- China

- /

- Semiconductors

- /

- SHSE:688256

Top Growth Companies With High Insider Ownership In August 2024

Reviewed by Simply Wall St

In August 2024, global markets have faced significant volatility, with major indices such as the S&P 500 and Nasdaq Composite experiencing sharp declines. Amidst these fluctuations, investors are increasingly focusing on companies with strong growth potential and high insider ownership, which can signal confidence from those closest to the business. In this environment, identifying growth companies where insiders hold substantial stakes can provide a measure of stability and potential upside. Here are three top growth stocks that stand out for their high insider ownership in August 2024.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 80.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 52.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

We'll examine a selection from our screener results.

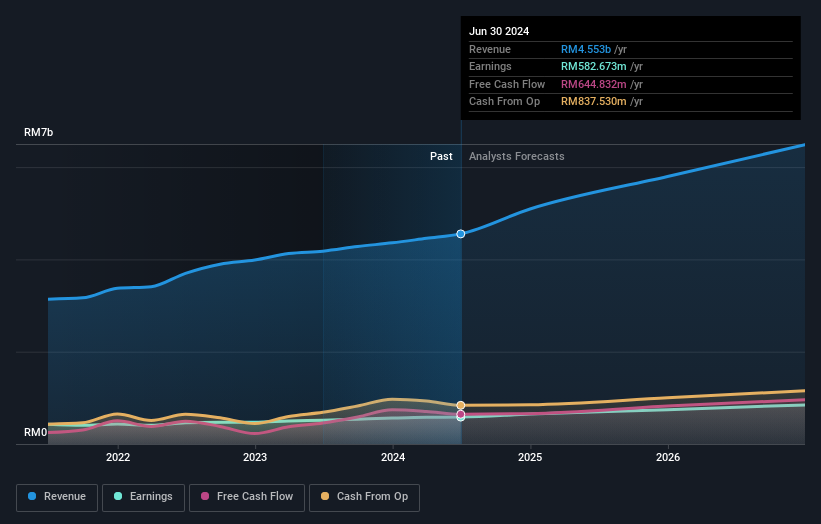

Mr D.I.Y. Group (M) Berhad (KLSE:MRDIY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mr D.I.Y. Group (M) Berhad, with a market cap of MYR19.47 billion, is an investment holding company that operates retail stores offering home improvement products and mass merchandise in Malaysia and Brunei.

Operations: The company generates MYR4.46 billion in revenue from its retail home improvement segment.

Insider Ownership: 15.3%

Earnings Growth Forecast: 12.4% p.a.

Mr D.I.Y. Group (M) Berhad demonstrates strong growth potential with substantial insider ownership, evidenced by a 15.5% earnings increase over the past year and forecasted annual revenue growth of 12.9%, outpacing the Malaysian market's 6.2%. Recent financial results show first-quarter sales rising to MYR 1.14 billion, with net income at MYR 144.88 million. The company also affirmed an interim dividend of MYR 0.01 per share, totaling approximately MYR 94.5 million for FY2024.

- Unlock comprehensive insights into our analysis of Mr D.I.Y. Group (M) Berhad stock in this growth report.

- In light of our recent valuation report, it seems possible that Mr D.I.Y. Group (M) Berhad is trading beyond its estimated value.

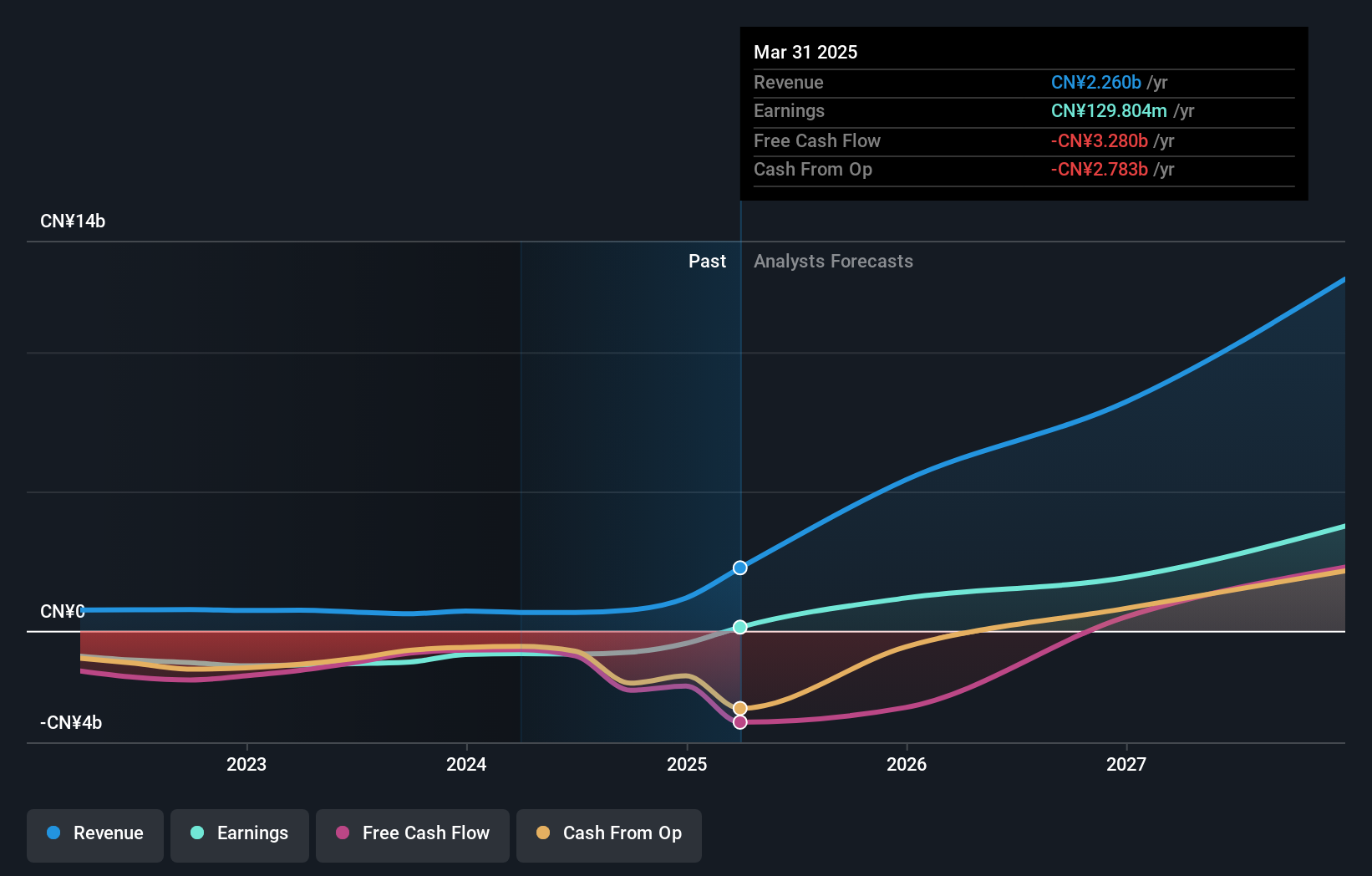

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cambricon Technologies Corporation Limited researches, develops, designs, and sells core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥95.77 billion.

Operations: Cambricon Technologies generates revenue from core chips used in cloud servers, edge computing, and terminal equipment within China.

Insider Ownership: 28.7%

Earnings Growth Forecast: 97.5% p.a.

Cambricon Technologies, with high insider ownership, is set for significant growth. Its revenue is forecast to grow 56.6% annually, outpacing the CN market's 13.5%. Earnings are expected to increase by 97.45% per year and become profitable within three years. The company recently announced a share repurchase program worth up to CNY 40 million, aimed at equity incentives, signaling confidence in its future performance despite current volatility in its share price.

- Click here to discover the nuances of Cambricon Technologies with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Cambricon Technologies' share price might be too optimistic.

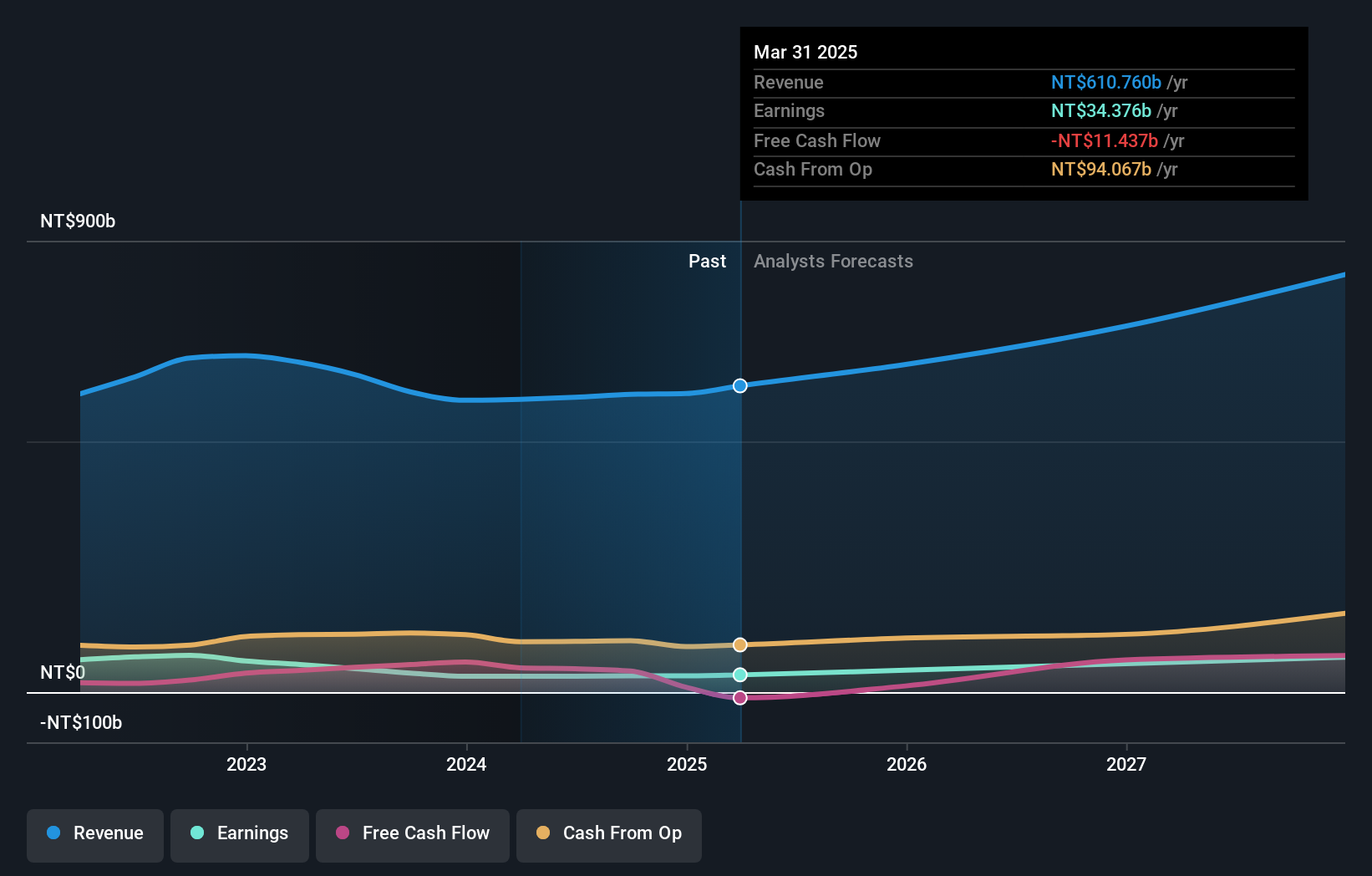

ASE Technology Holding (TWSE:3711)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ASE Technology Holding Co., Ltd. and its subsidiaries offer semiconductor packaging and testing, as well as electronic manufacturing services globally, with a market cap of NT$595.78 billion.

Operations: The company's revenue segments include NT$51.35 billion from testing, NT$261.77 billion from packaging, and NT$298.92 billion from electronic manufacturing services (EMS).

Insider Ownership: 28.6%

Earnings Growth Forecast: 31.4% p.a.

ASE Technology Holding, with substantial insider ownership, shows promising growth potential. The company's revenue for July 2024 was TWD 51.60 billion, up from TWD 48.35 billion a year ago. Earnings are forecast to grow at 31.45% annually, outpacing the Taiwan market's average of 18.7%. Despite its high volatility and unstable dividend track record, ASE is trading at a significant discount to its estimated fair value and expects annual profit growth above market rates over the next three years.

- Click to explore a detailed breakdown of our findings in ASE Technology Holding's earnings growth report.

- According our valuation report, there's an indication that ASE Technology Holding's share price might be on the cheaper side.

Seize The Opportunity

- Investigate our full lineup of 1462 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Flawless balance sheet with high growth potential.