As global markets continue to react positively to recent political developments and economic indicators, major indices like the S&P 500 have reached new highs, driven by optimism around potential trade deals and AI investments. With growth stocks outperforming value shares for the first time this year, investors are increasingly focusing on high-growth tech stocks that could benefit from these trends. In such a dynamic environment, identifying companies with strong innovation capabilities and exposure to burgeoning sectors like artificial intelligence can be key in exploring promising investment opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Chanjet Information Technology (SEHK:1588)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chanjet Information Technology Company Limited operates in the cloud service and software sectors within Mainland China, with a market capitalization of HK$2.02 billion.

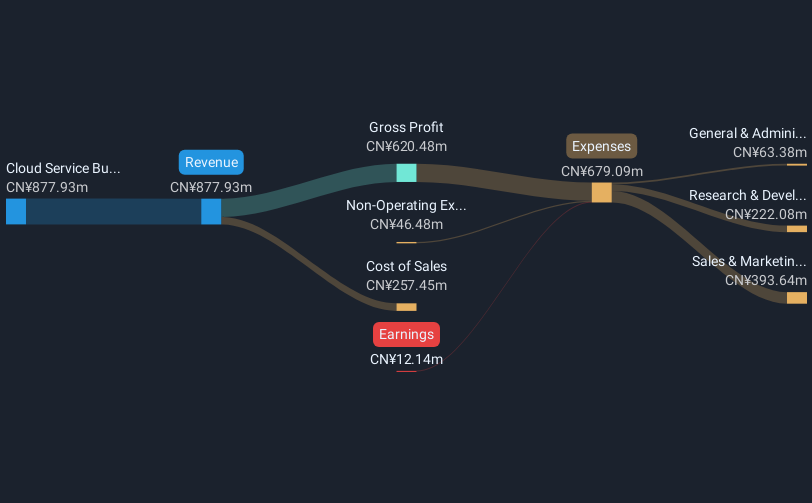

Operations: Chanjet Information Technology focuses on cloud services and software in Mainland China, generating CN¥877.93 million from its cloud service business.

Chanjet Information Technology is poised for significant growth, evidenced by its projected annual revenue increase of 13.8% and earnings growth of 40.52%. This performance is notably robust, especially considering the broader Hong Kong market's slower pace. The company's strategic shift towards cloud subscriptions, which are expected to constitute over two-thirds of total revenue, underscores a commitment to recurring revenue streams—a critical factor in the software industry's ongoing transition to SaaS models. Moreover, Chanjet's recent guidance anticipates a substantial profit increase up to RMB 36 million for 2024, nearly doubling last year’s figures without relying on one-time gains from asset disposals or equity investments that buoyed previous results. These indicators not only highlight Chanjet’s operational efficiency but also its adaptability in a competitive tech landscape.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topsec Technologies Group Inc. operates in China, offering cybersecurity, big data, and cloud services with a market cap of CN¥8.05 billion.

Operations: The company generates revenue primarily from its cybersecurity segment, which accounts for CN¥3.06 billion. The business focuses on providing integrated solutions in cybersecurity, big data, and cloud services within the Chinese market.

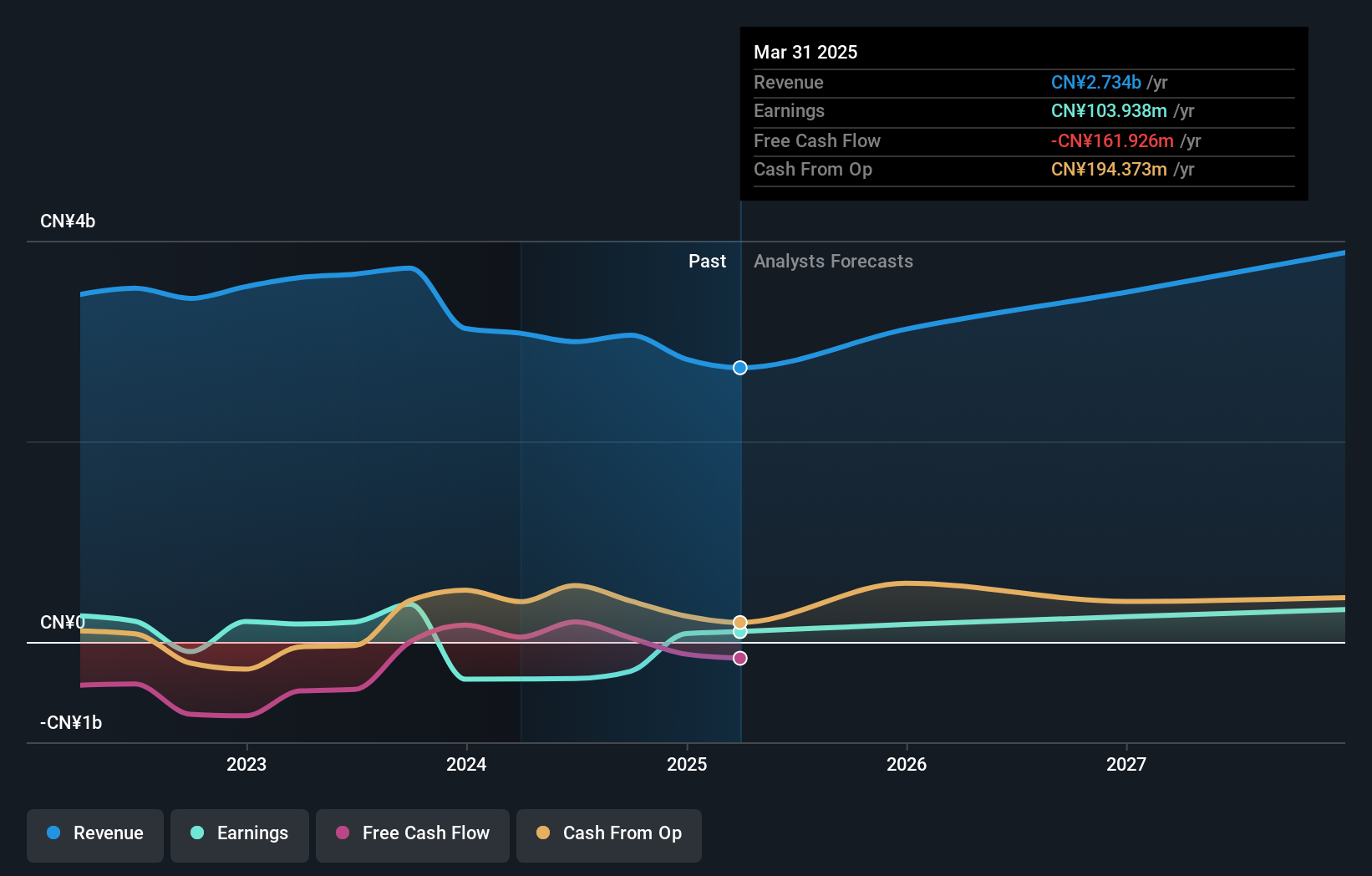

Topsec Technologies Group is navigating a transformative phase, underscored by its removal from key indices and a reshuffling of its board, reflecting strategic shifts aimed at revitalizing its operations. Despite these challenges, the company is poised for notable growth with revenue expected to surge by 15% annually. This growth trajectory is complemented by an ambitious forecast for earnings to increase by 73.67% per year. Moreover, Topsec's commitment to innovation and market adaptation is evident in its R&D investments which are crucial for maintaining competitive edge in the rapidly evolving tech landscape. These developments suggest that while Topsec faces hurdles, its focus on strategic realignment and robust growth projections may well position it favorably in the dynamic tech sector.

Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Jiuyuan Yinhai Software Co., Ltd specializes in offering medical insurance, digital government affairs, and smart cities services to government departments and industry ecosystem entities in China, with a market cap of CN¥6.92 billion.

Operations: Jiuyuan Yinhai Software focuses on delivering specialized services in medical insurance, digital government affairs, and smart cities to Chinese government departments and industry ecosystems. The company operates with a market capitalization of CN¥6.92 billion.

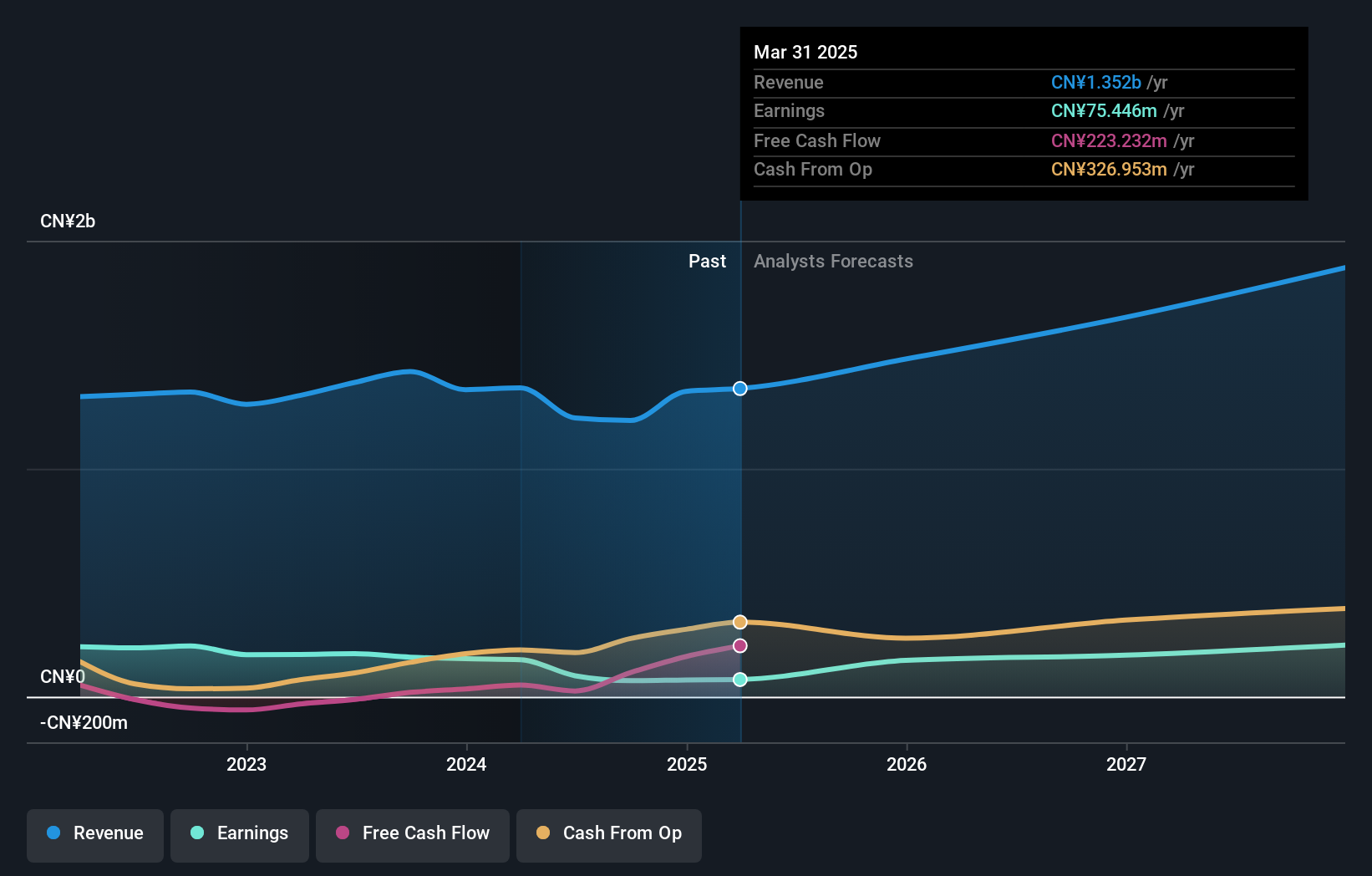

Sichuan Jiuyuan Yinhai Software has demonstrated resilience despite a challenging year, with revenue forecasted to grow at 18.6% annually, outpacing the CN market average of 13.4%. This growth is underpinned by significant R&D investments which have been crucial in maintaining its competitive edge in the software sector. The company's recent earnings report showed a dip, with net income at CNY 18.81 million from last year's CNY 114.22 million; however, it is set for a robust recovery with earnings expected to surge by 39.3% per year. These figures reflect a strategic focus on innovation and market adaptation that could shape its trajectory in the evolving tech landscape.

Summing It All Up

- Navigate through the entire inventory of 1226 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1588

Chanjet Information Technology

Engages in the cloud service and software businesses in Mainland China.

Flawless balance sheet and good value.

Market Insights

Community Narratives