Exploring Three High Growth Tech Stocks With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and fluctuating indices, the technology sector continues to capture attention with the Nasdaq Composite reaching new heights despite broader market declines. In this environment, identifying high growth tech stocks involves looking for companies that not only demonstrate strong innovation and adaptability but also show resilience amid economic shifts such as those currently seen in inflation trends and interest rate expectations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1262 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China, with a market capitalization of approximately HK$3.83 billion.

Operations: Inspur Digital focuses on three main revenue streams: cloud services, management software, and IoT solutions, generating CN¥2.26 billion, CN¥2.55 billion, and CN¥3.53 billion respectively. The company's diverse offerings in the technology sector cater to various business needs within China.

Inspur Digital Enterprise Technology has demonstrated robust performance with a remarkable 84.5% earnings growth over the past year, significantly outpacing the software industry's average of 16.9%. With an annual revenue increase projected at 23.3%, the company is set to grow well above Hong Kong's market average of 7.7%. This dynamic growth is supported by substantial R&D investments, which are crucial in maintaining its competitive edge in evolving tech landscapes. Looking ahead, Inspur’s strategic focus on innovation and expanding market reach suggests promising prospects, underscored by an expected earnings surge of 38.8% annually over the next three years.

- Get an in-depth perspective on Inspur Digital Enterprise Technology's performance by reading our health report here.

Understand Inspur Digital Enterprise Technology's track record by examining our Past report.

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs in China and has a market cap of CN¥28.67 billion.

Operations: Xiamen Amoytop Biotech Co., Ltd. generates its revenue primarily from the biologics segment, contributing CN¥2.60 billion. The company is involved in the research, development, production, and sale of recombinant protein drugs in China.

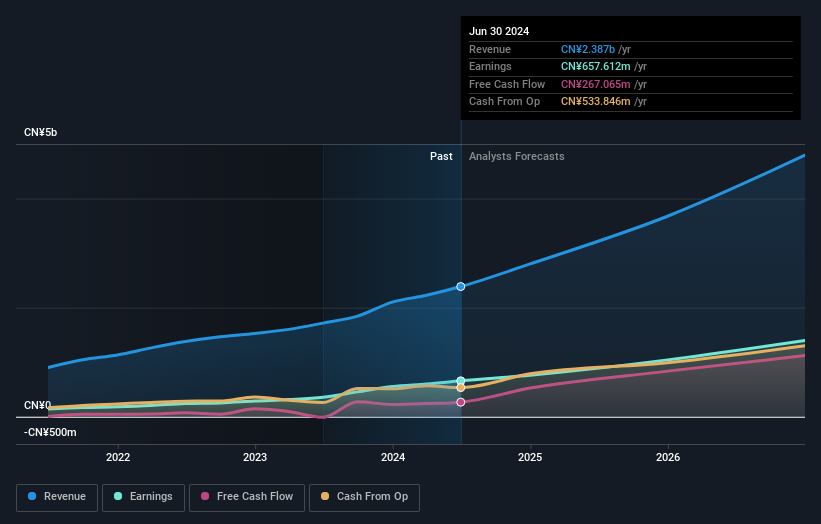

Xiamen Amoytop Biotech has shown impressive growth with a 32% forecast in annual earnings, outpacing the Chinese market's average of 25.7%. This rapid expansion is underpinned by a significant revenue jump to CNY 1.95 billion from CNY 1.46 billion year-over-year, reflecting a robust annual increase of 29%. The firm’s commitment to innovation is evident from its R&D spending trends, crucial for sustaining its competitive advantage in the fast-evolving biotech landscape. With earnings and revenue both growing faster than industry averages, Xiamen Amoytop's strategic investments in research are likely setting the stage for continued leadership and market share gains in its sector.

Lingyi iTech (Guangdong) (SZSE:002600)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market cap of CN¥60.92 billion.

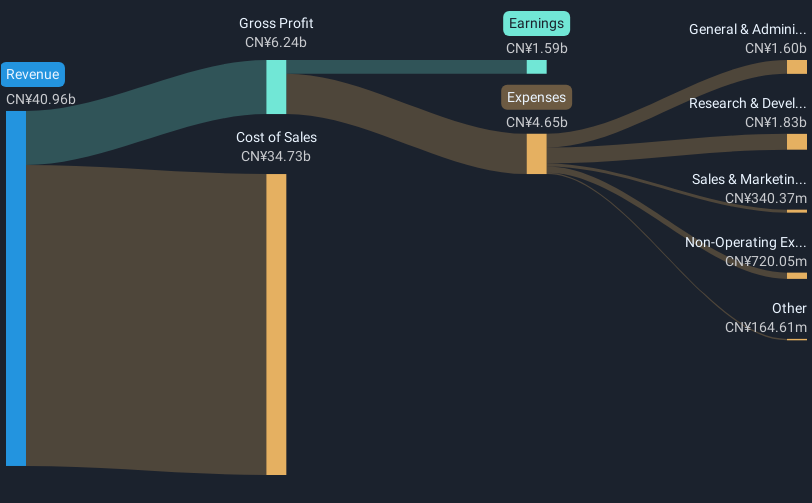

Operations: Lingyi iTech focuses on smart manufacturing services and solutions. The company generates revenue through its diverse offerings in this sector, leveraging advanced technologies to meet client needs.

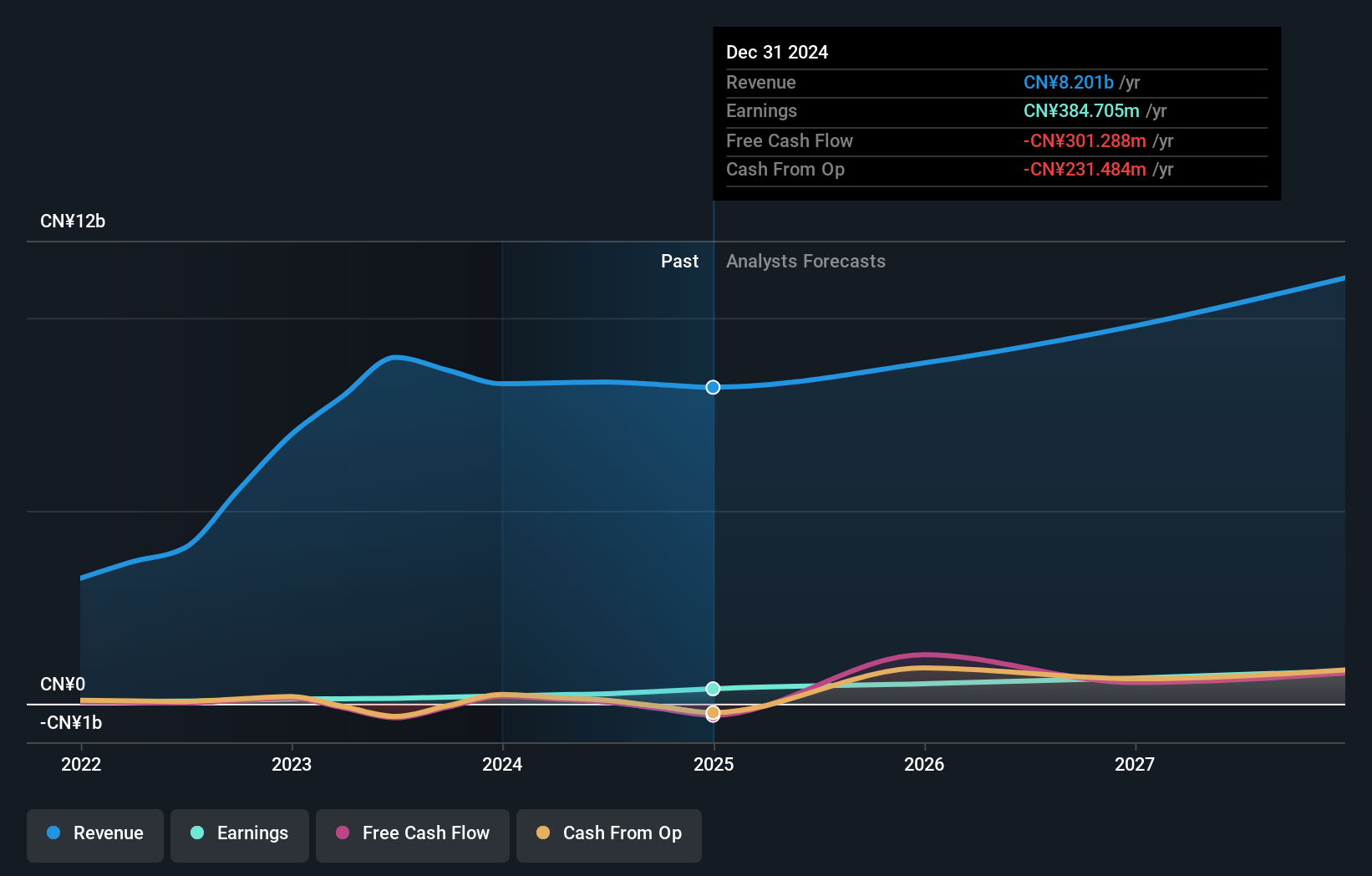

Lingyi iTech (Guangdong) is navigating a complex landscape with its recent earnings report showing a revenue surge to CNY 31.48 billion, up from CNY 24.65 billion, yet facing a dip in net income to CNY 1.41 billion from CNY 1.87 billion previously. This juxtaposition highlights the challenges of scaling operations while maintaining profitability, especially as the company has not engaged in share repurchases this year, reflecting perhaps a strategic pause or reallocation of capital towards fostering growth avenues. Despite these financial dynamics, Lingyi iTech's commitment to innovation remains evident with an expected annual profit growth of 28.9%, outstripping the broader Chinese market forecast of 25.7%. This robust projection is underpinned by its significant R&D investments and revenue growth forecasts at 16.1% annually, signaling potential for sustained competitive edge in its tech domain.

- Click to explore a detailed breakdown of our findings in Lingyi iTech (Guangdong)'s health report.

Gain insights into Lingyi iTech (Guangdong)'s past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 1262 High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688278

Xiamen Amoytop Biotech

Engages in research, development, production, and sale of recombinant protein drugs in China.

Exceptional growth potential with flawless balance sheet.