- China

- /

- Communications

- /

- SZSE:002792

Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices like the S&P 500 and Nasdaq Composite reflecting significant gains over the past two years despite recent volatility, investors are keenly observing economic indicators such as the Chicago PMI and GDP forecasts that suggest potential challenges ahead. Amidst these broader market dynamics, small-cap stocks offer intriguing opportunities for those looking to diversify their portfolios, particularly when these companies demonstrate strong fundamentals and potential for growth in sectors less impacted by current economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Grinm Advanced Materials (SHSE:600206)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Grinm Advanced Materials Co., Ltd. focuses on the research, development, manufacture, and sale of advanced materials within the nonferrous metals industry in China with a market cap of CN¥13.18 billion.

Operations: Grinm Advanced Materials generates revenue primarily from the sale of advanced materials in the nonferrous metals sector. The company has a market cap of CN¥13.18 billion, indicating its significant presence in the industry.

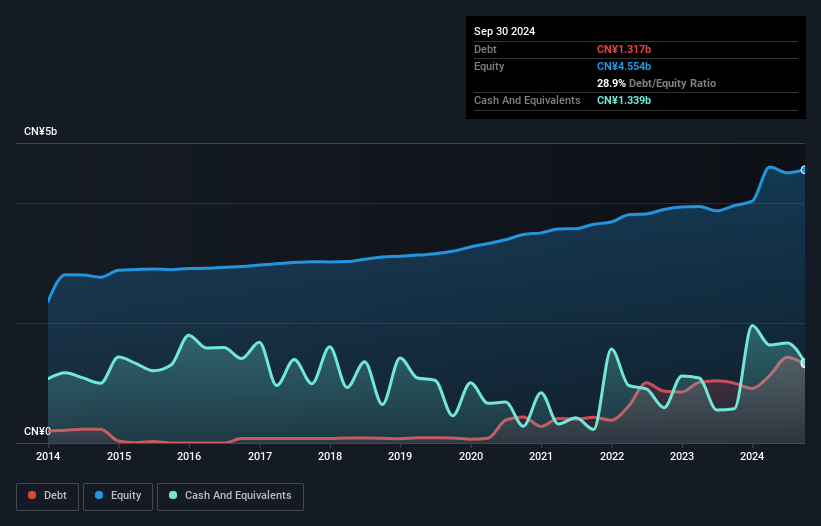

Grinm Advanced Materials, a promising player in its field, reported sales of CN¥6.76 billion for the nine months ending September 2024, down from CN¥8.32 billion the previous year. Despite this dip, earnings growth of 34.6% outpaced the semiconductor industry’s 12.9%, showcasing resilience and potential for future growth. With a debt-to-equity ratio climbing to 28.9% over five years and a significant one-off gain of CN¥54 million impacting recent results, Grinm's financial landscape is complex yet intriguing. The company also benefits from strong interest coverage at 9.7 times EBIT, indicating solid financial management amidst volatility.

Tongyu Communication (SZSE:002792)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tongyu Communication Inc. engages in the research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, optical modules, and other products globally with a market cap of CN¥7.44 billion.

Operations: Tongyu Communication generates revenue primarily through the sale of mobile communication antennas, RF devices, and optical modules. The company's cost structure involves expenses related to research and development, manufacturing, and sales operations. Notably, its gross profit margin has shown variability over recent periods.

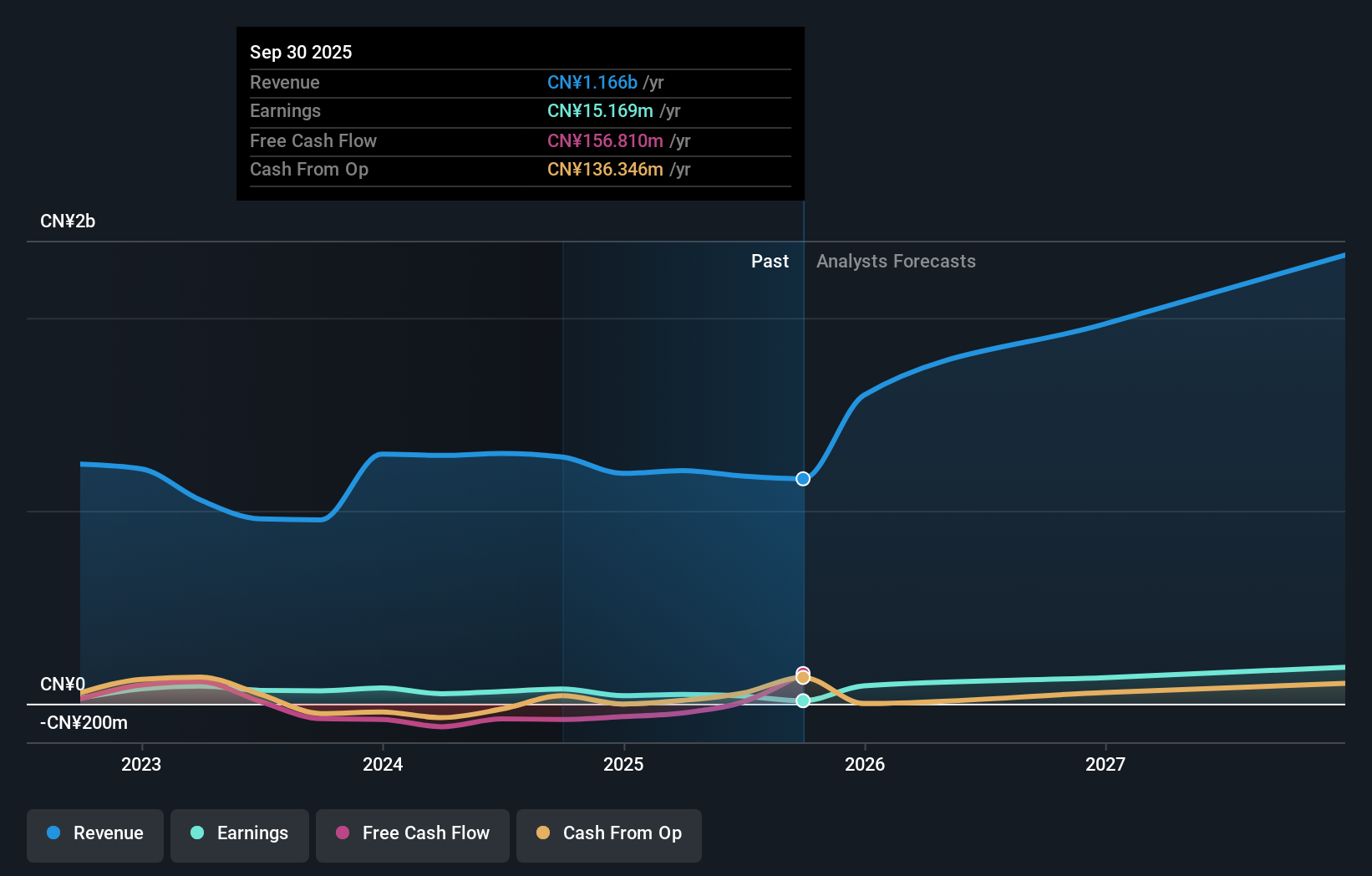

Tongyu Communication, a smaller player in the communications sector, has shown promising growth with earnings increasing by 21.1% over the past year, outpacing the industry average of -3%. Despite facing a slight dip in revenue to CN¥843 million from CN¥858 million last year, its net income stood at CN¥51.49 million. A notable one-off gain of CN¥31.5 million impacted recent financial results positively. The company's debt-to-equity ratio rose slightly to 0.9% over five years but remains manageable as cash surpasses total debt levels. Earnings are projected to grow annually by 50%, suggesting potential for future expansion.

- Get an in-depth perspective on Tongyu Communication's performance by reading our health report here.

Evaluate Tongyu Communication's historical performance by accessing our past performance report.

EST Tools (SZSE:300488)

Simply Wall St Value Rating: ★★★★★☆

Overview: EST Tools Co., Ltd. is engaged in the research, development, manufacturing, and sale of cutting tools and precision spline gauges both in China and internationally, with a market cap of CN¥4.19 billion.

Operations: EST Tools generates revenue primarily from the sale of cutting tools and precision spline gauges. The company has a market cap of CN¥4.19 billion, indicating its significant presence in the industry.

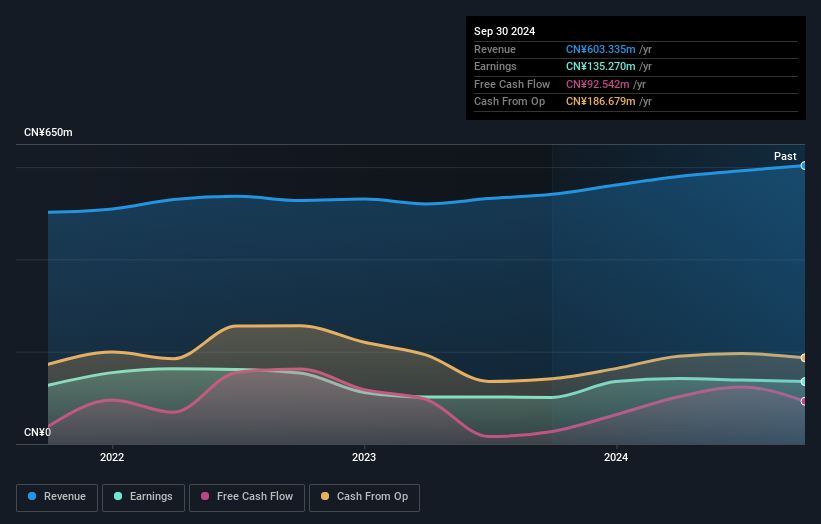

EST Tools, a smaller player in the machinery sector, has shown impressive earnings growth of 33.9% over the past year, outpacing the industry average of -0.06%. The company's debt-to-equity ratio rose from 5.8% to 38.2% over five years, yet its net debt to equity remains satisfactory at 8.3%. Interest payments are well-covered with an EBIT coverage of 18.9 times, indicating strong financial health. Recent revenue climbed to CNY 437.77 million from CNY 395.64 million last year, while net income slightly improved to CNY 96.64 million from CNY 96.57 million previously reported for nine months ending September 2024.

- Delve into the full analysis health report here for a deeper understanding of EST Tools.

Explore historical data to track EST Tools' performance over time in our Past section.

Summing It All Up

- Reveal the 4651 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongyu Communication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002792

Tongyu Communication

Researches and develops, manufactures, sells, and services mobile communication antennas, radio frequency (RF) devices, optical modules, and other products worldwide.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives