As global markets continue to react positively to cooling inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones have seen significant gains. This backdrop of economic optimism presents a fertile ground for investors exploring diverse opportunities, including those in the realm of penny stocks. Although often considered a relic from earlier market days, penny stocks still represent smaller or emerging companies that can offer substantial growth potential when backed by solid financials and strategic direction.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.63 | HK$41.79B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.99 | HK$628.44M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,713 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lhyfe SA is a renewable energy company that designs, installs, and operates green hydrogen production units in France with a market cap of €162.35 million.

Operations: The company's revenue is derived from its Oil & Gas - Exploration & Production segment, totaling €2.60 million.

Market Cap: €162.35M

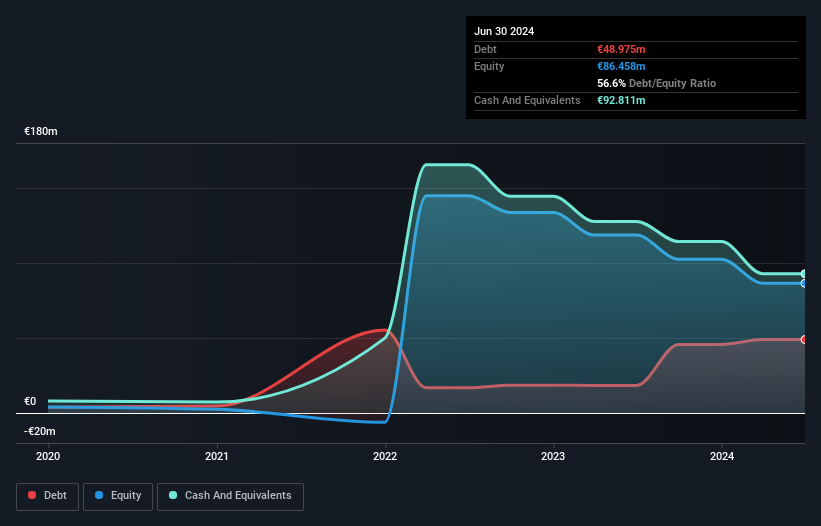

Lhyfe SA, operating in the renewable energy sector, has a market cap of €162.35 million and generates €3 million in revenue, but remains unprofitable with a negative return on equity of -36.55%. Despite its lack of profitability, Lhyfe's financial health appears stable as its short-term assets exceed both short-term and long-term liabilities. The company holds more cash than total debt and maintains a sufficient cash runway for over a year based on current free cash flow. However, share price volatility remains high compared to other French stocks. Revenue is projected to grow significantly at 45.95% annually despite no near-term profitability forecasted.

- Click here and access our complete financial health analysis report to understand the dynamics of Lhyfe.

- Learn about Lhyfe's future growth trajectory here.

Sanford (NZSE:SAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sanford Limited is involved in the farming, harvesting, processing, storage, and marketing of seafood products with a market cap of NZ$420.78 million.

Operations: The company's revenue segment is focused on the farming, harvesting, processing, and selling of seafood products, generating NZ$582.91 million.

Market Cap: NZ$420.78M

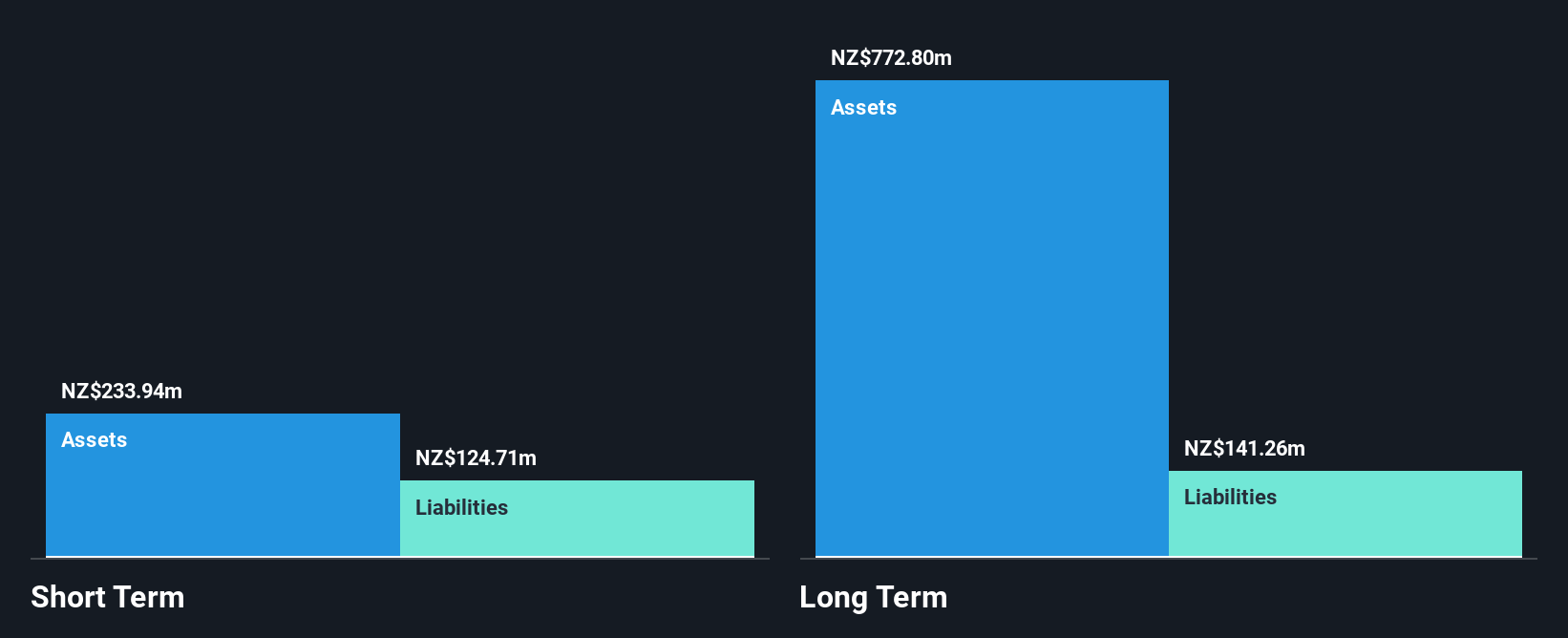

Sanford Limited, with a market cap of NZ$420.78 million and revenue of NZ$582.91 million, has shown significant earnings growth of 96.5% over the past year, surpassing both its historical performance and the broader food industry trend. Despite this progress, its return on equity remains low at 2.8%, and short-term assets do not fully cover long-term liabilities (NZ$268 million). The company has reduced dividends to manage debt levels effectively while maintaining satisfactory net debt to equity at 26.3%. Sanford's board is relatively inexperienced with an average tenure of 1.6 years, contrasting with a seasoned management team averaging two years in tenure.

- Click to explore a detailed breakdown of our findings in Sanford's financial health report.

- Review our growth performance report to gain insights into Sanford's future.

Eastern Polymer Group (SET:EPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eastern Polymer Group Public Company Limited, with a market cap of THB10.25 billion, operates through its subsidiaries to manufacture and distribute rubber insulation, automotive products, and plastic packing both in Thailand and internationally.

Operations: The company's revenue is derived from three primary segments: Rubber Insulation (THB4.33 billion), Packaging Plastics (THB2.38 billion), and Automotive Plastics (THB7.28 billion).

Market Cap: THB10.25B

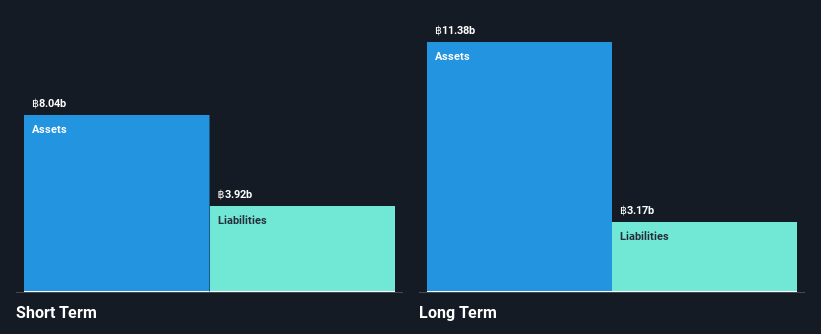

Eastern Polymer Group, with a market cap of THB10.25 billion, operates in rubber insulation, packaging plastics, and automotive plastics segments. Despite stable weekly volatility and seasoned leadership, the company faces challenges with negative earnings growth over the past year and declining profit margins from 9.7% to 5.9%. However, its debt is well-covered by operating cash flow (37.6%), interest payments are manageable with EBIT coverage at 5.9x, and short-term assets exceed liabilities significantly. Although trading slightly below fair value estimates and having satisfactory net debt to equity (18.6%), dividend sustainability remains unstable amidst these dynamics.

- Get an in-depth perspective on Eastern Polymer Group's performance by reading our balance sheet health report here.

- Explore Eastern Polymer Group's analyst forecasts in our growth report.

Where To Now?

- Get an in-depth perspective on all 5,713 Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Polymer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:EPG

Eastern Polymer Group

Through its subsidiaries, engages in the manufacture and distribution of rubber insulation, automotive, and plastic packing products in Thailand and internationally.

Excellent balance sheet and fair value.