- China

- /

- Entertainment

- /

- SZSE:002247

Spotlight On January 2025's Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have kicked off 2025 with a mix of optimism and caution, as strong U.S. labor market data clashes with inflation concerns, leading to choppy trading sessions. Amidst this backdrop, investors are increasingly looking at penny stocks—an investment area that may seem outdated but still holds potential for growth. These stocks often represent smaller or newer companies and can offer unique opportunities when backed by solid financials and sound fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$141.28M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.55 | £405.37M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.76 | MYR449.66M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Starflex (SET:SFLEX) | THB2.58 | THB2B | ★★★★☆☆ |

Click here to see the full list of 5,703 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Linmon Media (SEHK:9857)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linmon Media Limited is a drama series production company operating in Mainland China and internationally, with a market cap of approximately HK$1.07 billion.

Operations: The company's revenue is primarily generated from the Chinese Mainland, amounting to CN¥946.90 million, with additional contributions of CN¥45.24 million from other countries and regions.

Market Cap: HK$1.07B

Linmon Media, with a market cap of HK$1.07 billion, has recently become profitable and is debt-free, offering some stability in the volatile penny stock space. The company’s short-term assets significantly exceed its liabilities, which adds to its financial robustness. Linmon's recent licensing agreement with Tencent for drama series and movies could enhance revenue streams from 2025 to 2027. However, the change in auditors from Ernst & Young to Moore CPA Limited due to fee disagreements might raise concerns about financial transparency. Despite low return on equity at 1.2%, earnings are forecasted to grow significantly each year.

- Get an in-depth perspective on Linmon Media's performance by reading our balance sheet health report here.

- Examine Linmon Media's earnings growth report to understand how analysts expect it to perform.

Zhejiang Jihua Group (SHSE:603980)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Jihua Group Co., Ltd. operates in the dyestuff industry with a market capitalization of approximately CN¥2.82 billion.

Operations: There are no specific revenue segments reported for this company.

Market Cap: CN¥2.82B

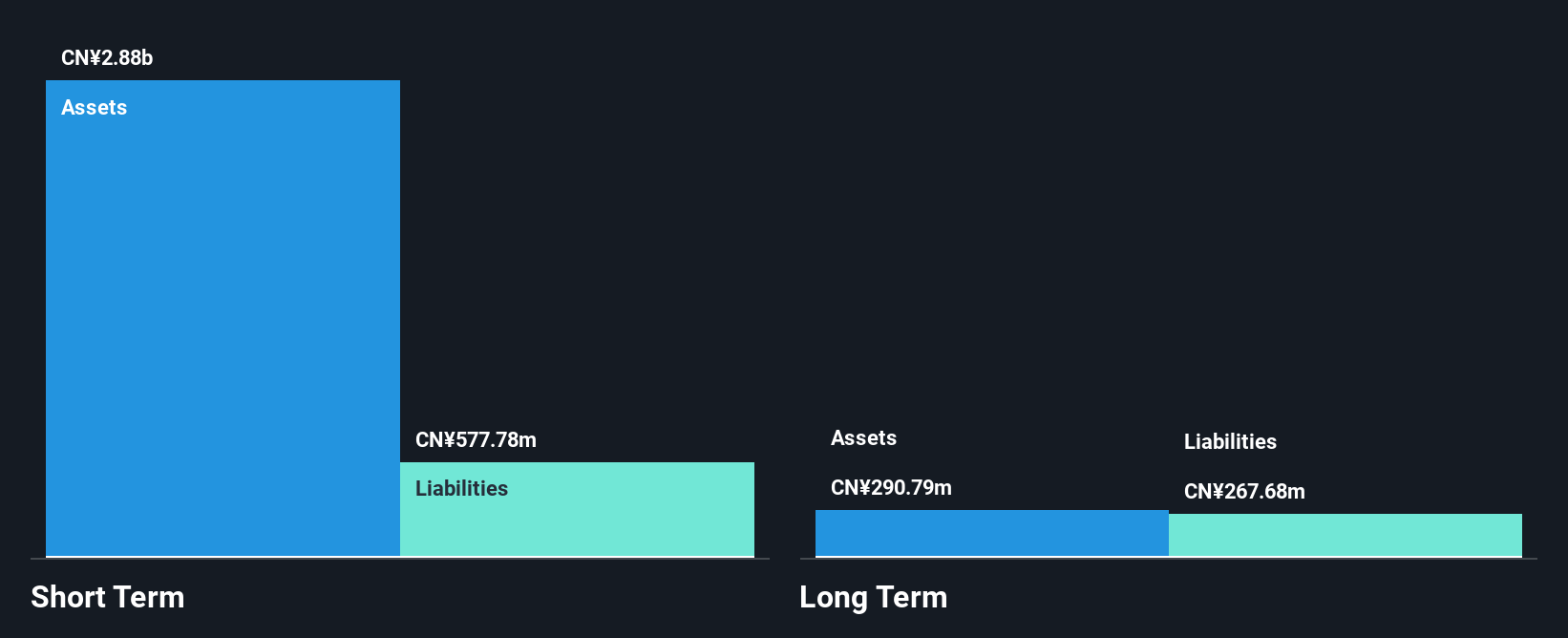

Zhejiang Jihua Group, with a market cap of CN¥2.82 billion, has shown improvement in its financial performance despite being unprofitable over the past five years. The company reported sales of CN¥1.16 billion for the nine months ending September 2024, marking a decrease from the previous year but achieving a net income of CN¥128.2 million compared to a prior net loss. Short-term assets exceed both short and long-term liabilities significantly, reflecting strong liquidity and debt management capabilities as cash surpasses total debt levels. However, challenges remain with profitability and negative return on equity at -1.41%.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Jihua Group.

- Explore historical data to track Zhejiang Jihua Group's performance over time in our past results report.

Zhejiang Juli Culture DevelopmentLtd (SZSE:002247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Juli Culture Development Co., Ltd. operates in the cultural and entertainment industry with a market capitalization of CN¥2.17 billion.

Operations: Zhejiang Juli Culture Development Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.17B

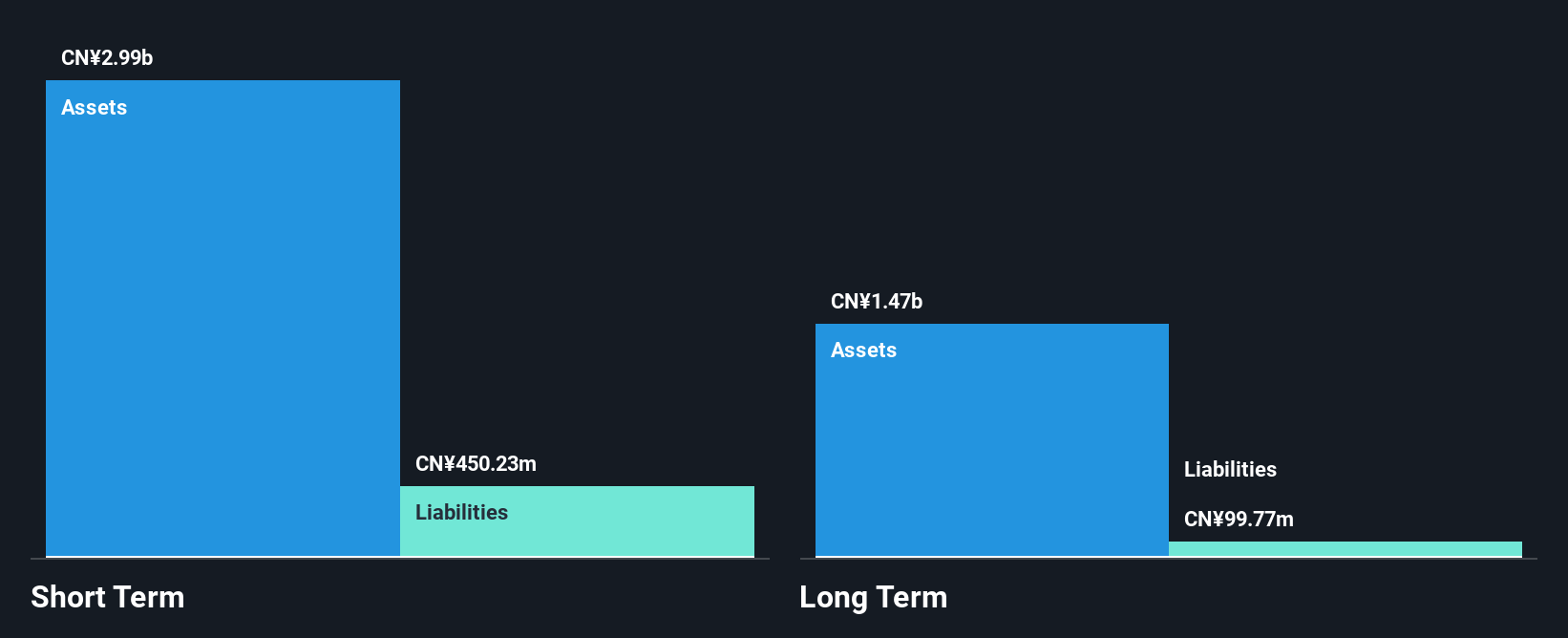

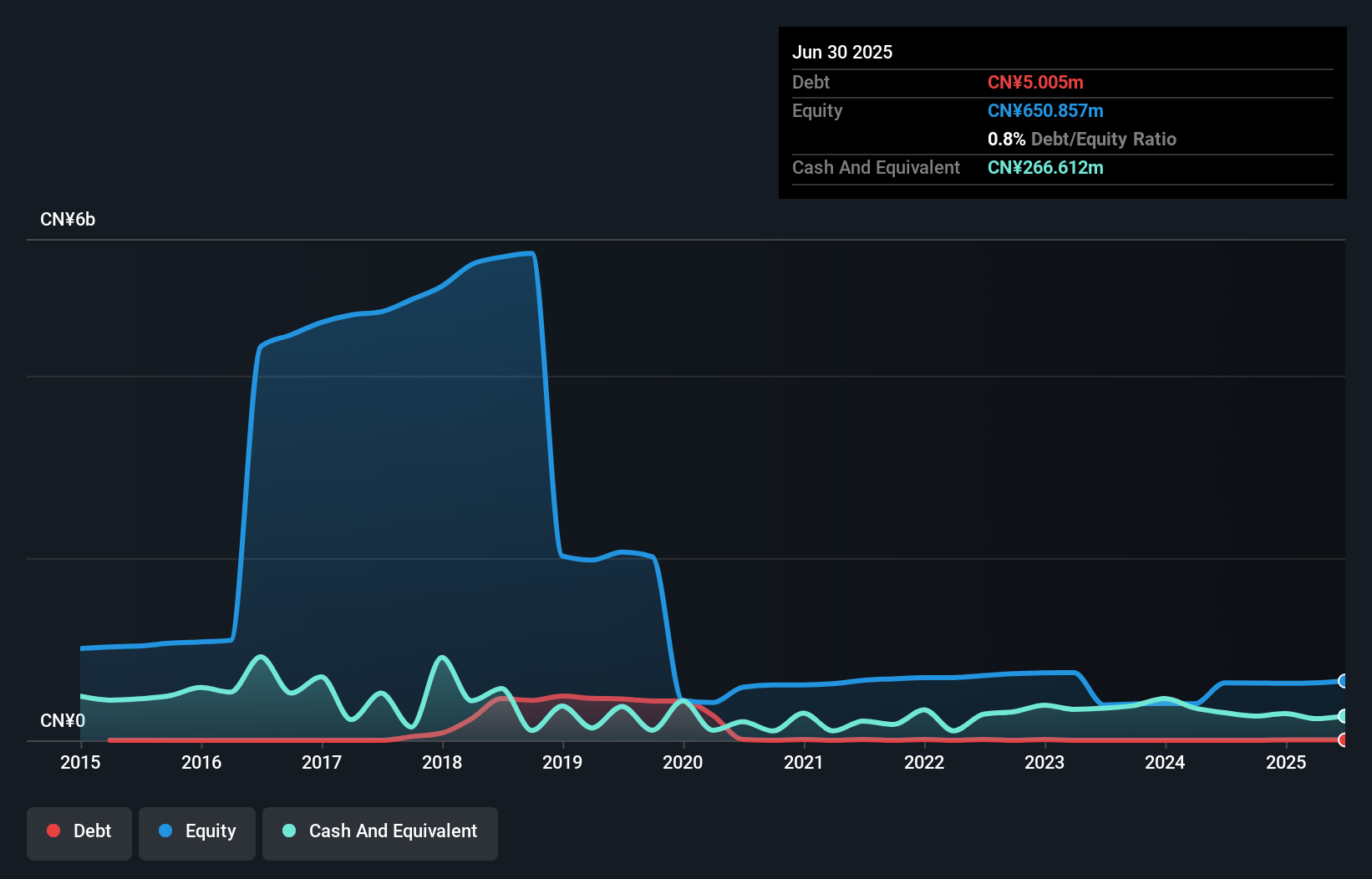

Zhejiang Juli Culture Development Co., Ltd. has demonstrated significant financial improvement, achieving profitability over the past year with a net income of CN¥220.53 million for the nine months ending September 2024, reversing from a prior net loss. The company benefits from strong liquidity, with short-term assets of CN¥596.7 million exceeding both short and long-term liabilities substantially. It is debt-free, offering stability in its financial structure. Despite high weekly volatility compared to other Chinese stocks, its price-to-earnings ratio (9.5x) suggests it may be undervalued relative to the broader market average of 31.8x, appealing to value-focused investors.

- Dive into the specifics of Zhejiang Juli Culture DevelopmentLtd here with our thorough balance sheet health report.

- Evaluate Zhejiang Juli Culture DevelopmentLtd's historical performance by accessing our past performance report.

Seize The Opportunity

- Explore the 5,703 names from our Penny Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zhejiang Juli Culture DevelopmentLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Juli Culture DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002247

Zhejiang Juli Culture DevelopmentLtd

Zhejiang Juli Culture Development Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives