- China

- /

- Personal Products

- /

- SZSE:003006

January 2025's Top 3 Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and political uncertainties, investors are witnessing a turbulent start to the year, with U.S. equities experiencing notable declines and small-cap stocks underperforming their larger counterparts. In such a volatile environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential opportunities for investors seeking resilience amid market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Turkcell Iletisim Hizmetleri (IBSE:TCELL) | TRY95.20 | TRY190.03 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.34 | 50% |

| Bank BTPN Syariah (IDX:BTPS) | IDR860.00 | IDR1715.86 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | US$39.26 | US$78.06 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥12.88 | CN¥26.06 | 50.6% |

| TSE (KOSDAQ:A131290) | ₩42850.00 | ₩86326.99 | 50.4% |

| Shinko Electric Industries (TSE:6967) | ¥5868.00 | ¥11708.78 | 49.9% |

| AK Medical Holdings (SEHK:1789) | HK$4.28 | HK$8.52 | 49.8% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.14 | CN¥18.40 | 50.3% |

| Coeur Mining (NYSE:CDE) | US$6.35 | US$12.63 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

Zhejiang Lante Optics (SHSE:688127)

Overview: Zhejiang Lante Optics Co., Ltd. manufactures and sells optical products in China, with a market cap of CN¥10.32 billion.

Operations: The company generates revenue from its Photographic Equipment & Supplies segment, amounting to CN¥1.05 billion.

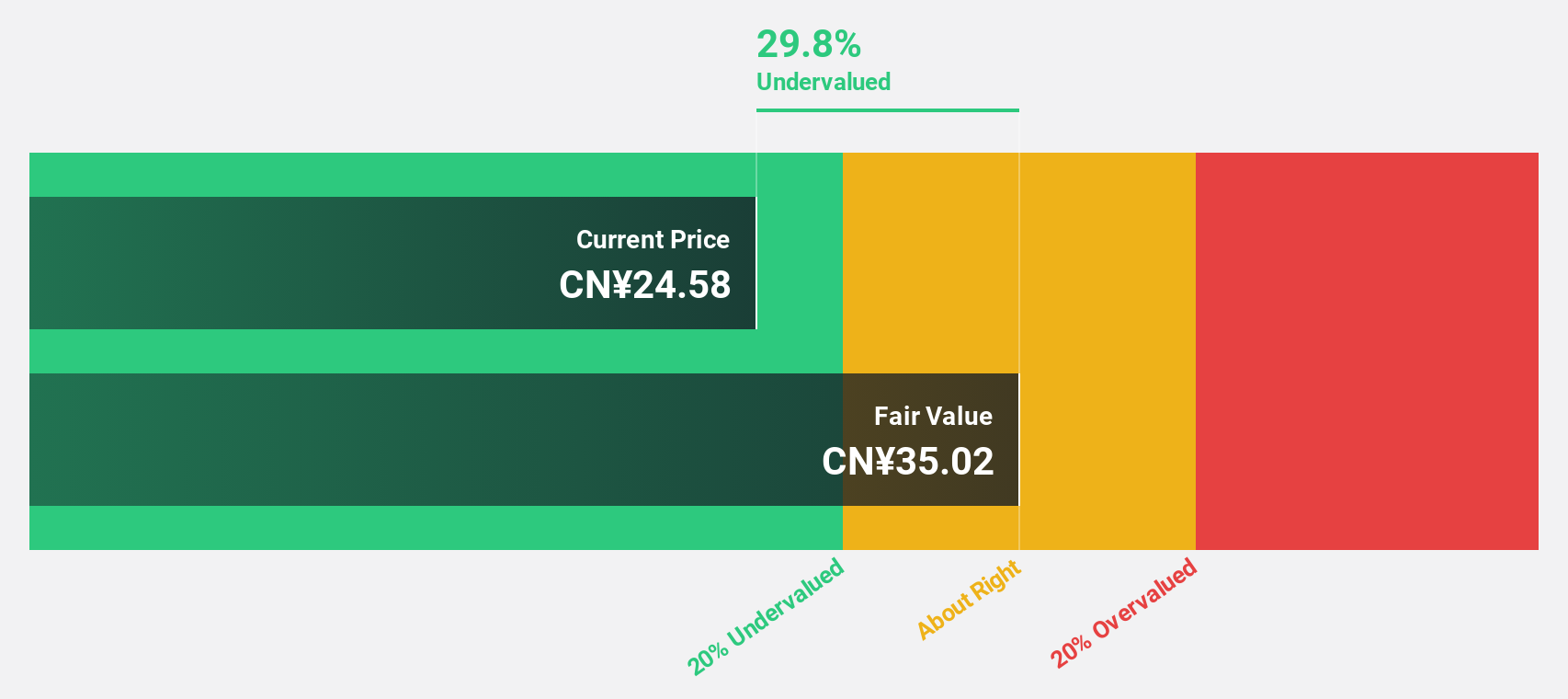

Estimated Discount To Fair Value: 29.6%

Zhejiang Lante Optics appears undervalued, trading at CN¥24.91, below its estimated fair value of CN¥35.37. Its earnings grew by over 100% in the past year, with future annual profit growth expected at 23.07%. Revenue forecasts show a robust annual increase of 20.4%, outpacing the broader Chinese market's growth rate of 13.4%. However, its return on equity is projected to remain relatively low at 18.7% in three years.

- Our comprehensive growth report raises the possibility that Zhejiang Lante Optics is poised for substantial financial growth.

- Dive into the specifics of Zhejiang Lante Optics here with our thorough financial health report.

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥17.69 billion.

Operations: The company's revenue segments include network security products, trusted security management platforms, and specialized security services and solutions.

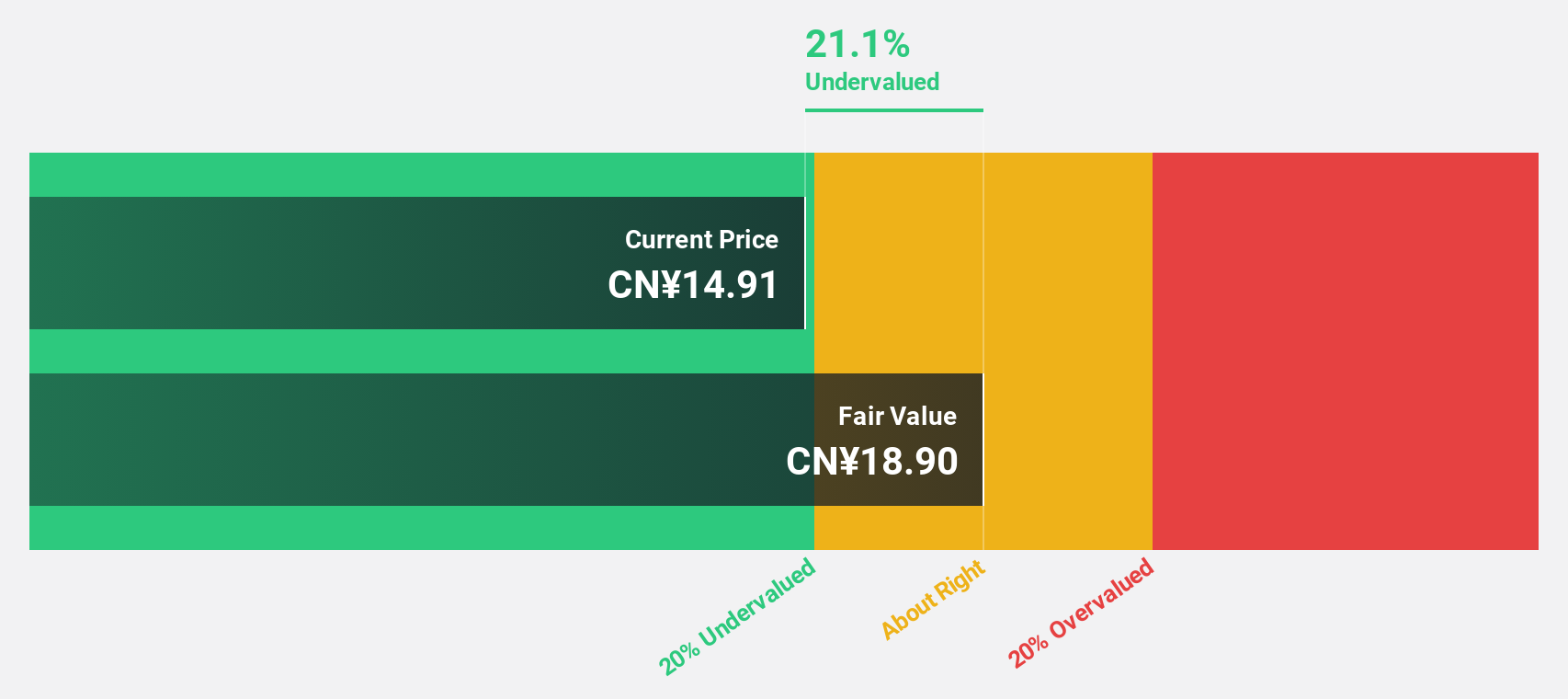

Estimated Discount To Fair Value: 40.8%

Venustech Group is trading at CN¥14.52, significantly below its estimated fair value of CN¥24.52, suggesting potential undervaluation based on cash flows. Despite a recent net loss of CNY 210.07 million for the nine months ending September 2024, earnings are forecast to grow annually by 28.6%, outpacing the Chinese market's growth rate of 25%. However, profit margins have decreased from last year and return on equity is expected to remain low at 8.1%.

- Our expertly prepared growth report on Venustech Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Venustech Group stock in this financial health report.

Chongqing Baiya Sanitary Products (SZSE:003006)

Overview: Chongqing Baiya Sanitary Products Co., Ltd. operates in the hygiene and sanitary products industry, with a market cap of CN¥9.60 billion.

Operations: The company's revenue primarily comes from its Personal Products segment, which generated CN¥2.99 billion.

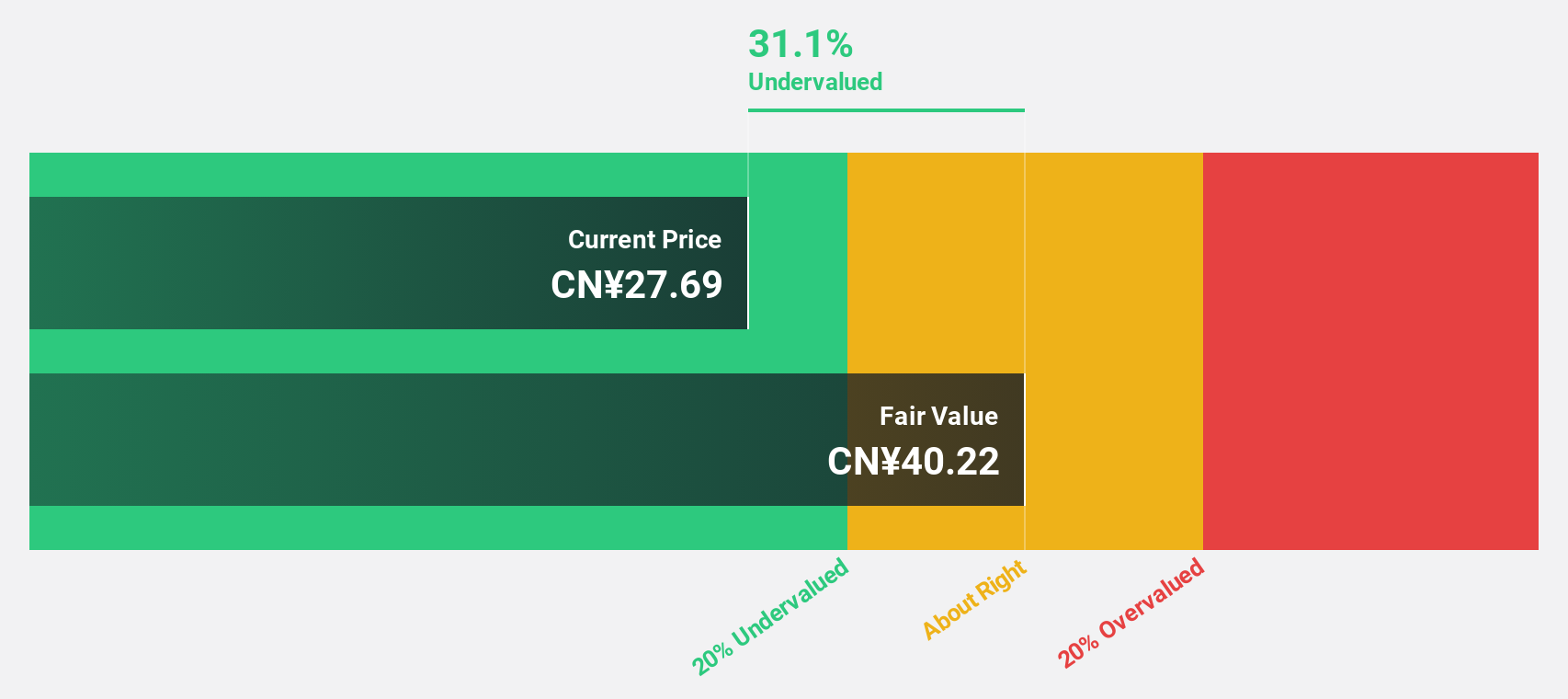

Estimated Discount To Fair Value: 29.8%

Chongqing Baiya Sanitary Products, trading at CN¥22.97, is valued below its estimated fair value of CN¥32.72, highlighting potential undervaluation based on cash flows. The company reported sales of CN¥2.32 billion for the first nine months of 2024, up from CN¥1.48 billion last year, with net income rising to CN¥238.52 million from CN¥182.4 million. Earnings are projected to grow annually by 26%, surpassing the Chinese market's growth rate of 25%.

- Insights from our recent growth report point to a promising forecast for Chongqing Baiya Sanitary Products' business outlook.

- Take a closer look at Chongqing Baiya Sanitary Products' balance sheet health here in our report.

Seize The Opportunity

- Dive into all 874 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003006

Chongqing Baiya Sanitary Products

Chongqing Baiya Sanitary Products Co., Ltd.

Exceptional growth potential with flawless balance sheet.