RIAMB Beijing Technology Development And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, U.S. stocks ended the year on a strong note despite mixed performances in recent weeks, with major indices like the S&P 500 and Nasdaq Composite achieving significant annual gains. However, challenges such as a declining Chicago PMI and revisions to GDP forecasts highlight potential headwinds for small-cap companies navigating these economic conditions. In this environment, identifying promising small-cap stocks involves looking for those with solid fundamentals and growth potential that can withstand broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

RIAMB (Beijing) Technology Development (SHSE:603082)

Simply Wall St Value Rating: ★★★★★☆

Overview: RIAMB (Beijing) Technology Development Co., Ltd. operates in the field of intelligent logistics systems and has a market capitalization of approximately CN¥5.35 billion.

Operations: RIAMB's primary revenue stream is from its Intelligent Logistics System, generating approximately CN¥1.94 billion.

RIAMB (Beijing) Technology Development showcases a compelling narrative with its earnings growing by 5.6% over the past year, outpacing the Machinery industry average of -0.06%. The company is in a strong position financially, holding more cash than total debt and ensuring interest payments are well-covered. Recent figures reveal sales for the first nine months of 2024 reached CNY 1.45 billion, up from CNY 1.38 billion the previous year, while net income saw a modest rise to CNY 121.78 million from CNY 119.62 million last year, despite basic earnings per share dipping slightly to CNY 0.77 from CNY 0.98.

- Delve into the full analysis health report here for a deeper understanding of RIAMB (Beijing) Technology Development.

Understand RIAMB (Beijing) Technology Development's track record by examining our Past report.

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Skychem Technology Co., Ltd. focuses on the research, development, and manufacturing of electronic materials for industries such as printed circuit boards, semiconductors and packaging, and touch screens, with a market cap of approximately CN¥6.09 billion.

Operations: Skychem's primary revenue stream comes from its specialty chemicals segment, generating CN¥364.94 million.

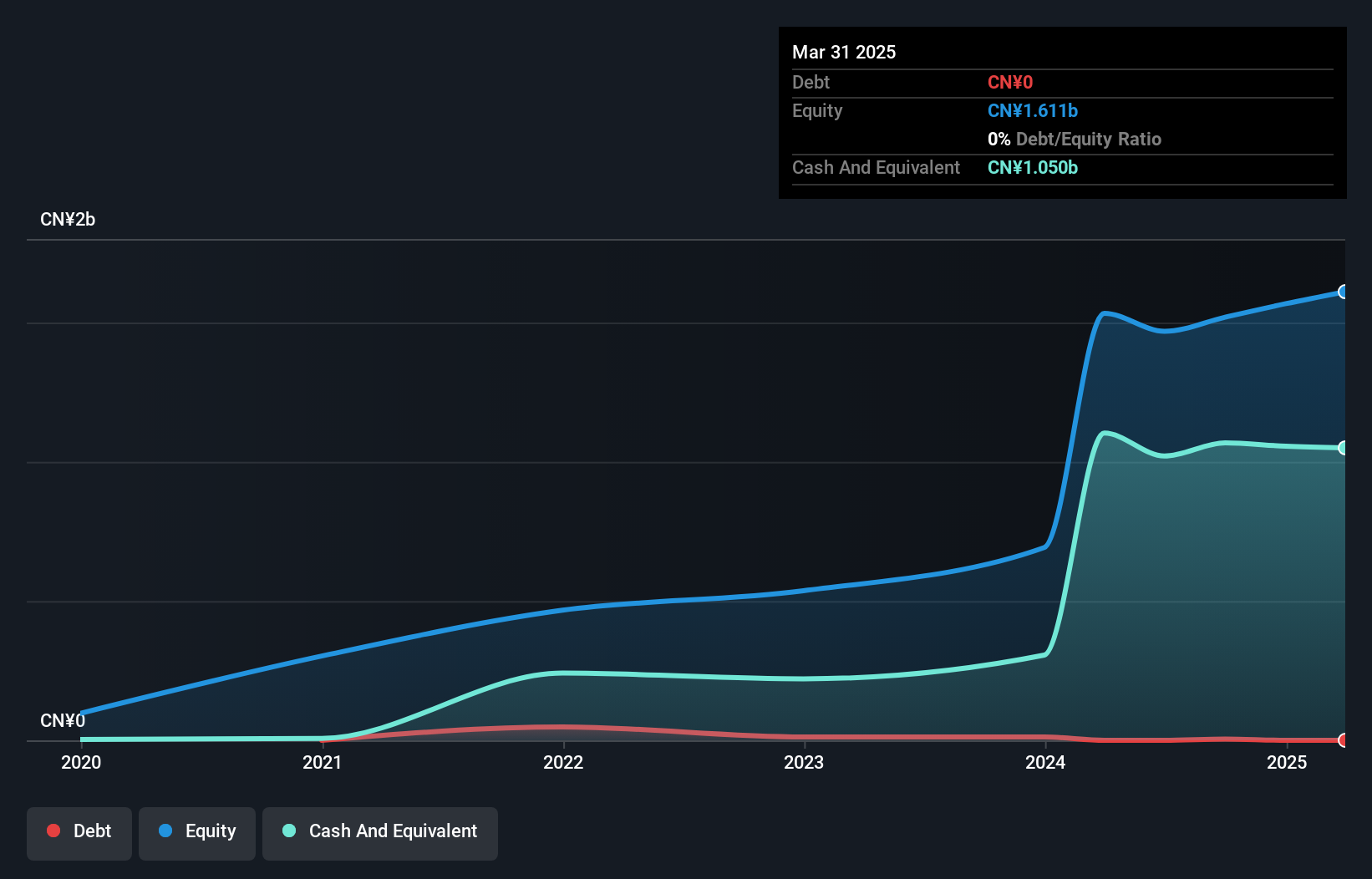

Guangdong Skychem Technology, a dynamic player in the chemicals sector, showcases impressive earnings growth of 38.6% over the past year, outpacing its industry peers who faced a downturn of 4.7%. The company is debt-free and has maintained this status for five years, highlighting financial prudence. Recent earnings reports reveal net income for nine months at CNY 57.17 million, up from CNY 41.65 million previously, with basic earnings per share rising to CNY 0.98 from CNY 0.89 last year. Despite high share price volatility recently, its robust free cash flow indicates solid operational efficiency and potential for future growth.

- Dive into the specifics of Guangdong Skychem Technology here with our thorough health report.

Gain insights into Guangdong Skychem Technology's past trends and performance with our Past report.

MH Robot & Automation (SZSE:301199)

Simply Wall St Value Rating: ★★★★★★

Overview: MH Robot & Automation Co., Ltd. specializes in intelligent equipment systems, Internet of Things solutions, planning and design, and EPC services both in China and globally, with a market cap of CN¥3.87 billion.

Operations: MH Robot & Automation generates revenue primarily through its intelligent equipment systems and Internet of Things solutions. The company has a market cap of CN¥3.87 billion, reflecting its scale in the industry.

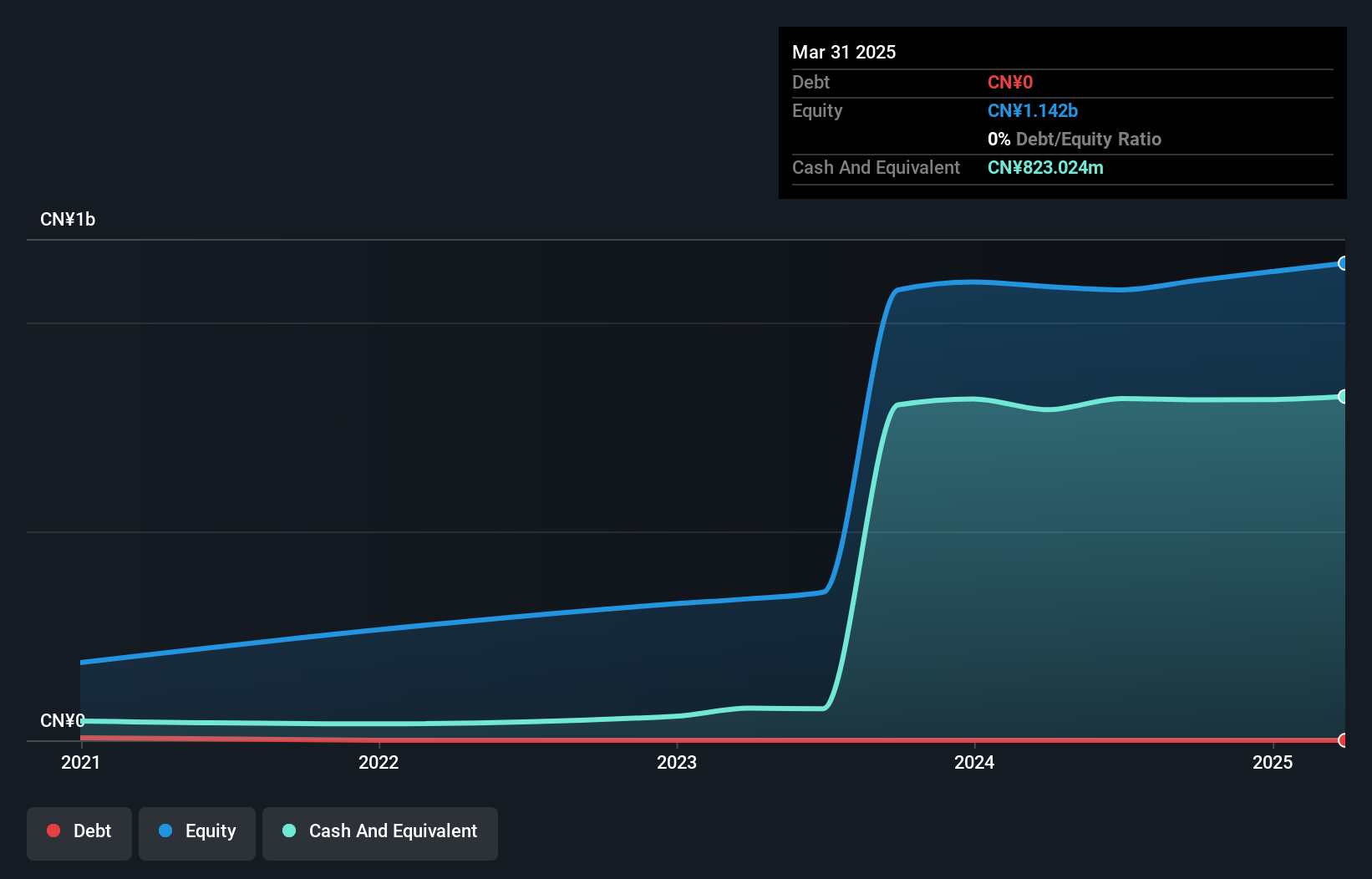

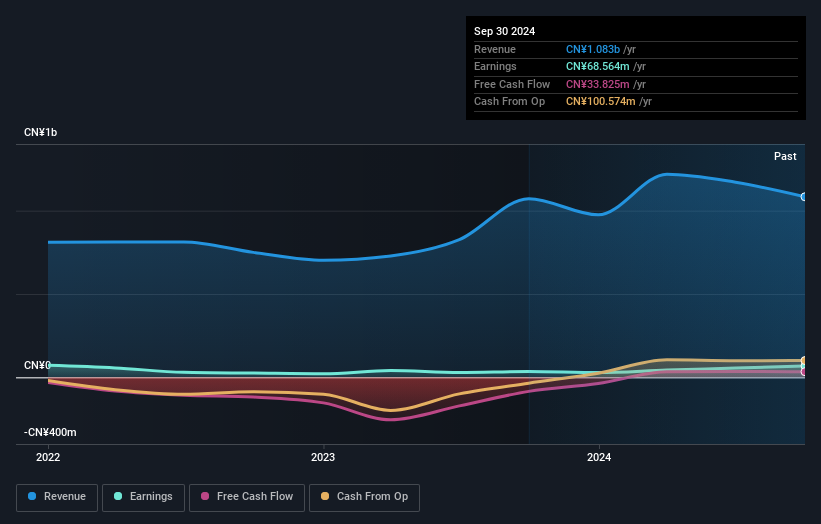

MH Robot & Automation, a nimble player in the machinery sector, has displayed robust earnings growth of 96.3% over the past year, significantly outpacing its industry peers. Despite a challenging five-year period with an average annual earnings decline of 22.9%, recent performance shows promise with net income climbing to CNY 67.01 million from CNY 26.71 million year-on-year for nine months ending September 2024. Trading at approximately 22.7% below estimated fair value and boasting high-quality earnings, this debt-free company seems poised for potential growth amidst competitive pressures in automation technology markets.

- Get an in-depth perspective on MH Robot & Automation's performance by reading our health report here.

Evaluate MH Robot & Automation's historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 4651 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688603

Guangdong Skychem Technology

Engages in research and development and manufacturing of electronic materials in the printed circuit board, semiconductor and packaging, and touch screen industries.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives