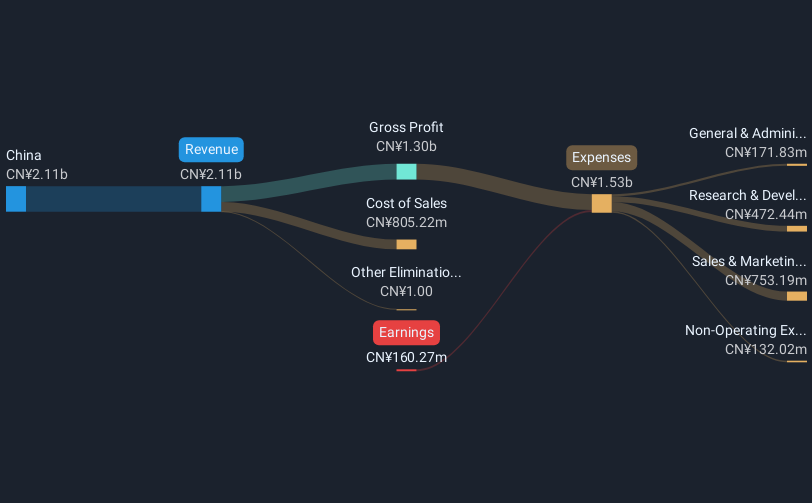

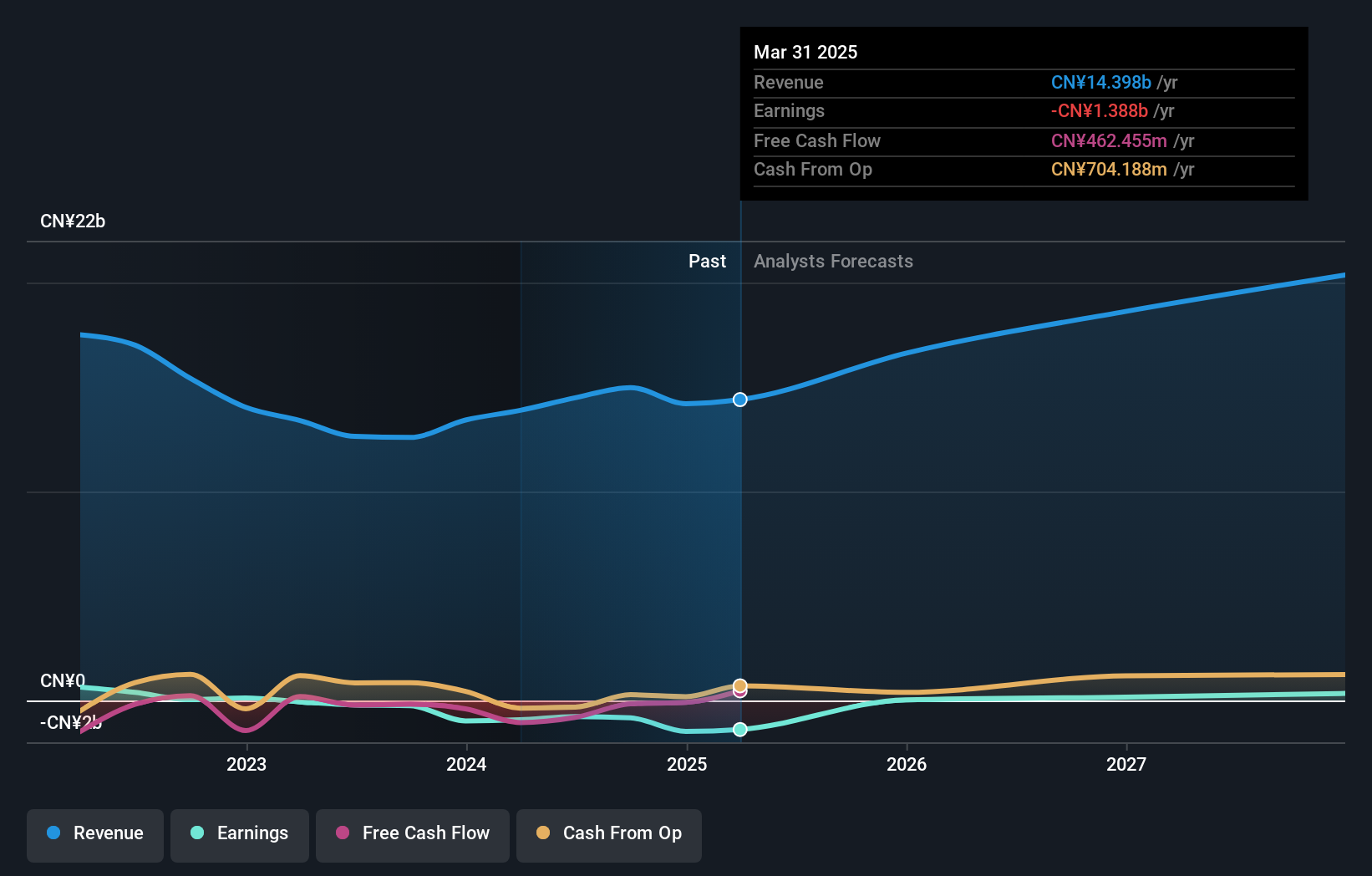

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Greatwall Technology Group Co., Ltd. (SZSE:000066) is a company with a market cap of CN¥41.87 billion, engaged in technology and electronics manufacturing and services.

Operations: Greatwall Technology operates primarily in the technology and electronics manufacturing sector. Its revenue streams are diversified across various segments within this industry. The company focuses on providing a range of products and services, contributing to its overall financial performance.

China Greatwall Technology Group is navigating a transformative phase, underscored by its recent aggressive share repurchase strategy, with CNY 256 million allocated to buy back shares at a maximum of CNY 18 each. This move, aimed at fueling equity incentives, complements its robust forecasted revenue growth of 18.2% annually—outpacing the broader Chinese market's average. Despite current unprofitability and a volatile share price in recent months, the firm's strategic investments in R&D are poised to bolster its competitive edge in high-growth tech sectors. With earnings expected to surge by an impressive 101.82% annually, Greatwall Technology is setting the stage for significant future profitability and market presence expansion.

Summing It All Up

- Click here to access our complete index of 1229 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China Greatwall Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000066

China Greatwall Technology Group

China Greatwall Technology Group Co., Ltd.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives