- China

- /

- Auto Components

- /

- SZSE:002662

Discovering Three Undiscovered Gems with Solid Potential

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher due to easing inflation and robust bank earnings, investors are increasingly turning their attention to small-cap stocks, which often offer unique growth opportunities in such dynamic environments. In this context of economic optimism and shifting market dynamics, identifying stocks with strong fundamentals and potential for growth becomes crucial for those seeking to uncover hidden gems within the market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Xiamen Bank (SHSE:601187)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Bank Co., Ltd. offers a range of banking products and services to individuals, corporate clients, and small and microfinance businesses, with a market cap of CN¥14.25 billion.

Operations: Xiamen Bank generates revenue primarily through interest income from loans and advances, as well as fees and commissions from its banking services. The bank's cost structure includes interest expenses on deposits and borrowings, along with operational costs related to providing its financial services. Notably, the net profit margin has shown variability over recent periods.

With total assets of CN¥403.3 billion and equity of CN¥31.8 billion, Xiamen Bank stands out as a noteworthy player in the banking sector. The bank's deposits and loans are nearly balanced at CN¥223.3 billion and CN¥222.0 billion, respectively, reflecting prudent financial management. It maintains an adequate allowance for bad loans at 0.7% of total loans, coupled with a robust allowance ratio of 398%. Although recent earnings growth was negative at -8.9%, the forecast suggests a promising annual growth rate of 26%. Trading significantly below its estimated fair value by 52%, it offers potential investment appeal.

- Click here and access our complete health analysis report to understand the dynamics of Xiamen Bank.

Explore historical data to track Xiamen Bank's performance over time in our Past section.

Beijing WKW Automotive PartsLtd (SZSE:002662)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing WKW Automotive Parts Co., Ltd. engages in the research, development, manufacture, and sale of interior and exterior trim systems for passenger cars both in China and internationally, with a market cap of CN¥5.78 billion.

Operations: The company generates revenue primarily from the sale of interior and exterior trim systems for passenger cars. Its cost structure includes expenses related to research, development, and manufacturing processes.

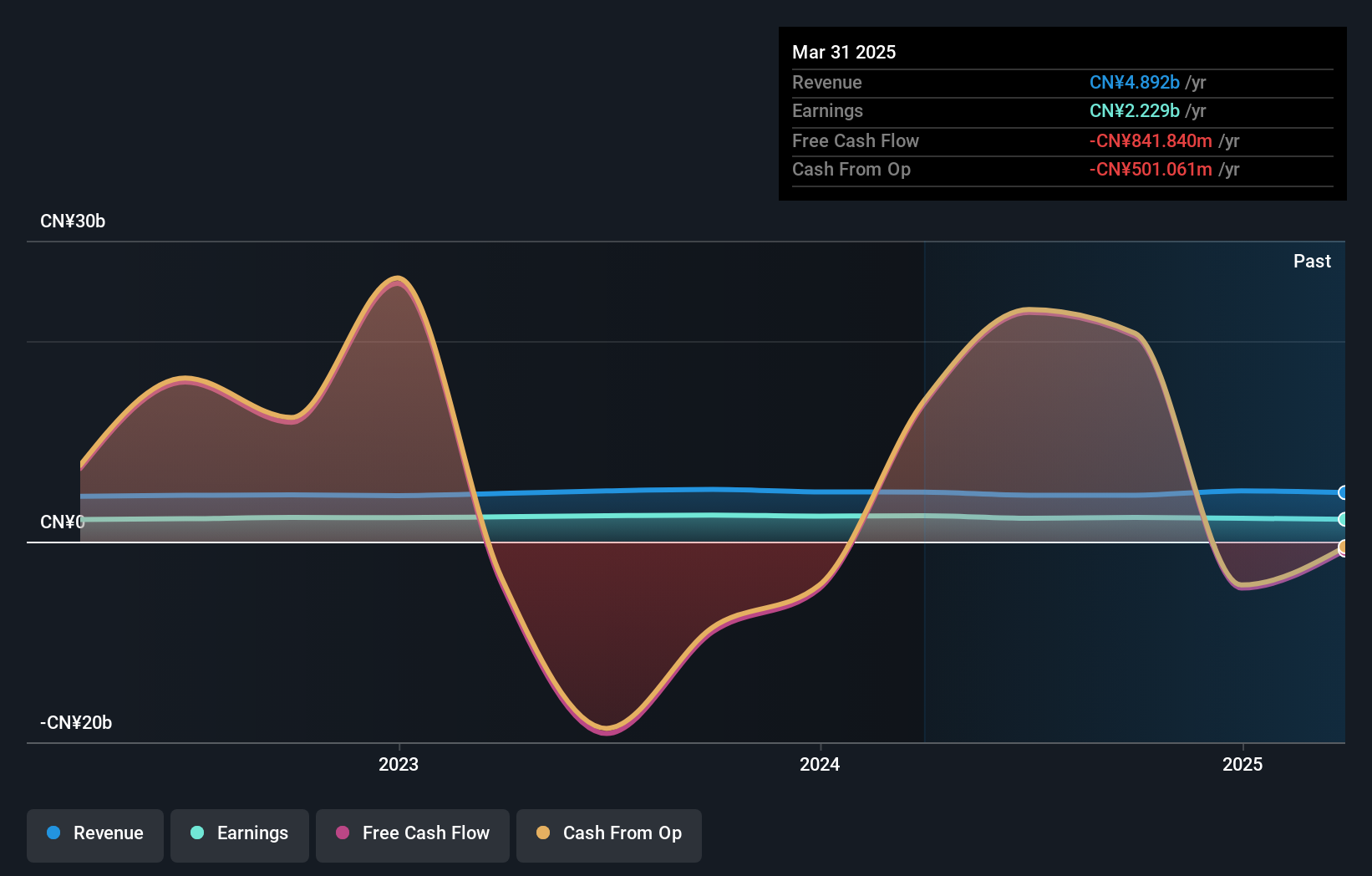

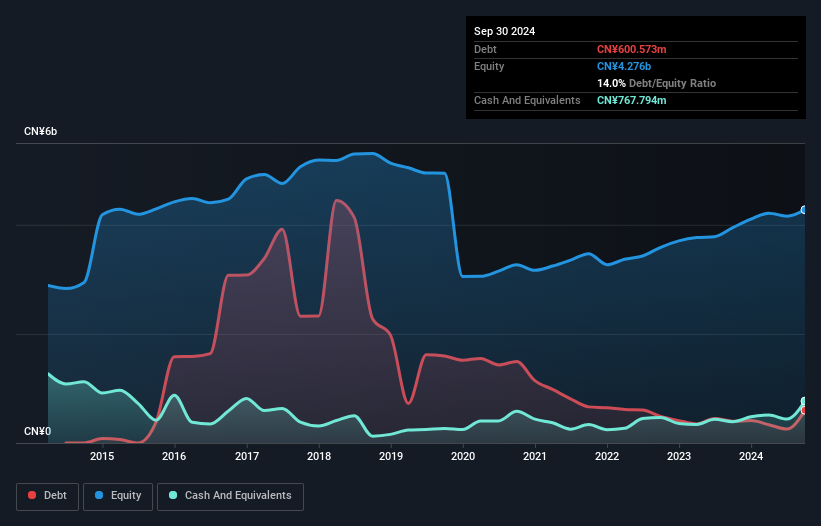

Beijing WKW Automotive Parts has shown strong financial health, with earnings growing 73% annually over the past five years, highlighting its high-quality earnings. Despite a recent dip in sales to CNY 2.37 billion from CNY 2.62 billion and net income falling slightly to CNY 322 million for the nine months ending September 2024, the company remains profitable with positive free cash flow and sufficient interest coverage. Its debt-to-equity ratio has improved significantly from 32% to just 14%, indicating prudent financial management. Trading at a discount of about 24% below estimated fair value suggests potential investment appeal.

Tel-Aviv Stock Exchange (TASE:TASE)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Tel-Aviv Stock Exchange Ltd. operates a stock exchange in Israel with a market cap of ₪3.81 billion.

Operations: Revenue for the Tel-Aviv Stock Exchange Ltd. is derived primarily from unclassified services, amounting to ₪423.90 million.

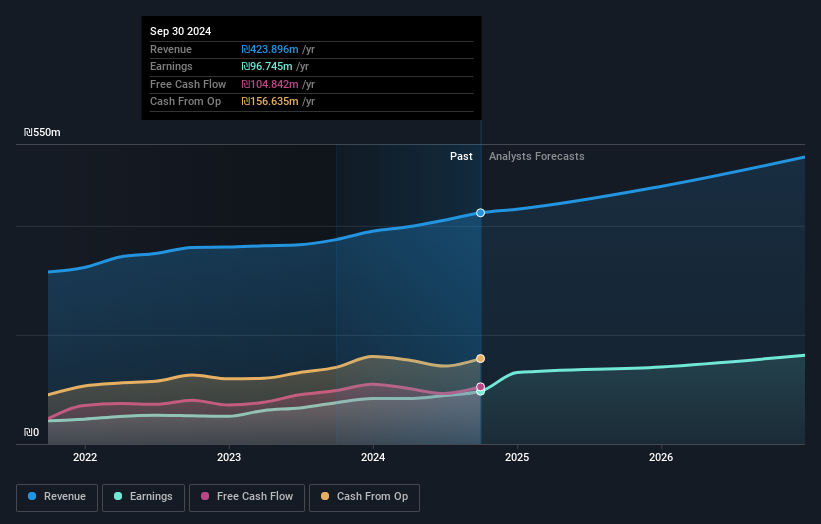

Tel-Aviv Stock Exchange (TASE) has shown promising performance with a net income of ILS 26.03 million in Q3 2024, up from ILS 18.23 million the previous year, reflecting strong earnings growth of 27.8% over the past year. The company recently completed a share repurchase program, acquiring over 4.6 million shares for ILS 202.4 million at ILS 43.79 each, which could indicate confidence in its value proposition and financial health; TASE's debt to equity ratio has risen to 16.4% over five years but remains manageable given its high-quality earnings and positive free cash flow of ILS104.84 million as of September 2025.

- Delve into the full analysis health report here for a deeper understanding of Tel-Aviv Stock Exchange.

Learn about Tel-Aviv Stock Exchange's historical performance.

Next Steps

- Investigate our full lineup of 4642 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fengjing Automotive Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002662

Beijing Fengjing Automotive Parts

Develops, manufactures, and sells interior and exterior trim systems for passenger cars in China and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives