As global markets navigate choppy waters with U.S. equities facing declines amid inflation fears and political uncertainty, investors are increasingly seeking stability in their portfolios. In such a volatile environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for those looking to enhance their investment strategy.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1999 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

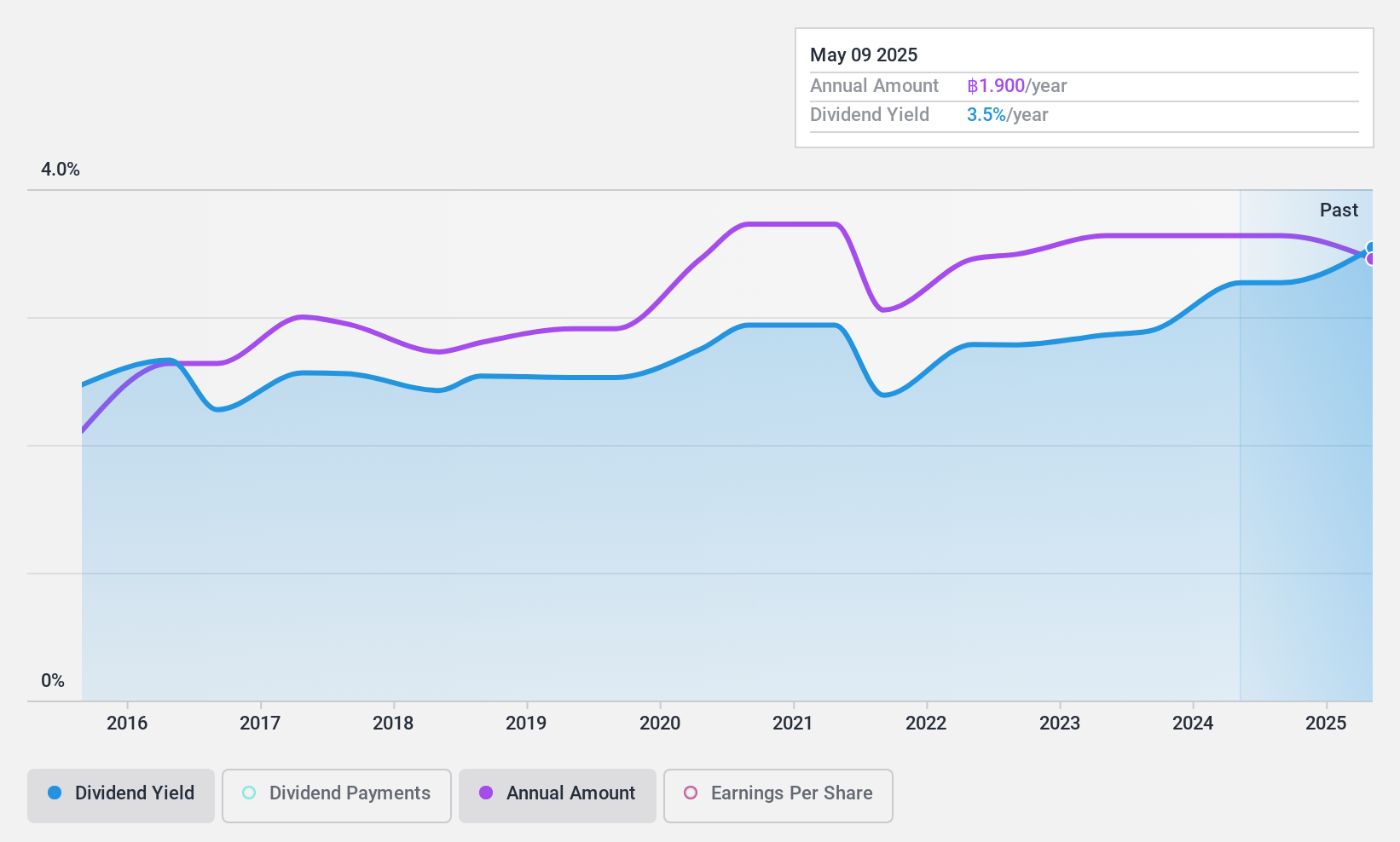

President Bakery (SET:PB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: President Bakery Public Company Limited manufactures and sells bakery products in Thailand, with a market cap of THB26.78 billion.

Operations: The company generates THB7.60 billion from its manufacture and sales of bakery products segment.

Dividend Yield: 3.4%

President Bakery's dividend payments have been stable and growing over the past decade, supported by a sustainable payout ratio of 54.1% from earnings and 58.6% from cash flows. Despite being reliable, its dividend yield of 3.36% is modest compared to top-tier payers in Thailand's market. Recent earnings showed slight declines with net income at THB 415.1 million for Q3 2024, amidst executive changes that could influence future strategic directions.

- Click here to discover the nuances of President Bakery with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, President Bakery's share price might be too pessimistic.

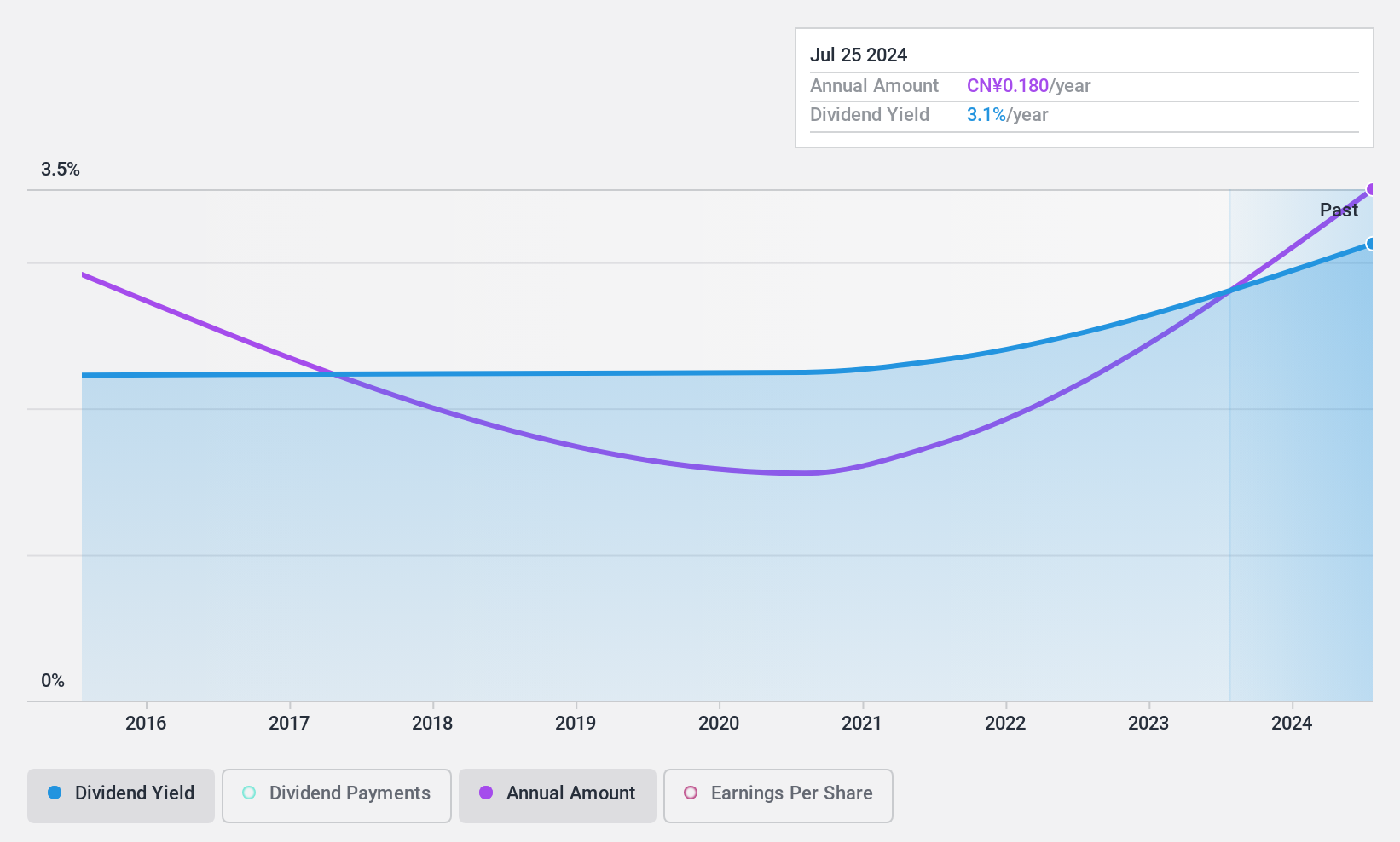

Top Energy CompanyShanxi (SHSE:600780)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Top Energy Company Ltd. Shanxi operates in the thermal power generation, power transmission, and distribution sectors in China with a market cap of CN¥6.09 billion.

Operations: Top Energy Company Ltd. Shanxi's revenue is derived from its operations in thermal power generation, power transmission, and distribution within China.

Dividend Yield: 3.4%

Top Energy Company Shanxi's dividend payments are well covered by earnings and cash flows, with payout ratios of 39.3% and 31.8% respectively. Despite this coverage, the dividends have been volatile over the past decade, experiencing significant annual drops. The company trades at a discount to its estimated fair value and offers a competitive dividend yield of 3.39%, placing it in the top quartile among Chinese dividend payers, though recent earnings showed declines with net income at CNY 384.39 million for nine months ending September 2024 compared to CNY 539.37 million previously.

- Delve into the full analysis dividend report here for a deeper understanding of Top Energy CompanyShanxi.

- Our valuation report unveils the possibility Top Energy CompanyShanxi's shares may be trading at a discount.

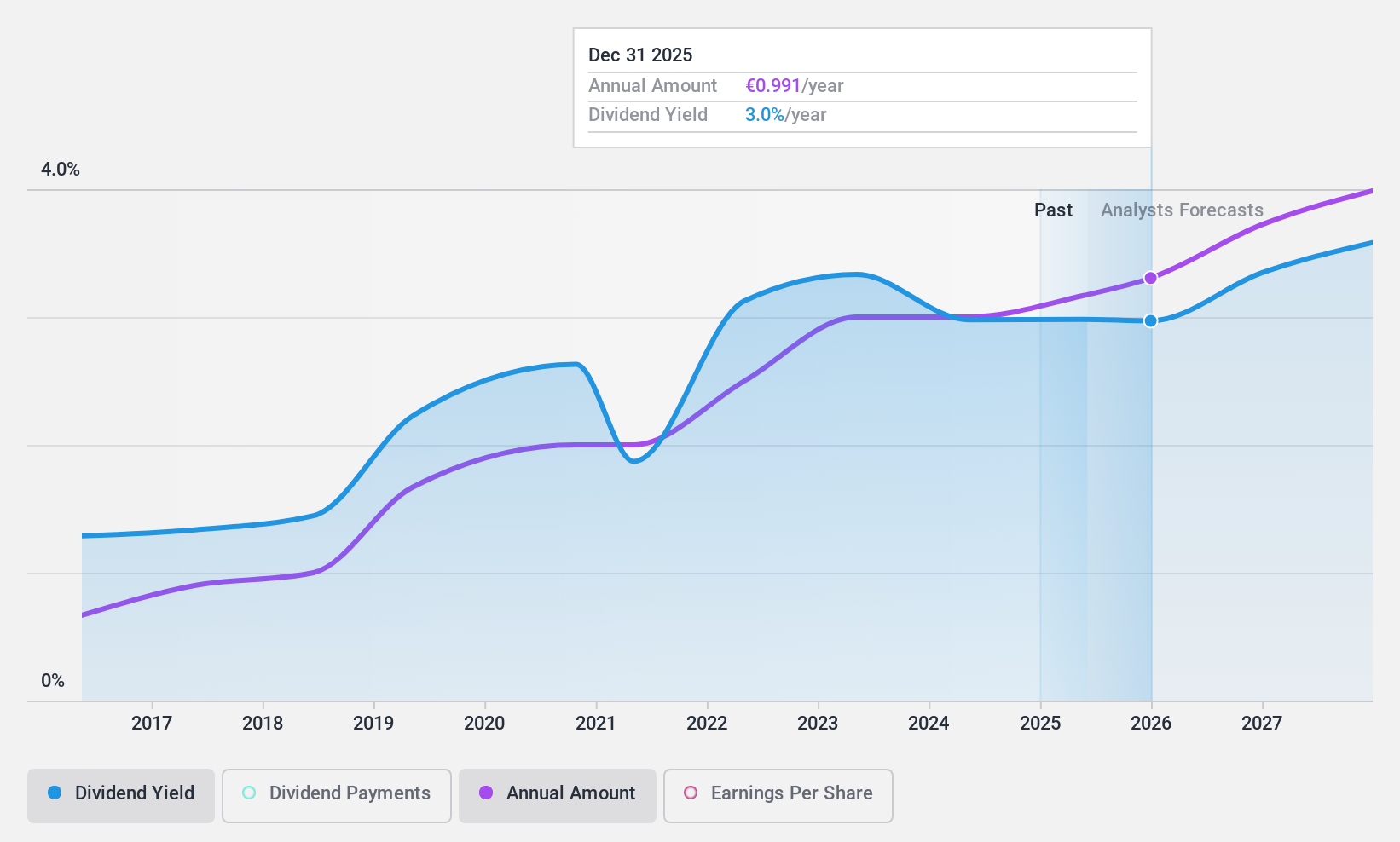

Wienerberger (WBAG:WIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wienerberger AG is a European company that manufactures and sells clay blocks, facing bricks, roof tiles, and pavers with a market cap of €2.81 billion.

Operations: Wienerberger AG generates its revenue from the production and sale of clay blocks, facing bricks, roof tiles, and pavers across Europe.

Dividend Yield: 3.5%

Wienerberger's dividend yield of 3.51% is below the top tier in Austria and not well covered by earnings, with a high payout ratio of 144.6%. However, dividends have been stable and growing over the past decade, supported by a low cash payout ratio of 40.2%. Despite recent earnings declines—net income fell to €46.08 million for nine months ending September 2024 from €312.53 million previously—the company trades at a significant discount to its estimated fair value.

- Take a closer look at Wienerberger's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Wienerberger is trading behind its estimated value.

Make It Happen

- Navigate through the entire inventory of 1999 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PB

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives