As global markets navigate a choppy start to 2025, with U.S. equities facing inflation fears and political uncertainties, investors are keenly assessing opportunities amid the volatility. In this environment, identifying potentially undervalued stocks can be crucial, as these assets may offer value by trading below their intrinsic worth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.45 | CN¥34.17 | 48.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.32 | TRY78.59 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.89 | 49.9% |

| Helens International Holdings (SEHK:9869) | HK$1.93 | HK$3.85 | 49.9% |

| Elekta (OM:EKTA B) | SEK61.10 | SEK122.02 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥23.34 | CN¥43.28 | 46.1% |

| Meriaura Group Oyj (OM:MERIS) | SEK0.49 | SEK0.98 | 50% |

| Constellium (NYSE:CSTM) | US$10.32 | US$20.58 | 49.9% |

| W5 Solutions (OM:W5) | SEK47.20 | SEK93.96 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

China Jushi (SHSE:600176)

Overview: China Jushi Co., Ltd. is a company that manufactures and sells fiberglass both in China and internationally, with a market cap of CN¥44.03 billion.

Operations: The company generates revenue of CN¥15.08 billion from its production and sale of glass fiber and related products.

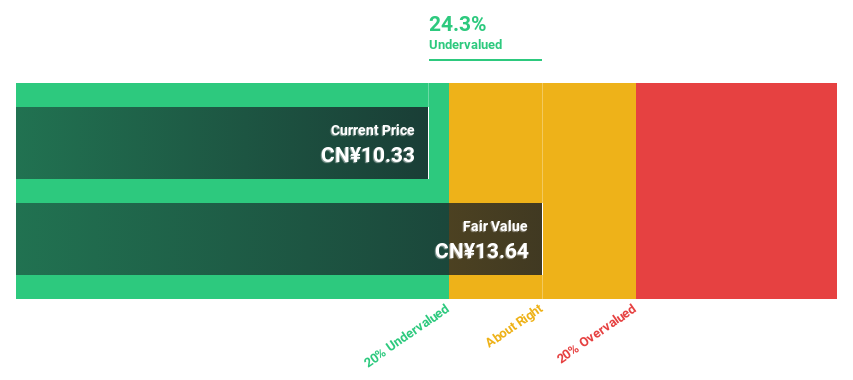

Estimated Discount To Fair Value: 18.4%

China Jushi is trading at CN¥11.58, approximately 18.4% below its estimated fair value of CN¥14.18, indicating potential undervaluation based on discounted cash flow analysis. Despite lower profit margins this year (12.6%) compared to last year (24.3%), earnings are forecast to grow significantly at 27% annually over the next three years, outpacing the Chinese market's growth rate of 24.8%. However, its dividend yield is not well covered by free cash flows, which may be a concern for income-focused investors.

- Our earnings growth report unveils the potential for significant increases in China Jushi's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of China Jushi.

Ningbo Haitian Precision MachineryLtd (SHSE:601882)

Overview: Ningbo Haitian Precision Machinery Ltd (SHSE:601882) is a company involved in the manufacturing of precision machinery, with a market cap of CN¥10.62 billion.

Operations: The company's revenue primarily comes from its General Equipment Manufacturing segment, which generated CN¥3.31 billion.

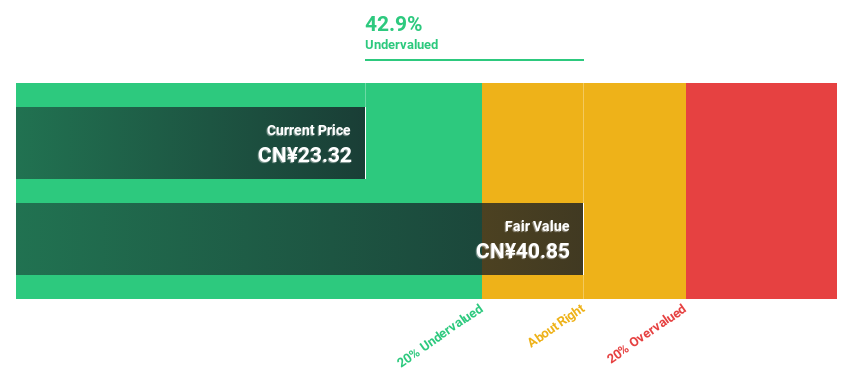

Estimated Discount To Fair Value: 46.8%

Ningbo Haitian Precision Machinery is trading at CN¥21.54, significantly below its estimated fair value of CN¥40.45, highlighting undervaluation based on discounted cash flow analysis. Despite a slight decline in sales and net income for the first nine months of 2024, the company is expected to achieve annual earnings growth of over 20% in the coming years. Analysts agree on a potential stock price increase of 35.1%, reflecting optimism about future performance despite current challenges.

- Our growth report here indicates Ningbo Haitian Precision MachineryLtd may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Ningbo Haitian Precision MachineryLtd's balance sheet health report.

Asymchem Laboratories (Tianjin) (SZSE:002821)

Overview: Asymchem Laboratories (Tianjin) Co., Ltd. operates as a contract development and manufacturing organization (CDMO) providing services to the pharmaceutical industry, with a market cap of CN¥24.12 billion.

Operations: The company's revenue from pharmaceutical technology services amounts to CN¥5.57 billion.

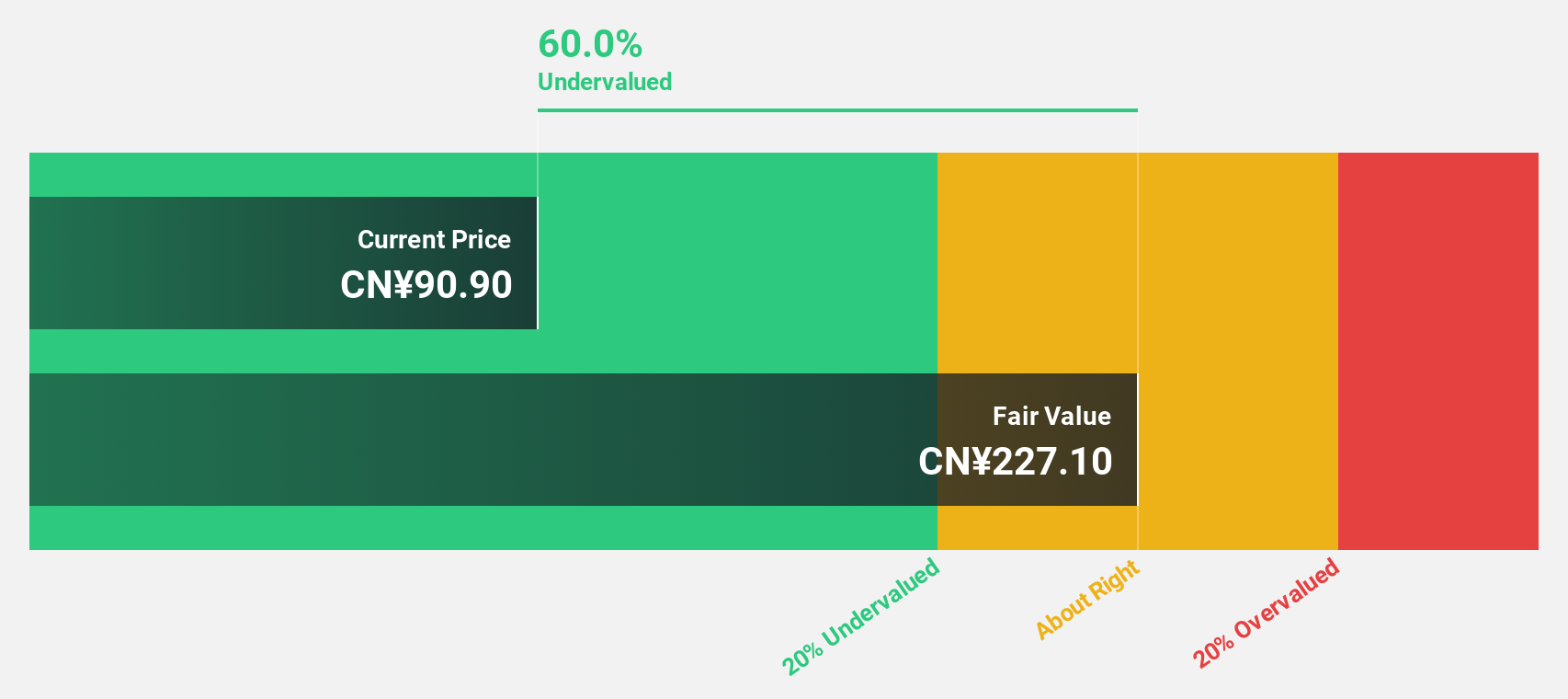

Estimated Discount To Fair Value: 16.3%

Asymchem Laboratories (Tianjin) is trading at CN¥73.99, 16.3% below its fair value estimate of CN¥88.45, suggesting potential undervaluation based on cash flows. Despite a significant drop in sales and net income for the nine months ending September 2024, the company is forecasted to achieve annual earnings growth of 29.7%, outpacing the Chinese market average. However, profit margins have decreased from last year, and its dividend yield of 2.43% lacks coverage by free cash flows.

- In light of our recent growth report, it seems possible that Asymchem Laboratories (Tianjin)'s financial performance will exceed current levels.

- Get an in-depth perspective on Asymchem Laboratories (Tianjin)'s balance sheet by reading our health report here.

Where To Now?

- Click here to access our complete index of 870 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002821

Asymchem Laboratories (Tianjin)

Asymchem Laboratories (Tianjin) Co., Ltd.

Flawless balance sheet with reasonable growth potential.