3 Top Dividend Stocks With Up To 5.1% Yield For Your Investment Strategy

Reviewed by Simply Wall St

As global markets face volatility due to inflation concerns and political uncertainties, investors are increasingly seeking stable income sources amidst fluctuating indices. In this environment, dividend stocks can offer a reliable stream of income, making them an attractive option for investors looking to balance risk with potential returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.39% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.50% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.99% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

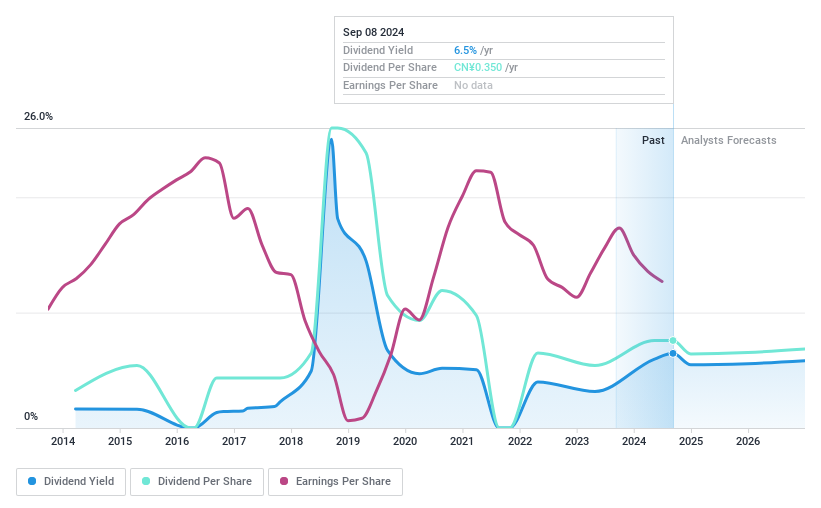

Sichuan Teway Food GroupLtd (SHSE:603317)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sichuan Teway Food Group Co., Ltd is involved in the research, development, production, and sale of compound seasonings in China with a market cap of CN¥13.44 billion.

Operations: Sichuan Teway Food Group Co., Ltd generates its revenue primarily through the sale of compound seasonings in China.

Dividend Yield: 3%

Sichuan Teway Food Group Ltd's dividend yield of 2.98% is competitive in the Chinese market, ranking in the top 25%. The company has shown significant earnings growth, with net income rising to CNY 432.43 million for the first nine months of 2024. Dividends are covered by both earnings and cash flows, with payout ratios at sustainable levels (74% and 72.7%, respectively). However, its dividend history is short and volatile over six years.

- Click here and access our complete dividend analysis report to understand the dynamics of Sichuan Teway Food GroupLtd.

- The analysis detailed in our Sichuan Teway Food GroupLtd valuation report hints at an deflated share price compared to its estimated value.

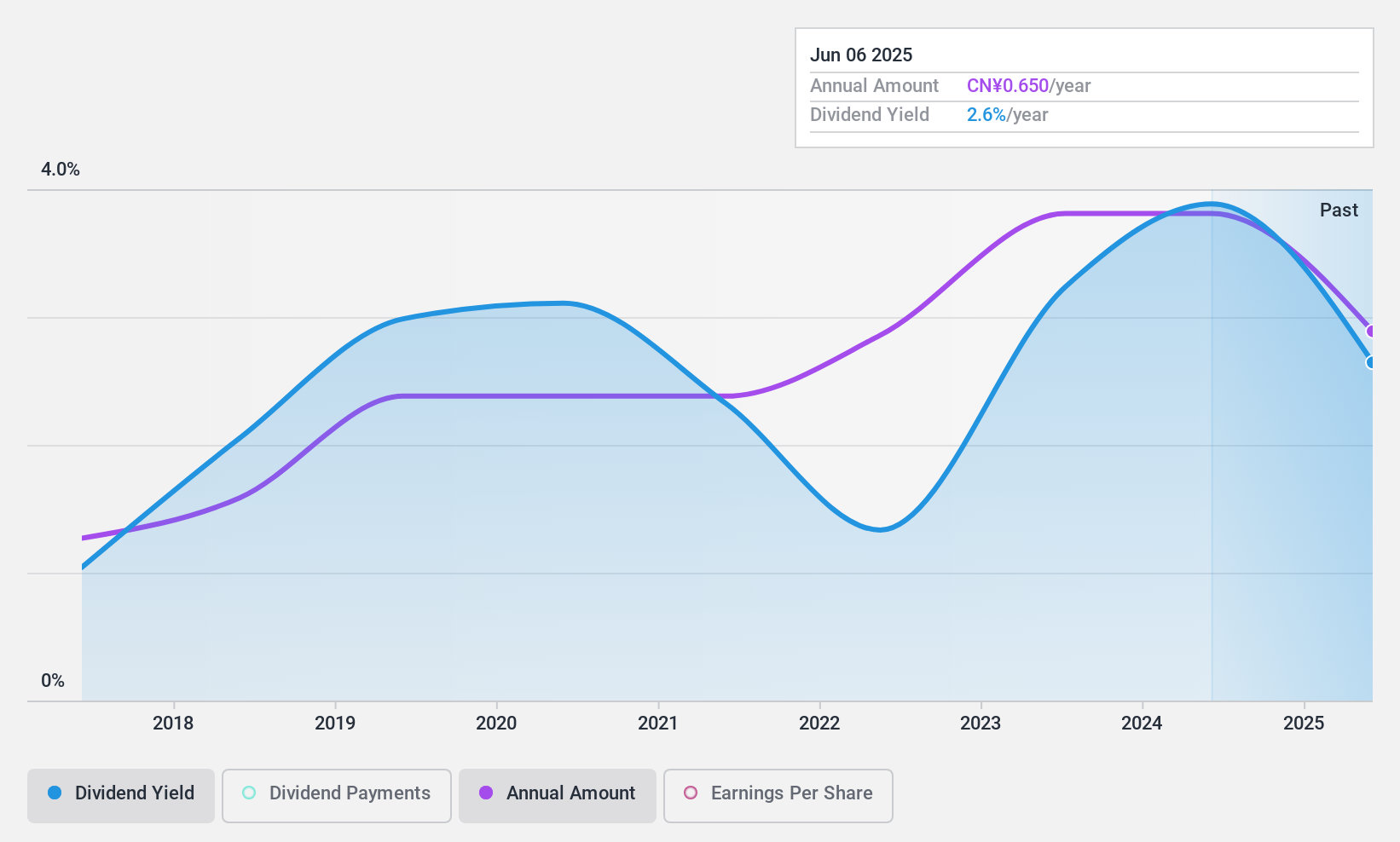

Comefly Outdoor (SHSE:603908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Comefly Outdoor Co., Ltd., operating under the brand MOBI GARDEN, specializes in the research, design, development, and sale of outdoor products in China with a market cap of CN¥1.90 billion.

Operations: The company's revenue primarily comes from its apparel segment, totaling CN¥1.38 billion.

Dividend Yield: 3.8%

Comefly Outdoor's dividend yield of 3.83% places it among the top 25% in the Chinese market. Despite a relatively short dividend history of eight years, payments have been stable and are well-covered by earnings (payout ratio: 89.7%) and cash flows (cash payout ratio: 51.3%). The company trades at a discount to its estimated fair value, but recent earnings show a decline with net income at CNY 92.43 million for the first nine months of 2024.

- Take a closer look at Comefly Outdoor's potential here in our dividend report.

- Our valuation report unveils the possibility Comefly Outdoor's shares may be trading at a discount.

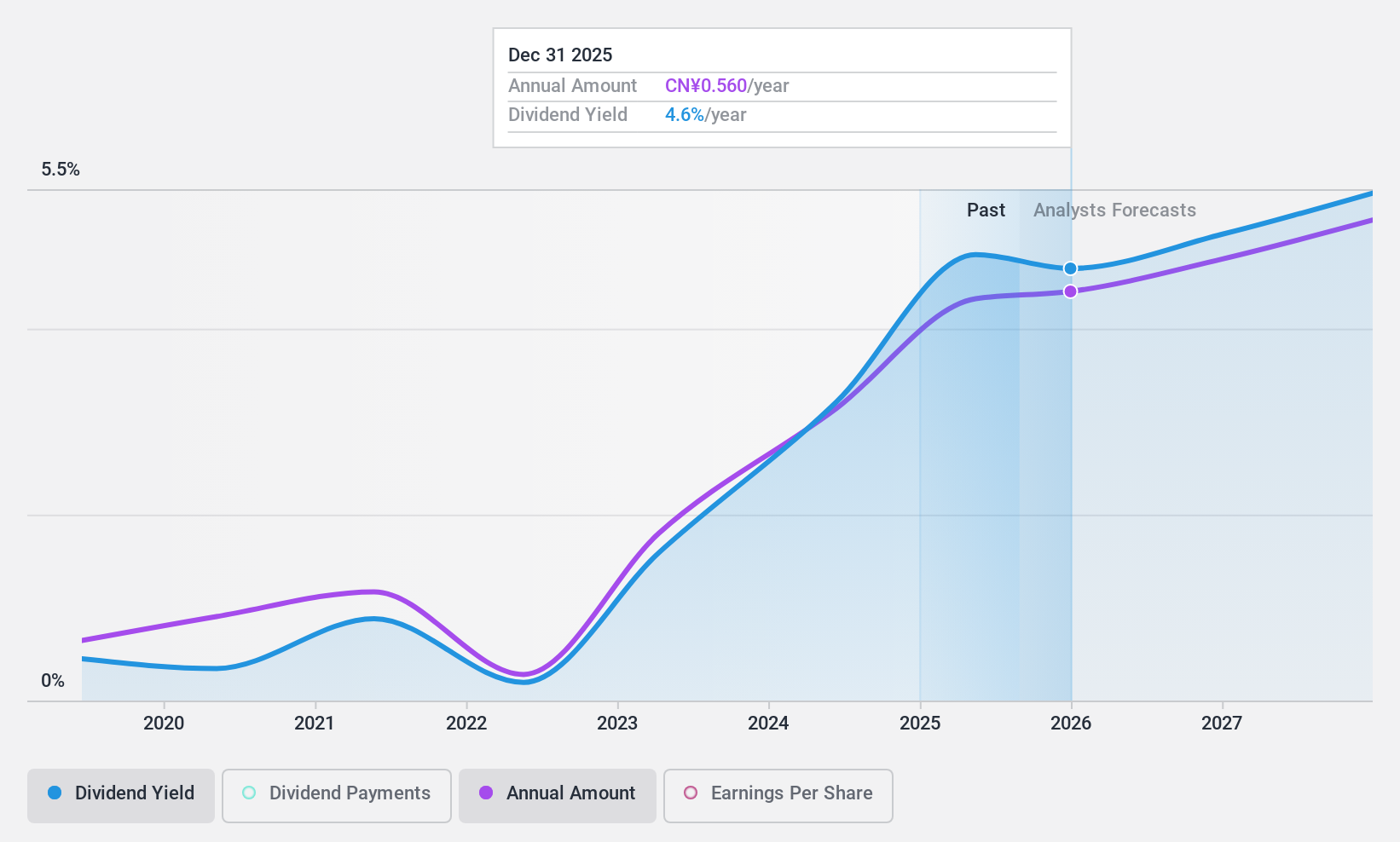

Canny Elevator (SZSE:002367)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Canny Elevator Co., Ltd. operates in China, focusing on the research, development, manufacturing, sale, installation, repair, and maintenance of elevators with a market cap of CN¥5.05 billion.

Operations: Canny Elevator Co., Ltd.'s revenue from its elevator segment amounts to CN¥4.34 billion.

Dividend Yield: 5.1%

Canny Elevator's dividend yield of 5.12% ranks it in the top 25% of Chinese dividend payers, but its sustainability is questionable with a high payout ratio of 94.3%. Although dividends have grown over the past decade, they have been volatile and not reliably covered by earnings or cash flows. Recent earnings show a decline, with net income at CNY 281.71 million for the first nine months of 2024, down from CNY 350.39 million a year ago.

- Delve into the full analysis dividend report here for a deeper understanding of Canny Elevator.

- According our valuation report, there's an indication that Canny Elevator's share price might be on the expensive side.

Seize The Opportunity

- Click this link to deep-dive into the 2007 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603908

Comefly Outdoor

Comefly Outdoor Co., Ltd., doing business as MOBI GARDEN, engages in the research, design, development, and sale of outdoor products in China.

Excellent balance sheet, good value and pays a dividend.