Private companies are CGN Nuclear Technology Development Co., Ltd.'s (SZSE:000881) biggest owners and were rewarded after market cap rose by CN¥435m last week

Key Insights

- Significant control over CGN Nuclear Technology Development by private companies implies that the general public has more power to influence management and governance-related decisions

- The top 6 shareholders own 50% of the company

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

To get a sense of who is truly in control of CGN Nuclear Technology Development Co., Ltd. (SZSE:000881), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are private companies with 46% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, private companies were the biggest beneficiaries of last week’s 8.0% gain.

In the chart below, we zoom in on the different ownership groups of CGN Nuclear Technology Development.

See our latest analysis for CGN Nuclear Technology Development

What Does The Institutional Ownership Tell Us About CGN Nuclear Technology Development?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

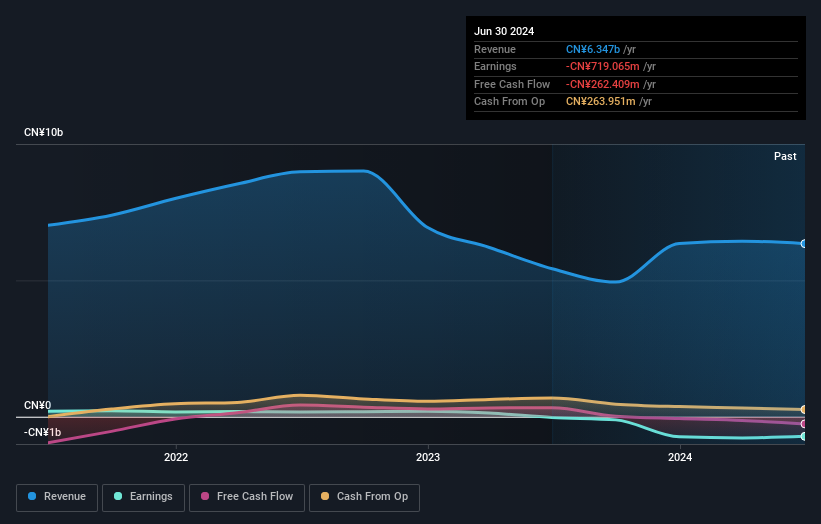

Less than 5% of CGN Nuclear Technology Development is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

Hedge funds don't have many shares in CGN Nuclear Technology Development. China General Nuclear Power Corporation is currently the largest shareholder, with 29% of shares outstanding. With 13% and 4.3% of the shares outstanding respectively, China Dalian International Economic and Technical Cooperation Group Co., Ltd. and Xiao Min Chen are the second and third largest shareholders.

We also observed that the top 6 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of CGN Nuclear Technology Development

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own some shares in CGN Nuclear Technology Development Co., Ltd.. As individuals, the insiders collectively own CN¥345m worth of the CN¥5.9b company. It is good to see some investment by insiders, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public-- including retail investors -- own 44% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

It seems that Private Companies own 46%, of the CGN Nuclear Technology Development stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that CGN Nuclear Technology Development is showing 1 warning sign in our investment analysis , you should know about...

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000881

CGN Nuclear Technology Development

CGN Nuclear Technology Development Co., Ltd.

Adequate balance sheet and slightly overvalued.