As global markets navigate the complexities of a resilient U.S. labor market and persistent inflation concerns, investors are witnessing choppy conditions with significant fluctuations in major indices like the Nasdaq Composite and Russell 2000. Amidst these uncertainties, dividend stocks can offer a reliable income stream, providing stability through regular payouts even when broader market volatility is at play.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

Click here to see the full list of 2016 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

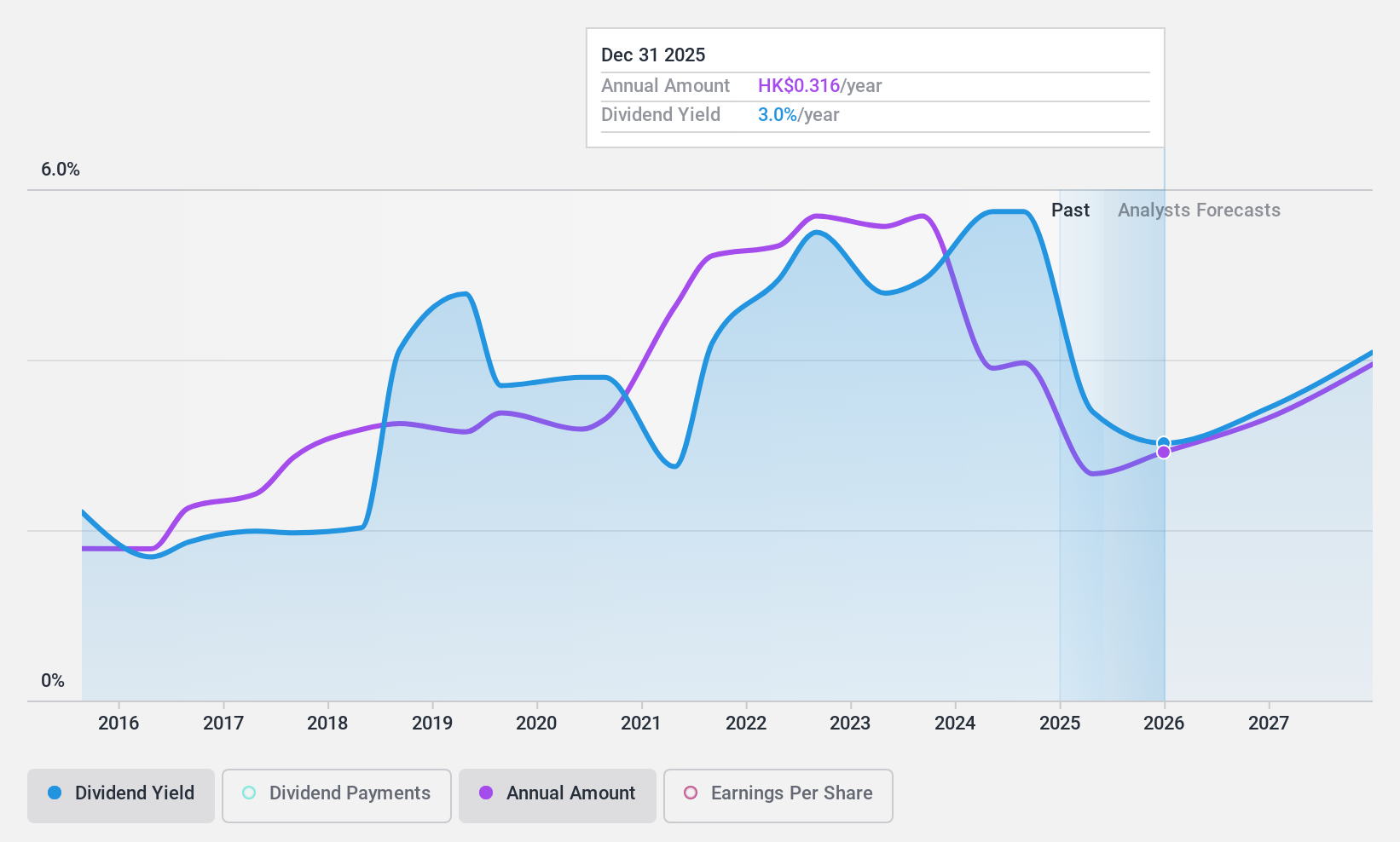

China Medical System Holdings (SEHK:867)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Medical System Holdings Limited is an investment holding company that manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China, with a market cap of HK$17.25 billion.

Operations: The company's revenue primarily comes from its marketing, promotion, sales, and manufacturing of pharmaceutical products segment, which generated CN¥7.01 billion.

Dividend Yield: 5.8%

China Medical System Holdings offers a mixed picture for dividend stocks. Its dividends are covered by earnings with a payout ratio of 40.3% and cash flows at 76.6%. However, the dividend track record is unstable, having been volatile over the past decade despite some growth. Recent strategic agreements, such as the collaboration with Alpha Cognition Inc., could potentially enhance financial results and support future dividend sustainability if successful in commercialization efforts across Asia-Pacific regions.

- Click here and access our complete dividend analysis report to understand the dynamics of China Medical System Holdings.

- The valuation report we've compiled suggests that China Medical System Holdings' current price could be quite moderate.

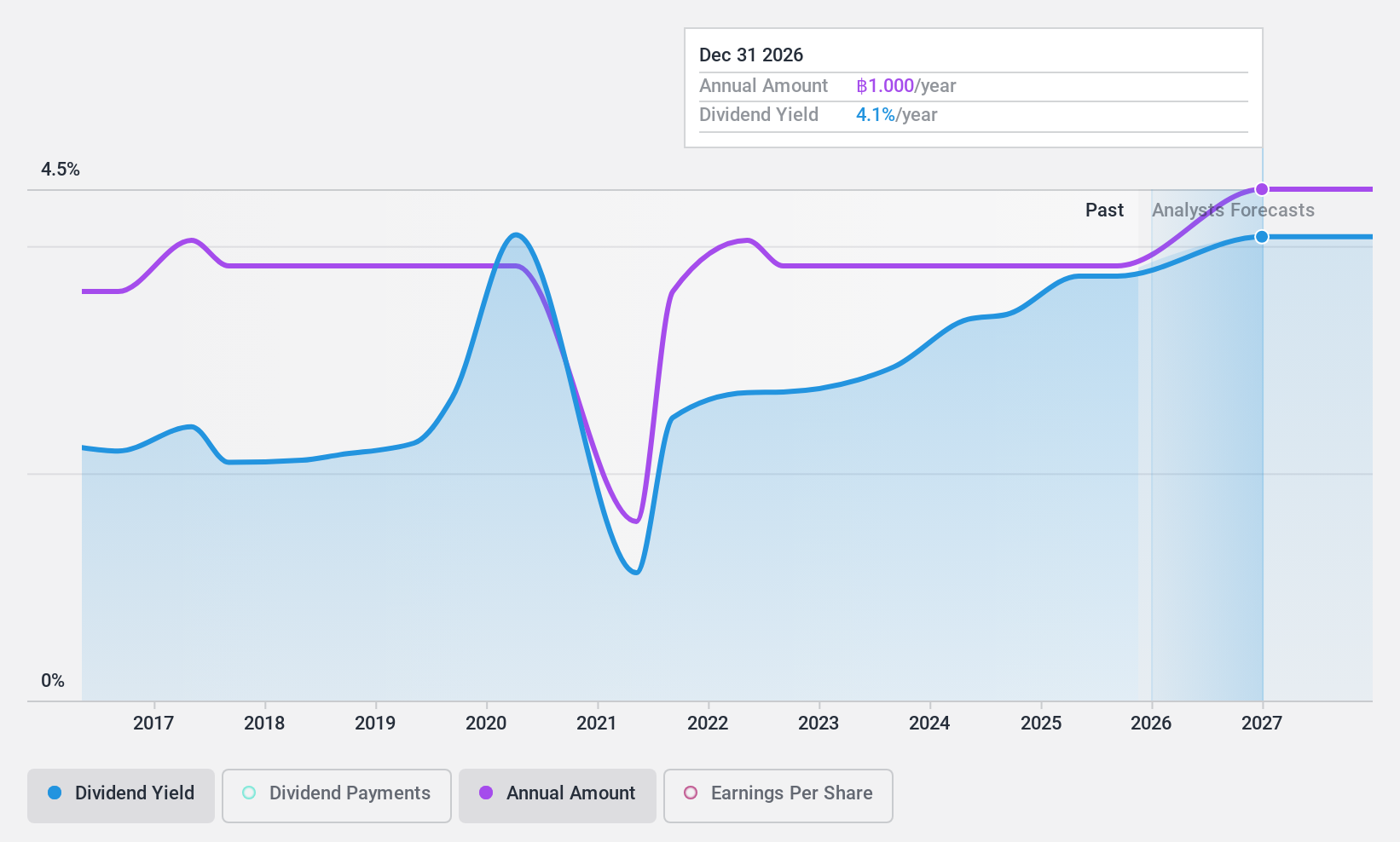

Bank of Ayudhya (SET:BAY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Ayudhya Public Company Limited, along with its subsidiaries, offers a range of commercial banking products and services to individuals, corporates, small and medium-sized businesses, and financial institutions, with a market cap of THB178.75 billion.

Operations: Bank of Ayudhya's revenue segments include Retail at THB75.25 billion and Commercial at THB35.20 billion.

Dividend Yield: 3.5%

Bank of Ayudhya's dividends are well covered by earnings, with a current payout ratio of 20.1% and a forecasted ratio of 23.5% in three years, indicating sustainability despite past volatility. The stock trades at good value compared to peers and is 51.6% below estimated fair value, but its dividend yield is relatively low in the Thai market. Recent earnings showed stable net interest income growth but a slight decline in net income year-over-year.

- Unlock comprehensive insights into our analysis of Bank of Ayudhya stock in this dividend report.

- In light of our recent valuation report, it seems possible that Bank of Ayudhya is trading behind its estimated value.

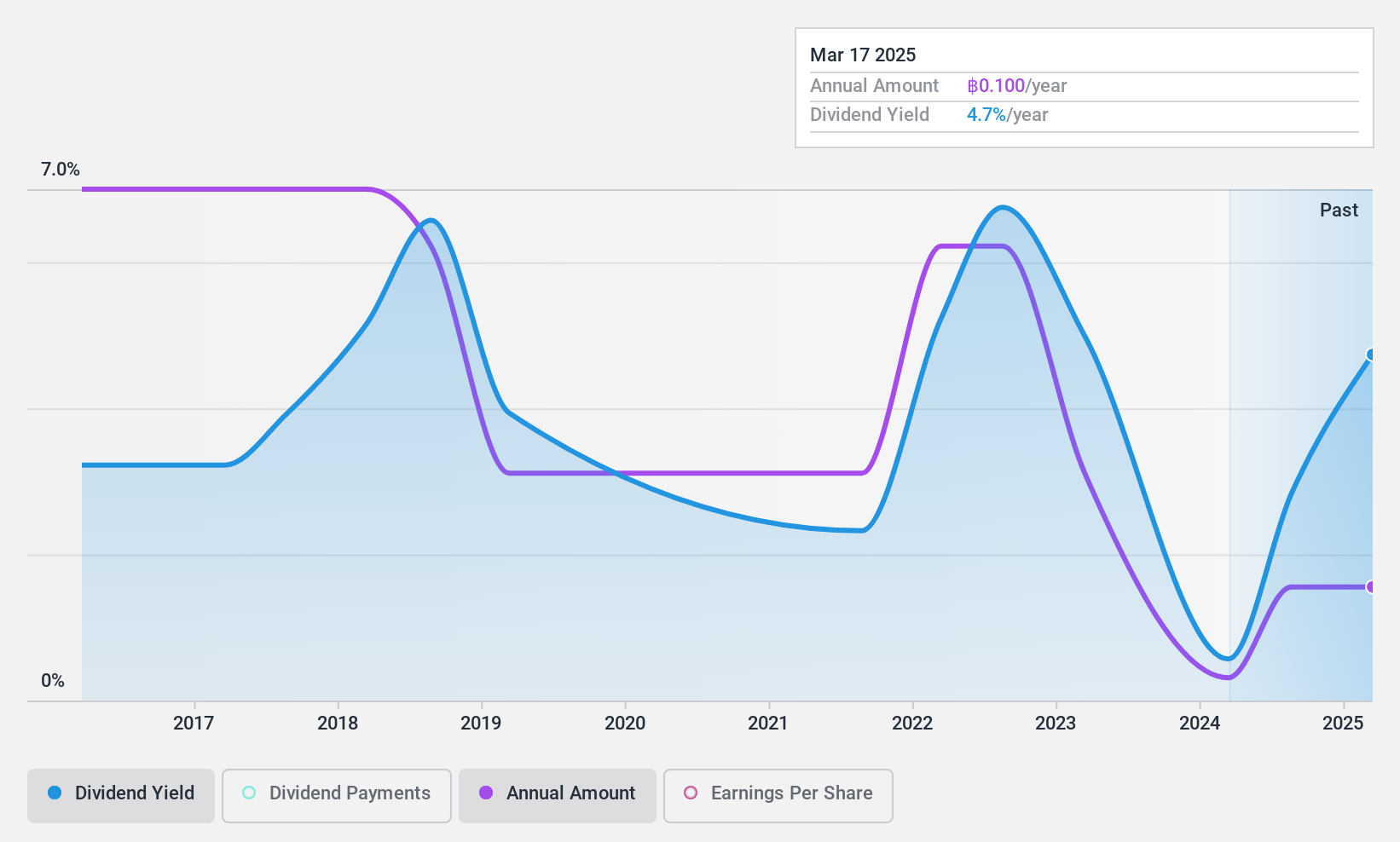

Vanachai Group (SET:VNG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vanachai Group Public Company Limited, along with its subsidiaries, is involved in the production and distribution of wood plates, medium density fiberboards, particle boards, doorskin, and melamine on wood plates both in Thailand and internationally, with a market cap of THB5.28 billion.

Operations: Vanachai Group's revenue segments include THB2.38 billion from the Glue Section and THB14.51 billion from Plywood Work Section and Door Surface Wood Panels.

Dividend Yield: 3.3%

Vanachai Group's dividends are well covered by both earnings and cash flows, with payout ratios of 21.6% and 8.4%, respectively, though they've been historically volatile. Trading significantly below estimated fair value, the stock offers a modest dividend yield of 3.29%, lower than top-tier Thai dividend payers. Recent earnings show improved profitability with net income rising to THB 165.89 million in Q3 2024 from THB 91.88 million the previous year, highlighting financial recovery potential despite an unstable dividend history.

- Navigate through the intricacies of Vanachai Group with our comprehensive dividend report here.

- The analysis detailed in our Vanachai Group valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 2016 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Ayudhya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:BAY

Bank of Ayudhya

Provides commercial banking products and services to individuals, corporates, small and medium-sized businesses, and financial institutions.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.