As global markets navigate mixed performances, with the S&P 500 closing out a strong year despite recent slumps, small-cap stocks have become a focal point for investors seeking growth opportunities amidst fluctuating economic indicators. In this dynamic environment, identifying promising small-cap companies requires careful attention to factors such as innovative business models and resilience in challenging market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang grandwall electric science&technologyltd (SHSE:603897)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Grandwall Electric Science & Technology Co., Ltd., along with its subsidiaries, focuses on the research, development, production, and sale of electromagnetic wire products both in China and internationally, with a market cap of CN¥4.59 billion.

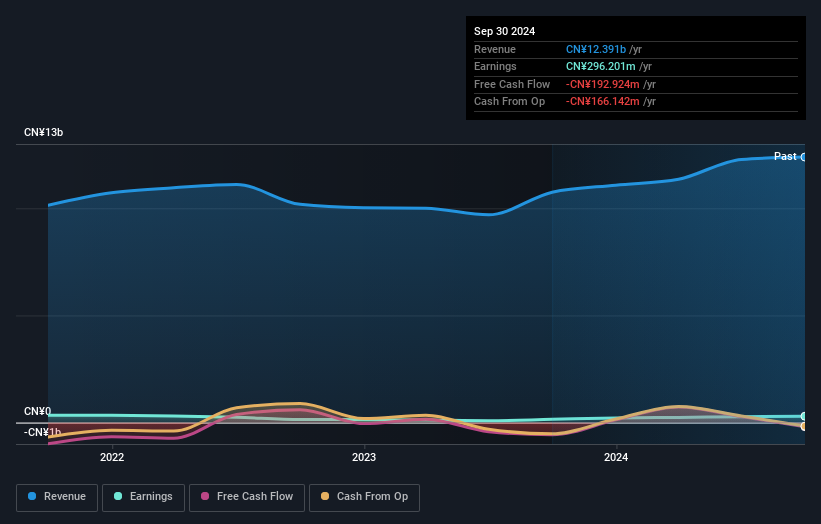

Operations: The company generates revenue primarily from its manufacturing segment, which amounts to CN¥12.39 billion.

Zhejiang Grandwall Electric, a small player in the electrical sector, has shown impressive growth with earnings surging 96.8% over the past year, outpacing the industry average of 1.1%. The company reported CNY 9.51 billion in sales for the nine months ending September 2024, up from CNY 8.20 billion a year prior. Despite an increase in its debt-to-equity ratio from 28% to nearly 40% over five years, it holds more cash than total debt and covers interest payments well at a rate of 14 times EBIT. Earnings per share improved to CNY 0.91 from CNY 0.53 last year, indicating strong financial health and potential for continued growth amidst industry challenges.

Mesnac (SZSE:002073)

Simply Wall St Value Rating: ★★★★★★

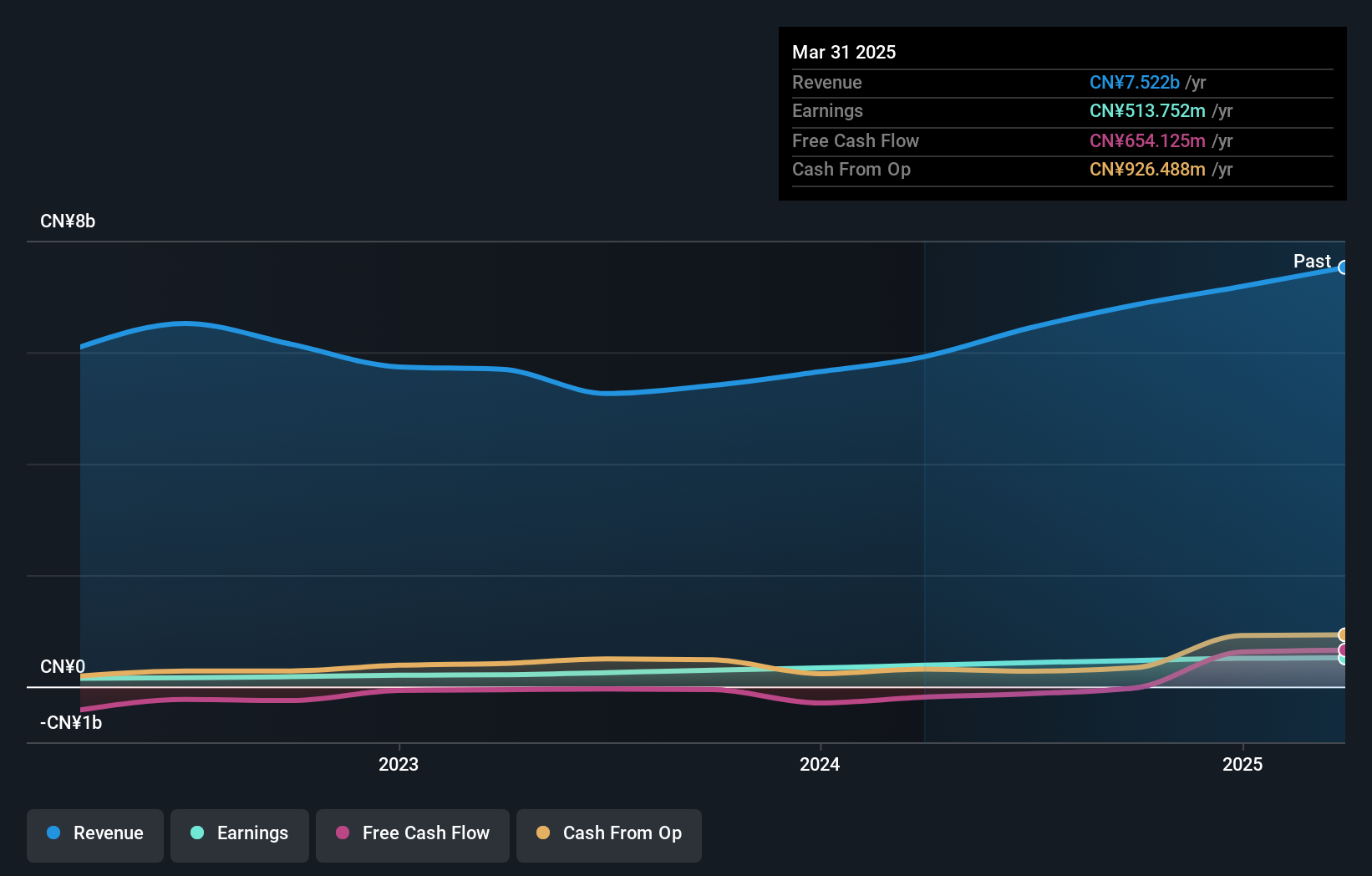

Overview: Mesnac Co., Ltd. focuses on the research, development, and innovation of application software and information equipment for the rubber industry both in China and internationally, with a market cap of CN¥7.98 billion.

Operations: Mesnac derives revenue primarily from its software and equipment offerings tailored for the rubber industry. The company's financial performance is influenced by its focus on innovation and development within this niche market.

Mesnac's recent performance highlights its potential as an intriguing investment. With earnings growth of 58% over the past year, it outpaced the broader machinery industry, which saw a slight contraction. The company's debt-to-equity ratio improved from 34.4% to 27.1% over five years, indicating prudent financial management. Despite not generating positive free cash flow lately, Mesnac's price-to-earnings ratio of 17x remains attractive compared to the CN market average of 33x. Recent earnings reports show a jump in net income from CNY 209 million to CNY 343 million for nine months ending September 2024, suggesting robust operational progress amidst ongoing strategic adjustments like stock repurchases and cancellations discussed in their upcoming shareholders meeting.

- Get an in-depth perspective on Mesnac's performance by reading our health report here.

Evaluate Mesnac's historical performance by accessing our past performance report.

IFE Elevators (SZSE:002774)

Simply Wall St Value Rating: ★★★★★★

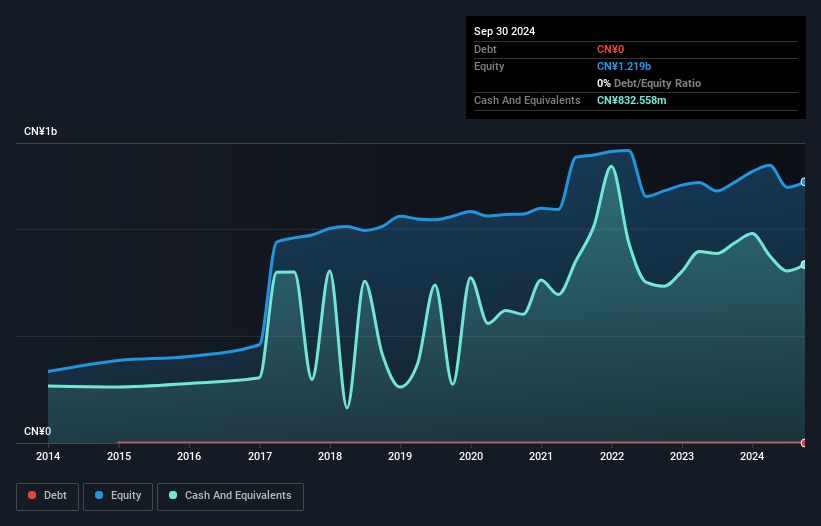

Overview: IFE Elevators Co., Ltd. designs, manufactures, installs, and maintains a range of lifts, escalators, and moving walkways in China and internationally with a market cap of CN¥2.31 billion.

Operations: IFE Elevators generates revenue primarily from the design, manufacture, installation, and maintenance of lifts, escalators, and moving walkways. The company's net profit margin has shown variability over recent periods.

With a solid footing in the machinery sector, IFE Elevators showcases a compelling value proposition with its price-to-earnings ratio at 17.2x, significantly lower than the CN market average of 33.6x. This debt-free company has shown resilience with an earnings growth of 8.4% over the past year, outpacing the industry average of -0.06%. Despite reporting CNY 1,116.65 million in sales for nine months ending September 2024—down from CNY 1,198.9 million prior year—the firm maintains high-quality earnings and non-cash contributions that bolster its financial health amidst fluctuating revenues and net income figures.

- Dive into the specifics of IFE Elevators here with our thorough health report.

Review our historical performance report to gain insights into IFE Elevators''s past performance.

Taking Advantage

- Embark on your investment journey to our 4651 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002073

Mesnac

Engages in the research, development, and innovation of application software and information equipment for rubber industry in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives