- Taiwan

- /

- Semiconductors

- /

- TPEX:3227

Uncovering Undiscovered Gems With Potential For November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating indices and mixed economic signals, small-cap stocks have shown resilience amid broader market volatility. With the S&P MidCap 400 reaching record highs before a recent pullback, investors are increasingly looking toward undiscovered gems that can offer potential amidst cautious earnings reports and economic uncertainties. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those seeking opportunities in less explored areas of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Jiangsu Jiangyin Rural Commercial BankLTD (SZSE:002807)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Jiangyin Rural Commercial Bank Co., LTD is a financial institution that provides banking services primarily in rural areas, with a market capitalization of CN¥10.07 billion.

Operations: The bank generates revenue primarily through interest income from loans and advances, alongside fees and commissions from its banking services. It incurs costs related to interest expenses on deposits and borrowings. The net profit margin has shown fluctuations, reflecting the bank's ability to manage its operational efficiencies.

Jiangsu Jiangyin Rural Commercial Bank, with assets totaling CN¥186.6 billion and equity of CN¥17.9 billion, stands out in its niche. Its earnings grew by 11.7% over the past year, surpassing the industry average of 2.7%. Total deposits are a robust CN¥146.8 billion against loans of CN¥117.1 billion, reflecting solid financial health with a net interest margin of 2.1%. The bank maintains an appropriate bad loan allowance at just 0.9% of total loans and benefits from primarily low-risk funding sources like customer deposits—87% to be exact—enhancing its stability in uncertain markets.

Jiangsu Zhangjiagang Rural Commercial Bank (SZSE:002839)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhangjiagang Rural Commercial Bank Co., Ltd offers a range of banking products and services in China, with a market capitalization of CN¥9.37 billion.

Operations: The bank generates revenue through various banking products and services in China. It has a market capitalization of CN¥9.37 billion.

Jiangsu Zhangjiagang Rural Bank, a smaller player in the banking sector, shows promising signs of growth and stability. With total assets of CN¥215.9 billion and equity at CN¥18.3 billion, it boasts a solid financial foundation. The bank's net income for the first nine months of 2024 reached CN¥1.49 billion, up from CN¥1.40 billion last year, showcasing consistent earnings growth at 3.7%. It maintains an allowance for bad loans at 0.9% of total loans and enjoys low-risk funding with 86% liabilities from customer deposits, highlighting its prudent risk management approach in a competitive industry landscape.

PixArt Imaging (TPEX:3227)

Simply Wall St Value Rating: ★★★★★★

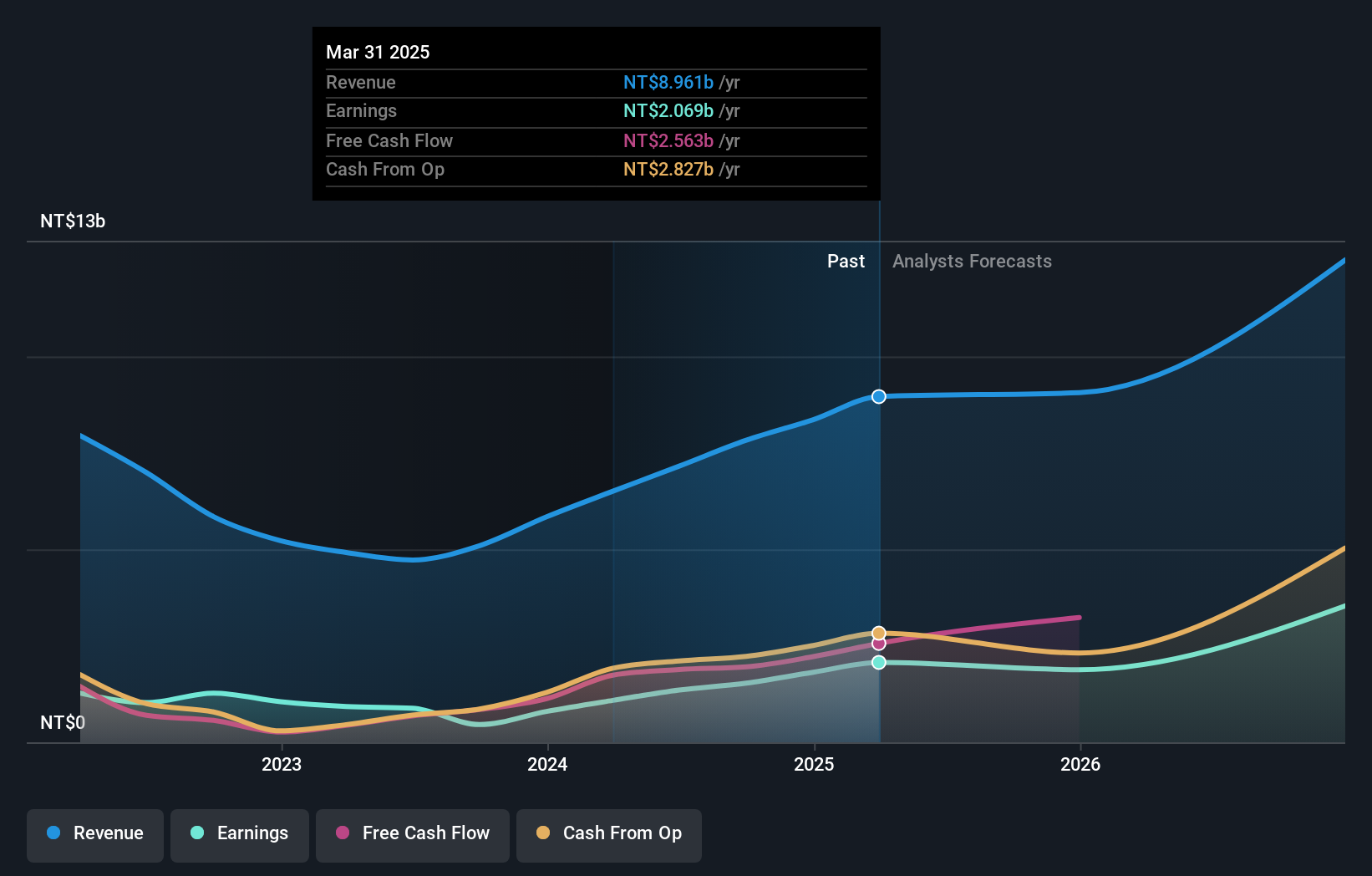

Overview: PixArt Imaging Inc. operates in the research, design, production, and sale of CMOS image sensors and related ICs across Taiwan, Hong Kong, China, Japan, and internationally with a market cap of NT$36.34 billion.

Operations: PixArt Imaging generates revenue primarily from the design and production of CMOS image sensors and related ICs, amounting to NT$7.16 billion. The company has a market cap of NT$36.34 billion.

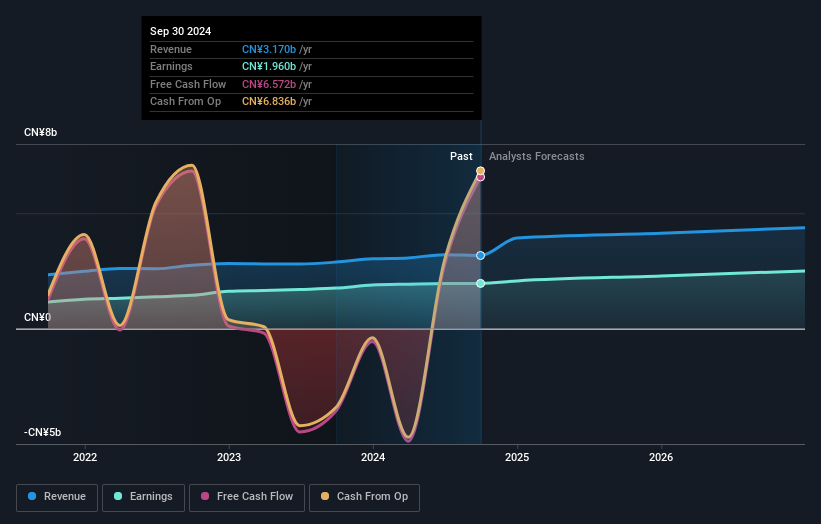

PixArt Imaging has been making waves in the semiconductor space, with earnings growth of 53.2% over the past year, significantly outpacing the industry average of 2.1%. The company is trading at a substantial discount, around 50.2% below its estimated fair value, which might catch investors' eyes. Despite a volatile share price recently, PixArt remains debt-free and boasts high-quality earnings. Recent financials reveal impressive performance; for Q2 2024, sales reached TWD 2 billion compared to TWD 1.39 billion last year and net income surged to TWD 487 million from TWD 218 million previously.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4700 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3227

PixArt Imaging

Researches, designs, produces, and sells CMOS image sensors and related ICs in Taiwan, Hong Kong, China, Japan, and internationally.

Flawless balance sheet, undervalued and pays a dividend.