- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600738

3 Penny Stocks In Global Market With Market Caps Under US$500M

Reviewed by Simply Wall St

Global markets have recently experienced significant turbulence, with the announcement of unexpected tariffs triggering steep declines and fueling concerns about slowing economic growth and potential recession. Amidst this volatility, investors are increasingly looking at various asset classes for opportunities that might withstand or even benefit from such uncertain conditions. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing possibilities for those seeking growth at lower price points. Despite being a somewhat outdated term, these stocks can represent hidden gems when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.31 | SGD125.64M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD1.92 | SGD7.59B | ✅ 5 ⚠️ 0 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.22 | MYR612.08M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.465 | MYR2.31B | ✅ 5 ⚠️ 0 View Analysis > |

| Sarawak Plantation Berhad (KLSE:SWKPLNT) | MYR2.20 | MYR613.87M | ✅ 5 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.335 | £232.23M | ✅ 4 ⚠️ 5 View Analysis > |

| Warpaint London (AIM:W7L) | £3.19 | £257.71M | ✅ 5 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.09 | £350.1M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.616 | £2B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,714 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gilston Group (SEHK:2011)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gilston Group Limited is an investment holding company that designs, manufactures, and sells finished zippers and other garment accessories for original equipment manufacturers of apparel brands, with a market cap of approximately HK$775.57 million.

Operations: The company's revenue is derived from two main segments: Manufacture and Sales of Zippers, contributing HK$237.88 million, and Provision of Property Management Services, generating HK$95.50 million.

Market Cap: HK$775.57M

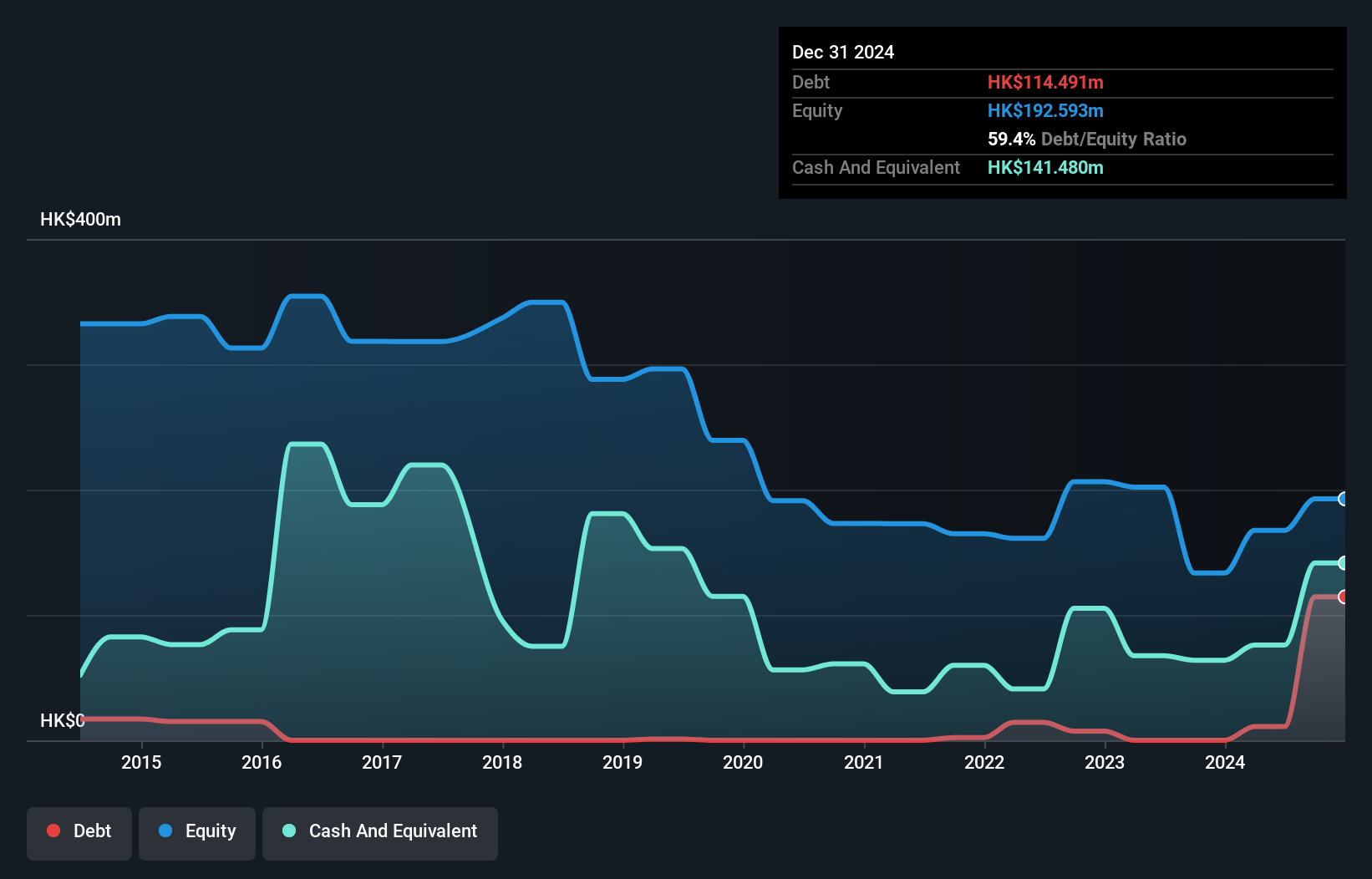

Gilston Group Limited has recently reported a turnaround to profitability, with net income reaching HK$32.3 million for 2024 compared to a net loss of HK$69.04 million the previous year, driven by stable performance in its zipper business and full-year contributions from its property management segment. The company’s short-term assets exceed both short- and long-term liabilities, suggesting solid financial footing. Management's experience averages over three years, indicating stability at the helm. Despite a low return on equity of 17.1%, debt levels are well-managed with more cash than total debt and strong interest coverage ratios.

- Click here and access our complete financial health analysis report to understand the dynamics of Gilston Group.

- Understand Gilston Group's track record by examining our performance history report.

China Vered Financial Holding (SEHK:245)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Vered Financial Holding Corporation Limited is an investment holding company offering asset management, consultancy, financing, and securities advisory and brokerage services across Hong Kong, Mainland China, Japan, and Canada with a market cap of HK$1.60 billion.

Operations: The company's revenue is primarily derived from its Investment Holding segment at HK$65.2 million, followed by Asset Management at HK$14.99 million and Securities Brokerage at HK$9.17 million.

Market Cap: HK$1.6B

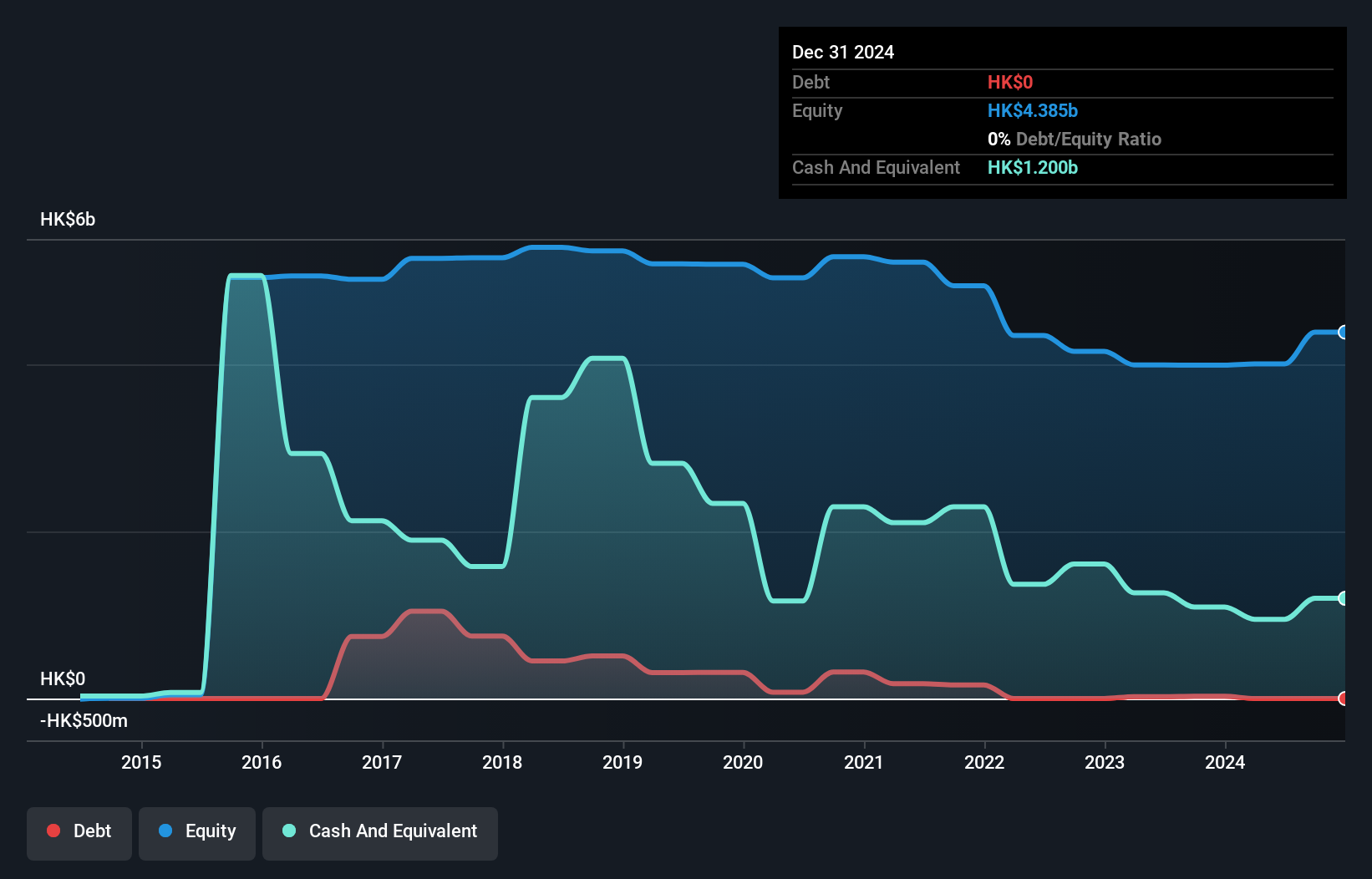

China Vered Financial Holding Corporation Limited has achieved a significant turnaround, posting a net income of HK$222.82 million for 2024, reversing from a previous net loss. This profitability is largely due to substantial investment gains, although rising staff costs have offset some benefits. The company operates debt-free with short-term assets of HK$1.4 billion comfortably covering liabilities, providing financial stability. While the management team is experienced with an average tenure of 2.1 years, the board remains relatively new at 1.1 years on average. Despite its low return on equity at 5.1%, its price-to-earnings ratio suggests good value relative to the Hong Kong market.

- Dive into the specifics of China Vered Financial Holding here with our thorough balance sheet health report.

- Explore historical data to track China Vered Financial Holding's performance over time in our past results report.

Lanzhou Lishang Guochao Industrial GroupLtd (SHSE:600738)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lanzhou Lishang Guochao Industrial Group Co., Ltd operates department stores in China and internationally, with a market cap of CN¥3.30 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥701.90 million.

Market Cap: CN¥3.3B

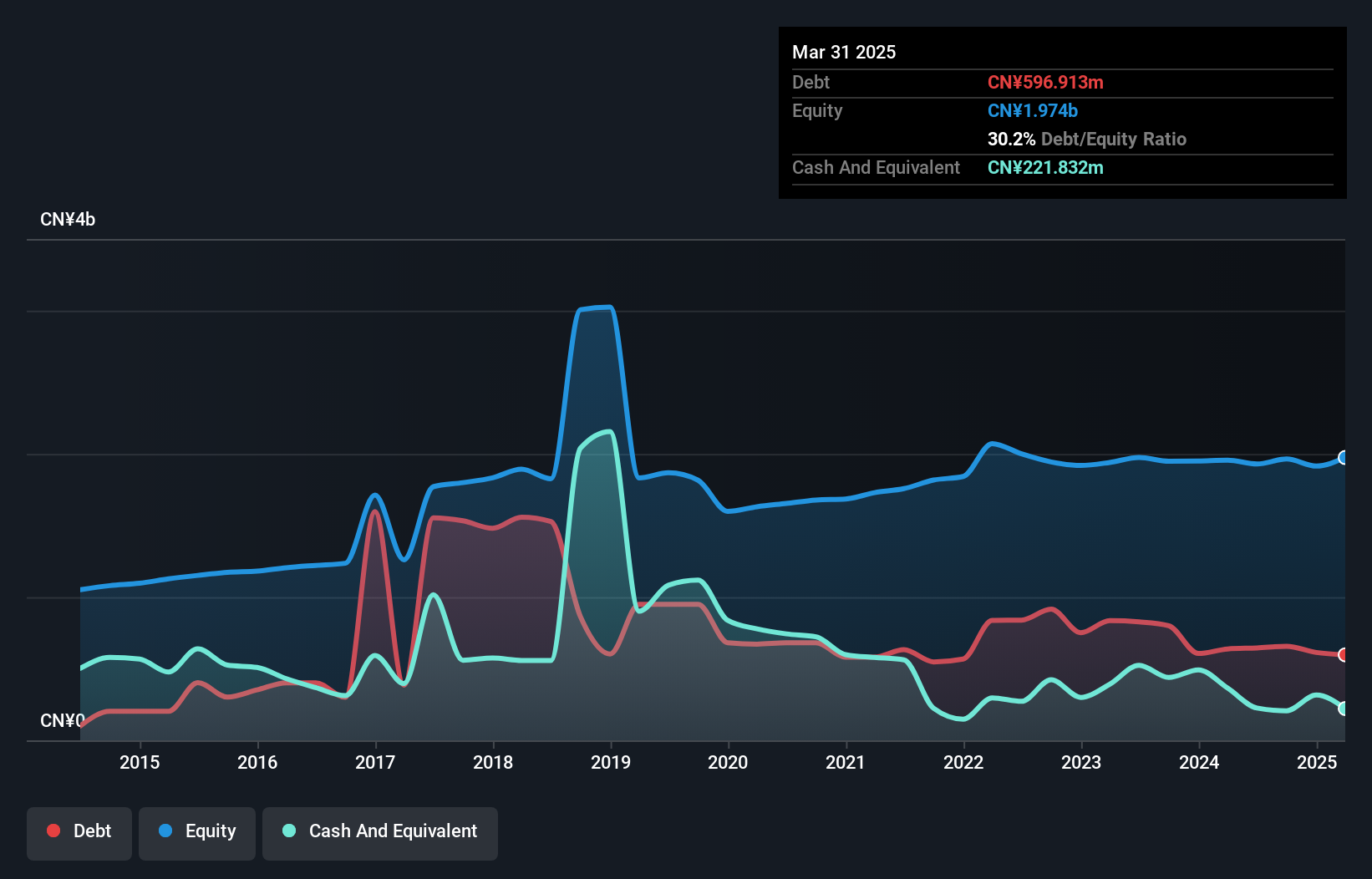

Lanzhou Lishang Guochao Industrial Group Ltd. demonstrates a mixed financial profile. Despite experiencing impressive earnings growth of 166.5% over the past year and maintaining high-quality earnings, its return on equity is low at 5.2%. The company's debt is well managed with a net debt to equity ratio of 22.9%, and interest payments are covered effectively by EBIT, but short-term assets fall short of covering both long-term and short-term liabilities. While the management team lacks experience with an average tenure of two years, shareholders have not faced significant dilution recently, indicating some stability in ownership structure.

- Click here to discover the nuances of Lanzhou Lishang Guochao Industrial GroupLtd with our detailed analytical financial health report.

- Evaluate Lanzhou Lishang Guochao Industrial GroupLtd's historical performance by accessing our past performance report.

Key Takeaways

- Discover the full array of 5,714 Global Penny Stocks right here.

- Contemplating Other Strategies? We've found 27 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600738

Lanzhou Lishang Guochao Industrial GroupLtd

Operates department stores in China and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)