- China

- /

- Paper and Forestry Products

- /

- SHSE:603165

Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, with U.S. stocks experiencing broad-based declines and smaller-cap indexes facing the brunt of the downturn. Amidst these challenges, investors are increasingly focused on identifying potential opportunities within small-cap stocks that can weather economic fluctuations and offer growth prospects. In this environment, discovering promising small-cap stocks requires a keen understanding of market dynamics and an ability to spot companies with strong fundamentals that can thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Mildef Crete | NA | 0.93% | 9.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Zhejiang Rongsheng Environmental Protection Paper (SHSE:603165)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Rongsheng Environmental Protection Paper Co., Ltd. operates in the paper manufacturing industry with a focus on environmentally friendly products and has a market capitalization of approximately CN¥3.28 billion.

Operations: Rongsheng Environmental Protection Paper generates revenue primarily from its paper manufacturing operations, focusing on eco-friendly products. The company's market capitalization stands at approximately CN¥3.28 billion.

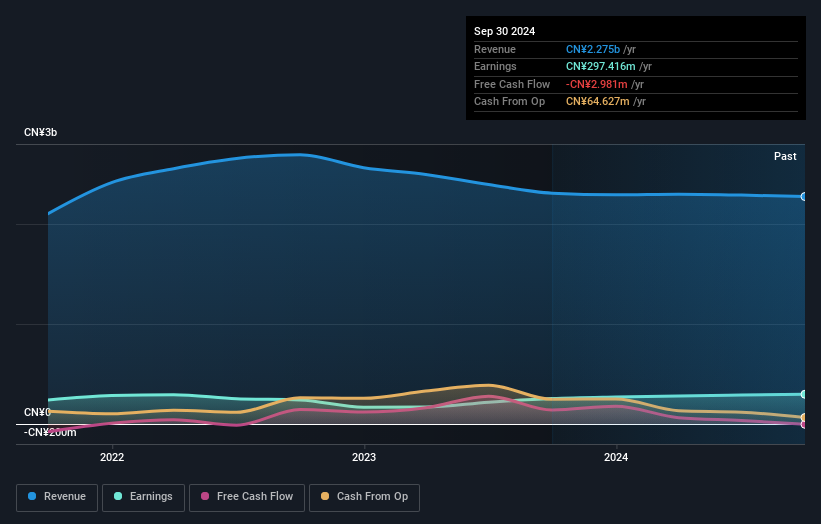

Zhejiang Rongsheng, a small cap player in the paper industry, has shown resilience with its earnings growing 1.7% annually over five years. The company reported CNY 248.78 million in net income for the first nine months of 2024, up from CNY 222.04 million last year, while basic earnings per share rose to CNY 0.93 from CNY 0.82. Despite a debt-to-equity ratio increase to 78.1%, its interest payments are well covered by EBIT at a robust 61 times coverage, reflecting financial stability amidst market challenges and strategic buybacks totaling CNY 65.81 million this year enhancing shareholder value perception.

Daiichi Jitsugyo (TSE:8059)

Simply Wall St Value Rating: ★★★★★★

Overview: Daiichi Jitsugyo Co., Ltd. supplies industrial machinery worldwide and has a market capitalization of approximately ¥87.78 billion.

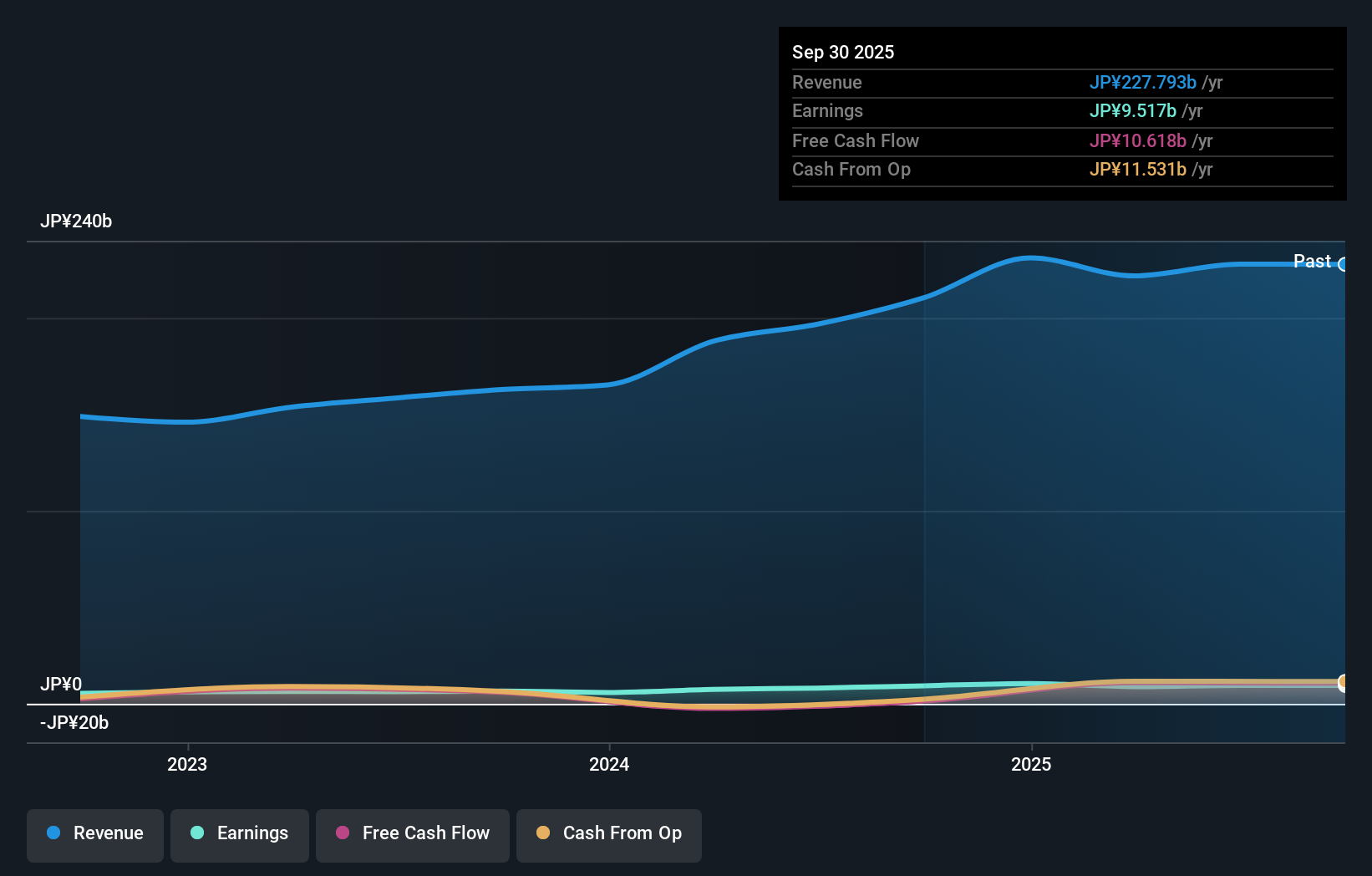

Operations: Daiichi Jitsugyo generates revenue primarily from its Electronics Business, contributing ¥51.48 billion, and the Energy Solutions Business, adding ¥48.14 billion. The Industrial Machinery and Automotive segments also play significant roles with revenues of ¥32.38 billion and ¥39.06 billion, respectively.

Earnings for Daiichi Jitsugyo surged by 43% over the past year, outpacing the Trade Distributors industry’s modest 0.8% rise. This growth is bolstered by a reduced debt-to-equity ratio, now at 3.2%, down from 18.4% over five years, indicating stronger financial health. The company holds more cash than total debt and maintains high-quality earnings with a price-to-earnings ratio of 9.8x, below Japan's market average of 13.5x, suggesting potential value for investors. However, dividends have been cut to ¥41 per share from ¥78 last year as they aim for ¥200 billion in sales this fiscal year ending March 2025.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Value Rating: ★★★★★★

Overview: Chenming Electronic Tech. Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and globally with a market cap of NT$27.18 billion.

Operations: The primary revenue stream for Chenming Electronic Tech. Corp. comes from the production and sales of computer and mobile device components, generating NT$8.53 billion. The company's financial performance is reflected in its market capitalization of NT$27.18 billion.

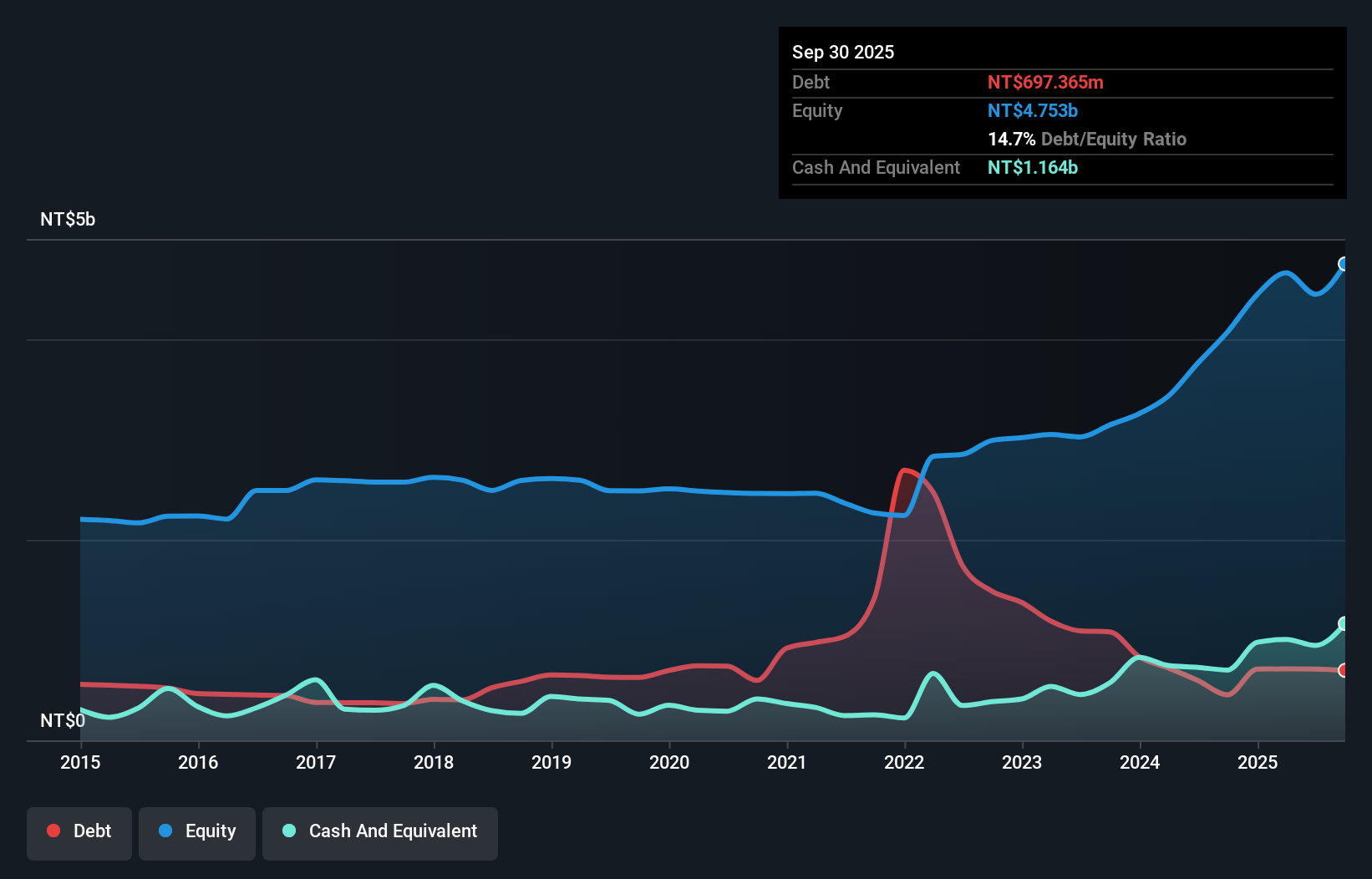

Chenming Electronic Tech, a smaller player in the tech industry, has showcased impressive growth with earnings surging by 119% over the past year. The company is trading at 62% below its estimated fair value, suggesting potential undervaluation. Despite recent shareholder dilution, Chenming's financial health seems robust with more cash than debt and positive free cash flow of TWD 1.04 billion for the latest quarter. Recent earnings reports highlight strong performance; third-quarter sales increased to TWD 2.66 billion from TWD 1.77 billion last year, while net income rose to TWD 164 million from TWD 82 million previously.

- Click here and access our complete health analysis report to understand the dynamics of Chenming Electronic Tech.

Gain insights into Chenming Electronic Tech's past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 4632 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Rongsheng Environmental Protection Paper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603165

Zhejiang Rongsheng Environmental Protection Paper

Zhejiang Rongsheng Environmental Protection Paper Co., Ltd.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives