SiS Distribution (Thailand) And 2 Other Reliable Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones Industrial Average have recorded significant gains. Amidst this backdrop of optimism, investors are increasingly turning their attention to dividend stocks as a reliable source of income, particularly in times of economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

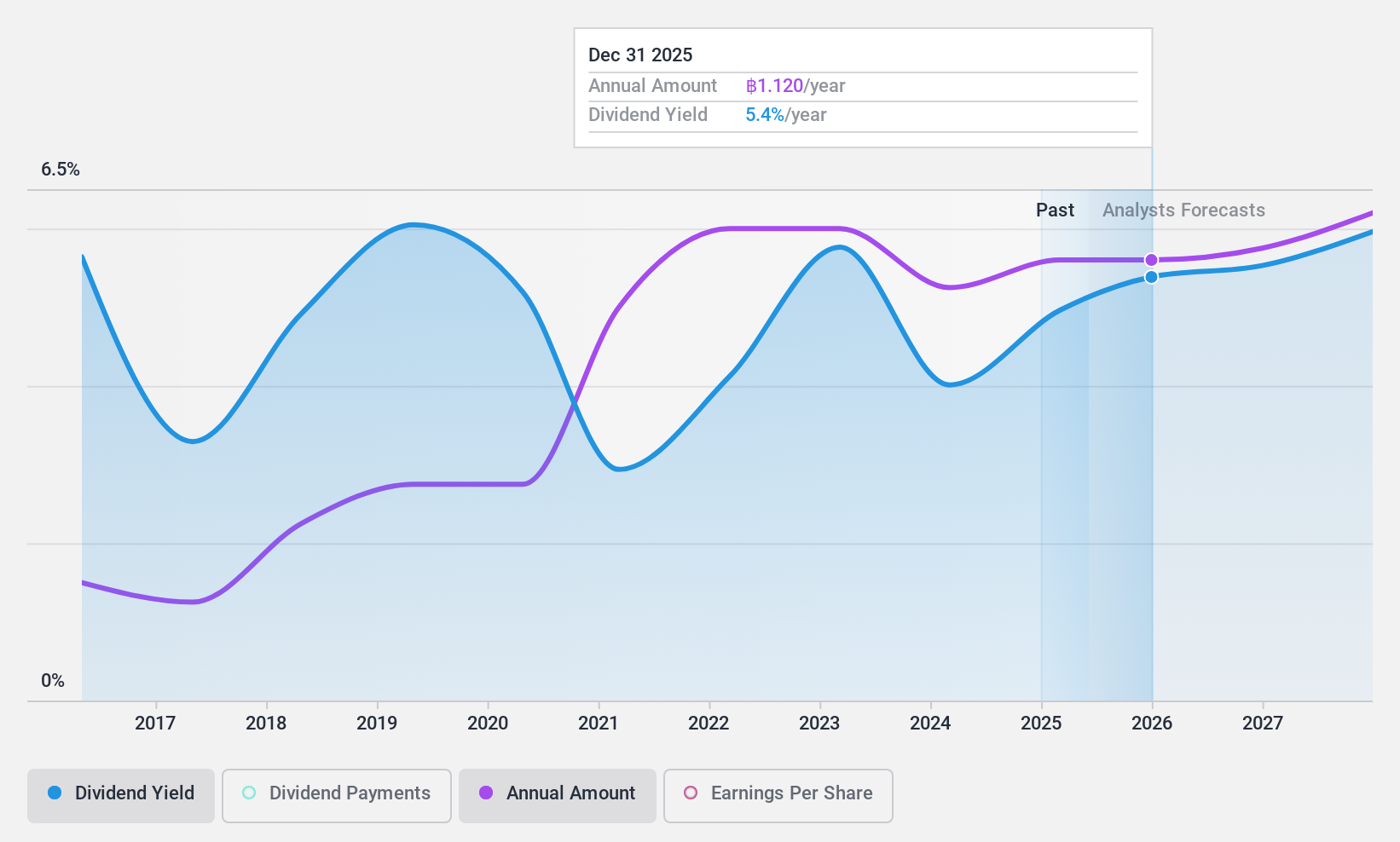

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SiS Distribution (Thailand) Public Company Limited, with a market cap of THB8.84 billion, operates in Thailand distributing computer components, smartphones, and office automation equipment.

Operations: SiS Distribution (Thailand) Public Company Limited generates revenue from various segments, including Phones at THB5.25 billion, Consumer Products at THB8.37 billion, Value Add Products at THB5.29 billion, and Commercial Products at THB6.36 billion.

Dividend Yield: 4.1%

SiS Distribution (Thailand) offers a reliable dividend history with stable and growing payments over the past decade. Despite a high debt level, its dividends are well-covered by both earnings and cash flows, with a payout ratio of 57.3% and cash payout ratio of 26.3%. However, the dividend yield of 4.08% is lower than the top quartile in Thailand's market. Recent earnings showed slight declines in net income, but sales have increased year-over-year.

- Take a closer look at SiS Distribution (Thailand)'s potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of SiS Distribution (Thailand) shares in the market.

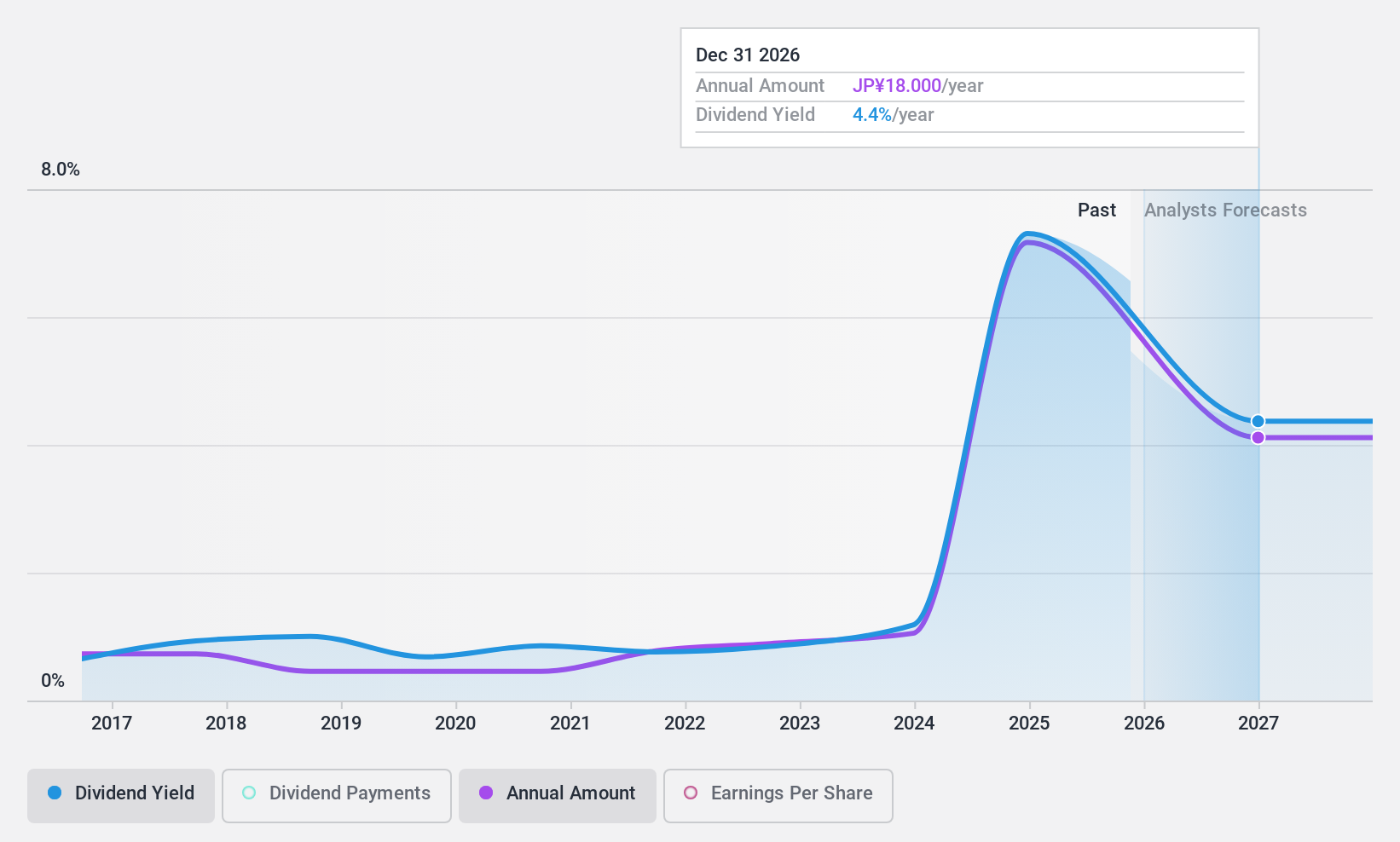

Septeni Holdings (TSE:4293)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Septeni Holdings Co., Ltd. operates in digital marketing and media platform businesses both in Japan and internationally, with a market cap of ¥79.03 billion.

Operations: Septeni Holdings Co., Ltd. generates revenue through its subsidiaries by engaging in digital marketing and media platform operations across Japan and international markets.

Dividend Yield: 8.2%

Septeni Holdings' dividend yield is strong at 8.16%, placing it in the top 25% of JP market payers, but its sustainability is questionable due to a high cash payout ratio of 125.4%. Dividends have been volatile, with past drops over 20%, and are not well-covered by free cash flows despite a low payout ratio of 19.7%. Recent segment reorganization aims to boost growth amid lowered earnings guidance for fiscal year-end December 2024.

- Click here to discover the nuances of Septeni Holdings with our detailed analytical dividend report.

- The analysis detailed in our Septeni Holdings valuation report hints at an inflated share price compared to its estimated value.

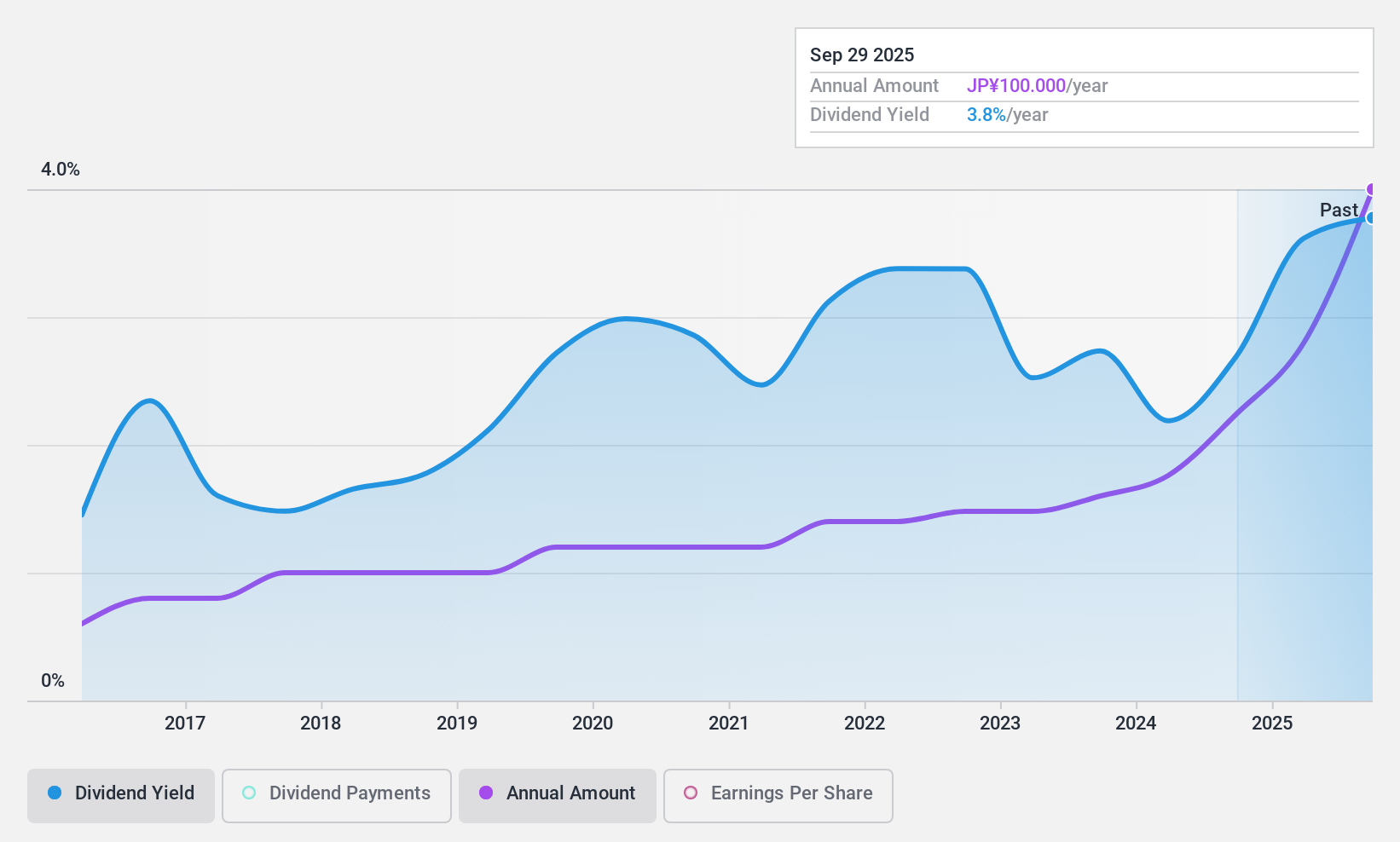

Kamei (TSE:8037)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kamei Corporation is a general trading company operating both in Japan and internationally, with a market cap of ¥58.15 billion.

Operations: Kamei Corporation's revenue is primarily derived from its Energy Business at ¥279.10 billion, followed by the Overseas/Trade Business at ¥86.78 billion, Automotive Related Business at ¥75.29 billion, Construction-Related Business at ¥52.50 billion, Food Business at ¥36.26 billion, Pharmacy Business at ¥19.71 billion, and Pet-Related Business at ¥13.97 billion.

Dividend Yield: 3.2%

Kamei's dividend payments have consistently grown over the past decade, supported by a low payout ratio of 18.6% and a cash payout ratio of 7.6%, indicating strong earnings and cash flow coverage. Trading significantly below estimated fair value, Kamei offers an attractive entry point for investors seeking stability, as dividends have been reliable and stable with minimal volatility. However, its 3.17% yield is lower than the top dividend payers in Japan's market.

- Click to explore a detailed breakdown of our findings in Kamei's dividend report.

- The valuation report we've compiled suggests that Kamei's current price could be quite moderate.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1983 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SIS

SiS Distribution (Thailand)

Engages in the distribution of computer components, smartphones, and office automation equipment in Thailand.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives