- Hong Kong

- /

- Hospitality

- /

- SEHK:308

3 Penny Stocks With Market Caps Over US$700M To Consider

Reviewed by Simply Wall St

As global markets navigate a mix of inflation concerns and political uncertainties, investors are seeking opportunities amid the volatility. Penny stocks, often associated with smaller or newer companies, remain an intriguing segment for those looking to capitalize on potential growth at lower price points. Despite being considered a throwback term, penny stocks can still offer significant value when backed by strong financials and clear growth prospects. In this article, we explore three such stocks that stand out as potential hidden gems in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £465.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| T.A.C. Consumer (SET:TACC) | THB4.30 | THB2.58B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.70 | £405.37M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.405 | £180.84M | ★★★★★☆ |

| Starflex (SET:SFLEX) | THB2.56 | THB1.99B | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £67.32M | ★★★★☆☆ |

Click here to see the full list of 5,720 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

United Arab Bank P.J.S.C (ADX:UAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: United Arab Bank P.J.S.C. offers commercial banking products and services to institutional and corporate clients in the United Arab Emirates, with a market capitalization of AED2.78 billion.

Operations: The company's revenue segment includes Retail Banking, which generated AED54.37 million.

Market Cap: AED2.78B

United Arab Bank P.J.S.C. has demonstrated consistent profitability growth over the past five years, with earnings increasing by an average of 63.9% annually, although recent growth has slowed to 5.7%. Its market capitalization stands at AED2.78 billion, and it maintains a stable financial structure with a Loans to Assets ratio of 54% and primarily low-risk funding sources. Despite high-quality earnings and an appropriate Loans to Deposits ratio of 76%, UAB faces challenges such as high bad loan levels (5.1%) and lower-than-industry-average earnings growth. Recent initiatives include sustainability efforts through partnerships like Canon's climate compensation program, reflecting strong corporate social responsibility commitments.

- Click here to discover the nuances of United Arab Bank P.J.S.C with our detailed analytical financial health report.

- Gain insights into United Arab Bank P.J.S.C's outlook and expected performance with our report on the company's earnings estimates.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services, with a market cap of HK$5.43 billion.

Operations: The company generates revenue from several segments, including Tourist Attraction and Related Operations (HK$2.28 billion), Passenger Transportation Operations (HK$1.09 billion), Hotel Operations (HK$746.12 million), Travel Document and Related Operations (HK$435.27 million), and Corporate and Others (HK$36.08 million).

Market Cap: HK$5.43B

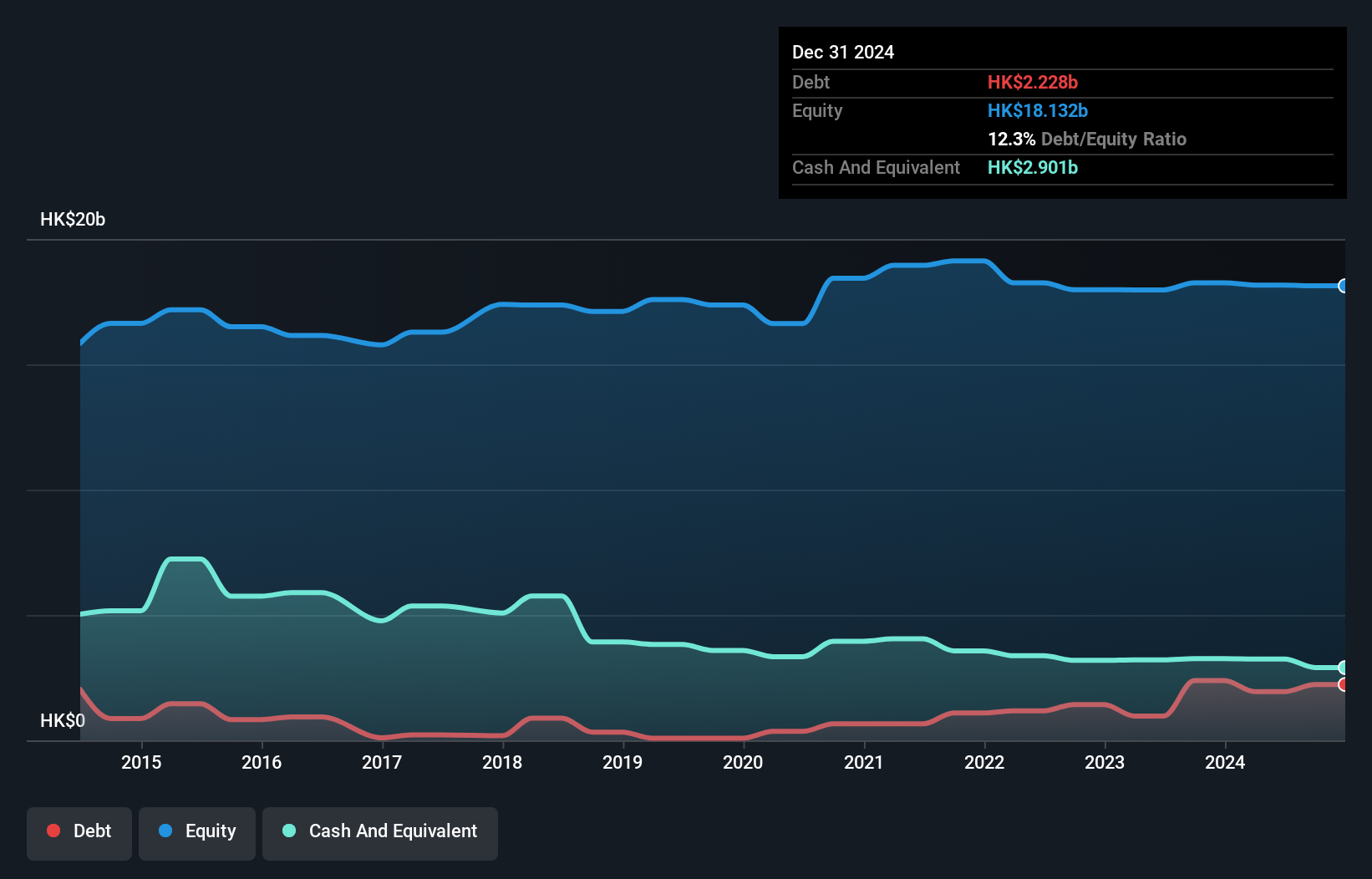

China Travel International Investment Hong Kong Limited, with a market cap of HK$5.43 billion, faces challenges despite its diverse revenue streams across tourist attractions, transportation, and hotel operations. The company's debt to equity ratio has increased over the past five years but remains manageable as cash exceeds total debt. However, earnings have declined by 9.7% annually over five years and recent negative growth highlights profitability concerns. While short-term assets cover both short- and long-term liabilities comfortably, profit margins have decreased from 3.7% to 1.7%. The board is experienced with an average tenure of 5.4 years; however, earnings growth forecasts remain optimistic at 41.33% annually amidst ongoing strategic initiatives discussed in recent shareholder meetings.

- Get an in-depth perspective on China Travel International Investment Hong Kong's performance by reading our balance sheet health report here.

- Understand China Travel International Investment Hong Kong's earnings outlook by examining our growth report.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd. operates in the production and sale of yarns in China, with a market cap of CN¥4.17 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥4.17B

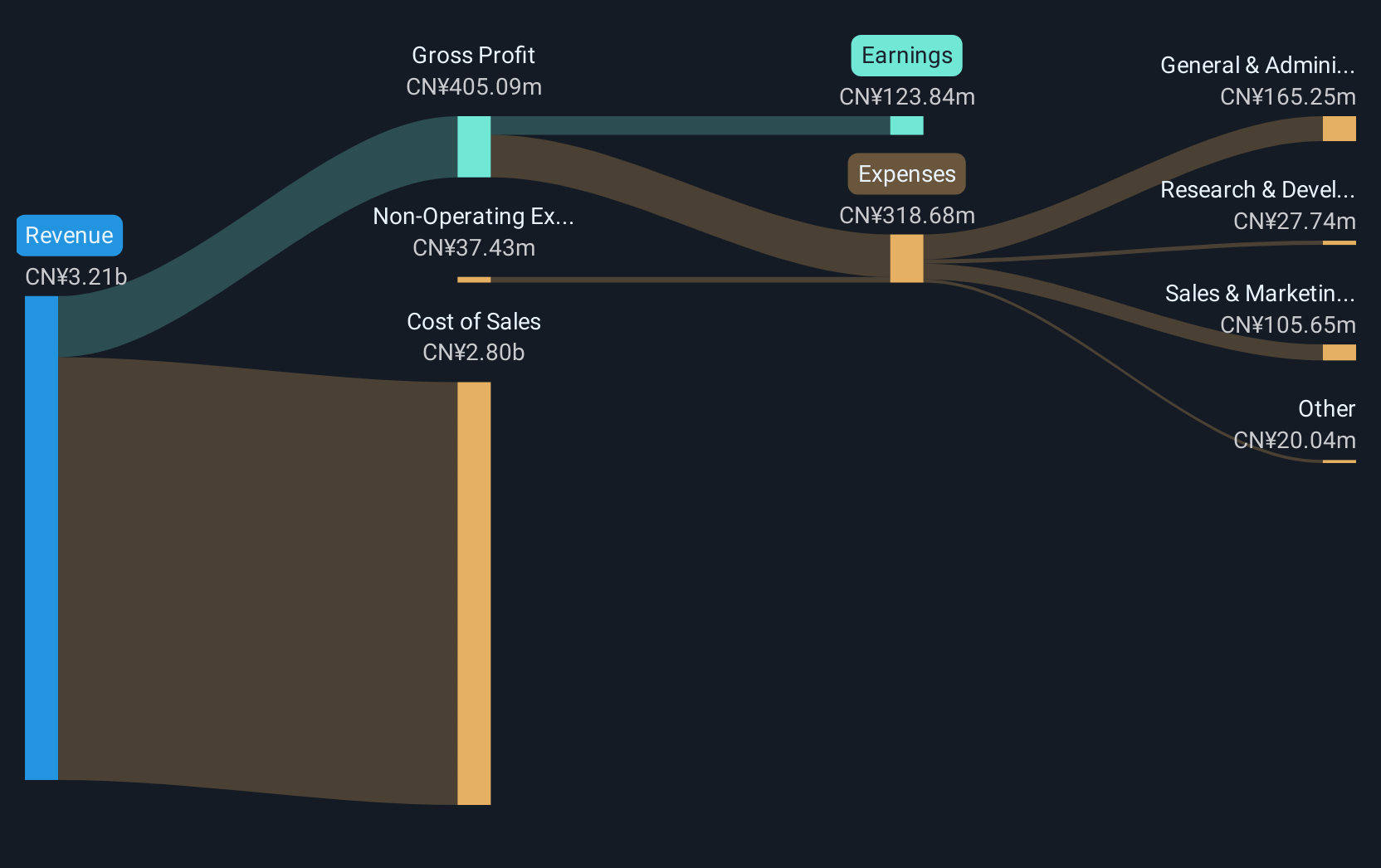

Zhewen Pictures Group Co., Ltd. has shown a stable financial performance with a market cap of CN¥4.17 billion, demonstrating earnings growth of 5.7% over the past year, surpassing the industry average. Despite a low return on equity at 7.8%, the company maintains strong financial health with more cash than debt and short-term assets exceeding liabilities by CN¥1 billion. Recent earnings reports reveal increased sales and net income compared to last year, although profit margins slightly declined from 4% to 3.9%. The stock trades significantly below its estimated fair value, suggesting potential for future appreciation despite some volatility in past earnings due to large one-off items.

- Dive into the specifics of Zhewen Pictures Groupltd here with our thorough balance sheet health report.

- Learn about Zhewen Pictures Groupltd's historical performance here.

Taking Advantage

- Dive into all 5,720 of the Penny Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:308

China Travel International Investment Hong Kong

Provides travel and tourism services.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives