Jinli Group Holdings (TWSE:8429 shareholders incur further losses as stock declines 10% this week, taking three-year losses to 14%

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Jinli Group Holdings Limited (TWSE:8429) shareholders have had that experience, with the share price dropping 14% in three years, versus a market return of about 37%. It's down 24% in about a month.

If the past week is anything to go by, investor sentiment for Jinli Group Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Jinli Group Holdings

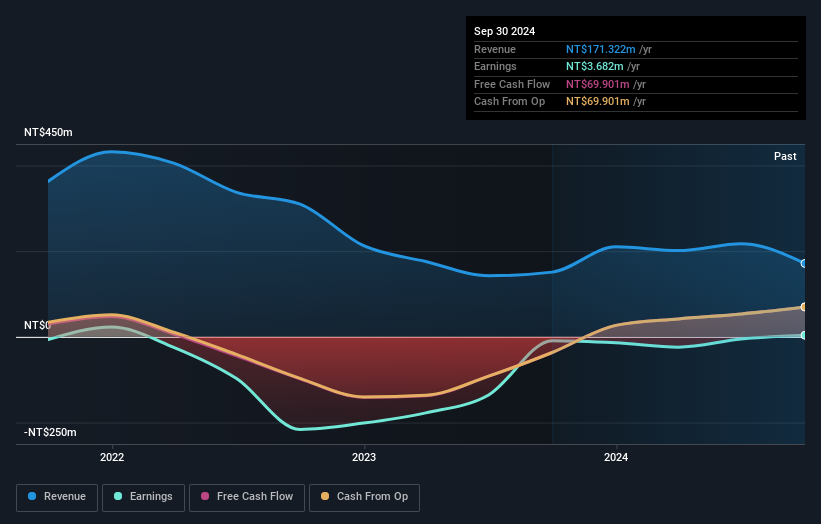

We don't think that Jinli Group Holdings' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years Jinli Group Holdings saw its revenue shrink by 33% per year. That's definitely a weaker result than most pre-profit companies report. With revenue in decline, the share price decline of 5% per year is hardly undeserved. It would probably be worth asking whether the company can fund itself to profitability. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Jinli Group Holdings shareholders are down 1.8% for the year, but the market itself is up 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Jinli Group Holdings .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8429

Jinli Group Holdings

An investment holding company, manufactures, processes, and sells clothing and footwear in China.

Adequate balance sheet with acceptable track record.