- China

- /

- Consumer Durables

- /

- SHSE:603008

Bank of the Philippine Islands And 2 Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a positive shift, with major U.S. stock indexes rebounding and European indices rising on easing inflation concerns, investors are increasingly looking to solidify their portfolios with reliable dividend stocks. In this climate of cautious optimism, selecting stocks that offer consistent dividend payouts can be an effective strategy for generating steady income while potentially benefiting from market upswings.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.03% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.96% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

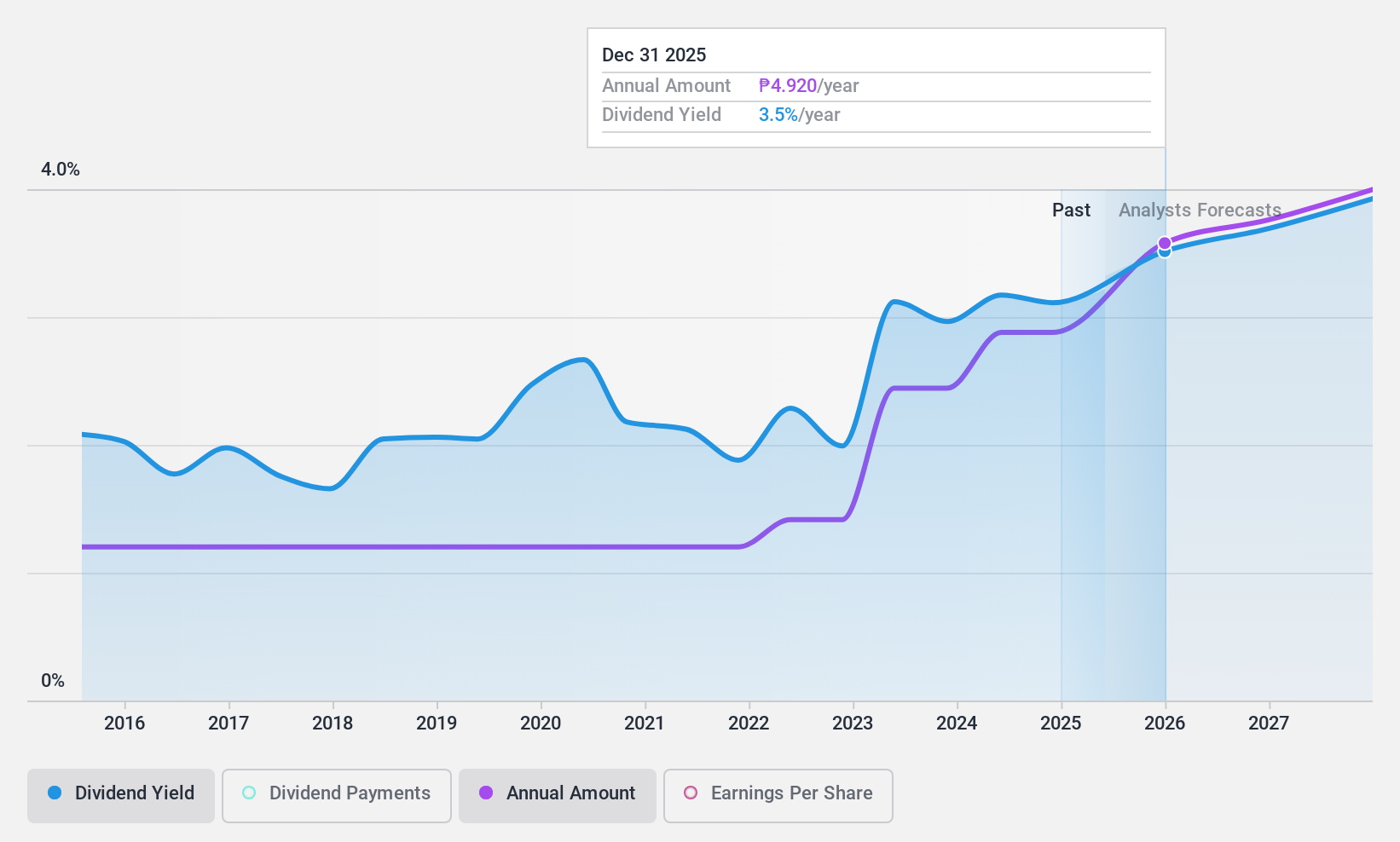

Bank of the Philippine Islands (PSE:BPI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of the Philippine Islands, with a market cap of ₱646.89 billion, offers a range of financial products and services to both retail and corporate clients in the Philippines through its subsidiaries.

Operations: Bank of the Philippine Islands generates revenue through various financial products and services aimed at retail and corporate clients in the Philippines.

Dividend Yield: 3.2%

Bank of the Philippine Islands recently declared a cash dividend of PHP 1.98 per share, reflecting its stable dividend history over the past decade. With a payout ratio of 29.9%, dividends are well covered by earnings, and future coverage is expected to remain strong at 35.6%. Despite a lower yield compared to top-tier payers in the Philippines, BPI's consistent earnings growth supports its reliable and gradually increasing dividends.

- Dive into the specifics of Bank of the Philippine Islands here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Bank of the Philippine Islands shares in the market.

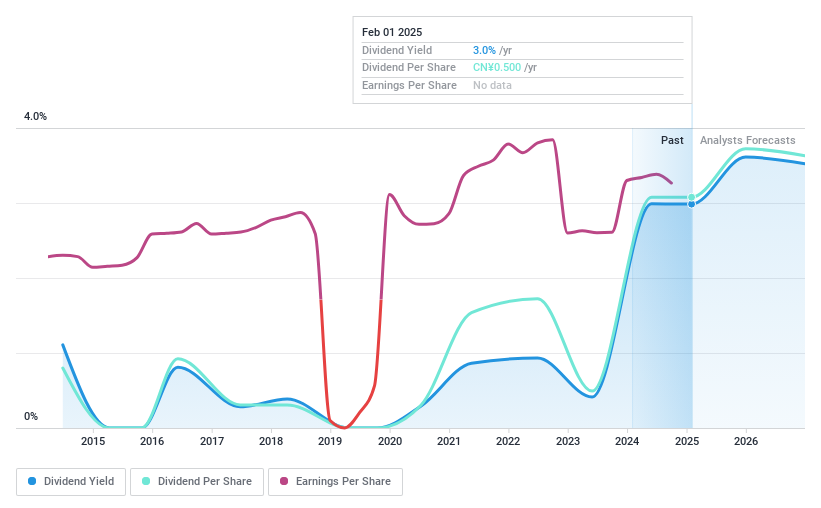

Xilinmen FurnitureLtd (SHSE:603008)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xilinmen Furniture Co., Ltd is a company that designs, develops, produces, and sells bedroom furniture products in China with a market cap of CN¥6.19 billion.

Operations: Xilinmen Furniture Co., Ltd generates its revenue through the design, development, production, and sale of bedroom furniture products in China.

Dividend Yield: 3.1%

Xilinmen Furniture's dividend payments are well-supported by earnings and cash flows, with a payout ratio of 46% and a cash payout ratio of 32.3%. Although the company trades below its estimated fair value, its dividend track record is unstable and has shown volatility over the past decade. Recent share buybacks totaling CNY 79.98 million may indicate management's confidence in financial stability despite slight declines in revenue and net income for the nine months ending September 2024.

- Unlock comprehensive insights into our analysis of Xilinmen FurnitureLtd stock in this dividend report.

- Our valuation report unveils the possibility Xilinmen FurnitureLtd's shares may be trading at a discount.

Komatsu (TSE:6301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Komatsu Ltd. is a global manufacturer and seller of construction, mining, and utility equipment across various regions including Japan, the Americas, Europe, China, and others, with a market cap of ¥4.03 trillion.

Operations: Komatsu Ltd.'s revenue segments include Construction Machinery/Vehicles generating ¥3.74 trillion, Industrial Machinery Others contributing ¥207.34 billion, and Retail Finance at ¥117.84 billion.

Dividend Yield: 3.8%

Komatsu's dividend payments are supported by a payout ratio of 43% and a cash payout ratio of 61.4%, indicating coverage by earnings and cash flows. Despite recent increases, such as the interim dividend rising from JPY 72 to JPY 83 per share, its dividends have been volatile over the past decade. The company projects strong financial performance for FY2025 with net income expected at JPY 376 billion, suggesting potential stability in future payouts.

- Get an in-depth perspective on Komatsu's performance by reading our dividend report here.

- According our valuation report, there's an indication that Komatsu's share price might be on the cheaper side.

Summing It All Up

- Investigate our full lineup of 1975 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603008

Xilinmen FurnitureLtd

Designs, develops, produces, and sells bedroom furniture products in China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives