Growth Companies With High Insider Ownership To Watch In January 2025

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mix of gains and setbacks, with U.S. indices showing moderate increases despite declining consumer confidence and manufacturing figures. Amidst these fluctuations, investors are increasingly focusing on growth companies with high insider ownership, as such firms often indicate strong internal belief in their potential and can offer resilience during uncertain economic times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

China Youran Dairy Group (SEHK:9858)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Youran Dairy Group Limited is an investment holding company that operates as an integrated provider of products and services in the upstream dairy industry in the People's Republic of China, with a market cap of HK$6.27 billion.

Operations: The company generates revenue from two main segments: the Raw Milk Business, contributing CN¥14.07 billion, and Comprehensive Ruminant Farming Solutions, which adds CN¥7.65 billion.

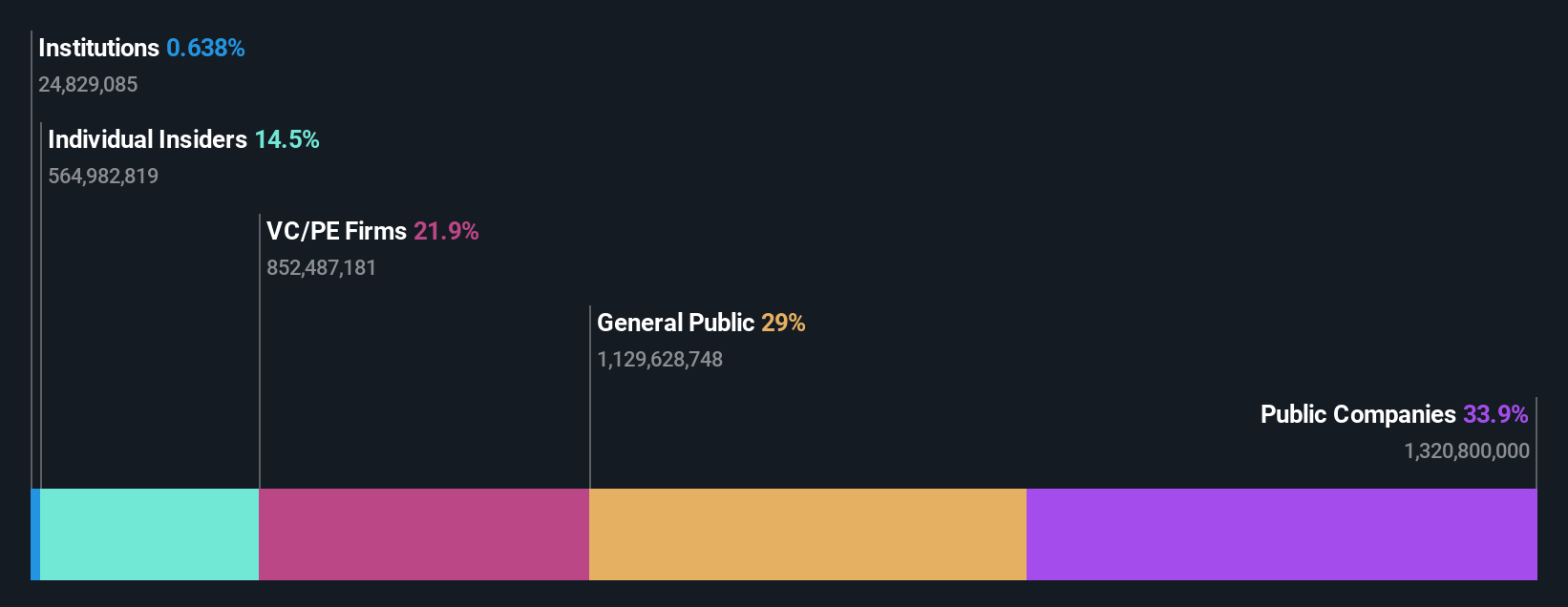

Insider Ownership: 14.5%

Earnings Growth Forecast: 98% p.a.

China Youran Dairy Group is forecasted to achieve profitability within three years, with earnings expected to grow significantly at 98% per year. Despite a high level of debt and past shareholder dilution, the company trades at good value relative to peers. Revenue growth is projected at 8.9% annually, surpassing the Hong Kong market average of 7.6%. However, insider trading activity over the past three months remains unavailable for analysis.

- Dive into the specifics of China Youran Dairy Group here with our thorough growth forecast report.

- According our valuation report, there's an indication that China Youran Dairy Group's share price might be on the cheaper side.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and financial institutions globally, with a market cap of CHF4.68 billion.

Operations: Revenue segments for Temenos include software licensing, maintenance, and services provided to banking and financial institutions worldwide.

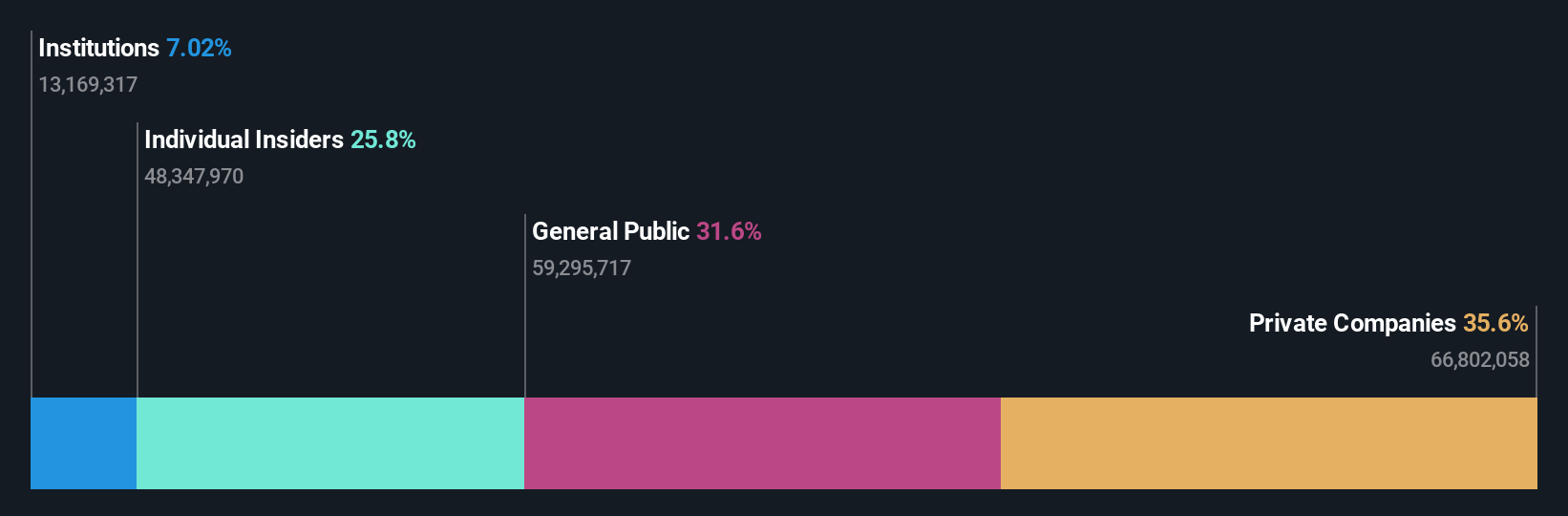

Insider Ownership: 21.8%

Earnings Growth Forecast: 11.6% p.a.

Temenos is experiencing moderate growth, with earnings projected to increase by 11.6% annually, outpacing the Swiss market. Despite a high debt level, it trades at 41.4% below its estimated fair value. Recent client wins in Malaysia and Canada highlight its strategic expansion through cloud-based solutions and digital transformation initiatives. The introduction of generative AI capabilities in collaboration with NVIDIA further underscores Temenos' commitment to innovation and enhancing customer experiences within the banking sector.

- Click here and access our complete growth analysis report to understand the dynamics of Temenos.

- Our valuation report here indicates Temenos may be undervalued.

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Co., Ltd is involved in the research, development, cultivation, production, and sale of edible fungi in China with a market capitalization of CN¥14.29 billion.

Operations: Fujian Wanchen Biotechnology Group generates revenue through its activities in the research, development, cultivation, production, and sale of edible fungi within China.

Insider Ownership: 14.7%

Earnings Growth Forecast: 83.3% p.a.

Fujian Wanchen Biotechnology Group is poised for significant growth, with earnings projected to increase 83.3% annually, surpassing the CN market's growth rate. The company trades at a substantial discount to its estimated fair value despite recent shareholder dilution and share price volatility. Recent earnings reports show a turnaround from losses to profitability, supported by robust revenue growth from CNY 4.90 billion to CNY 20.61 billion year-on-year, reflecting strong operational performance and potential for future expansion.

- Delve into the full analysis future growth report here for a deeper understanding of Fujian Wanchen Biotechnology Group.

- The valuation report we've compiled suggests that Fujian Wanchen Biotechnology Group's current price could be quite moderate.

Make It Happen

- Discover the full array of 1497 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300972

Fujian Wanchen Biotechnology Group

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Exceptional growth potential and undervalued.