- China

- /

- Electronic Equipment and Components

- /

- SZSE:002389

Exploring None High Growth Tech Stocks With Potential Expansion

Reviewed by Simply Wall St

In recent weeks, global markets have experienced significant fluctuations, with small-cap stocks underperforming their large-cap counterparts and the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainty. As investors navigate these choppy waters, identifying high-growth tech stocks with potential for expansion requires a keen eye on companies that demonstrate resilience in challenging economic environments and possess innovative capabilities to capitalize on emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 29.92% | 61.97% | ★★★★★★ |

Click here to see the full list of 1223 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Anhui XDLK Microsystem (SHSE:688582)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui XDLK Microsystem Corporation Limited focuses on the research, development, production, and sale of sensors in China and has a market cap of CN¥20.94 billion.

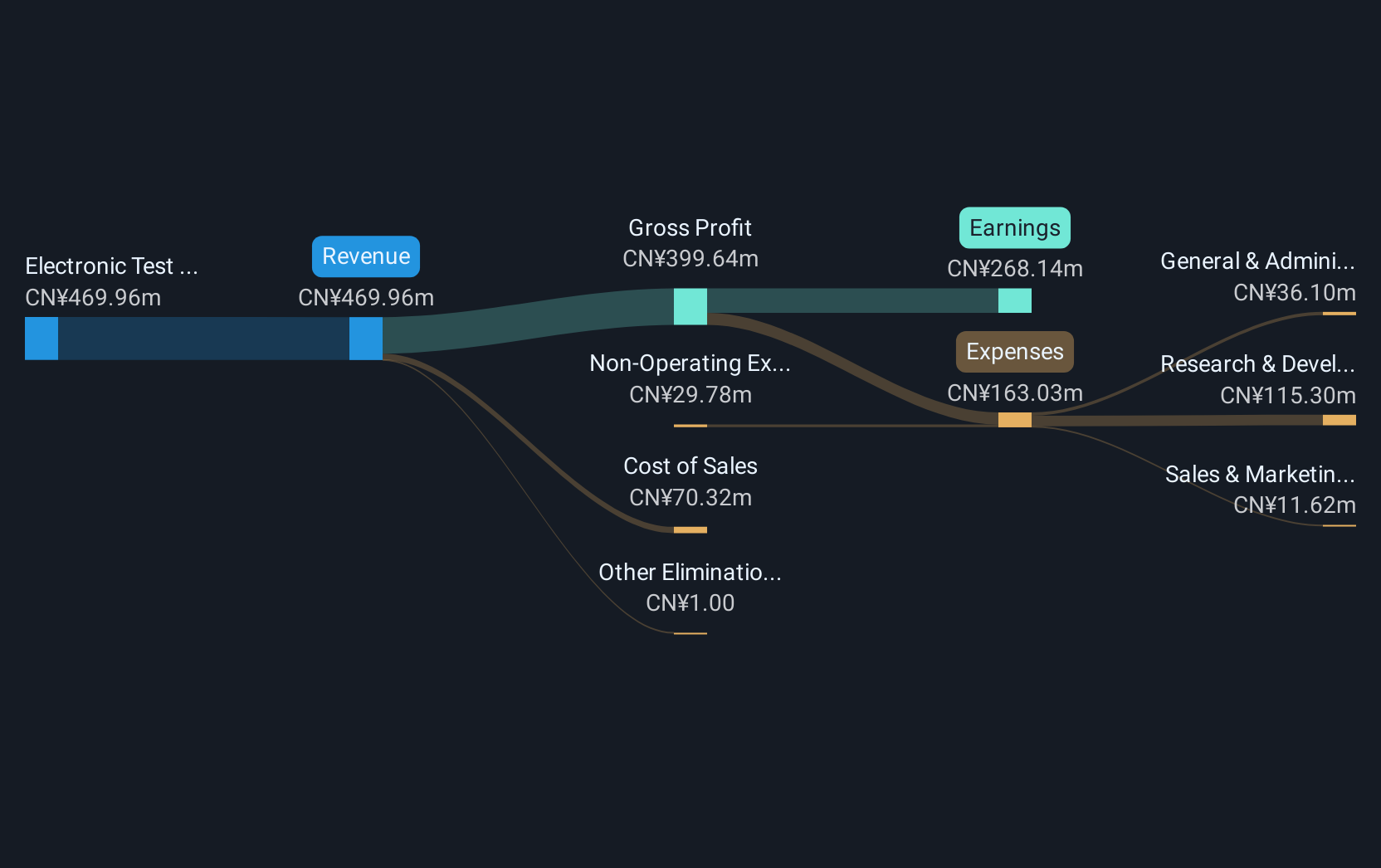

Operations: XDLK Microsystem primarily generates revenue through its electronic test and measurement instruments segment, which contributes CN¥396.31 million. The company focuses on sensor technology within China, leveraging its research and development capabilities to support its product offerings.

Anhui XDLK Microsystem, a notable entity in the tech sector, has demonstrated robust financial growth with a 38.1% annual increase in revenue and a 34% projected annual earnings growth over the next three years. The company's commitment to innovation is evident from its significant R&D investments, aligning with industry trends towards advanced microsystems technology. Recent events such as their Q3 earnings call and an extraordinary shareholders meeting underline their proactive approach in stakeholder engagement and transparency. With earnings having surged by 37.6% over the past year, outpacing the electronic industry's average, Anhui XDLK is positioned to capitalize on expanding market demands while continuing to enhance shareholder value through strategic initiatives and strong fiscal management.

- Delve into the full analysis health report here for a deeper understanding of Anhui XDLK Microsystem.

Assess Anhui XDLK Microsystem's past performance with our detailed historical performance reports.

Aerospace CH UAVLtd (SZSE:002389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aerospace CH UAV Co., Ltd specializes in the research, design, manufacturing, testing, sales, and servicing of drones and their onboard mission equipment with a market capitalization of CN¥17.57 billion.

Operations: Aerospace CH UAV Co., Ltd focuses on the entire lifecycle of drones, from development to service. The company generates revenue through sales of drones and related mission equipment.

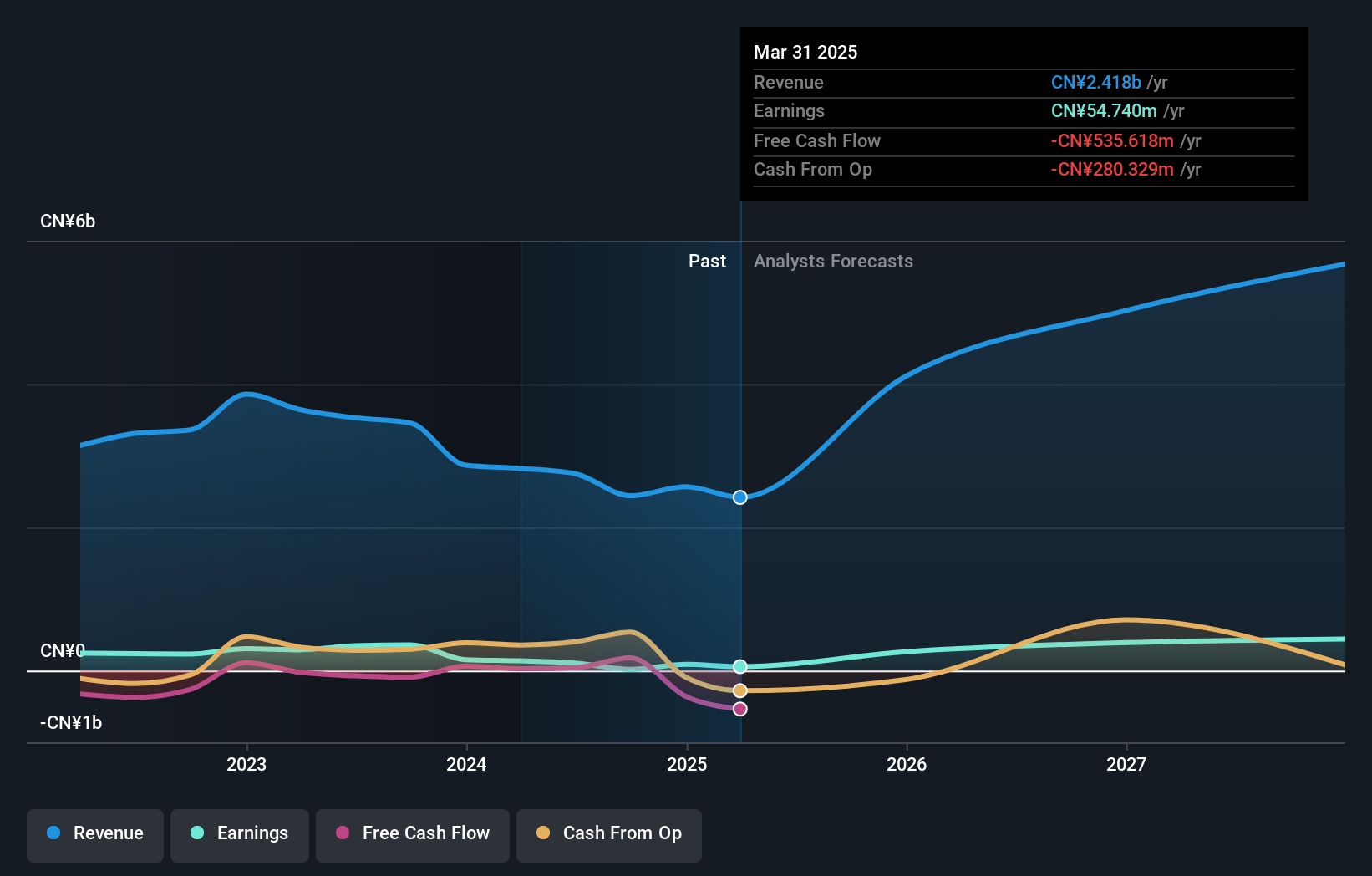

Aerospace CH UAVLtd, amidst a challenging fiscal period, reported a significant revenue drop to CNY 1.29 billion from CNY 1.72 billion year-over-year and saw net income plummet to CNY 6.17 million from CNY 141.87 million. Despite these setbacks, the company is poised for recovery with expected annual revenue and earnings growth of 29.1% and 59.6%, respectively, outpacing the Chinese market averages of 13.4% and 25%. These projections are supported by strategic board changes and an emphasis on governance during their recent extraordinary general meeting, positioning them well for future resilience in the tech sector.

- Get an in-depth perspective on Aerospace CH UAVLtd's performance by reading our health report here.

Understand Aerospace CH UAVLtd's track record by examining our Past report.

Range Intelligent Computing Technology Group (SZSE:300442)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Range Intelligent Computing Technology Group Company Limited specializes in developing data centers and technology campuses, with a market capitalization of CN¥93.99 billion.

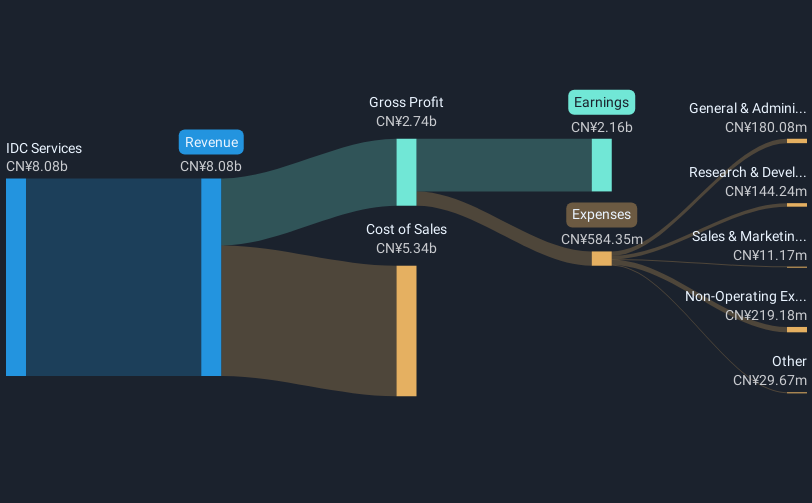

Operations: The company generates revenue primarily from IDC Services, amounting to CN¥8.08 billion.

Range Intelligent Computing Technology Group has demonstrated robust financial performance with a significant increase in revenue, rising from CNY 2.68 billion to CNY 6.41 billion within nine months, marking a substantial growth trajectory. The company's net income also surged impressively from CNY 1.12 billion to CNY 1.51 billion in the same period, reflecting an earnings growth of over 30%. This financial upswing is underpinned by strategic expansions and innovations in AI and computing technologies, positioning Range well amidst industry competitors for continued upward momentum.

Taking Advantage

- Discover the full array of 1223 High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002389

Aerospace CH UAVLtd

Engages in the research and development, designing, manufacturing, testing, sales, and service of drones and its onboard mission equipment.

Flawless balance sheet with high growth potential.