- China

- /

- Specialty Stores

- /

- SZSE:301088

RumereLtd's (SZSE:301088) Upcoming Dividend Will Be Larger Than Last Year's

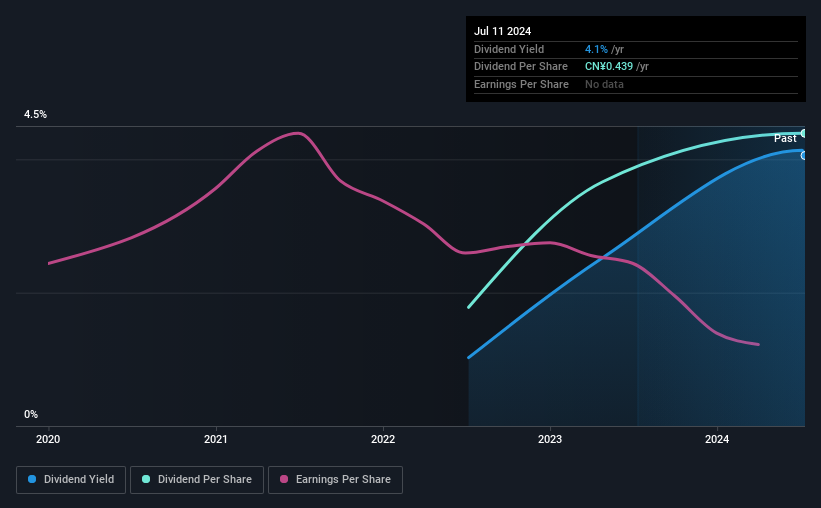

The board of Rumere Co.,Ltd. (SZSE:301088) has announced that it will be paying its dividend of CN¥0.439 on the 12th of July, an increased payment from last year's comparable dividend. This will take the annual payment to 4.1% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for RumereLtd

RumereLtd Is Paying Out More Than It Is Earning

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, the dividend made up 135% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

Earnings per share is forecast to rise by 22.2% over the next year. If the dividend continues on its recent course, the payout ratio in 12 months could be 110%, which is a bit high and could start applying pressure to the balance sheet.

RumereLtd Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 2 years, which isn't that long in the grand scheme of things. The annual payment during the last 2 years was CN¥0.178 in 2022, and the most recent fiscal year payment was CN¥0.439. This means that it has been growing its distributions at 57% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. RumereLtd's EPS has fallen by approximately 33% per year during the past three years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We're Not Big Fans Of RumereLtd's Dividend

Overall, while the dividend being raised can be good, there are some concerns about its long term sustainability. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, the dividend is not reliable enough to make this a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for RumereLtd (of which 2 are significant!) you should know about. Is RumereLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301088

RumereLtd

Primarily engages in the research and development, production, and online sale of its own clothing brand products and jewellery in China.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026