Zhengzhou Jiean Hi-TechLtd's (SZSE:300845) Returns On Capital Not Reflecting Well On The Business

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Zhengzhou Jiean Hi-TechLtd (SZSE:300845), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Zhengzhou Jiean Hi-TechLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

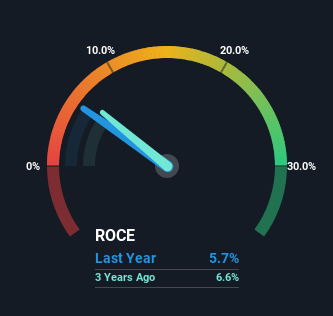

0.057 = CN¥45m ÷ (CN¥935m - CN¥150m) (Based on the trailing twelve months to June 2024).

Thus, Zhengzhou Jiean Hi-TechLtd has an ROCE of 5.7%. In absolute terms, that's a low return, but it's much better than the Software industry average of 2.8%.

View our latest analysis for Zhengzhou Jiean Hi-TechLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Zhengzhou Jiean Hi-TechLtd has performed in the past in other metrics, you can view this free graph of Zhengzhou Jiean Hi-TechLtd's past earnings, revenue and cash flow.

So How Is Zhengzhou Jiean Hi-TechLtd's ROCE Trending?

On the surface, the trend of ROCE at Zhengzhou Jiean Hi-TechLtd doesn't inspire confidence. Over the last five years, returns on capital have decreased to 5.7% from 26% five years ago. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

The Bottom Line

Bringing it all together, while we're somewhat encouraged by Zhengzhou Jiean Hi-TechLtd's reinvestment in its own business, we're aware that returns are shrinking. And investors may be recognizing these trends since the stock has only returned a total of 17% to shareholders over the last three years. As a result, if you're hunting for a multi-bagger, we think you'd have more luck elsewhere.

Zhengzhou Jiean Hi-TechLtd does have some risks, we noticed 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhengzhou Jiean Hi-TechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300845

Zhengzhou Jiean Hi-TechLtd

Engages in the research, development, and technical services of computer simulation training systems in rail transit, emergency safety, and other fields in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026