The five-year shareholder returns and company earnings persist lower as Inmyshow Digital Technology(Group)Co.Ltd (SHSE:600556) stock falls a further 21% in past week

While not a mind-blowing move, it is good to see that the Inmyshow Digital Technology(Group)Co.,Ltd. (SHSE:600556) share price has gained 13% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 60% after a long stretch. So we're not so sure if the recent bounce should be celebrated. We'd err towards caution given the long term under-performance.

If the past week is anything to go by, investor sentiment for Inmyshow Digital Technology(Group)Co.Ltd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Inmyshow Digital Technology(Group)Co.Ltd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

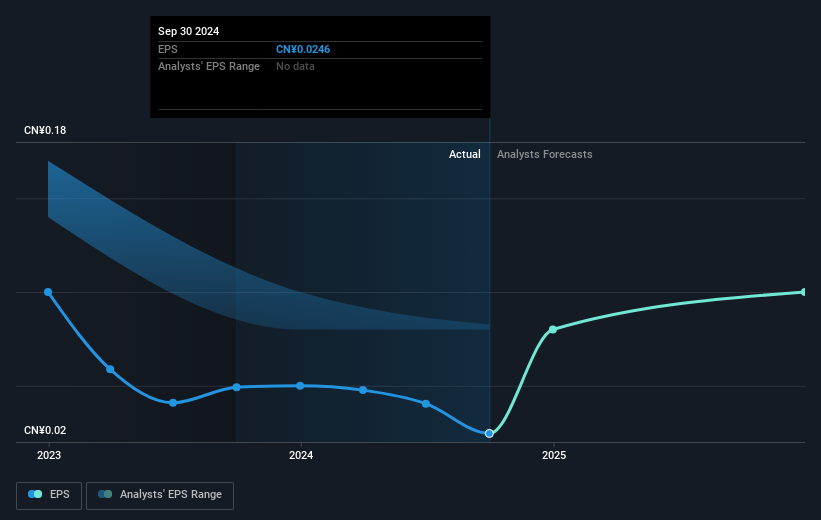

Looking back five years, both Inmyshow Digital Technology(Group)Co.Ltd's share price and EPS declined; the latter at a rate of 33% per year. The share price decline of 17% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve. With a P/E ratio of 209.90, it's fair to say the market sees a brighter future for the business.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Inmyshow Digital Technology(Group)Co.Ltd's earnings, revenue and cash flow.

A Different Perspective

Inmyshow Digital Technology(Group)Co.Ltd provided a TSR of 2.6% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Inmyshow Digital Technology(Group)Co.Ltd (1 makes us a bit uncomfortable) that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600556

Inmyshow Digital Technology(Group)Co.Ltd

Inmyshow Digital Technology(Group)Co.,Ltd.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives