- China

- /

- Semiconductors

- /

- SHSE:688596

3 Growth Companies To Consider With Up To 28% Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year, with U.S. equities facing pressure from inflation concerns and political uncertainties, investors are increasingly looking for resilient opportunities amidst this volatility. In such an environment, growth companies with significant insider ownership can offer a compelling proposition, as high insider stakes often align management's interests with those of shareholders, potentially fostering long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 35.8% |

| Medley (TSE:4480) | 34% | 27.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai GenTech (SHSE:688596)

Simply Wall St Growth Rating: ★★★★★☆

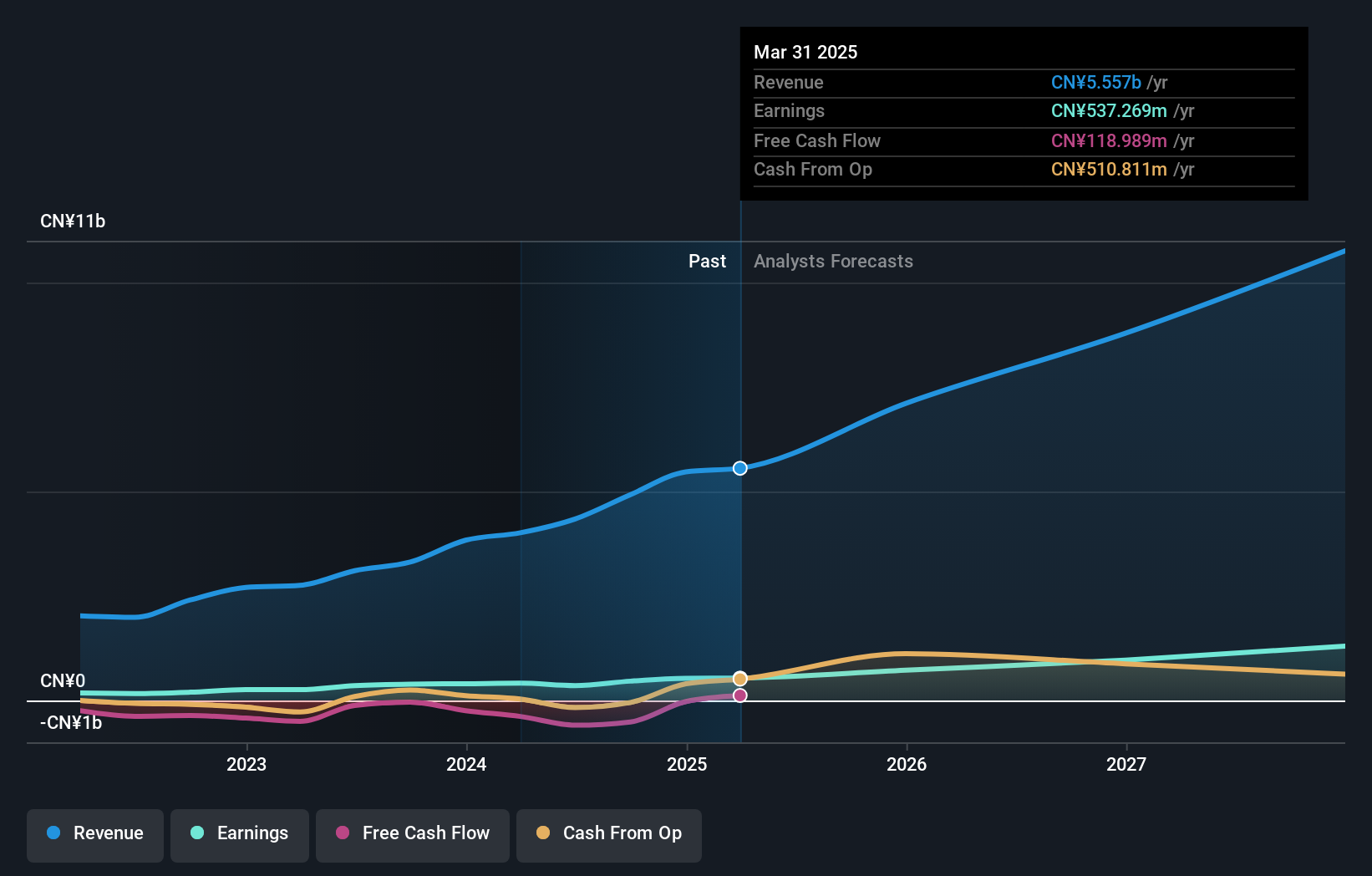

Overview: Shanghai GenTech Co., Ltd. offers process critical system solutions to hi-tech and advanced manufacturing industries in China, with a market cap of CN¥9.65 billion.

Operations: Shanghai GenTech Co., Ltd. generates its revenue by providing essential system solutions to customers within China's hi-tech and advanced manufacturing sectors.

Insider Ownership: 13.5%

Shanghai GenTech has demonstrated solid growth, with earnings increasing by 17.9% over the past year and revenue reaching CNY 3.50 billion for the first nine months of 2024. The company is trading at a favorable price-to-earnings ratio of 22.9x, below the Chinese market average, indicating good relative value compared to peers. However, despite high expected annual profit growth of 32%, its dividend yield remains low and not well covered by free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Shanghai GenTech.

- In light of our recent valuation report, it seems possible that Shanghai GenTech is trading behind its estimated value.

Ingenic SemiconductorLtd (SZSE:300223)

Simply Wall St Growth Rating: ★★★★★☆

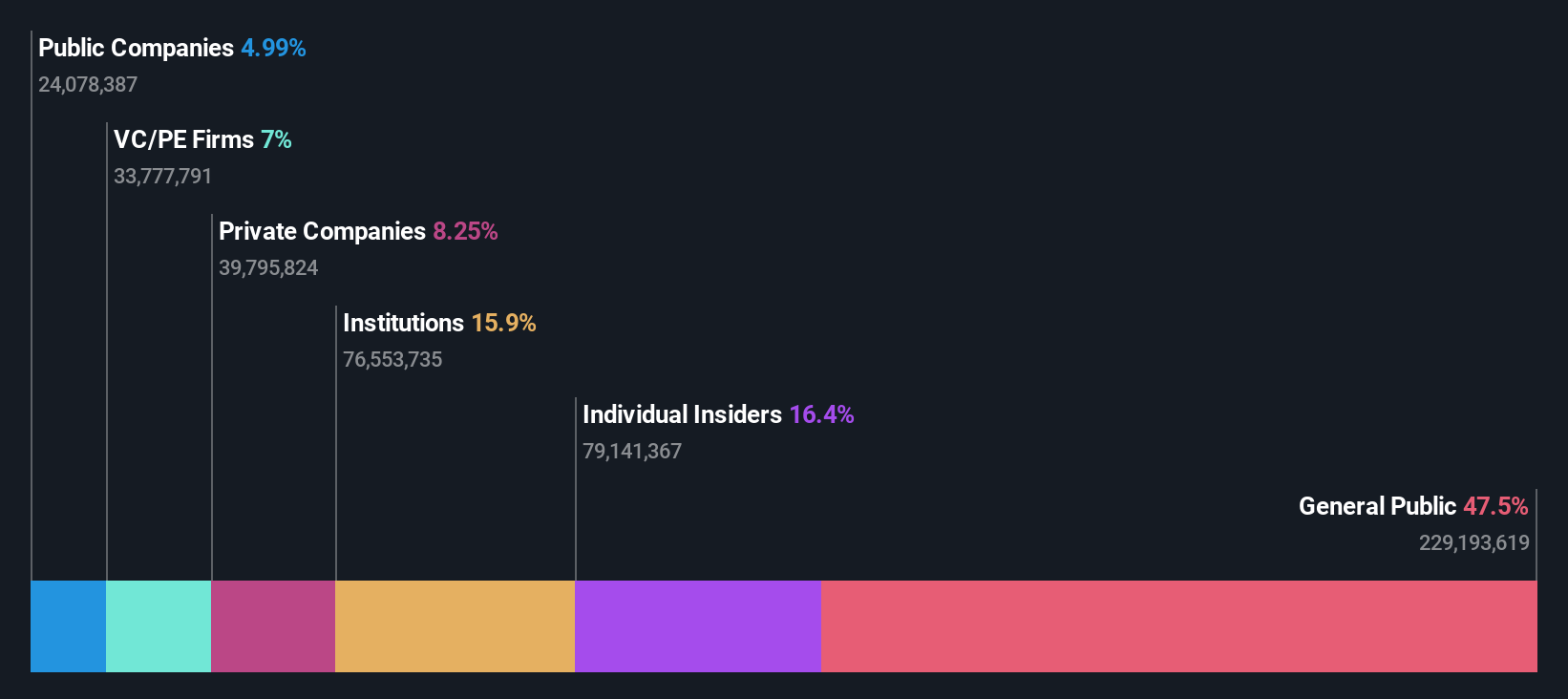

Overview: Ingenic Semiconductor Co., Ltd. focuses on the research, development, design, and sale of integrated circuit chip products both in China and internationally, with a market cap of CN¥29.56 billion.

Operations: The company's revenue is derived from its activities in the research, development, design, and sale of integrated circuit chip products across domestic and international markets.

Insider Ownership: 16.7%

Ingenic Semiconductor Ltd. exhibits strong growth potential, with forecasted annual earnings and revenue growth rates of 38.4% and 25.1%, respectively, outpacing the Chinese market averages. Despite a recent decline in earnings to CNY 304.42 million for the first nine months of 2024, its innovative collaboration with InnoPhase IoT on AI-enabled battery camera technology positions it well for future expansion in smart home and industrial IoT markets, enhancing its competitive edge amidst evolving industry demands.

- Unlock comprehensive insights into our analysis of Ingenic SemiconductorLtd stock in this growth report.

- The valuation report we've compiled suggests that Ingenic SemiconductorLtd's current price could be inflated.

Leyard Optoelectronic (SZSE:300296)

Simply Wall St Growth Rating: ★★★★☆☆

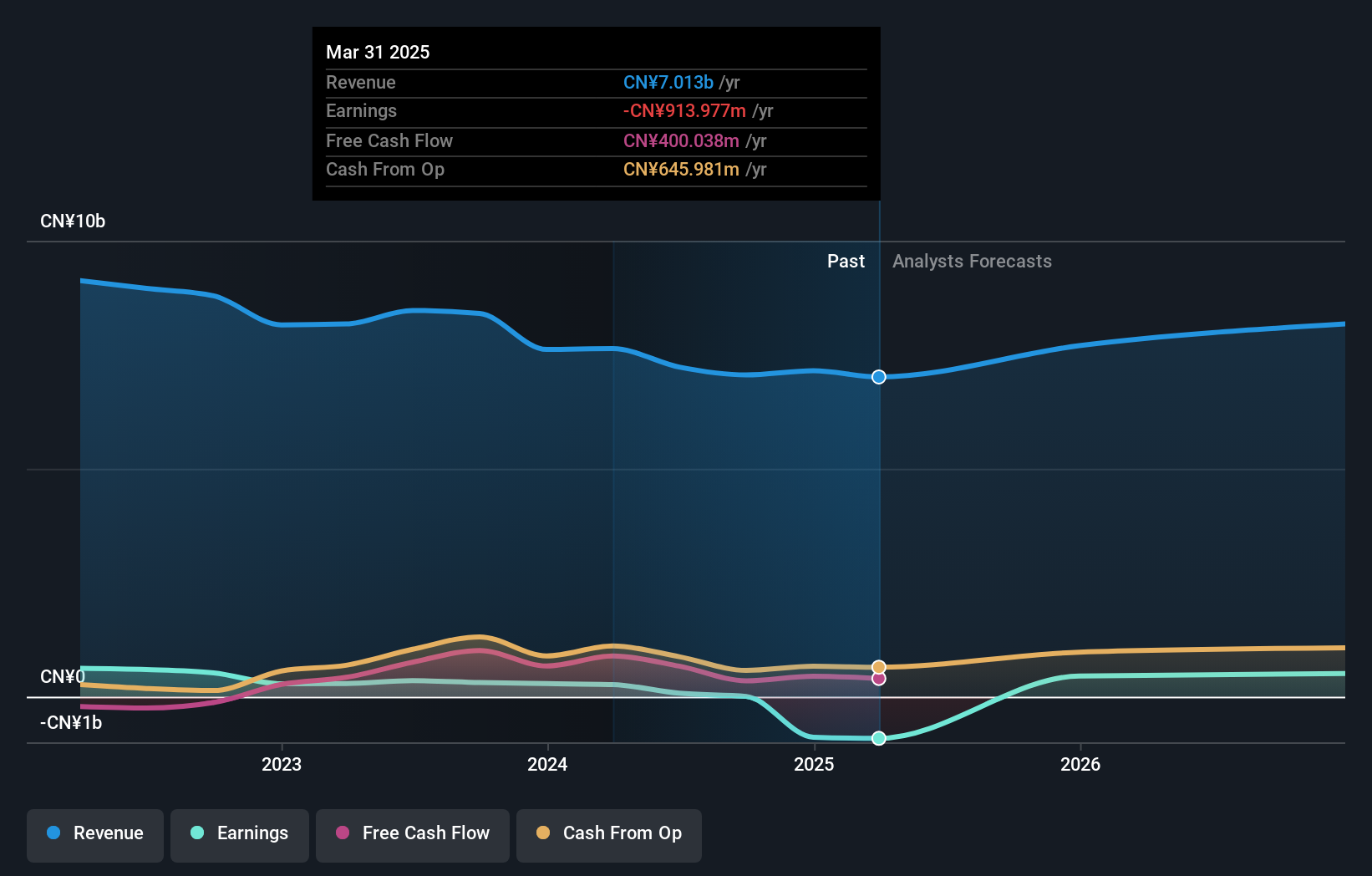

Overview: Leyard Optoelectronic Co., Ltd. is an audio-visual technology company operating in China and internationally, with a market cap of CN¥14.61 billion.

Operations: Leyard Optoelectronic Co., Ltd. generates its revenue through various segments in the audio-visual technology sector, serving both domestic and international markets.

Insider Ownership: 28.6%

Leyard Optoelectronic is positioned for significant earnings growth, forecasted at 71% annually, surpassing the Chinese market's average. However, its revenue growth of 17.2% lags behind expectations for high-growth companies. The company faces challenges with a volatile share price and declining profit margins from 3.7% to 0.09%. Despite no recent insider trading activity, it trades at good value compared to peers and completed a modest buyback worth CNY 22.4 million in late 2024.

- Get an in-depth perspective on Leyard Optoelectronic's performance by reading our analyst estimates report here.

- The analysis detailed in our Leyard Optoelectronic valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Access the full spectrum of 1438 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688596

Shanghai GenTech

Provides process critical system solutions to customers in hi-tech and advanced manufacturing industries in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives