- China

- /

- Entertainment

- /

- SZSE:300027

People & Technology Leads These 3 Premier Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets experience a boost from cooling inflation and strong bank earnings, major U.S. stock indexes have rebounded, with value stocks outperforming growth shares amid sector-specific movements. In this environment, companies that combine innovative technology with high insider ownership can offer unique insights into their potential for sustainable growth and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 35.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

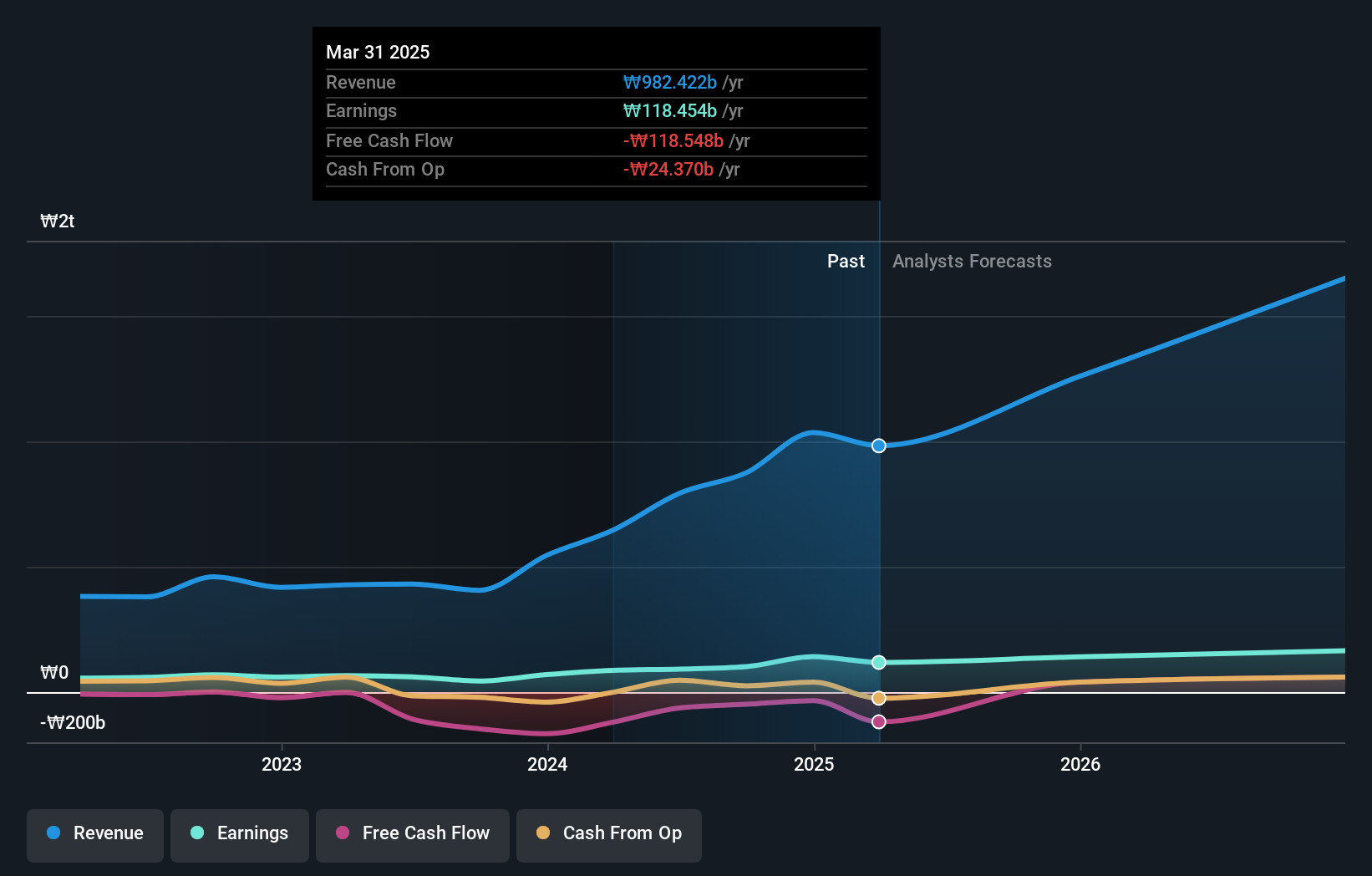

People & Technology (KOSDAQ:A137400)

Simply Wall St Growth Rating: ★★★★★★

Overview: People & Technology Inc. provides machinery solutions including coating, calendaring, slitting, and automation services with a market cap of approximately ₩947.33 billion.

Operations: The company's revenue is primarily derived from the Machinery & Industrial Equipment segment, amounting to approximately ₩874.54 million.

Insider Ownership: 16.4%

People & Technology exhibits strong growth potential, with earnings projected to grow significantly at 37.26% annually, outpacing the KR market's 28.9%. The company is trading at a substantial discount of 65.2% below its estimated fair value and offers good relative value compared to peers. Revenue is expected to increase by 35.4% per year, exceeding the market average of 9.3%. Despite high non-cash earnings, insider transactions show no significant activity recently.

- Dive into the specifics of People & Technology here with our thorough growth forecast report.

- The analysis detailed in our People & Technology valuation report hints at an deflated share price compared to its estimated value.

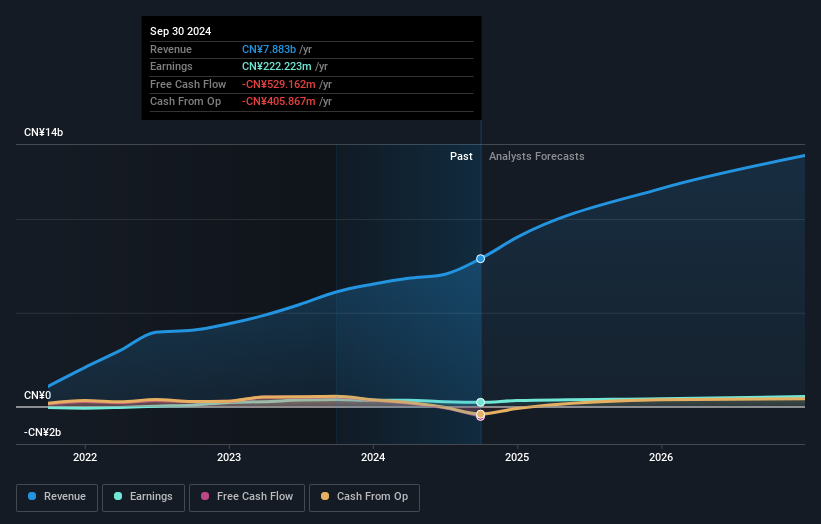

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation is an entertainment media company operating in China and internationally, with a market cap of CN¥6.99 billion.

Operations: Huayi Brothers Media Corporation generates revenue through its entertainment media operations both domestically in China and internationally.

Insider Ownership: 17.5%

Huayi Brothers Media shows promising growth potential with revenue expected to increase by 45.2% annually, surpassing the Chinese market's average of 13.4%. Earnings are forecasted to grow significantly at 110.47% per year, with profitability anticipated within three years, indicating above-average market growth. Despite a net loss of CNY 42.48 million for the first nine months of 2024, this is an improvement from the previous year's larger loss. Recent shareholder meetings focus on strategic share offerings and stock option plans, reflecting active management engagement in future growth strategies.

- Click here and access our complete growth analysis report to understand the dynamics of Huayi Brothers Media.

- According our valuation report, there's an indication that Huayi Brothers Media's share price might be on the expensive side.

Huakai Yibai TechnologyLtd (SZSE:300592)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Huakai Yibai Technology Co., Ltd. offers environmental art design services for indoor spaces in the People's Republic of China and has a market capitalization of CN¥5.40 billion.

Operations: Huakai Yibai Technology Co., Ltd. generates its revenue primarily from providing environmental art design services for indoor spaces within China.

Insider Ownership: 29.2%

Huakai Yibai Technology is poised for growth, with revenue expected to grow at 22.9% annually, outpacing the Chinese market. Despite a drop in profit margins from 6.1% to 2.8%, earnings are forecasted to rise significantly by 33.8% per year. Recent acquisitions by insiders Zhuang Junchao and Hu Fanjin, totaling CNY 483 million for an 11.66% stake, highlight strong insider confidence amid volatile share prices and ongoing strategic financial maneuvers.

- Delve into the full analysis future growth report here for a deeper understanding of Huakai Yibai TechnologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of Huakai Yibai TechnologyLtd shares in the market.

Make It Happen

- Gain an insight into the universe of 1472 Fast Growing Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives