Shanghai Zhongchen Electronic TechnologyLtd And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate mixed performances, with the S&P 500 and Nasdaq Composite marking significant annual gains amid economic uncertainties like declining PMI readings and revised GDP forecasts, investors are increasingly seeking opportunities in lesser-known stocks to diversify their portfolios. In this environment, identifying a good stock often involves looking for companies that demonstrate resilience and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Zhongchen Electronic TechnologyLtd (SHSE:603275)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Zhongchen Electronic Technology Ltd (SHSE:603275) operates in the electronic technology sector with a market capitalization of CN¥4.82 billion.

Operations: Shanghai Zhongchen Electronic Technology Ltd generates revenue through its core operations in the electronic technology sector. The company reported a market capitalization of CN¥4.82 billion, reflecting its scale within the industry.

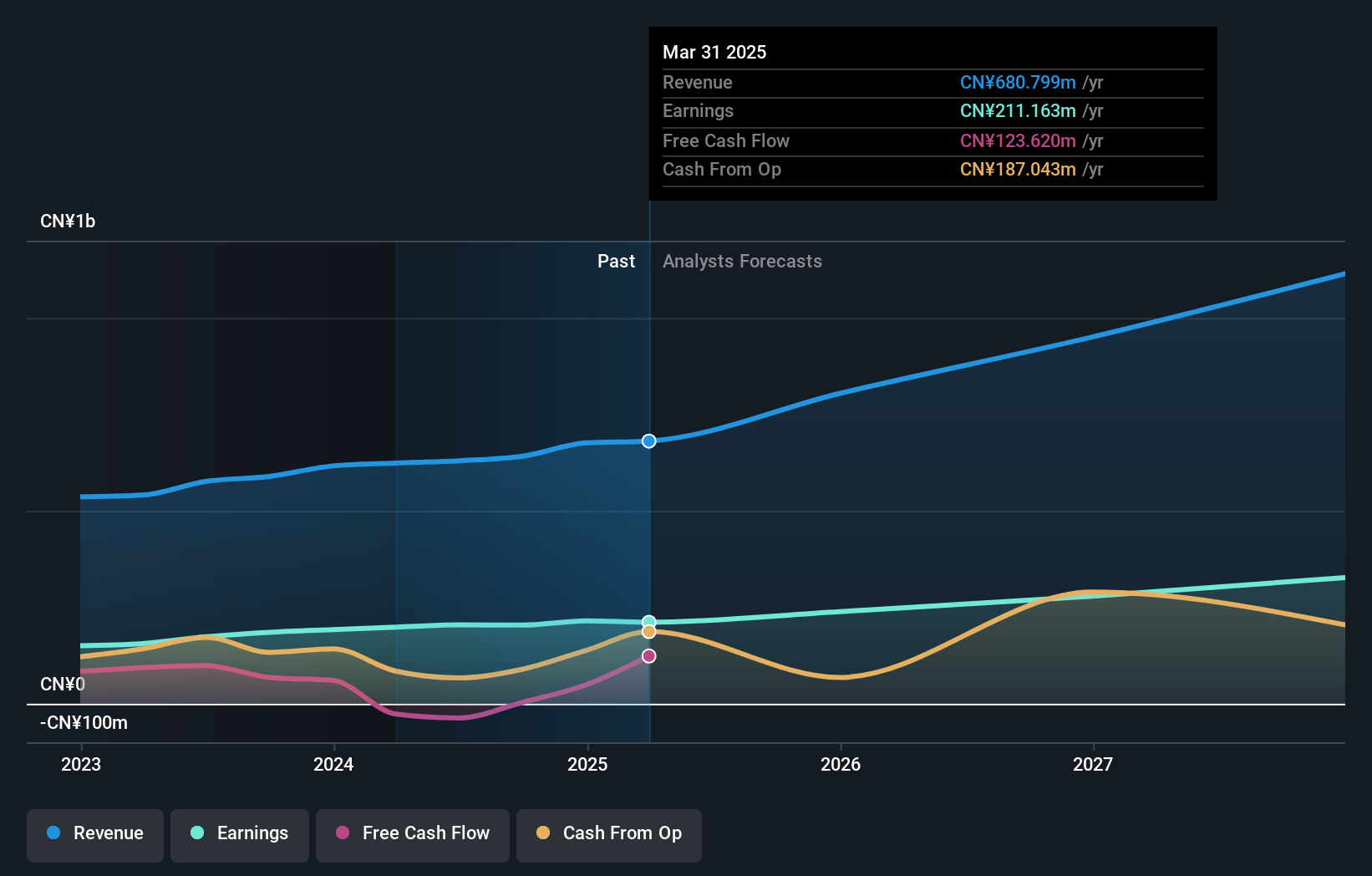

Shanghai Zhongchen Electronic Technology, a smaller player in the tech space, has been making noteworthy strides. Its earnings grew by 10% over the past year, outpacing the broader electrical industry. The company holds a price-to-earnings ratio of 23.6x, which is below the CN market average of 33.6x, suggesting potential undervaluation. Recent financials show sales reaching CNY 493 million for nine months ending September 2024, with net income at CNY 161 million. Additionally, it completed a share buyback program repurchasing nearly 897k shares for CNY 24 million since February last year.

Shenzhen Soling IndustrialLtd (SZSE:002766)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Soling Industrial Co., Ltd specializes in providing car-road-cloud solutions and has a market capitalization of CN¥4.77 billion.

Operations: Shenzhen Soling Industrial Co., Ltd generates revenue primarily from its car-road-cloud solutions. The company has a market capitalization of CN¥4.77 billion, reflecting its position in the industry.

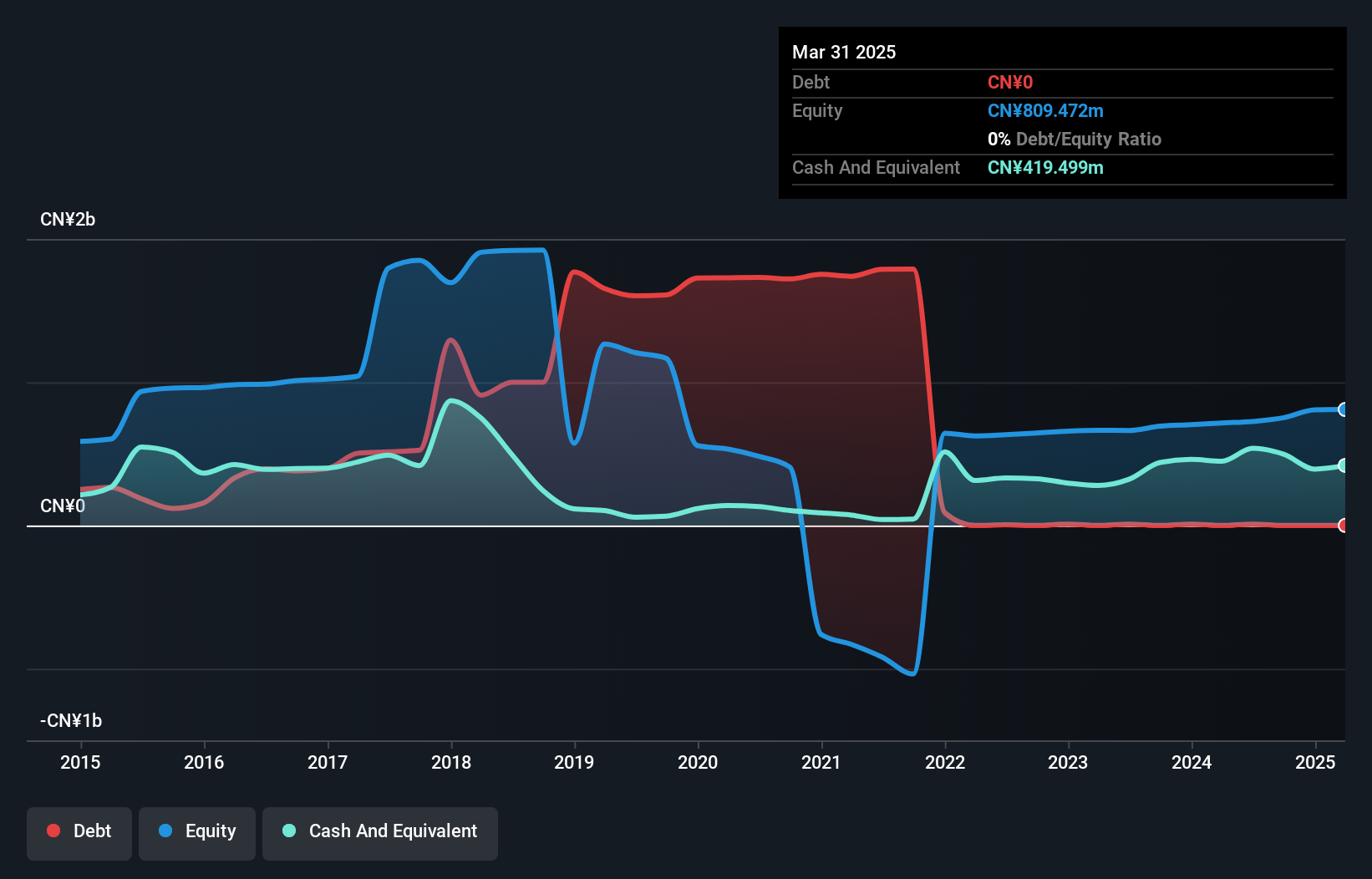

Soling has emerged as a promising player in the auto components sector, with earnings growth of 124.6% over the past year, outpacing the industry's 10.5%. The company is debt-free, a significant improvement from five years ago when its debt-to-equity ratio was 137.9%. Recent results show robust performance, with sales reaching CNY 1.03 billion for nine months ending September 2024, up from CNY 729.84 million last year. Net income also rose to CNY 44.07 million from CNY 19.38 million in the previous period, reflecting high-quality earnings and solid profitability without leverage concerns.

- Dive into the specifics of Shenzhen Soling IndustrialLtd here with our thorough health report.

Gain insights into Shenzhen Soling IndustrialLtd's past trends and performance with our Past report.

Xinlei Compressor (SZSE:301317)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xinlei Compressor Co., Ltd. focuses on the research, development, manufacture, and sale of air compressors and blowers in China, with a market cap of CN¥2.95 billion.

Operations: Xinlei Compressor generates revenue primarily from its Machinery & Industrial Equipment segment, amounting to CN¥1.01 billion.

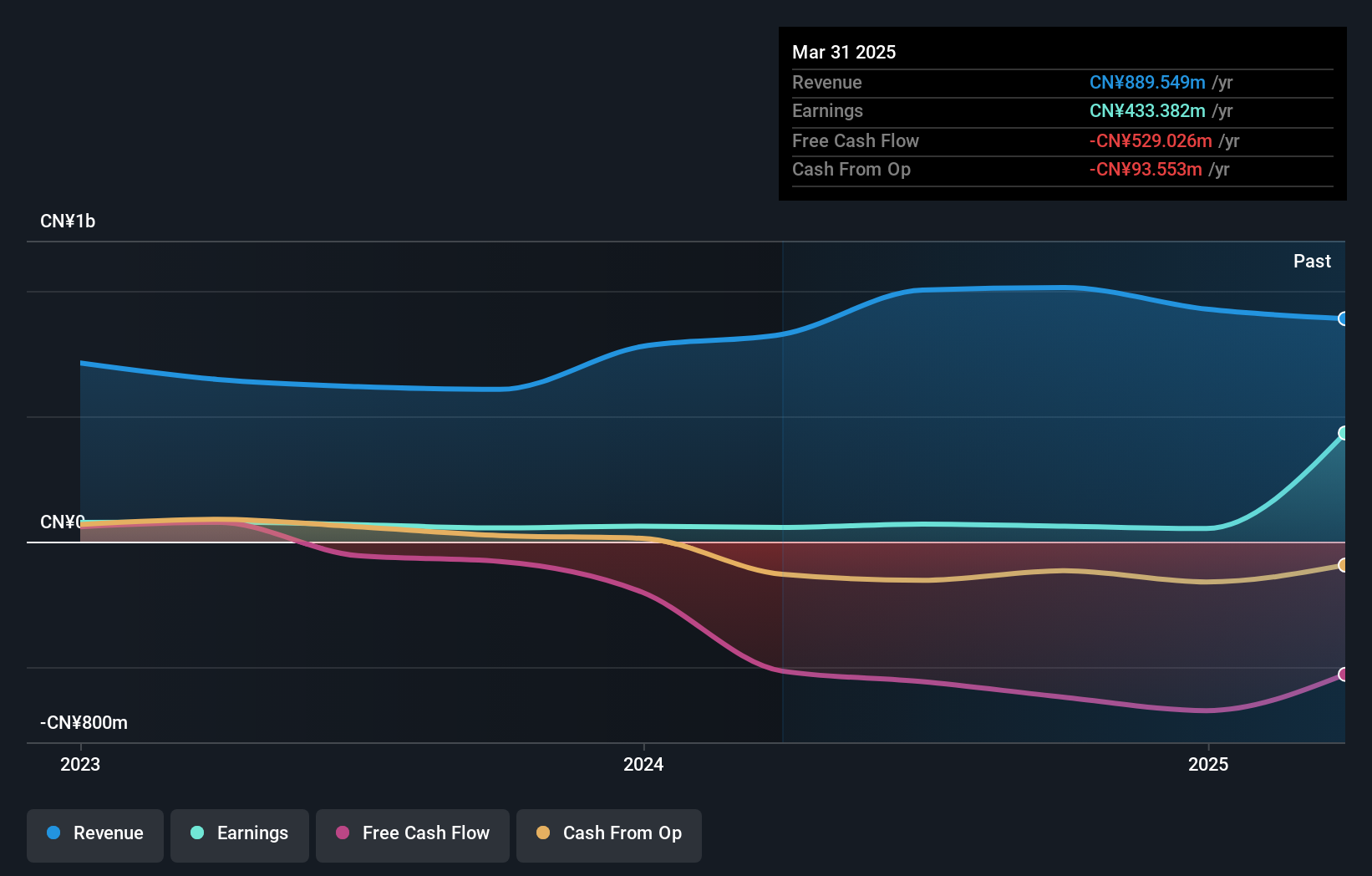

Xinlei Compressor, a smaller player in the machinery sector, has shown notable growth with earnings rising 12.2% over the past year, surpassing industry averages. The company's net profit margin stands at 6.1%, slightly down from the previous year's 9%. Despite this dip, Xinlei's financial health appears robust with its debt-to-equity ratio improving from 15.8% to 10.2% over five years and having more cash than total debt enhances stability. Recent buybacks completed for CNY79.79 million indicate confidence in its stock value; however, share price volatility remains high in recent months which could be a concern for investors seeking stability.

Taking Advantage

- Unlock our comprehensive list of 4651 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301317

Xinlei Compressor

Engages in the research and development, manufacture, and sale of air compressors and blowers in China.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives