- China

- /

- Auto Components

- /

- SZSE:000678

Xiangyang Automobile Bearing (SZSE:000678) delivers shareholders favorable 12% CAGR over 3 years, surging 13% in the last week alone

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Xiangyang Automobile Bearing Co., Ltd. (SZSE:000678) shareholders have seen the share price rise 41% over three years, well in excess of the market decline (19%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 5.3% in the last year.

The past week has proven to be lucrative for Xiangyang Automobile Bearing investors, so let's see if fundamentals drove the company's three-year performance.

View our latest analysis for Xiangyang Automobile Bearing

Xiangyang Automobile Bearing isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Xiangyang Automobile Bearing's revenue trended up 3.5% each year over three years. Considering the company is losing money, we think that rate of revenue growth is uninspiring. The modest growth is probably broadly reflected in the share price, which is up 12%, per year over 3 years. Ultimately, the important thing is whether the company is trending to profitability. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

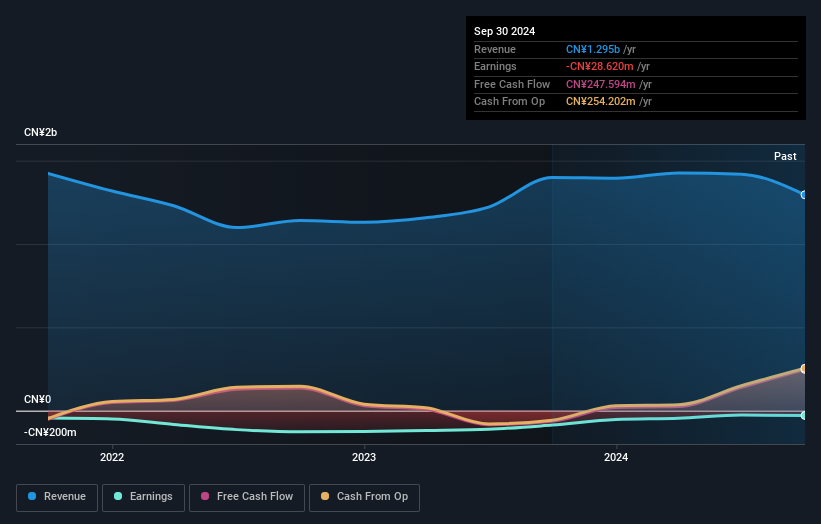

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Xiangyang Automobile Bearing's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Xiangyang Automobile Bearing shareholders are up 5.3% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.0% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Xiangyang Automobile Bearing .

We will like Xiangyang Automobile Bearing better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000678

Xiangyang Automobile Bearing

Researches, develops, manufactures, and sells automobile bearings in China.

Excellent balance sheet and slightly overvalued.