- Thailand

- /

- Consumer Finance

- /

- SET:THANI

January 2025's Top Penny Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and strong bank earnings, major indices such as the S&P 500 and Dow Jones have recorded significant gains. In this context, investors often look for opportunities that combine potential growth with financial stability. Penny stocks, though an older term, remain relevant as they represent smaller or newer companies that can offer surprising value. This article will explore several penny stocks that stand out for their financial strength and potential long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.97 | HK$615.75M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £150.44M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.065 | £791.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.415 | £181.48M | ★★★★★☆ |

Click here to see the full list of 5,728 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Earth Tech Environment (SET:ETC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Earth Tech Environment Public Company Limited operates in Thailand, focusing on the generation and distribution of electricity from industrial waste, with a market cap of THB3.61 billion.

Operations: The company generates revenue primarily from its Power Business, which accounts for THB752.72 million, and Construction activities contributing THB47.75 million.

Market Cap: THB3.61B

Earth Tech Environment has shown financial improvement, becoming profitable this year with a net income increase from THB 10.26 million to THB 28.08 million in the third quarter compared to last year. Despite low return on equity at 3.3%, the company maintains strong liquidity with short-term assets exceeding both short and long-term liabilities, and more cash than debt, although operating cash flow covers only 16.9% of its debt. Recent earnings were impacted by a large one-off gain of THB33.2M, while interest coverage remains weak at 1.6x EBIT, indicating potential challenges in managing debt obligations effectively.

- Take a closer look at Earth Tech Environment's potential here in our financial health report.

- Examine Earth Tech Environment's past performance report to understand how it has performed in prior years.

Ratchthani Leasing (SET:THANI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ratchthani Leasing Public Company Limited, along with its subsidiary, offers hire-purchase and leasing services in Thailand and has a market capitalization of THB8.47 billion.

Operations: The company generates revenue primarily from its Financial Service Business, accounting for THB1.83 billion, and its Insurance Brokerage Business, contributing THB168.62 million.

Market Cap: THB8.47B

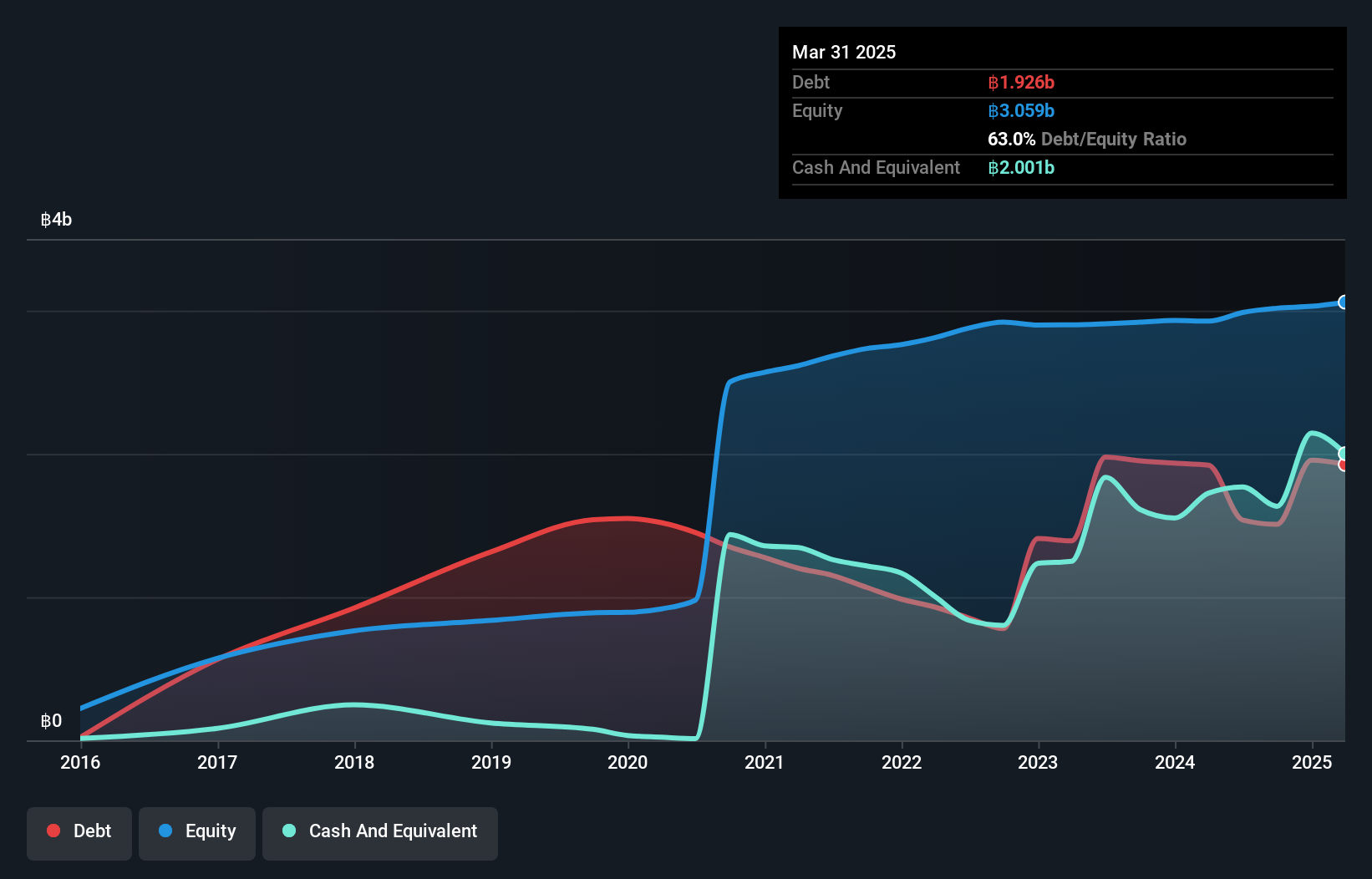

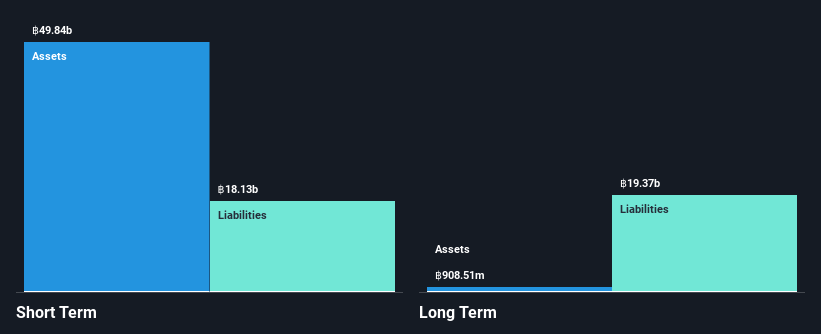

Ratchthani Leasing's recent earnings report indicates a decline, with third-quarter revenue at THB1.03 billion and net income at THB79.79 million, down from the previous year. The company's financials reveal high debt levels with a net debt to equity ratio of 265.4%, though short-term assets comfortably cover both short and long-term liabilities. Despite negative earnings growth over the past year, Ratchthani is trading below its estimated fair value and has not diluted shareholders recently. The seasoned management team averages over ten years in tenure, suggesting stability amidst challenges in profitability and return on equity metrics.

- Get an in-depth perspective on Ratchthani Leasing's performance by reading our balance sheet health report here.

- Learn about Ratchthani Leasing's future growth trajectory here.

Shandong Wohua Pharmaceutical (SZSE:002107)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shandong Wohua Pharmaceutical Co., Ltd. manufactures and sells pharmaceutical products in China, with a market cap of CN¥2.57 billion.

Operations: The company generates revenue of CN¥769.79 million from its pharmaceutical industry segment.

Market Cap: CN¥2.57B

Shandong Wohua Pharmaceutical has faced declining financial performance, with recent earnings reports showing a drop in revenue to CN¥576.68 million for the first nine months of 2024, down from CN¥716.39 million the previous year. The company's net income also decreased significantly to CN¥22.91 million from CN¥57.4 million year-on-year, reflecting challenges in maintaining profit margins and return on equity at 2.9%. Despite these setbacks, Shandong Wohua remains debt-free with short-term assets exceeding liabilities and has not experienced shareholder dilution recently, supported by an experienced management team averaging 5.5 years in tenure.

- Navigate through the intricacies of Shandong Wohua Pharmaceutical with our comprehensive balance sheet health report here.

- Evaluate Shandong Wohua Pharmaceutical's historical performance by accessing our past performance report.

Where To Now?

- Click here to access our complete index of 5,728 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:THANI

Ratchthani Leasing

Together with its subsidiary, provides hire-purchase and leasing services in Thailand.

Undervalued with high growth potential.