- China

- /

- Aerospace & Defense

- /

- SHSE:688070

The Price Is Right For Chengdu JOUAV Automation Tech Co.,Ltd. (SHSE:688070) Even After Diving 30%

Chengdu JOUAV Automation Tech Co.,Ltd. (SHSE:688070) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 15% in that time.

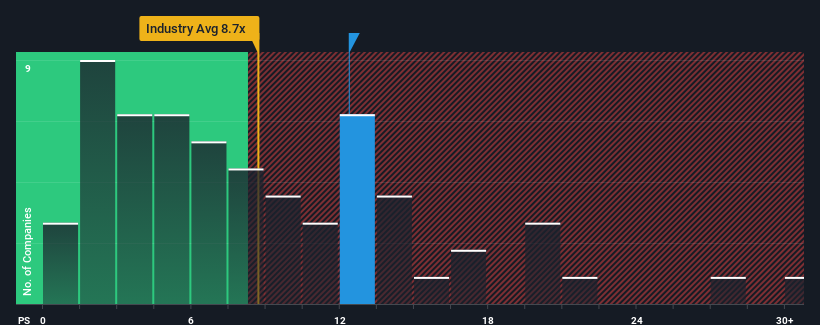

In spite of the heavy fall in price, Chengdu JOUAV Automation TechLtd's price-to-sales (or "P/S") ratio of 12.4x might still make it look like a sell right now compared to the wider Aerospace & Defense industry in China, where around half of the companies have P/S ratios below 8.7x and even P/S below 4x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Chengdu JOUAV Automation TechLtd

What Does Chengdu JOUAV Automation TechLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Chengdu JOUAV Automation TechLtd's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chengdu JOUAV Automation TechLtd.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Chengdu JOUAV Automation TechLtd's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. The last three years don't look nice either as the company has shrunk revenue by 11% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 172% over the next year. That's shaping up to be materially higher than the 33% growth forecast for the broader industry.

With this information, we can see why Chengdu JOUAV Automation TechLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

There's still some elevation in Chengdu JOUAV Automation TechLtd's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Chengdu JOUAV Automation TechLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Chengdu JOUAV Automation TechLtd that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Chengdu JOUAV Automation TechLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688070

Chengdu JOUAV Automation TechLtd

Develops, manufactures, sells, and services industrial drone-related products in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives