- China

- /

- Commercial Services

- /

- SZSE:301297

Beijing Jetsen Technology And 3 Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by inflation concerns and political shifts, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index recently dipping into correction territory. Amid this backdrop, discovering lesser-known stocks that offer potential for growth can be an attractive strategy for investors seeking to enhance their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 10.58% | 0.55% | 4.78% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| TOMONY Holdings | 68.34% | 6.88% | 13.82% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Techno Ryowa | 0.19% | 3.96% | 11.17% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Beijing Jetsen Technology (SZSE:300182)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Jetsen Technology Co., Ltd operates in the film and television industry in China with a market capitalization of CN¥14.05 billion.

Operations: Jetsen Technology's revenue primarily stems from its film and television operations in China. The company has a market capitalization of CN¥14.05 billion.

Jetsen Tech, a small player in the tech space, shows a mixed financial picture. With net debt to equity at a satisfactory 7.3%, it has managed to reduce this ratio from 26.6% over five years, indicating prudent financial management. Despite high-quality earnings and free cash flow positivity, its recent earnings growth of -18.2% trails behind the industry average of -16.1%. The price-to-earnings ratio of 41x remains attractive compared to the industry’s 49x, suggesting potential value for investors seeking opportunities in volatile markets like Jetsen's recent share price fluctuations indicate. Recent M&A activity and shareholder meetings hint at strategic shifts ahead.

- Navigate through the intricacies of Beijing Jetsen Technology with our comprehensive health report here.

Learn about Beijing Jetsen Technology's historical performance.

Guangdong Insight Brand Marketing GroupLtd (SZSE:300781)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Insight Brand Marketing Group Co., Ltd. operates in the marketing sector, focusing on brand marketing services, with a market capitalization of CN¥5.96 billion.

Operations: The company's primary revenue stream is direct marketing, generating CN¥849.93 million.

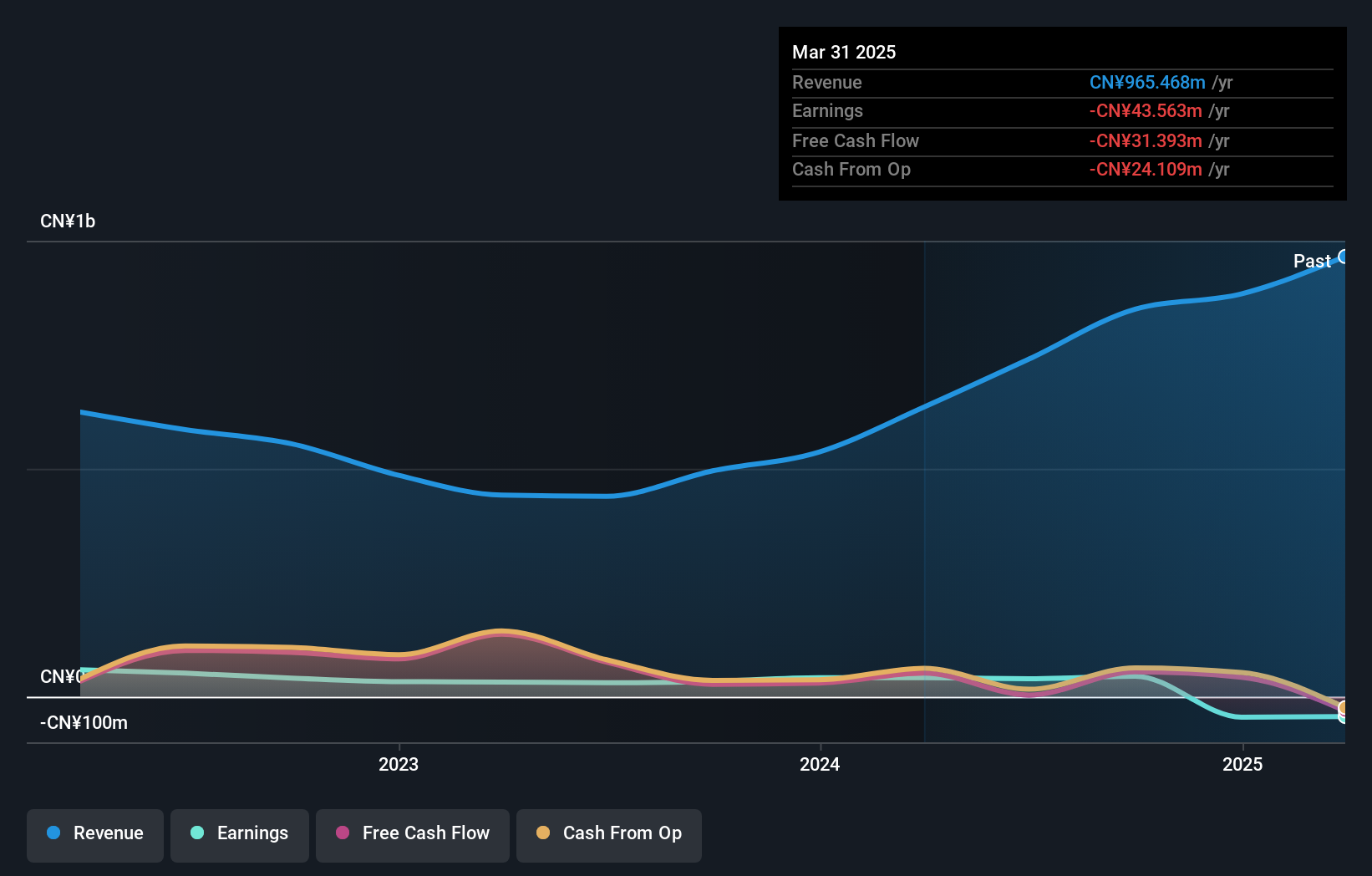

Guangdong Insight Brand Marketing Group, a relatively small player in its field, has shown impressive growth with earnings increasing by 34.3% over the past year, outpacing the Media industry which saw a decline of 10.2%. The company's net income for the nine months ending September 2024 was CNY 36.27 million, up from CNY 32.82 million in the previous year, indicating solid operational performance. Despite a debt to equity ratio rising to 4.7% over five years, it holds more cash than total debt and enjoys high-quality earnings, suggesting robust financial health even as it navigates share price volatility and strategic private placements approved by its board and regulatory bodies.

Ferrotec (An Hui) Technology DevelopmentLTD (SZSE:301297)

Simply Wall St Value Rating: ★★★★★★

Overview: Ferrotec (An Hui) Technology Development Co., LTD specializes in providing semiconductor equipment precision cleaning services and has a market cap of CN¥13.41 billion.

Operations: The company generates revenue primarily through semiconductor equipment precision cleaning services. It has a market cap of CN¥13.41 billion, indicating its significant presence in the industry.

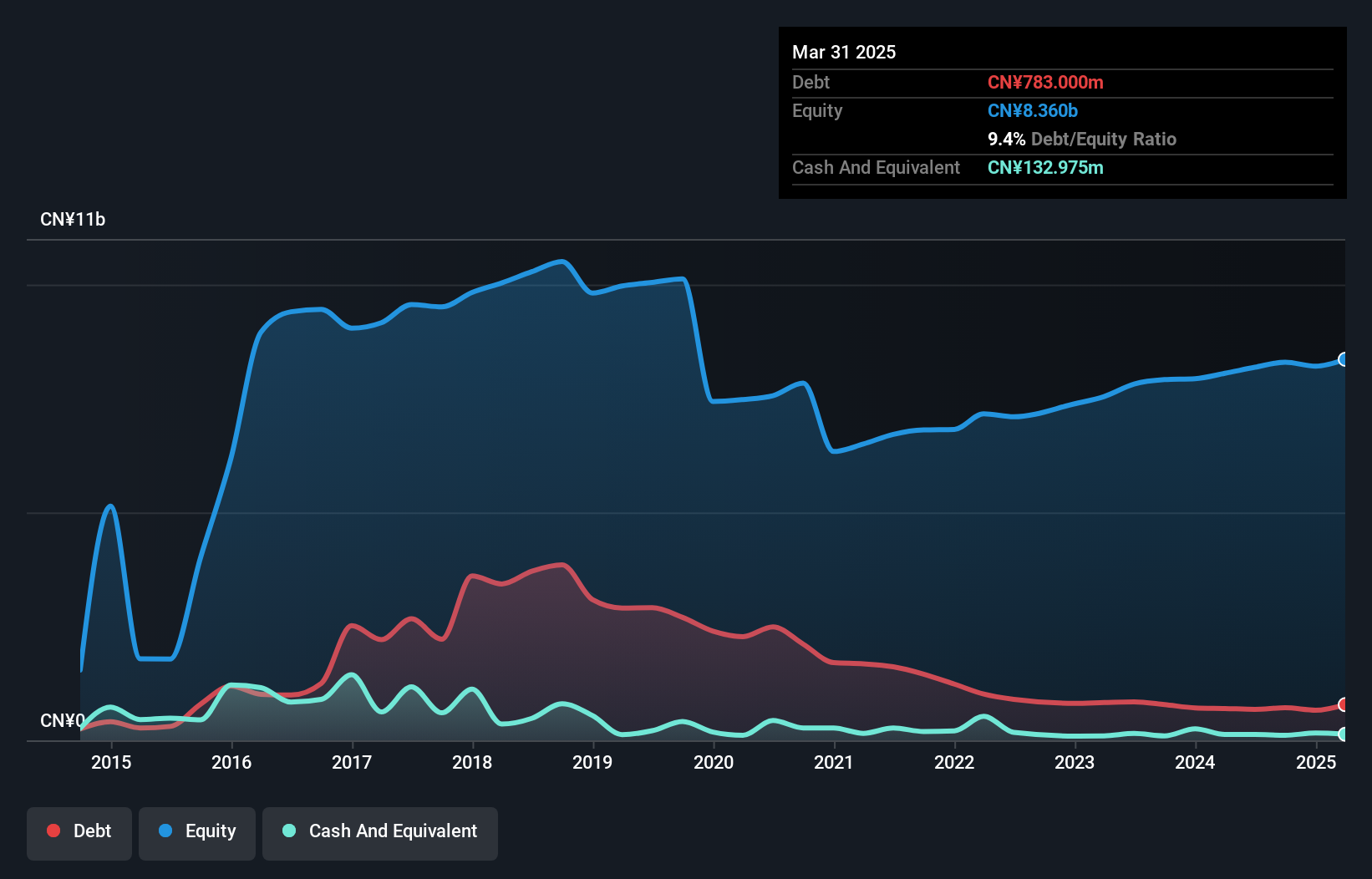

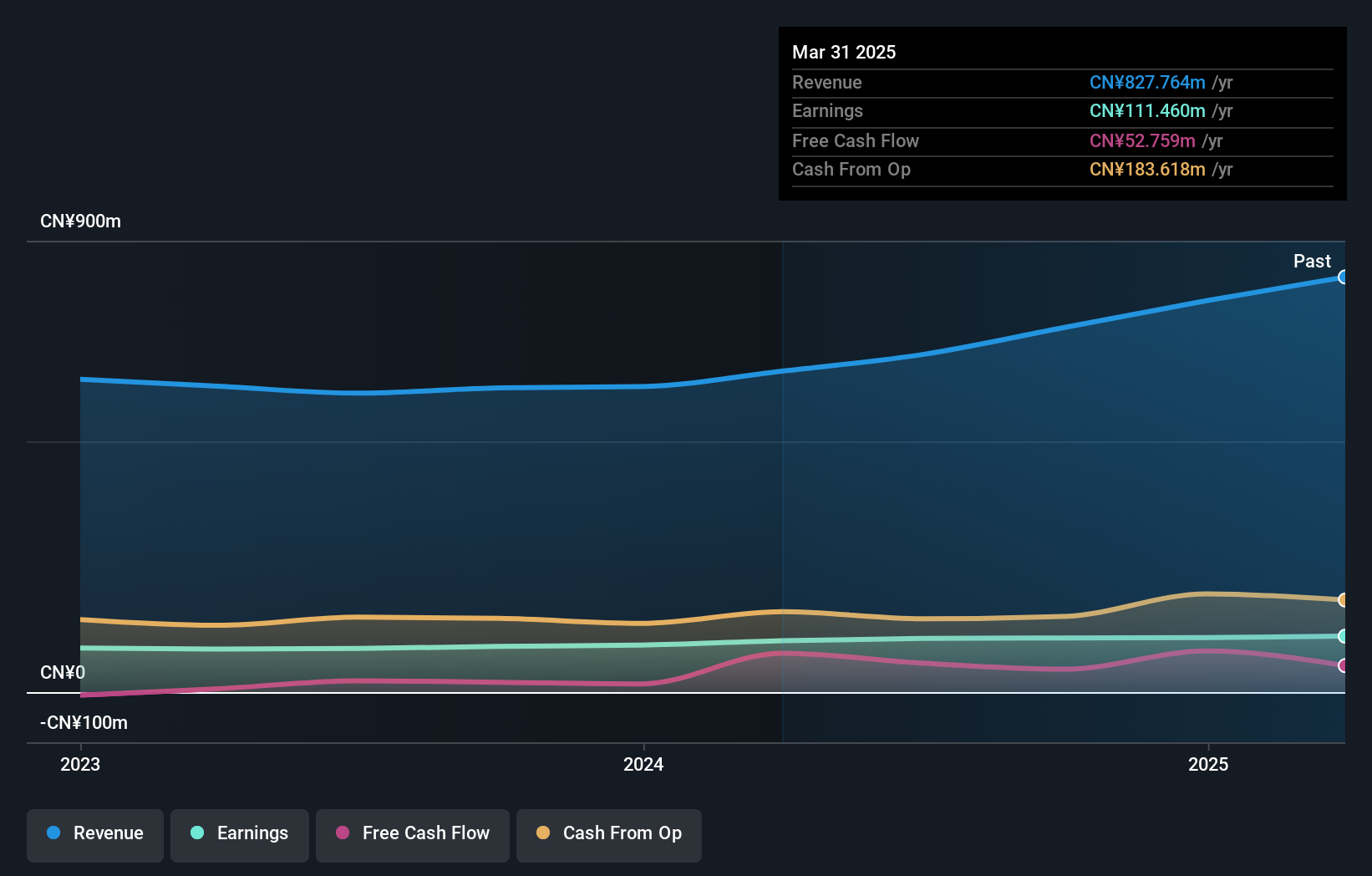

Ferrotec (An Hui) Technology Development Co., Ltd. has shown notable financial resilience with a debt to equity ratio dropping from 24.8% to 2.3% over five years, indicating improved financial stability. The company’s earnings growth of 11.1% in the past year outpaced the Commercial Services industry, which saw a -2.7% change, highlighting its competitive edge amidst industry challenges. Despite large one-off gains of CN¥25M impacting recent results, Ferrotec reported increased sales of CN¥560M and net income of CN¥79M for nine months ending September 2024 compared to the previous year, reflecting robust operational performance despite market volatility concerns.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4512 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301297

Ferrotec (An Hui) Technology DevelopmentLTD

Provides semiconductor equipment precision cleaning services.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives