Asian Growth Stocks With High Insider Ownership December 2025

Reviewed by Simply Wall St

As global markets experience shifts in interest rates and fluctuating economic indicators, Asian markets continue to attract attention with their unique growth opportunities and challenges. In this environment, stocks with high insider ownership can be particularly appealing as they may indicate a strong alignment between management and shareholder interests, potentially offering resilience amid market volatility.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.1% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

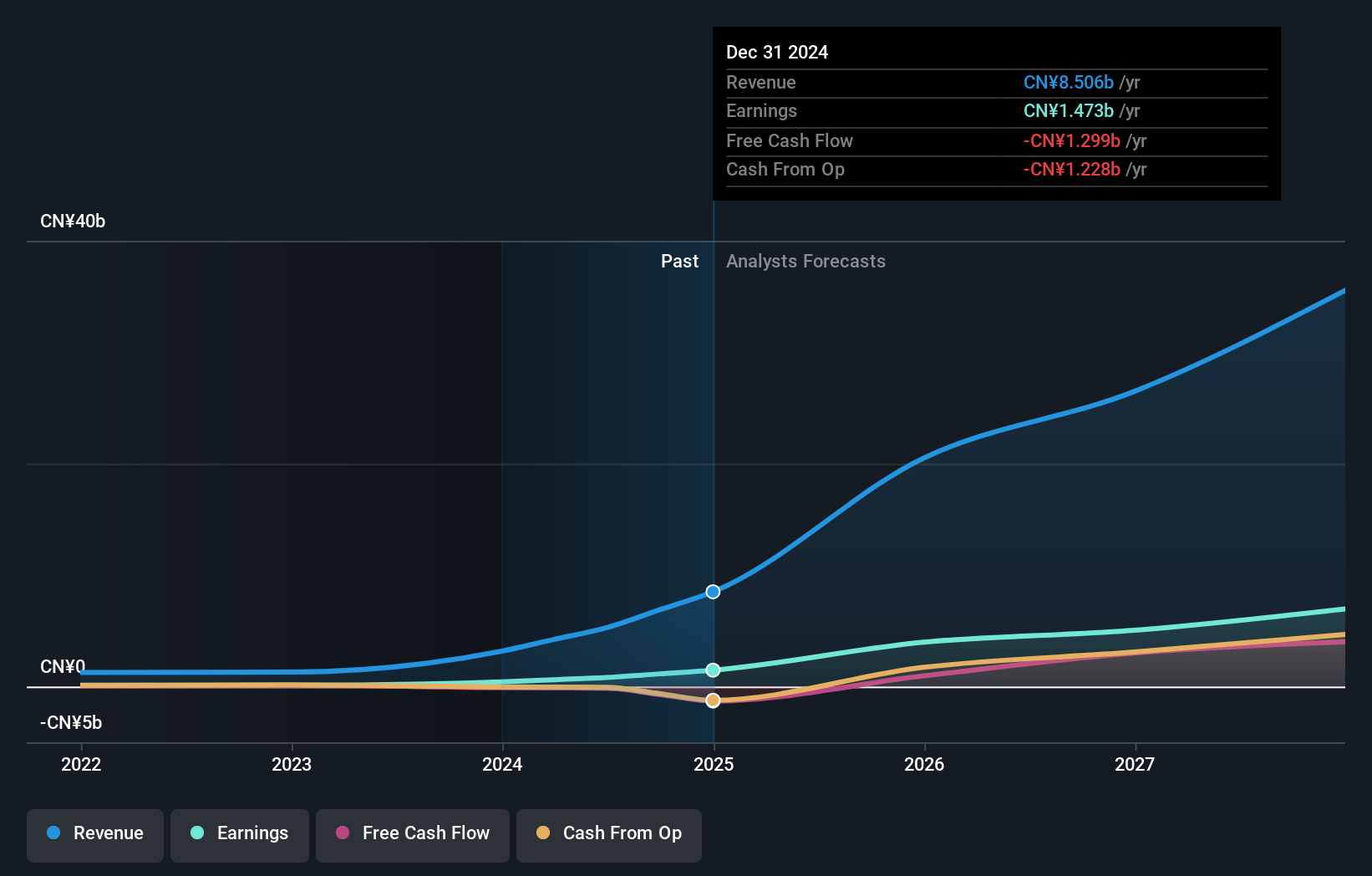

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$116.86 billion.

Operations: The company's revenue segment consists of Jewelry & Watches, generating CN¥17.34 billion.

Insider Ownership: 34.8%

Earnings Growth Forecast: 34.3% p.a.

Laopu Gold demonstrates strong growth potential, with earnings expected to grow significantly at 34.3% annually over the next three years, outpacing the Hong Kong market. Revenue is forecasted to increase by 31.3% per year, also surpassing market averages. Recent corporate actions include a follow-on equity offering of HK$2.72 billion and amendments to its Articles of Association reflecting capital changes. Despite no recent insider trading activity, analysts anticipate a substantial stock price rise of 57.9%.

- Take a closer look at Laopu Gold's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Laopu Gold's share price might be too optimistic.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

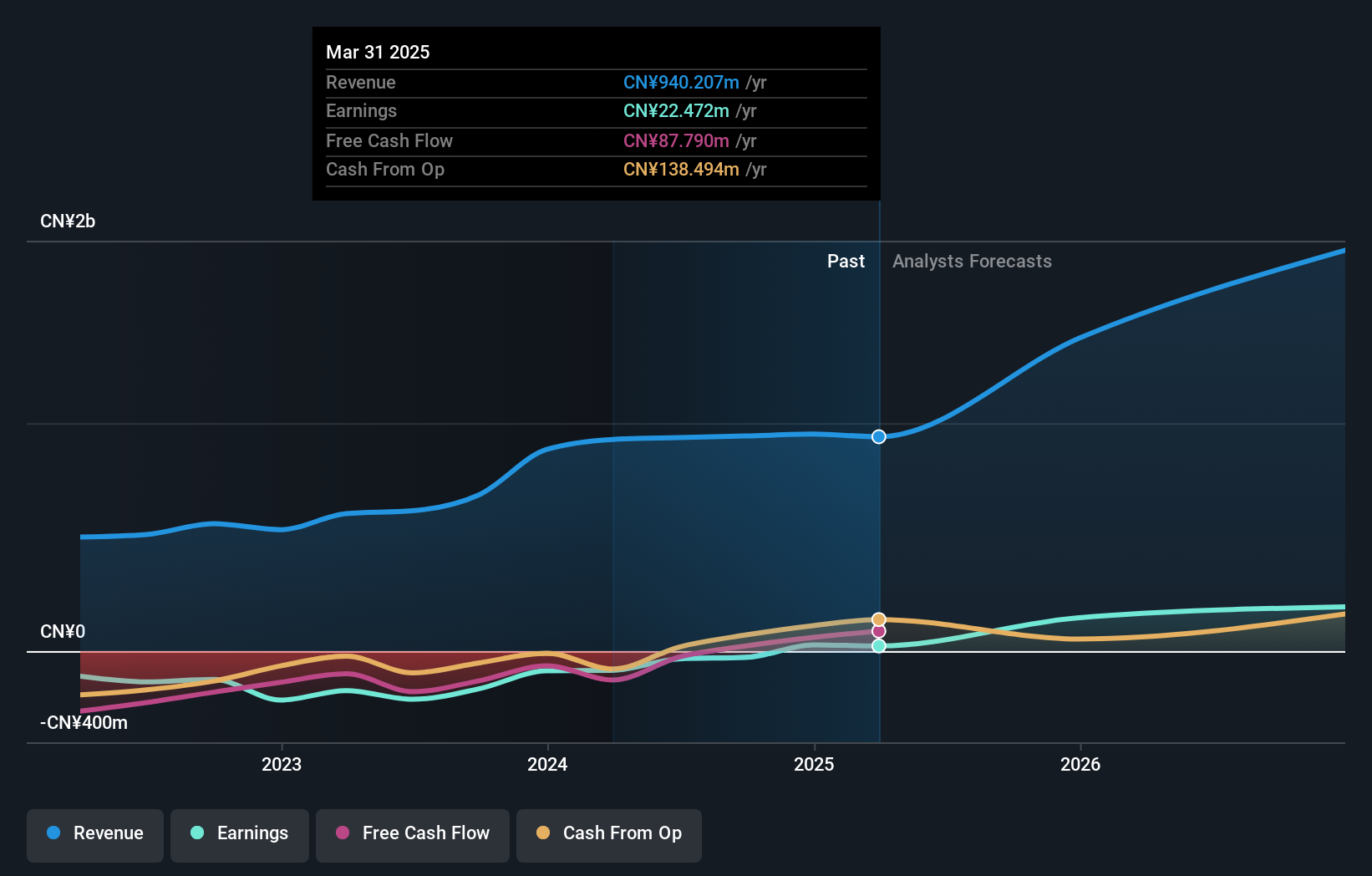

Overview: Genew Technologies Co., Ltd. is involved in the research, development, production, and sale of communication and network products globally with a market cap of CN¥7.92 billion.

Operations: Genew Technologies Co., Ltd. generates its revenue through the research, development, production, and sale of communication and network products worldwide.

Insider Ownership: 16.7%

Earnings Growth Forecast: 112.9% p.a.

Genew Technologies Ltd. is poised for substantial growth, with revenue expected to increase by 46.7% annually, surpassing the Chinese market average. The company is forecasted to become profitable within three years, highlighting its potential as a growth entity. Recently, Zhiyuan Capital acquired an additional 5% stake in Genew Technologies for CNY 213.11 million, increasing its total ownership to 10%, underscoring strong insider interest despite recent volatility and a reported net loss of CNY 47.19 million this year.

- Navigate through the intricacies of Genew TechnologiesLtd with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Genew TechnologiesLtd implies its share price may be too high.

Raksul (TSE:4384)

Simply Wall St Growth Rating: ★★★★☆☆

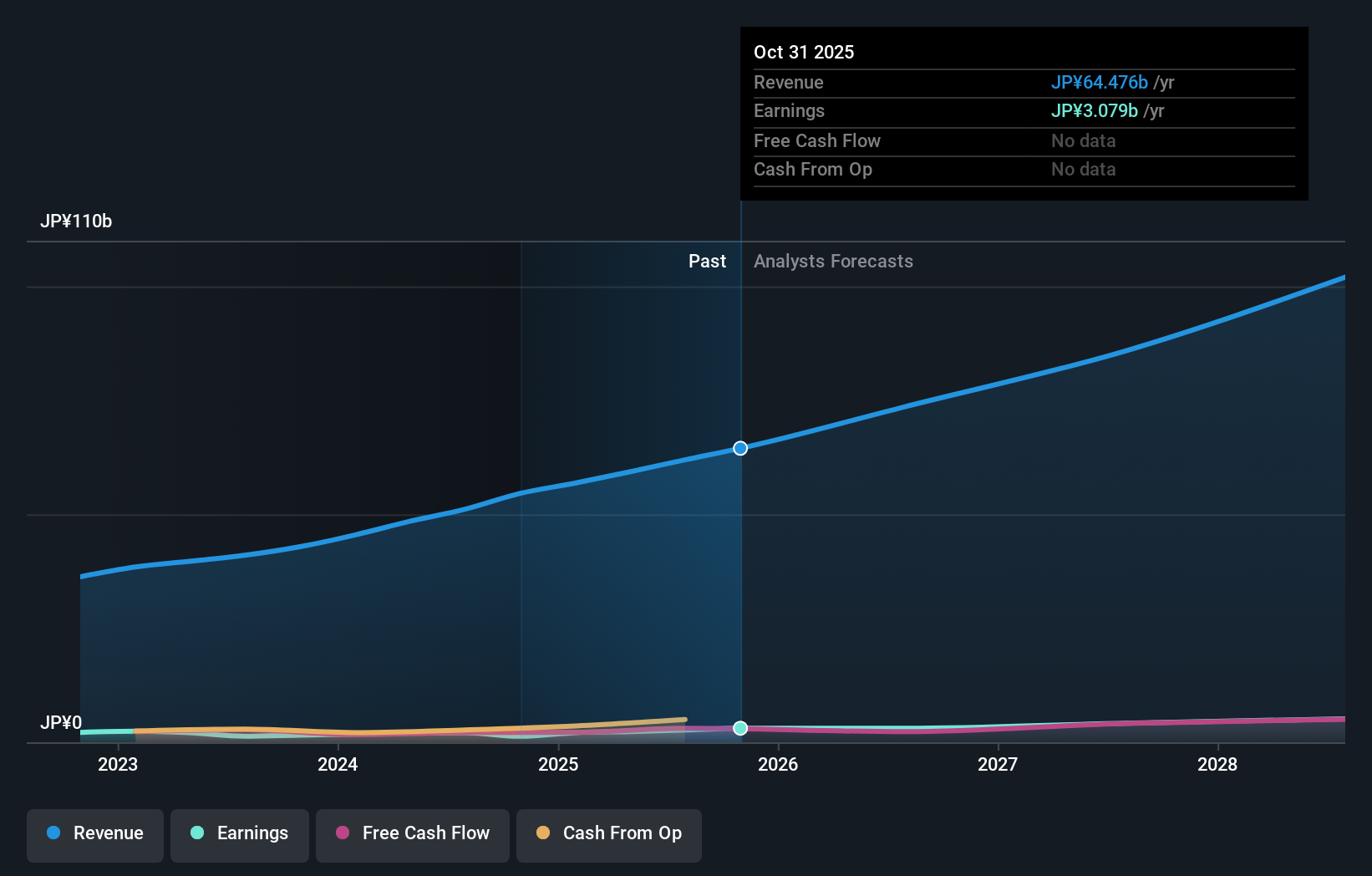

Overview: Raksul Inc. operates in Japan, offering printing services, with a market capitalization of approximately ¥102.69 billion.

Operations: The company's revenue primarily comes from its Procurement Platform, which generates ¥60.08 billion, followed by its Marketing Platform with ¥3.96 billion.

Insider Ownership: 14.3%

Earnings Growth Forecast: 18.6% p.a.

Raksul Inc. is experiencing earnings growth, expected to outpace the Japanese market at 18.6% annually, though revenue growth is slower than 20%. Despite high share price volatility and large one-off items affecting earnings quality, the company trades below its estimated fair value. On December 11, R2 Inc. proposed acquiring Raksul for ¥104 billion in cash, with a tender offer period from December 12 to February 4, potentially leading to full ownership by R2 Inc.

- Dive into the specifics of Raksul here with our thorough growth forecast report.

- Our valuation report unveils the possibility Raksul's shares may be trading at a premium.

Turning Ideas Into Actions

- Delve into our full catalog of 635 Fast Growing Asian Companies With High Insider Ownership here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)