- China

- /

- Electronic Equipment and Components

- /

- SZSE:000045

Undiscovered Gems With Strong Fundamentals For January 2025

Reviewed by Simply Wall St

As we step into January 2025, the global markets are navigating a mixed landscape, with major U.S. stock indexes ending the year on a high note despite recent economic data showing contractions in manufacturing activity and revised GDP forecasts. Amidst this backdrop, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and potential growth opportunities in an unpredictable environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Danske Andelskassers Bank (CPSE:DAB)

Simply Wall St Value Rating: ★★★★☆☆

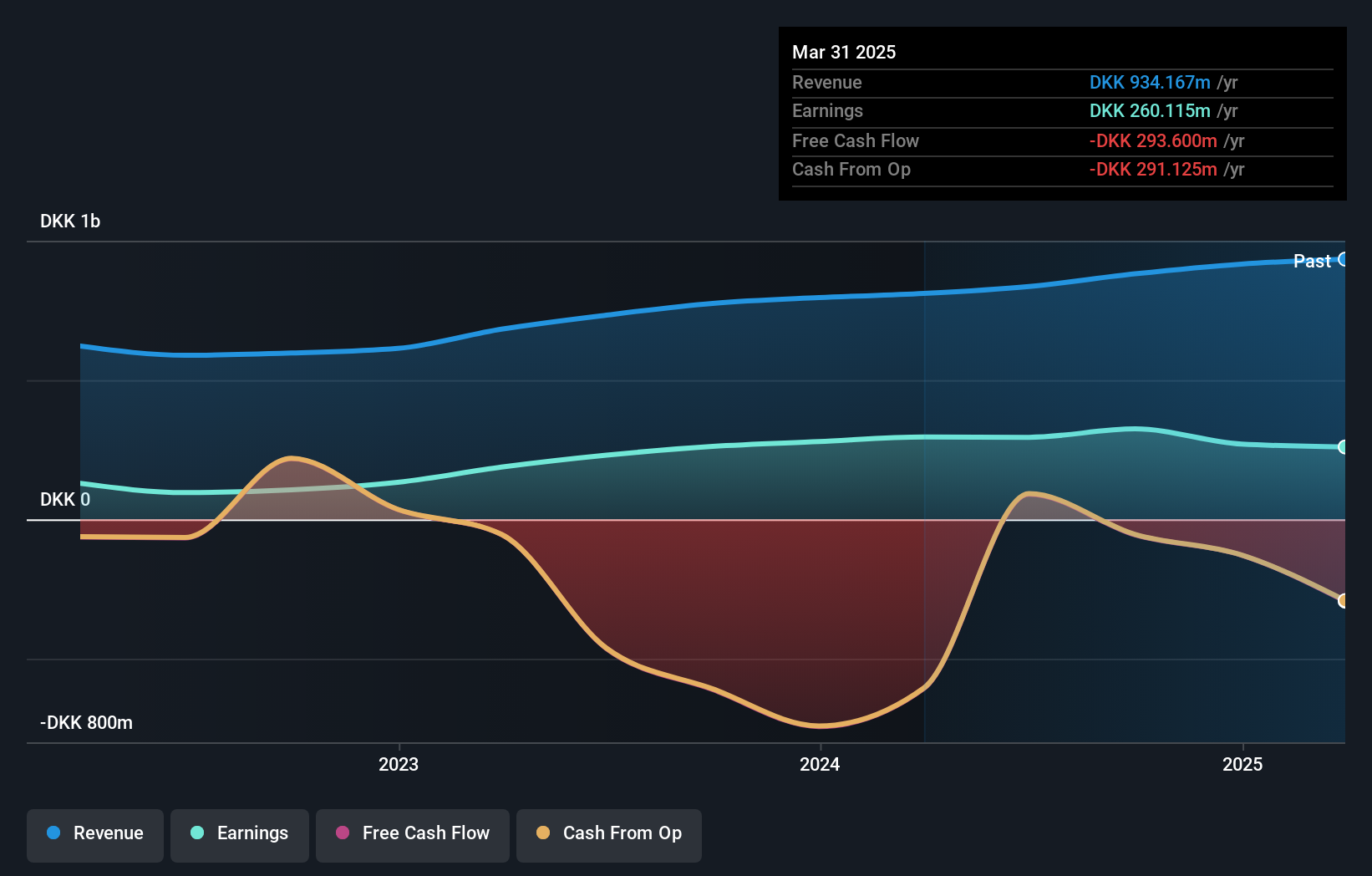

Overview: Danske Andelskassers Bank A/S offers a range of banking products and services to private individuals, small and medium-sized businesses, and institutional clients in Denmark, with a market capitalization of DKK3.20 billion.

Operations: Danske Andelskassers Bank generates revenue primarily from its banking segment, totaling DKK881.30 million. The company has a market capitalization of DKK3.20 billion, reflecting its financial standing in the Danish banking sector.

Danske Andelskassers Bank, a modestly sized player in the banking sector, boasts total assets of DKK17.1 billion and equity at DKK3.0 billion. With deposits reaching DKK13.0 billion and loans at DKK7.9 billion, it primarily relies on low-risk funding sources like customer deposits for 92% of its liabilities. The bank's earnings growth over the past year stood at 23.9%, outpacing the industry average of 16.7%. Despite trading at 6% below estimated fair value, free cash flow remains negative, yet its high-quality earnings offer some reassurance to investors seeking potential opportunities in smaller financial institutions.

Shenzhen Textile (Holdings) (SZSE:000045)

Simply Wall St Value Rating: ★★★★★☆

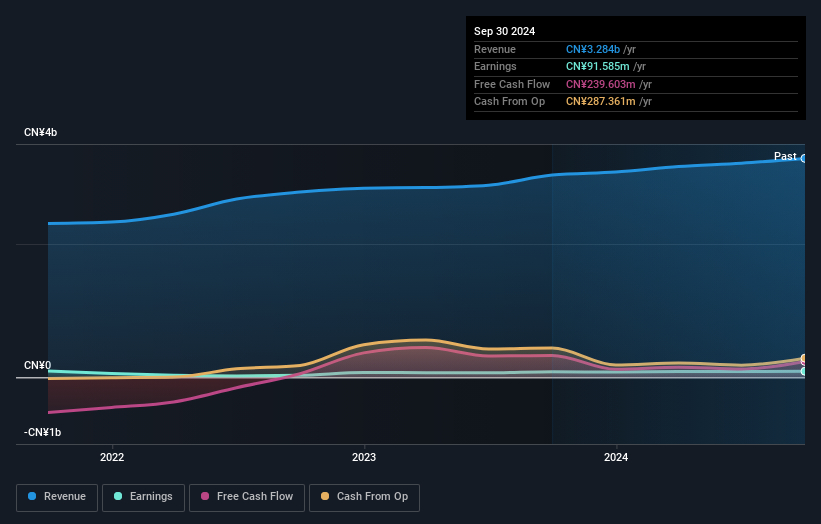

Overview: Shenzhen Textile (Holdings) Co., Ltd. focuses on the research, development, production, and sale of polarizers mainly in China with a market cap of CN¥4.90 billion.

Operations: Shenzhen Textile (Holdings) generates revenue primarily from the sale of polarizers. The company's financial performance is influenced by its focus on this core product line, with a market cap of CN¥4.90 billion.

Shenzhen Textile has been making waves with its recent performance, showcasing a net income of CNY 78.9 million for the nine months ending September 2024, up from CNY 66.58 million the previous year. This growth is reflected in its earnings per share, which rose to CNY 0.1558 from CNY 0.1315. The company seems well-positioned financially, as it holds more cash than total debt and enjoys high-quality earnings with interest payments covered by EBIT at a robust 27 times coverage. Despite an increase in its debt-to-equity ratio from 0.7 to 9.1 over five years, Shenzhen Textile's profitability and positive free cash flow suggest resilience and potential for future growth within the industry context.

- Take a closer look at Shenzhen Textile (Holdings)'s potential here in our health report.

Gain insights into Shenzhen Textile (Holdings)'s past trends and performance with our Past report.

Guangdong Delian Group (SZSE:002666)

Simply Wall St Value Rating: ★★★★★☆

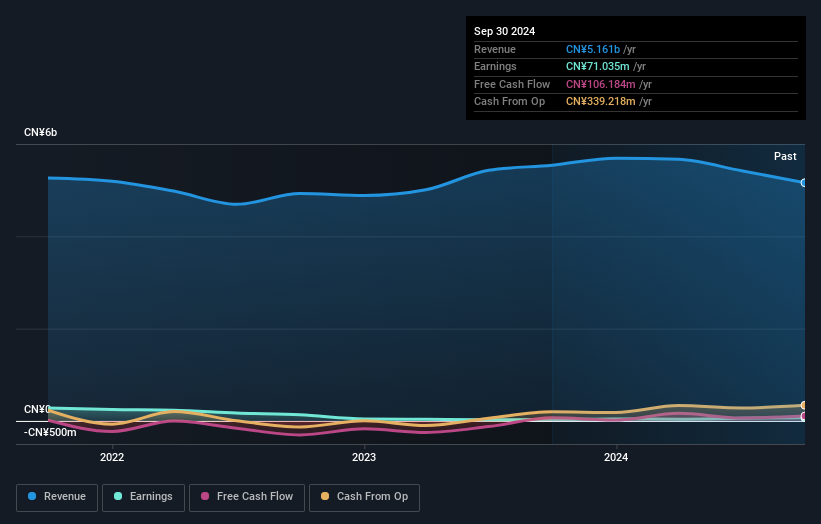

Overview: Guangdong Delian Group Co., Ltd. operates in the automobile fine chemicals, sales service, and repair and maintenance sectors in China with a market capitalization of CN¥3.41 billion.

Operations: Guangdong Delian Group generates revenue primarily from its automobile fine chemicals, sales service, and repair and maintenance sectors. The company's cost structure is influenced by the expenses associated with these operations. Its financial performance includes a focus on net profit margin trends over time.

Guangdong Delian Group is making waves with its innovative approach in the chemicals sector. The company reported a net income of CNY 78 million for the first nine months of 2024, up from CNY 51 million a year prior, reflecting strong earnings growth of 149.9% over the past year against an industry decline of -4.7%. Trading at a significant discount to its fair value estimate, Delian's debt management appears robust with a net debt to equity ratio at just 4.8%. A strategic partnership with Dow aims to enhance sustainable solutions in automotive packaging, underscoring Delian's commitment to circular economy principles.

- Unlock comprehensive insights into our analysis of Guangdong Delian Group stock in this health report.

Understand Guangdong Delian Group's track record by examining our Past report.

Turning Ideas Into Actions

- Discover the full array of 4651 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000045

Shenzhen Textile (Holdings)

Engages in the research and development, production, and sale of polarizers primarily in China.

Excellent balance sheet with proven track record.