Private companies invested in Foshan Haitian Flavouring and Food Company Ltd. (SHSE:603288) copped the brunt of last week's CN¥27b market cap decline

Key Insights

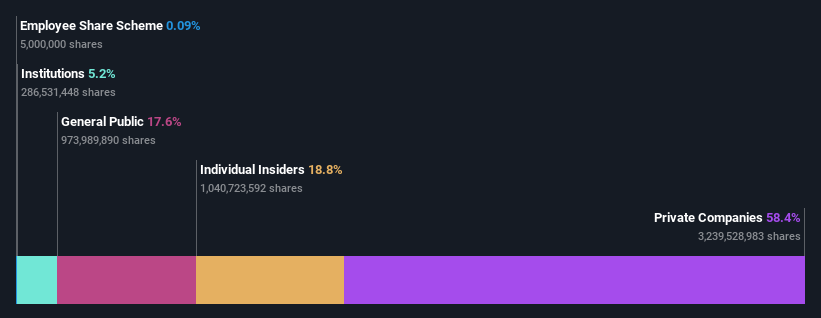

- The considerable ownership by private companies in Foshan Haitian Flavouring and Food indicates that they collectively have a greater say in management and business strategy

- 58% of the company is held by a single shareholder (Guangdong Haitian Group Co., Ltd.)

- 19% of Foshan Haitian Flavouring and Food is held by insiders

A look at the shareholders of Foshan Haitian Flavouring and Food Company Ltd. (SHSE:603288) can tell us which group is most powerful. We can see that private companies own the lion's share in the company with 58% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

While insiders, who own 19% shares weren’t spared from last week’s CN¥27b market cap drop, private companies as a group suffered the maximum losses

In the chart below, we zoom in on the different ownership groups of Foshan Haitian Flavouring and Food.

See our latest analysis for Foshan Haitian Flavouring and Food

What Does The Institutional Ownership Tell Us About Foshan Haitian Flavouring and Food?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

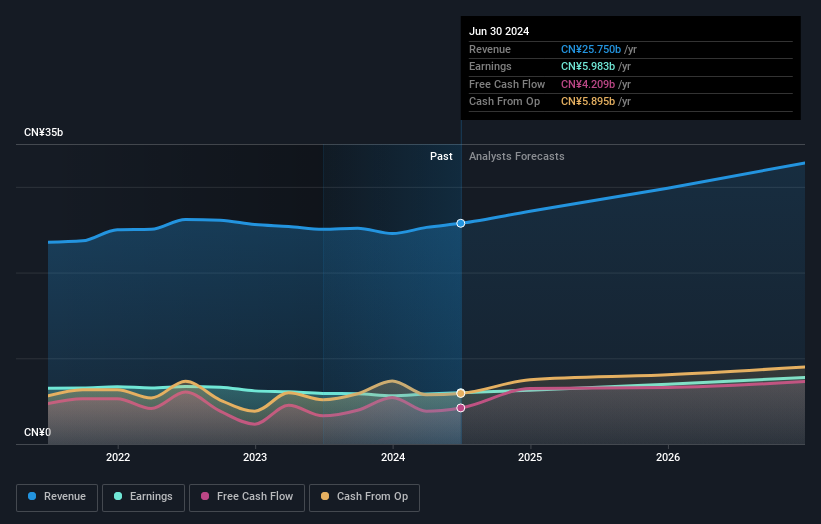

As you can see, institutional investors have a fair amount of stake in Foshan Haitian Flavouring and Food. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Foshan Haitian Flavouring and Food, (below). Of course, keep in mind that there are other factors to consider, too.

Foshan Haitian Flavouring and Food is not owned by hedge funds. Our data shows that Guangdong Haitian Group Co., Ltd. is the largest shareholder with 58% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. For context, the second largest shareholder holds about 9.6% of the shares outstanding, followed by an ownership of 3.2% by the third-largest shareholder. Two of the top three shareholders happen to be Chief Executive Officer and Vice Chairman, respectively. That is, insiders feature higher up in the heirarchy of the company's top shareholders.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Foshan Haitian Flavouring and Food

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Foshan Haitian Flavouring and Food Company Ltd.. It is very interesting to see that insiders have a meaningful CN¥44b stake in this CN¥234b business. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public-- including retail investors -- own 18% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 58%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Foshan Haitian Flavouring and Food better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Foshan Haitian Flavouring and Food .

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603288

Foshan Haitian Flavouring and Food

Foshan Haitian Flavouring and Food Company Ltd.

Excellent balance sheet established dividend payer.