- China

- /

- Electronic Equipment and Components

- /

- SZSE:300066

BIMobject And 2 Other Promising Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

As global markets navigate mixed performances, with U.S. stocks closing out a strong year despite recent volatility, investors are keeping a close eye on potential opportunities. Penny stocks, often representing smaller or newer companies, continue to intrigue due to their affordability and growth potential. Despite being considered an outdated term by some, these stocks can offer unique opportunities when backed by solid financials and strong fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £471.86M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Bosideng International Holdings (SEHK:3998) | HK$3.57 | HK$39.31B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £152.06M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.44 | £182.11M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.18M | ★★★★☆☆ |

Click here to see the full list of 5,850 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

BIMobject (OM:BIM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BIMobject AB is a software company that develops cloud solutions and services for building information modelling (BIM) globally, with a market cap of SEK645.98 million.

Operations: The company generates revenue primarily from its CAD / CAM Software segment, amounting to SEK169.40 million.

Market Cap: SEK645.98M

BIMobject AB, a software company with a market cap of SEK645.98 million, has shown resilience despite being currently unprofitable. The firm reported revenue growth to SEK43.21 million in Q3 2024 from SEK40.7 million the previous year, although net income decreased significantly. BIMobject's short-term assets exceed liabilities, and it maintains a cash runway exceeding three years if free cash flow continues its historical growth rate of 19.5% annually. Recent product developments like the launch of Bim.com indicate strategic expansion efforts aimed at enhancing user connectivity and access to extensive product data across its platforms.

- Get an in-depth perspective on BIMobject's performance by reading our balance sheet health report here.

- Gain insights into BIMobject's past trends and performance with our report on the company's historical track record.

Zhejiang Shibao (SEHK:1057)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Shibao Company Limited, along with its subsidiaries, is engaged in the research, design, development, production, and sale of automotive steering systems and accessories in the People’s Republic of China with a market cap of HK$7.90 billion.

Operations: No specific revenue segments are reported for Zhejiang Shibao Company Limited.

Market Cap: HK$7.9B

Zhejiang Shibao Company Limited, with a market cap of HK$7.90 billion, has demonstrated strong financial performance. The company's earnings grew by 195.4% over the past year, surpassing industry averages and reflecting high-quality earnings. Recent results for the nine months ended September 2024 show revenue increasing to CN¥1,817.57 million from CN¥1,176.52 million a year prior, with net income rising to CN¥111.98 million from CN¥40.73 million. Despite shareholder dilution and low return on equity at 8.9%, Zhejiang Shibao's seasoned management and robust asset coverage support its financial stability amidst volatility concerns in penny stocks investments.

- Click to explore a detailed breakdown of our findings in Zhejiang Shibao's financial health report.

- Gain insights into Zhejiang Shibao's historical outcomes by reviewing our past performance report.

Sanchuan Wisdom Technology (SZSE:300066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sanchuan Wisdom Technology Co., Ltd. manufactures and sells water meters under the San Chuan brand, with a market cap of CN¥3.88 billion.

Operations: No specific revenue segments are reported for Sanchuan Wisdom Technology Co., Ltd.

Market Cap: CN¥3.88B

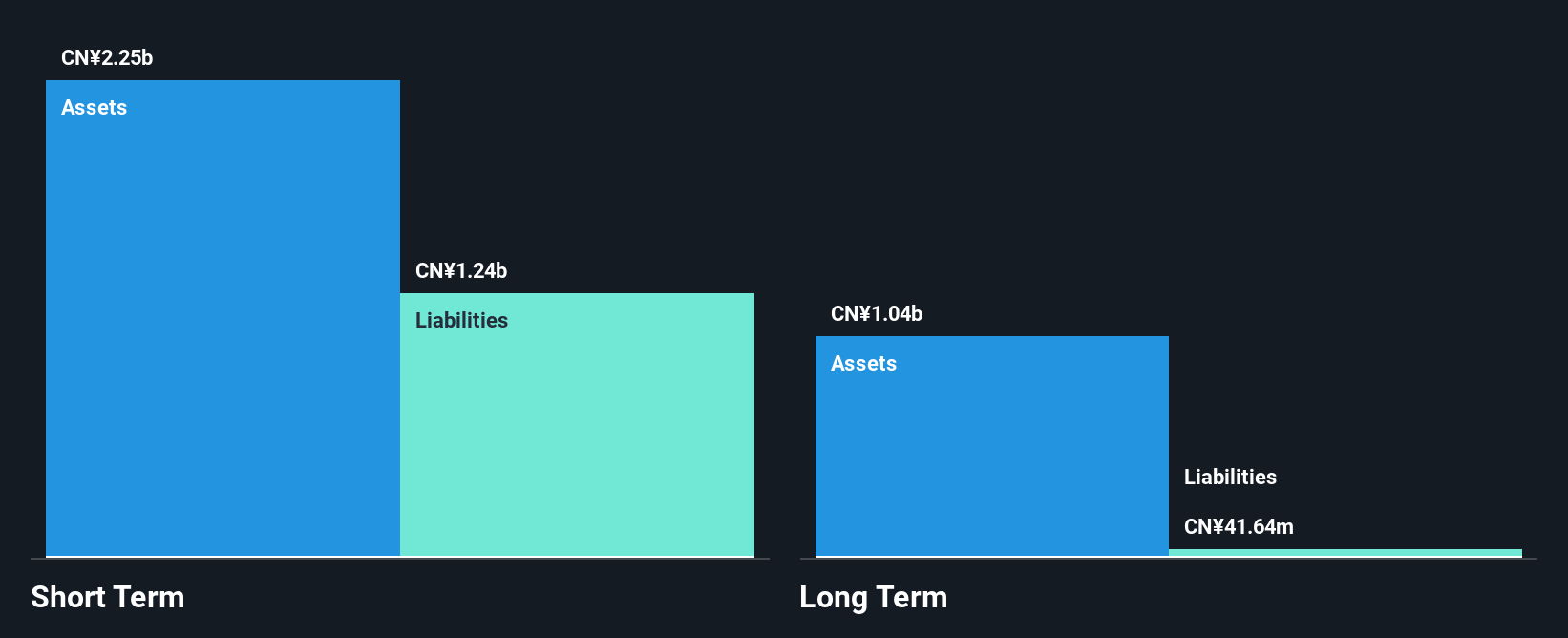

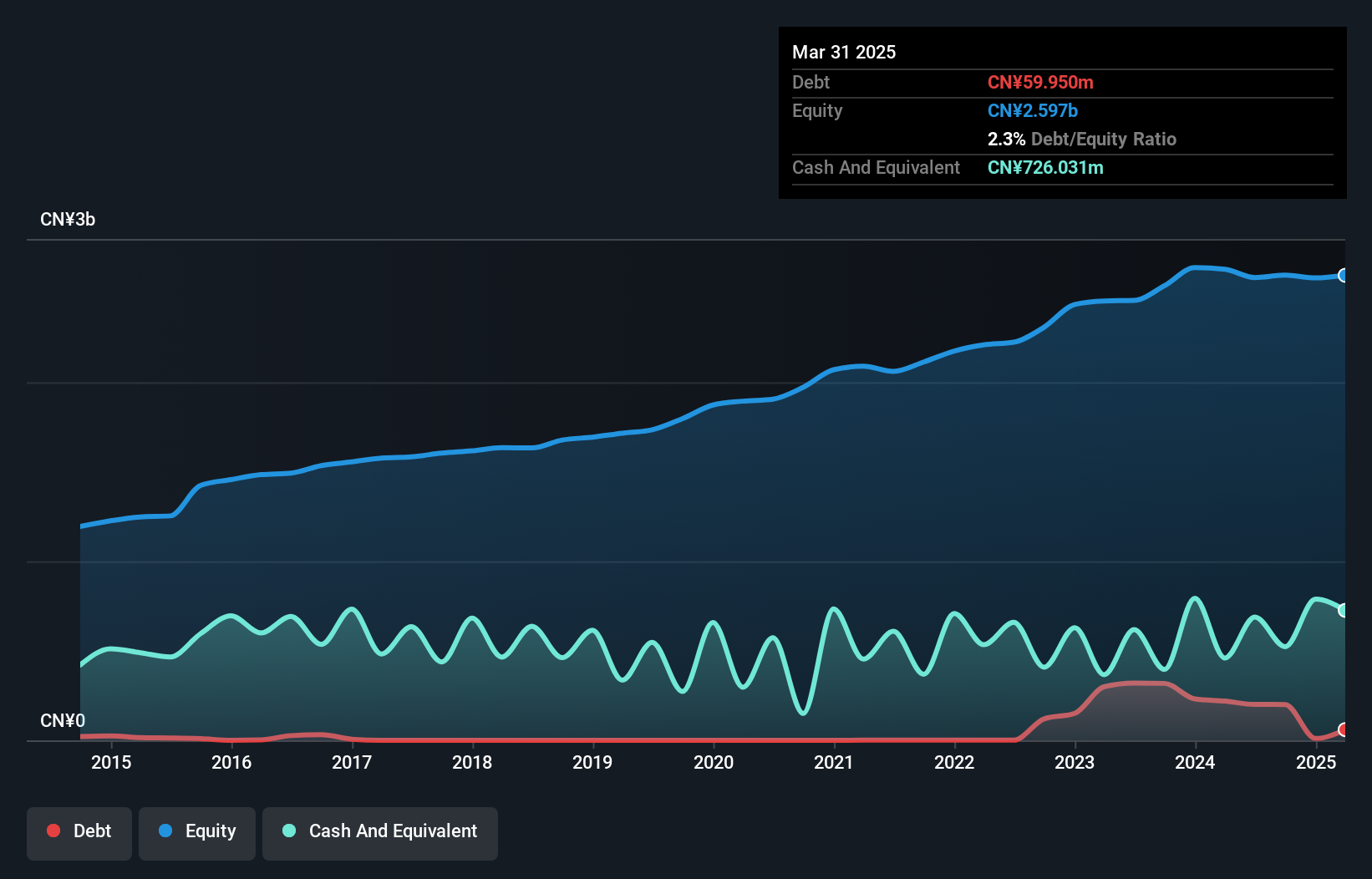

Sanchuan Wisdom Technology, with a market cap of CN¥3.88 billion, has faced challenges typical of penny stocks. The company's recent financial performance showed a decline in revenue to CN¥1,111.59 million from CN¥1,517.42 million and net income dropping to CN¥71.5 million from CN¥162.36 million year-over-year for the nine months ending September 2024. Despite stable weekly volatility and strong asset coverage exceeding both short-term (CN¥439.4M) and long-term liabilities (CN¥32.4M), the company experienced negative earnings growth (-41%) recently and was dropped from the S&P Global BMI Index in December 2024.

- Navigate through the intricacies of Sanchuan Wisdom Technology with our comprehensive balance sheet health report here.

- Evaluate Sanchuan Wisdom Technology's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 5,850 Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300066

Sanchuan Wisdom Technology

Manufactures and sells water meters under the San Chuan brand.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives