- South Korea

- /

- Food

- /

- KOSE:A003230

Insider-Favored Growth Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and technological disruptions, investors are keeping a close eye on sectors that show resilience amid volatility. With the Federal Reserve holding rates steady and AI competition intensifying, identifying growth companies with high insider ownership can offer unique insights into potential opportunities. In this environment, stocks where insiders have significant stakes may signal confidence in the company's long-term prospects, aligning well with current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

Let's take a closer look at a couple of our picks from the screened companies.

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★☆☆

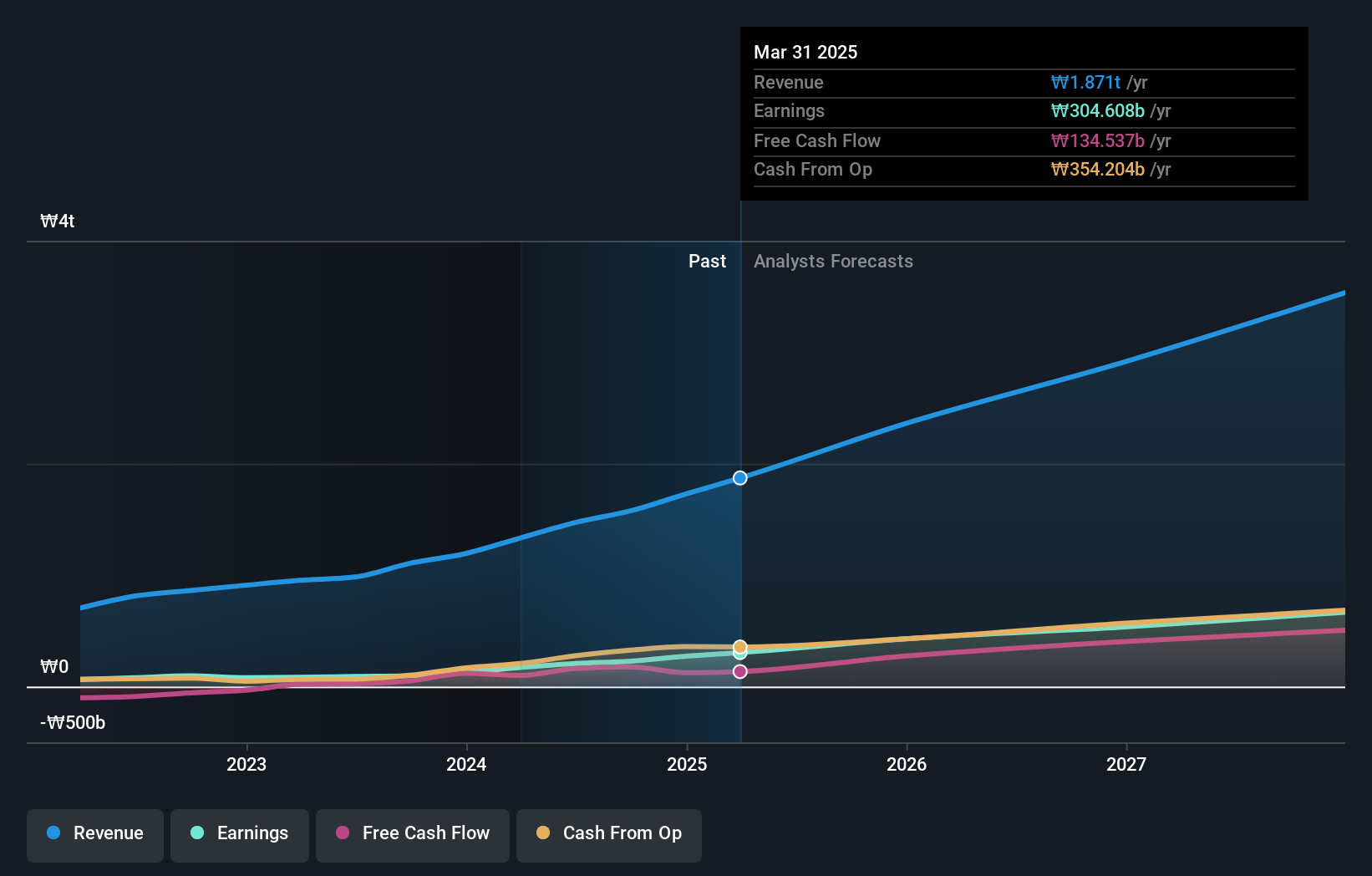

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both in South Korea and internationally, with a market cap of ₩6.03 trillion.

Operations: Samyang Foods generates revenue from its food business operations both domestically and internationally.

Insider Ownership: 11.6%

Samyang Foods is experiencing significant growth, with earnings expected to increase by 26.58% annually and recent profits up 133.8%. While its revenue growth forecast of 19.8% per year trails the 20% benchmark, it surpasses the Korean market average of 8.9%. Trading at a substantial discount to its estimated fair value, Samyang Foods benefits from high insider ownership, aligning management interests with shareholders despite no recent insider trading activity reported.

- Delve into the full analysis future growth report here for a deeper understanding of Samyang Foods.

- Our valuation report unveils the possibility Samyang Foods' shares may be trading at a premium.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Growth Rating: ★★★★☆☆

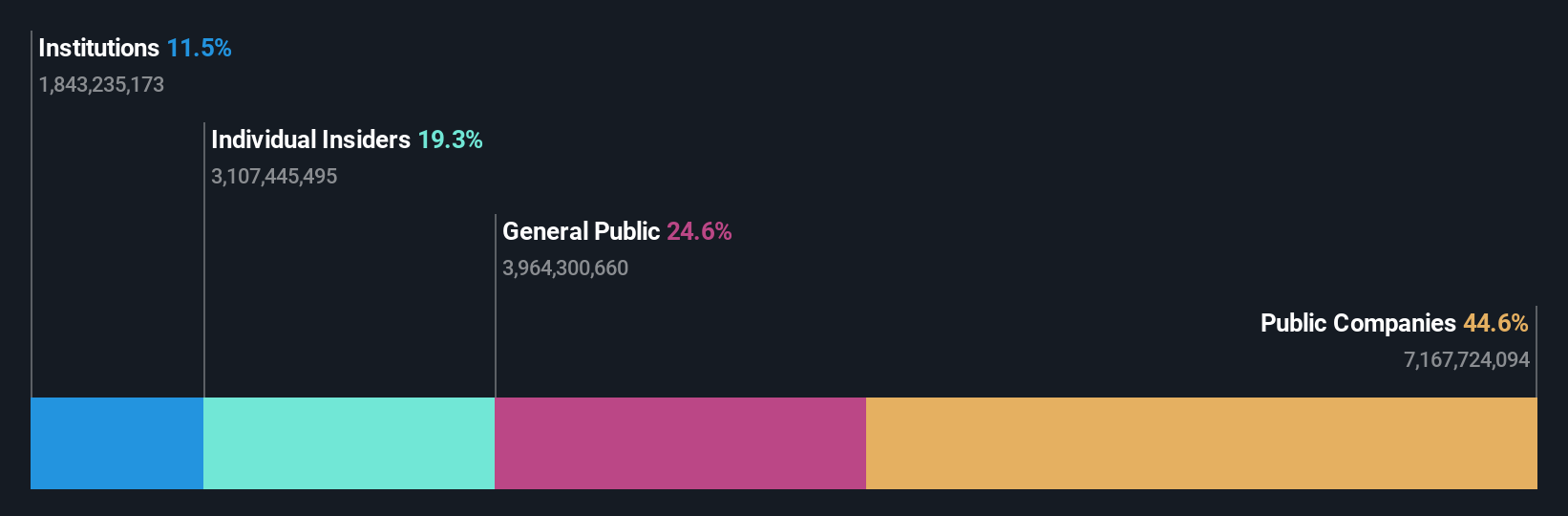

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$60.47 billion.

Operations: The company's revenue segments include the distribution and development of pharmaceutical and healthcare business, generating CN¥28.34 billion.

Insider Ownership: 19.3%

Alibaba Health Information Technology is experiencing robust growth, with earnings rising 47.3% over the past year and forecasted to grow significantly at 21.8% annually, outpacing the Hong Kong market average. The company's revenue increased to CNY 14.27 billion for the half-year ended September 2024, reflecting strong performance despite lower expected revenue growth of 9.7% per year compared to high benchmarks. Trading at a significant discount to its fair value enhances its appeal despite no recent insider trading activity reported.

- Click here to discover the nuances of Alibaba Health Information Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Alibaba Health Information Technology implies its share price may be too high.

KEBODA TECHNOLOGY (SHSE:603786)

Simply Wall St Growth Rating: ★★★★★☆

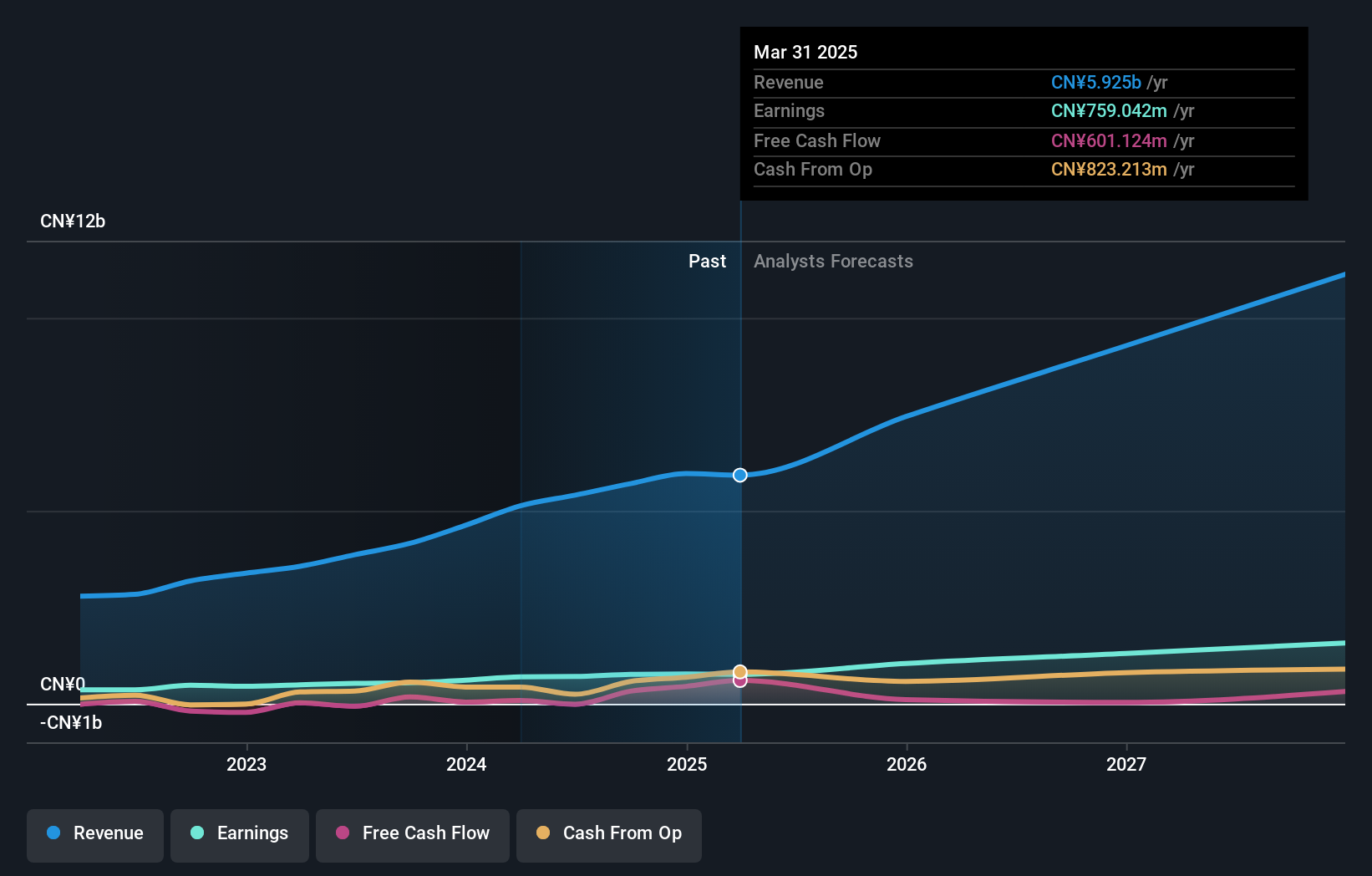

Overview: KEBODA TECHNOLOGY Co., Ltd. manufactures and sells automotive electronics and related products for the automotive industry in China, with a market cap of CN¥27.35 billion.

Operations: KEBODA TECHNOLOGY Co., Ltd. generates revenue through the manufacture and sale of automotive electronics and related products within China's automotive sector.

Insider Ownership: 12.8%

KEBODA TECHNOLOGY is experiencing strong growth, with earnings rising 39.8% over the past year and forecasted to grow significantly at 26.31% annually, outpacing the Chinese market average. Revenue is expected to increase by 22.4% per year, surpassing the market's growth rate of 13.5%. Despite no recent insider trading activity, its substantial insider ownership underscores confidence in its long-term prospects as it continues to expand rapidly in a competitive environment.

- Take a closer look at KEBODA TECHNOLOGY's potential here in our earnings growth report.

- According our valuation report, there's an indication that KEBODA TECHNOLOGY's share price might be on the expensive side.

Taking Advantage

- Unlock our comprehensive list of 1471 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Samyang Foods, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003230

Samyang Foods

Engages in the food business in South Korea and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives