- Israel

- /

- Diversified Financial

- /

- TASE:SHVA

Unearthing Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with major indexes like the S&P 500 and Nasdaq Composite hitting record highs, small-cap stocks represented by the Russell 2000 have faced recent declines, highlighting the ongoing divergence in market performance. Amidst this backdrop of economic indicators such as job growth rebounding and interest rate discussions taking center stage, investors are increasingly seeking opportunities in lesser-known stocks that may offer untapped potential. Identifying these undiscovered gems often involves looking for companies with strong fundamentals and innovative strategies that can thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Compañía General de Electricidad | 1.98% | 9.75% | -4.52% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jiangsu Zijin Rural Commercial BankLtd (SHSE:601860)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zijin Rural Commercial Bank Co., Ltd offers a range of banking products and services to both personal and business customers, with a market capitalization of CN¥10.84 billion.

Operations: The bank's revenue streams are derived from its comprehensive suite of banking products and services targeting both personal and business clients. With a market capitalization of CN¥10.84 billion, the financial performance is influenced by various cost structures inherent in its operations.

Jiangsu Zijin Rural Commercial Bank, with total assets of CN¥271 billion and equity of CN¥19.6 billion, seems to be an intriguing player in the financial sector. It has a sufficient allowance for bad loans at 217% and maintains an appropriate level of non-performing loans at 1.3%. Despite negative earnings growth of -3.2% last year, it trades at a significant discount to its estimated fair value by 47.7%. The bank's reliance on low-risk funding sources, primarily customer deposits making up 87% of liabilities, adds stability amidst industry challenges.

Luyang Energy-Saving Materials (SZSE:002088)

Simply Wall St Value Rating: ★★★★★★

Overview: Luyang Energy-Saving Materials Co., Ltd. specializes in the research, development, production, and sale of energy-saving products such as ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick for both domestic and international markets with a market cap of CN¥6.49 billion.

Operations: Luyang Energy-Saving Materials generates revenue primarily from the sale of energy-saving products, including ceramic fiber and insulating firebrick. The company's gross profit margin has shown variability, reflecting changes in production costs and pricing strategies over different periods.

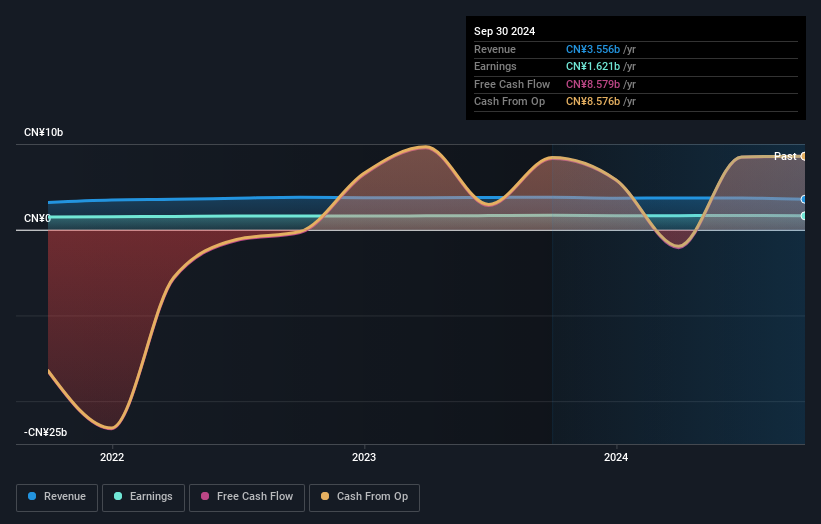

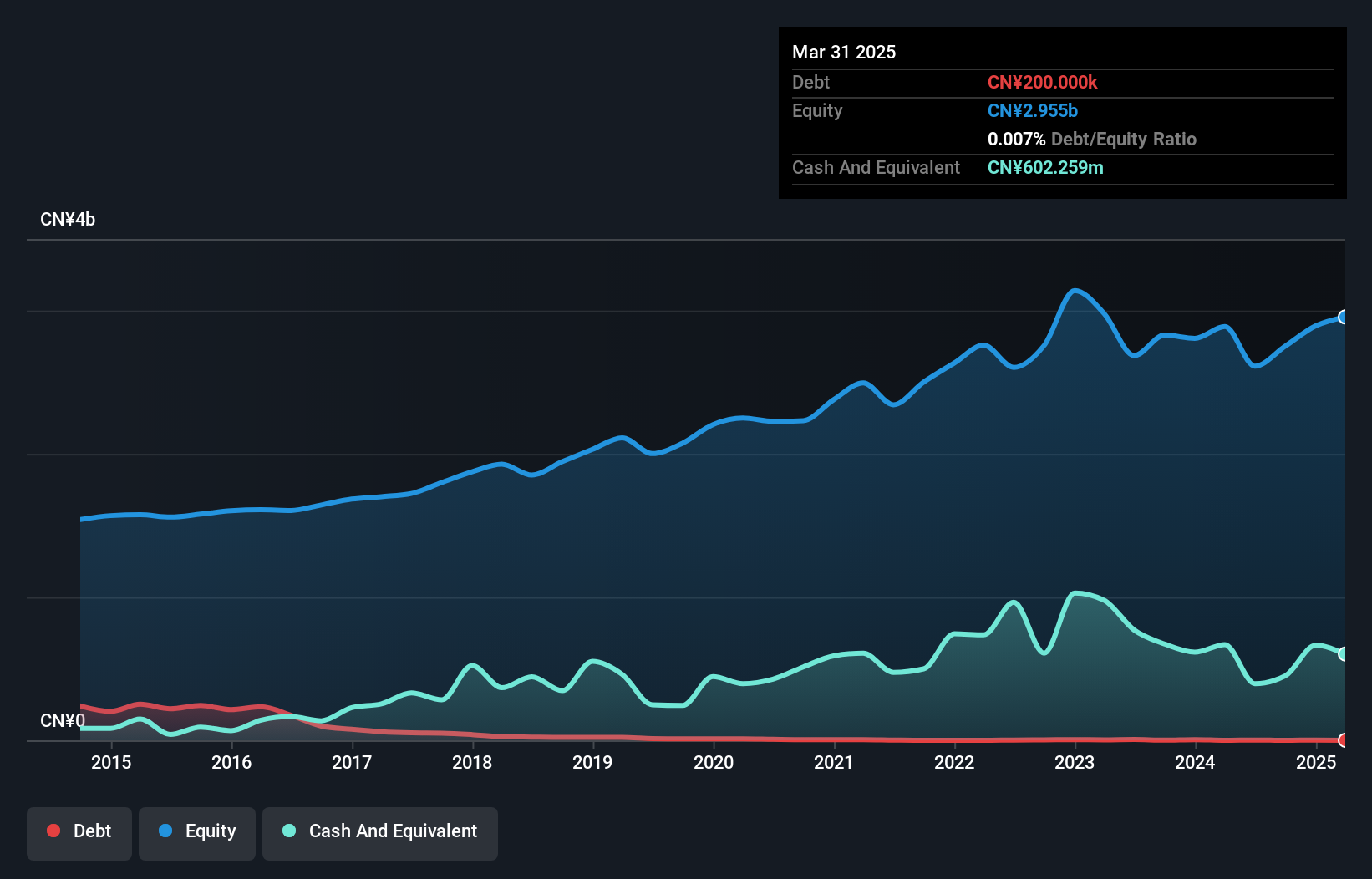

Luyang Energy-Saving Materials, a smaller player in the energy-saving sector, exhibits intriguing financial characteristics. Its price-to-earnings ratio of 13.8x suggests it's trading at a favorable value compared to the CN market average of 37x. Despite facing negative earnings growth of -2.5% over the past year, which is still better than the industry average of -5%, it boasts high-quality past earnings and forecasts an annual earnings growth rate of 17%. The company is debt-free now, contrasting with a debt-to-equity ratio of 0.5 five years ago, and has consistently positive free cash flow. Recent results show sales at CNY 2.54 billion for nine months ending September 2024, slightly down from CNY 2.56 billion last year while net income was CNY 341 million compared to CNY 364 million previously; basic EPS stood at CNY 0.67 against last year's CNY 0.72 reflecting modest performance amidst challenging conditions but potential for future improvement remains strong given its strategic positioning and financial health.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market cap of ₪1.01 billion.

Operations: The company generates revenue primarily from operating payment systems for international debit cards in Israel. It has a market cap of ₪1.01 billion, reflecting its financial standing in the industry.

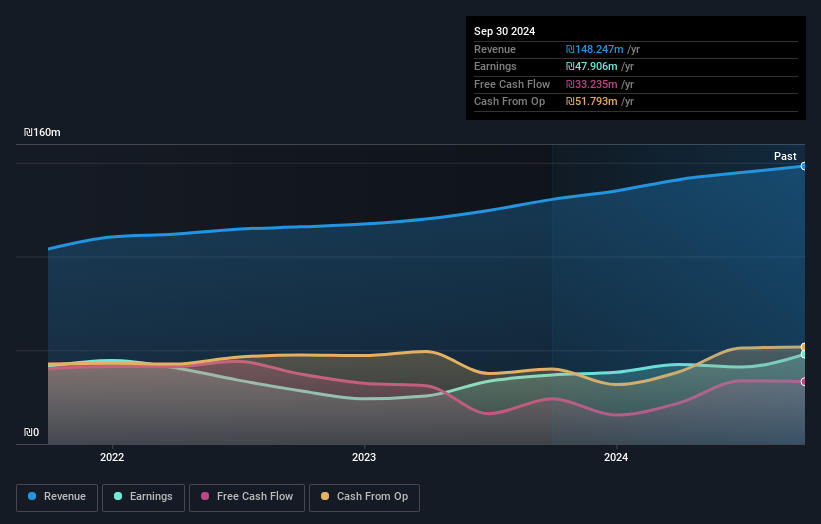

Automatic Bank Services, a nimble player in the financial sector, has shown robust performance with earnings surging by 30.2% over the past year, outpacing the industry average of -1.6%. The company reported third-quarter revenue of ILS 39.42 million and net income of ILS 15.55 million, reflecting significant growth from last year's figures. With no debt on its books for five years and high-quality non-cash earnings, it seems well-positioned financially. The free cash flow stands positive at ILS 33.24 million as of September 2024, indicating solid operational cash generation despite capital expenditures reaching ILS -18.56 million during this period.

Summing It All Up

- Click through to start exploring the rest of the 4637 Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SHVA

Automatic Bank Services

Operates payment systems for international debit cards in Israel.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives