- China

- /

- Semiconductors

- /

- SHSE:688256

Asian Growth Companies With High Insider Ownership In March 2025

Reviewed by Simply Wall St

As global markets face challenges from tariff uncertainties and inflation concerns, the Asian market has shown resilience with China's recent economic growth targets and stimulus plans. In this environment, companies with strong insider ownership can be particularly appealing as they often indicate a vested interest in long-term success, aligning management's goals with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.8% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| WinWay Technology (TWSE:6515) | 22.6% | 32.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 64.3% |

| BIWIN Storage Technology (SHSE:688525) | 18.9% | 57.6% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

We're going to check out a few of the best picks from our screener tool.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥325.01 billion.

Operations: Cambricon Technologies generates revenue from its core chip offerings across cloud servers, edge computing, and terminal equipment within China.

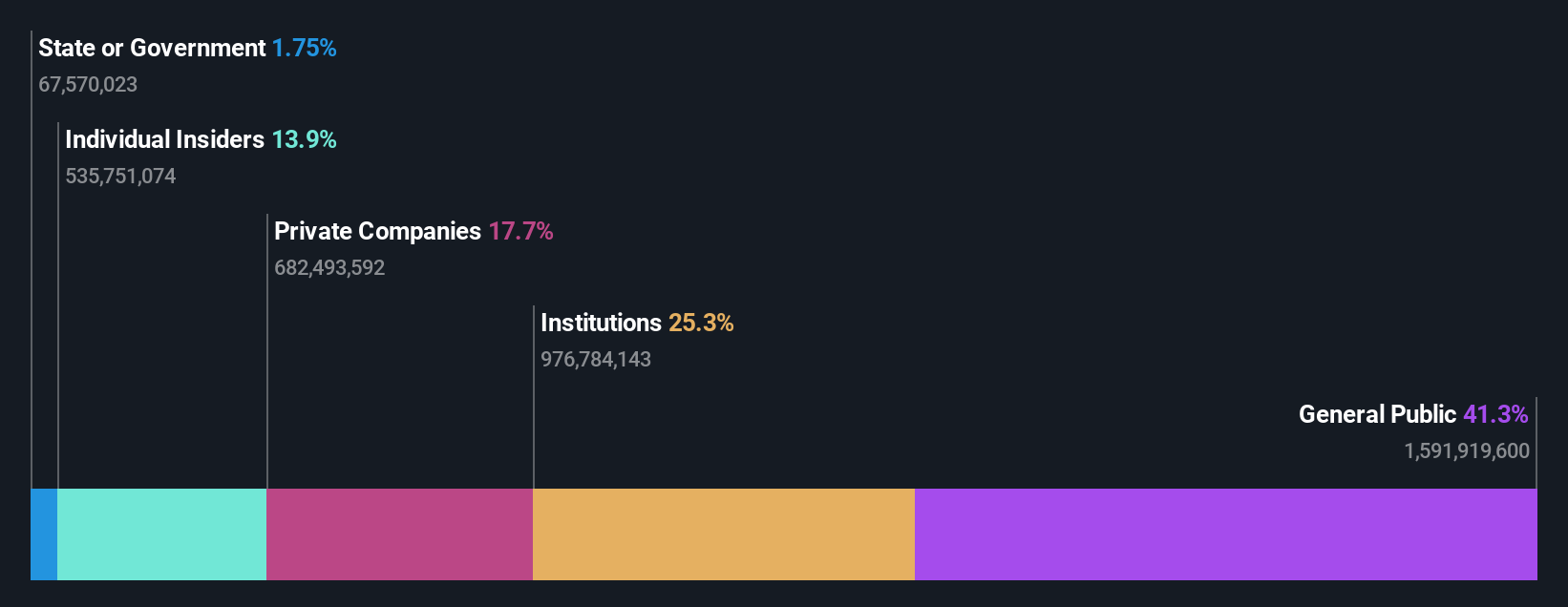

Insider Ownership: 28.7%

Earnings Growth Forecast: 58.5% p.a.

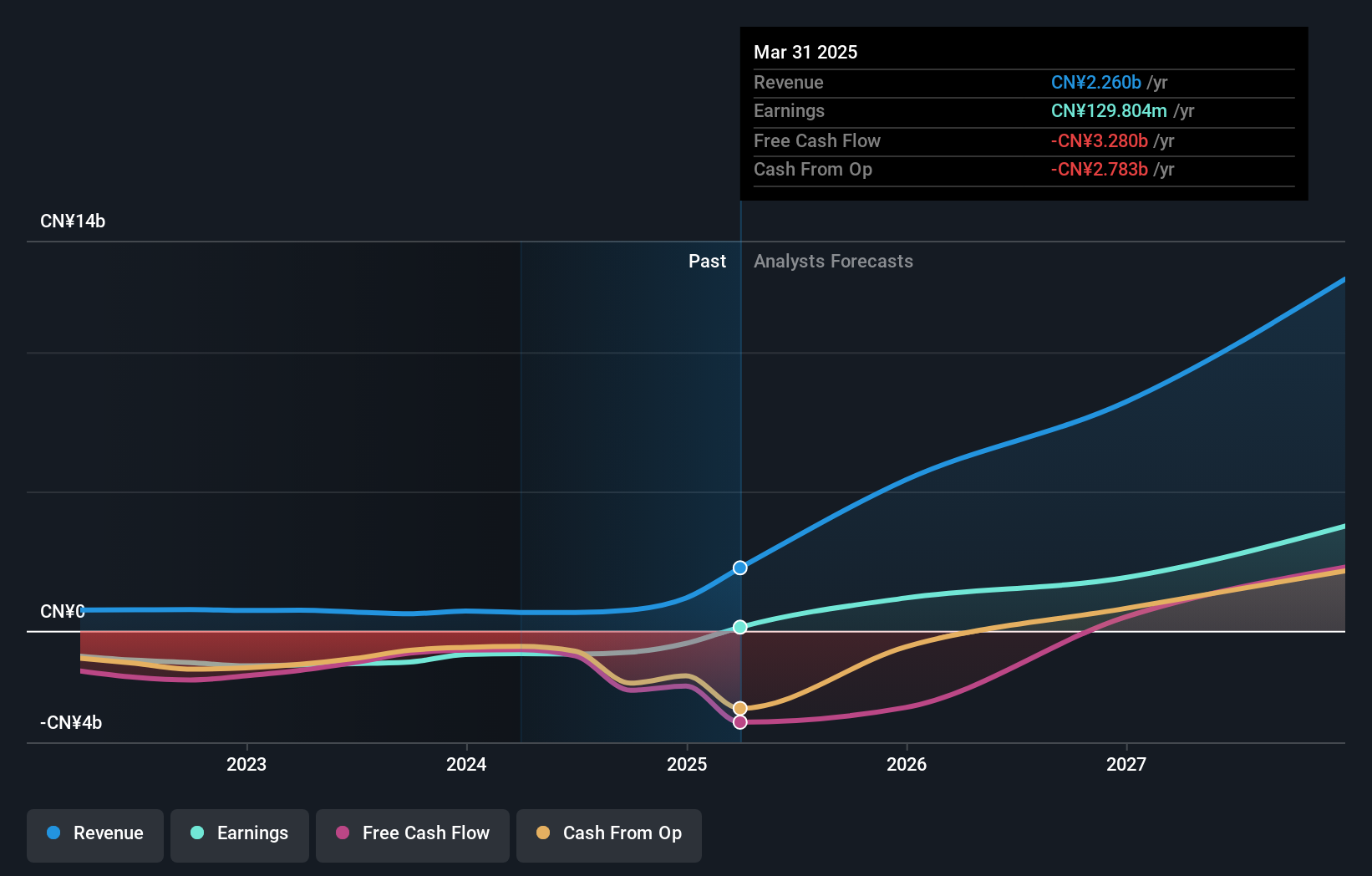

Cambricon Technologies is experiencing robust revenue growth, with a forecasted increase of 43.1% annually, outpacing the Chinese market average. Despite reporting a net loss of CNY 443.2 million for 2024, this marks an improvement from the previous year. The company is projected to achieve profitability within three years, with earnings expected to grow at 58.52% per year. However, its share price remains highly volatile and insider trading activity has been minimal recently.

- Delve into the full analysis future growth report here for a deeper understanding of Cambricon Technologies.

- Upon reviewing our latest valuation report, Cambricon Technologies' share price might be too optimistic.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. operates as a provider of IT services and solutions, with a market cap of CN¥64.32 billion.

Operations: The company's revenue segments include IT services and solutions.

Insider Ownership: 23.8%

Earnings Growth Forecast: 28.3% p.a.

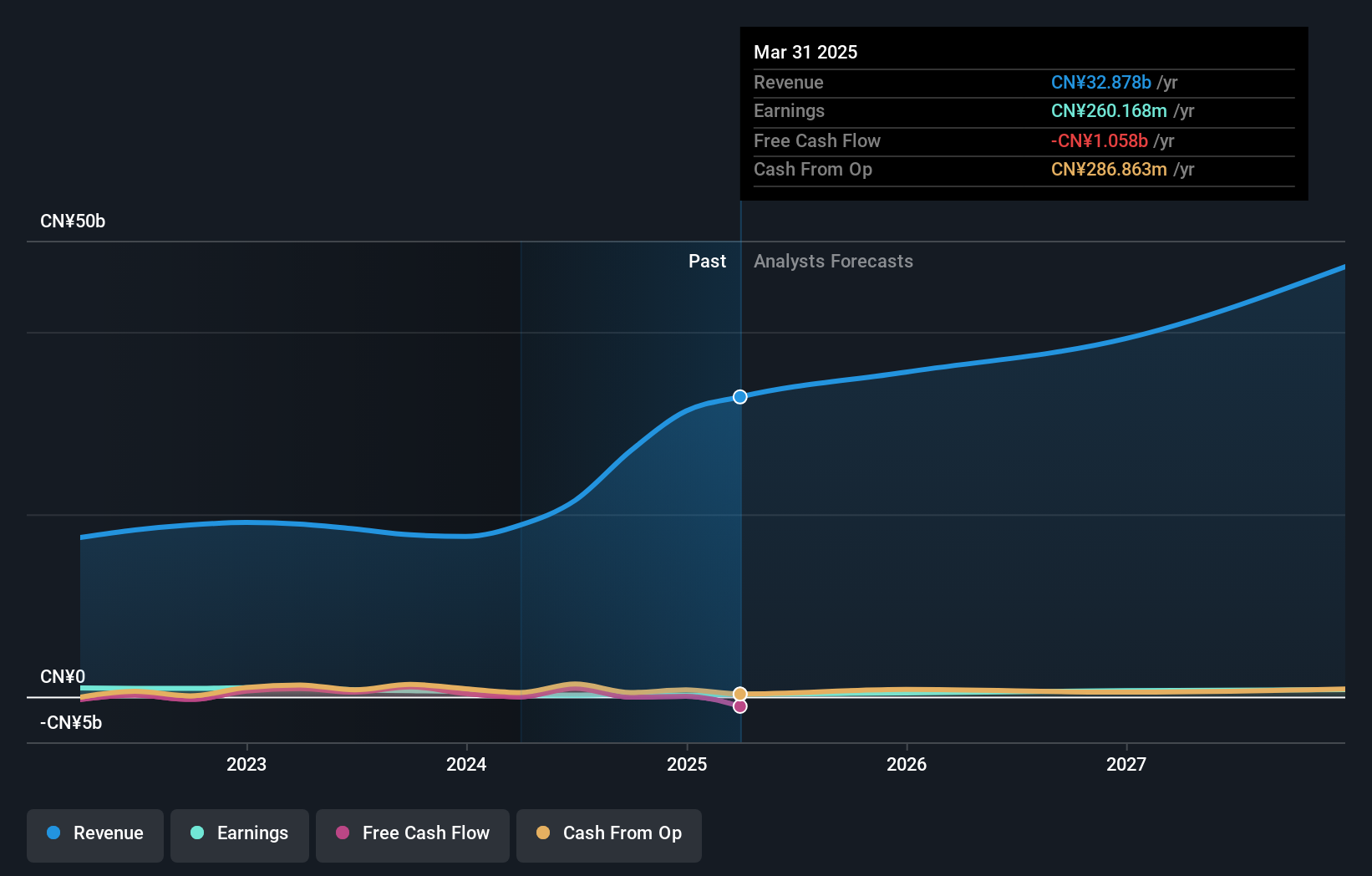

iSoftStone Information Technology is projected to experience significant earnings growth at 28.34% annually, surpassing the Chinese market's average of 25.5%. However, revenue growth is expected to be slower at 15.5%, though still above the market rate of 13.3%. Despite trading at a good value relative to peers, its return on equity is forecasted to remain low at 6.7%, and profit margins have declined from last year. The stock has shown high volatility recently with no substantial insider trading activity reported in the past three months.

- Click here to discover the nuances of iSoftStone Information Technology (Group) with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that iSoftStone Information Technology (Group) is priced lower than what may be justified by its financials.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, Europe, and other international markets; it has a market cap of NT$1.01 trillion.

Operations: Quanta Computer Inc.'s revenue from The Electronics Sector amounts to NT$3.05 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 17% p.a.

Quanta Computer's recent earnings report shows substantial growth, with sales reaching TWD 1.41 trillion and net income at TWD 59.70 billion, reflecting a strong increase from the previous year. Despite its Price-To-Earnings ratio of 16.9x being below the Taiwan market average, Quanta's revenue is expected to grow significantly faster than the market at 27.7% annually. However, its dividend yield of 4.98% isn't well covered by free cash flows, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of Quanta Computer stock in this growth report.

- Our valuation report here indicates Quanta Computer may be undervalued.

Taking Advantage

- Unlock our comprehensive list of 646 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

High growth potential with excellent balance sheet.